- Home

- »

- Medical Devices

- »

-

Intranasal Drug & Vaccine Delivery Market Size Report, 2030GVR Report cover

![Intranasal Drug And Vaccine Delivery Market Size, Share & Trends Report]()

Intranasal Drug And Vaccine Delivery Market Size, Share & Trends Analysis Report By Product, By Dosage (Deep Learning, Machine Learning), By Application, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-479-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

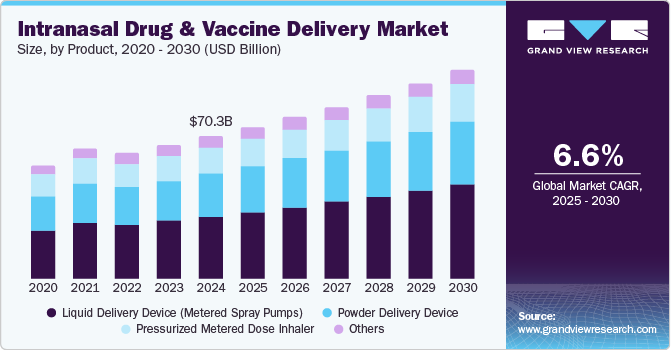

The global intranasal drug and vaccine delivery market size was estimated at USD 70.32 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. By 2050, the number of adults aged 50 and older with at least one chronic condition in the U.S. is projected to reach approximately 142.7 million, marking a 99.5% increase from the 71.5 million in 2020. This demographic shift underscores the urgent need for effective and accessible treatment options, particularly for chronic respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD), where intranasal delivery offers the advantage of rapid absorption and patient comfort.

Technological advancements in intranasal delivery systems are enhancing their appeal by improving patient compliance and broadening the therapeutic landscape. In 2023, innovations in device design and formulation have made these systems increasingly user-friendly, with studies indicating that over 60% of patients prefer non-invasive methods over traditional injections. This compelling preference is driving further investment in research and development, leading to the introduction of advanced intranasal devices that cater to a diverse range of indications, thus expanding the potential market for these therapies.

Furthermore, a 2023 study from Nature reveals that approximately 70% of patients prefer needle-free delivery methods, particularly among younger demographics and those with needle aversions. This strong consumer inclination towards convenient, pain-free administration is promoting the rapid adoption of intranasal delivery systems, which provide an effective alternative to invasive injection techniques. The focus on user-friendly options is poised to further accelerate market growth and adoption within clinical practices.

Moreover, the expanding therapeutic applications of intranasal delivery are propelling the market’s growth trajectory. The CDC highlights that nearly 25% of clinical trials involving intranasal delivery are now centered on neurological disorders, indicating a marked expansion in the scope of these therapies. As new therapeutic avenues are explored, including emergency medical uses, the potential for intranasal delivery systems to address diverse medical needs continues to broaden, positioning them as a key component in the future of drug administration.

Product Insights

Liquid delivery devices dominated the market with a revenue share of 43.7% in 2024. These devices, including metered spray pumps, circumvent first-pass metabolism, enhancing bioavailability and accelerating therapeutic effects. Their non-invasive design increases patient compliance, making them especially attractive for chronic conditions necessitating regular dosing. Furthermore, technological advancements have resulted in user-friendly devices that support self-administration, further promoting their adoption among patients and healthcare professionals.

Power delivery devices are expected to grow rapidly over the forecast period. These devices provide accurate dosing and consistent medication delivery, optimizing absorption via the nasal mucosa. Their user-friendly, non-invasive designs enhance patient compliance, while technological advancements, such as compressed gas systems, enable targeted delivery within the nasal cavity, significantly improving therapeutic outcomes.

Dosage Insights

Multi-dose systems led the market with a revenue share of 64.1% in 2024. Multi-dose systems provide improved tolerance and convenience, enabling patients to self-administer medications with fewer refills. This cost-effective solution enhances patient compliance, particularly for chronic conditions requiring ongoing treatment. The increasing preference for non-invasive delivery methods further drives the adoption of multi-dose systems among healthcare providers and patients.

The unit-dose segment is expected to register the fastest CAGR of 6.8% over the forecast period. Single-use formulations are favored for vaccines due to their increased safety and efficacy, simplifying administration processes. The trend toward unit-dose products supports medical guidelines for efficient treatment, particularly in emergencies. Growing approvals for unit-dose formulations, like naloxone nasal spray, enhance their appeal among healthcare providers and patients.

