- Home

- »

- Medical Devices

- »

-

Intraocular Lens Market Size, Share & Growth Report, 2030GVR Report cover

![Intraocular Lens Market Size, Share & Trends Report]()

Intraocular Lens Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Multifocal Intraocular Lens, Toric Intraocular Lens), By End-use (Hospitals, Ambulatory Surgery Centers), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-060-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intraocular Lens Market Summary

The global intraocular lens market size was estimated at USD 4,470.4 million in 2023 and is projected to reach USD 6,173.0 million by 2030, growing at a CAGR of 4.63% from 2024 to 2030. The market is driven by the growing diabetic population, technological advancements, increasing demand for multifocal IOLs, advantages of acrylic materials, upsurge in contract surgeries, government initiatives, and the rapidly growing elderly population.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, Canada is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, multifocal intraocular lenses accounted for a revenue of USD 2,284.5 million in 2022.

- Multifocal Intraocular Lenses is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 4,470.4 Million

- 2030 Projected Market Size: USD 6,173.0 Million

- CAGR (2024-2030): 4.63%

- North America: Largest market in 2022

The prevalence of vision impairment is increasing worldwide. According to WHO, around 2.2 billion people have a vision impairment, with at least 1 billion cases globally that could have been prevented or have yet to be addressed.

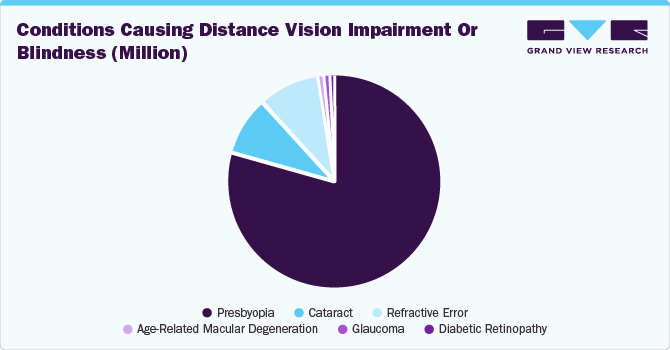

The main conditions causing distance vision impairment or blindness are cataract (94 million), age-related macular degeneration (8 million), glaucoma (7.7 million), and diabetic retinopathy (3.9 million). This growing burden of eye diseases is a significant driver for the market, as these conditions often require surgical interventions such as cataract removal and lens replacement. They not only bring back vision lost to cataracts but also correct refractive errors such as myopia, hyperopia, astigmatism, and presbyopia.

"The pie chart given below illustrates the global prevalence of vision impairment, caused by conditions such as cataracts, age-related macular degeneration, glaucoma, and diabetic retinopathy. The need for surgical interventions to treat these diseases significantly drives the intraocular lens market."

Technological advancements, continuous R&D, along with the launch of new IOL products, are propelling the market forward. Advances in IOL materials and surface modifications are enhancing the performance and comfort of IOLs, driving the adoption of IOL. Market players employ strategic initiatives such as mergers, acquisitions, and expansions to tap into new markets. For instance, in February 2024, Johnson & Johnson MedTech launched the TECNIS PureSee presbyopia-correcting intraocular lens (IOL) in Europe, the Middle East, and Africa (EMEA). This purely refractive lens provides high-quality vision, reduced visual symptoms, and improved outcomes for patients and surgeons, offering clarity of vision without compromising on visual quality or independence from spectacles. Such initiatives enhance business presence and lead to better outcomes.

“Cataract surgery is the number one surgery performed globally, with 28 million procedures each year. But only 10-15% of patients are getting advanced optical IOLs specifically designed for astigmatism and presbyopia, the TECNIS PureSee IOL give surgeons and patients the choice of a premium IOL that combines clarity of vision and reduced visual symptoms. “

“Jacqueline Henderson, President Vision, EMEA, Johnson & Johnson“

The increasing demand for multifocal IOL can be attributed to factors such as the rise in younger patients seeking solutions for presbyopia and a desire for spectacle independence. These lenses offer visual performance across various distances, catering to the need for satisfactory visual acuity and quality of vision for near, intermediate, and far distances. Additionally, the growing prevalence of cataracts is a significant driver of market expansion. According to a data from “Changes in NHS cataract surgery in England 2016-2021” shows that in England , there were 43,932 cataract procedures in November 2021, 21% higher than five years previously. With an increasing cataract prevalence, it is projected there will have been a 50% rise in cataract procedures from 2015 - 2035. Such an increase in the number of procedures show the growing demand is leading to the market expansion during the forecast period.

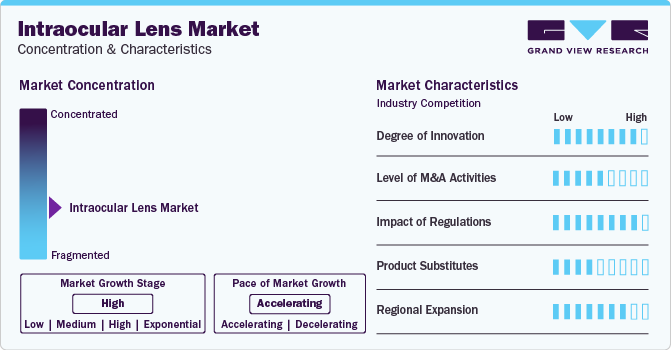

Market Concentration & Characteristics

The intraocular lens (IOL) market is characterized by its rapid growth, driven by the increasing prevalence of eye diseases such as cataracts among the aging population and technological advancements in IOLs. Key characteristics include a high concentration of major players competing through product innovations and strategic acquisitions. The market spans across various regions, with North America and Europe being significant contributors. Despite challenges such as high costs and the shortage of skilled ophthalmologists, especially in developing countries, the market is poised for expansion, fueled by the adoption of minimally invasive surgeries and the introduction of premium IOLs.

The industry has seen a high degree of innovation, with advancements in materials, designs, and technologies leading to the development of premium IOLs, such as multifocal, toric, and accommodating lenses, which offer improved visual outcomes and reduced dependence on glasses or IOL after cataract surgery.

Regulations play a crucial role in IOL industry, affecting both market entry and competition. These regulations also affect the bargaining power of buyers and suppliers, potentially leading to price fluctuations and industry consolidation, whereas regulations aim to protect consumers and maintain market quality, they pose challenges such as compliance costs and time delays for new entrants and innovators in IOL industry.

The level of M&A activities in IOL industry is high, reflecting the strategic importance of consolidating resources, gaining market share, and accessing new technologies or geographical markets. Major players engage in frequent mergers