Application Insights

Respiratory disorders held the largest market share of 41.1% in 2024, owing to the efficacy of intranasal delivery for conditions such as asthma, COPD, and allergic rhinitis. This method ensures rapid action, bypasses first-pass metabolism, and enhances bioavailability, while its non-invasive nature promotes patient compliance, especially among those averse to injections.

The vaccination segment is expected to register the fastest CAGR of 8.1% over the forecast period. Intranasal vaccines provide a needle-free administration option, improving patient compliance, particularly among children and needle-phobic individuals. They stimulate both mucosal and systemic immunity, offering localized protection against respiratory pathogens. This efficient delivery method, demonstrated during the COVID-19 pandemic, enhances mass vaccination efforts and broadens adoption in vaccination strategies.

Distribution Channel Insights

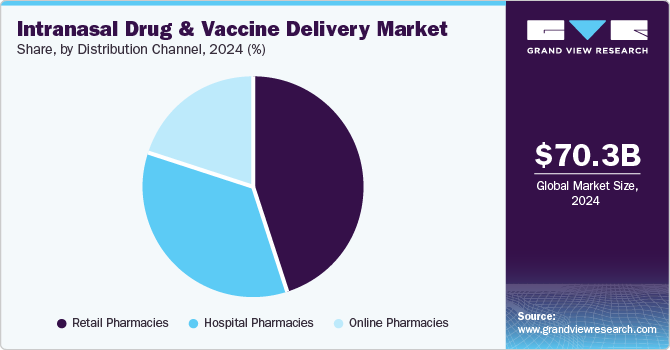

Retail pharmacies dominated the market and accounted for a share of 45.1% in 2024, fueled by rising patient awareness and a growing trend towards self-administration of medications. They offer a diverse selection of intranasal products, enhancing consumer access. Collaborations between device developers and pharmacy chains further ensure the availability of point-of-care medications without prescriptions.

Online pharmacies are projected to grow at the fastest CAGR of 7.8% over the forecast period. Patients can conveniently order intranasal medications from home, bypassing lengthy waits at traditional pharmacies. Online platforms provide competitive pricing and discounts, appealing to budget-conscious consumers. Increased telemedicine adoption and awareness of intranasal therapies further drive demand, making online pharmacies a preferred option for efficient, discreet healthcare solutions.

Regional Insights

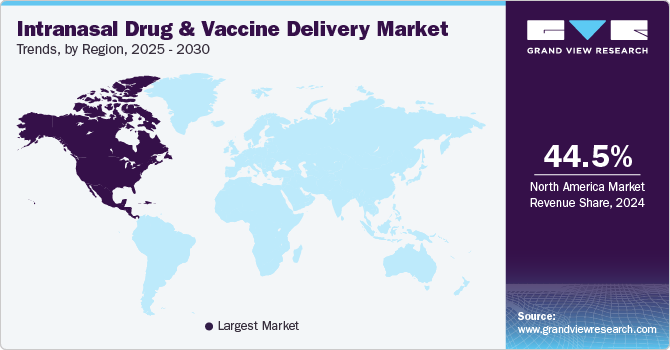

North America intranasal drug and vaccine delivery market dominated the global market with a revenue share of 44.5% in 2024. North America has a sophisticated healthcare infrastructure, a high prevalence of respiratory disorders, and a growing patient preference for non-invasive delivery methods. The region’s dynamic pharmaceutical industry promotes innovation, resulting in increased intranasal product launches, while heightened awareness during the COVID-19 pandemic has further spurred market growth.

U.S. Intranasal Drug And Vaccine Delivery Market Trends

The intranasal drug and vaccine delivery market in U.S. dominated the North America intranasal drug and vaccine delivery market with a revenue share of 82.4% in 2024. The U.S. has seen substantial investment in research and development, driven by high demand for effective treatment options. An established healthcare system facilitates swift adoption of new technologies, while the rising incidence of chronic diseases, along with regulatory support, fosters confidence in the intranasal product market.

Europe Intranasal Drug And Vaccine Delivery Market Trends

Europe intranasal drug and vaccine delivery market held substantial market share in 2024. Europe’s aging population and increasing prevalence of respiratory diseases are driving demand for effective intranasal therapies. Supportive regulatory frameworks and heightened awareness of non-invasive delivery methods further stimulate market growth, prompting pharmaceutical companies to invest in the development of innovative intranasal formulations.

The intranasal drug and vaccine delivery market in UK is expected to grow lucratively in the forecast period due to its robust healthcare system and commitment to patient-centered care. Heightened awareness of intranasal vaccine efficacy has fostered greater acceptance among providers and patients. Government initiatives supporting vaccination and funding for innovative delivery technologies are further driving market growth.

Asia Pacific Intranasal Drug And Vaccine Delivery Market Trends

Asia Pacific intranasal drug and vaccine delivery market is expected to register the fastest CAGR of 7.2% in the forecast period. The region is experiencing increased investments in healthcare infrastructure alongside a rising prevalence of chronic diseases, leading to substantial demand for effective drug delivery solutions. Growing public awareness of intranasal therapies and government support for vaccine development significantly contribute to market growth.

The intranasal drug and vaccine delivery market in China dominated the Asia Pacific intranasal drug and vaccine delivery market in 2024. China’s vast population and rising healthcare investments are fostering a strong focus on innovative drug delivery methods that meet the growing public demand for non-invasive treatments. Moreover, the country’s commitment to expanding vaccination programs enhances interest in intranasal vaccines, positioning China as a key player in the Asia Pacific market.

Key Intranasal Drug And Vaccine Delivery Company Insights

Some key companies operating in the market include GSK plc; Teva Pharmaceutical Industries Ltd; AptarGroup, Inc.; UCB S.A.; among others. Key players are prioritizing product innovation and forming strategic partnerships. Companies are expanding their portfolios through collaborations while advancing delivery technologies, especially in the area of vaccines. For instance, in July 2024, GSK and Flagship Pioneering partnered to develop novel medicines and vaccines, funding up to USD 150 million to explore promising concepts in respiratory and immunology through Flagship’s bioplatform ecosystem.

-

Teva Pharmaceutical Industries Ltd specializes in developing and commercializing innovative respiratory therapies, such as intranasal delivery systems. Their portfolio features dual-action inhalers and respiratory medications targeting asthma and COPD, enhancing patient outcomes through advanced drug formulation and delivery technologies.

-

Bespak Limited specializes in nasal drug delivery devices, providing solutions for liquid and powder formulations. They produce multi-dose nasal sprays, unit dose devices, and soft mist technologies, collaborating with pharmaceutical companies to create innovative systems for vaccines and biologics.

Key Intranasal Drug And Vaccine Delivery Companies:

The following are the leading companies in the intranasal drug and vaccine delivery market. These companies collectively hold the largest market share and dictate industry trends.

- GSK plc

- Teva Pharmaceutical Industries Ltd

- AptarGroup, Inc.

- UCB S.A., Belgium

- Teleflex Incorporated

- 3M

- Bespak Limited

- Optinose

- Intersect ENT

View a comprehensive list of companies in the Intranasal Drug & Vaccine Delivery Market

Recent Developments

-

In October 2024, Aptar Pharma acquired device technology assets from SipNose Nasal Delivery Systems, enhancing its intranasal drug delivery portfolio and strengthening its expertise in targeted nasal therapies for various indications.

-

In June 2024, the US FDA approved GSK’s AREXVY, the first RSV vaccine for adults aged 50-59 at increased risk, expanding its use beyond the previously approved age of 60 and older.

-

In April 2024, Bespak completed its spin-out from Recipharm, establishing a standalone organization focused on drug-device combination products for pulmonary and nasal inhalation, enhancing its innovative capabilities in the industry.

-

In April 2024, Teva established a clinical collaboration with Launch Therapeutics and secured USD 150 million from Abingworth to accelerate the development of its Dual-Action Asthma Rescue Inhaler, TEV-’248.

Intranasal Drug And Vaccine Delivery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 74.90 billion

Revenue forecast in 2030

USD 103.33 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, dosage, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GSK plc; Teva Pharmaceutical Industries Ltd; AptarGroup, Inc.; UCB S.A., Belgium; Teleflex Incorporated; 3M; Bespak Limited; Optinose; Intersect ENT

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intranasal Drug And Vaccine Delivery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intranasal drug and vaccine delivery market report based on product, dosage, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder Delivery Device

-

Liquid Delivery Device (Metered Spray Pumps)

-

Pressurized Metered Dose Inhaler

-

Others

-

-

Dosage Outlook (Revenue, USD Million, 2018 - 2030)

-

Unit-dose

-

Multi-dose

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory Disorders

-

Neurological Disorders

-

Vaccination

-

Pain Management

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."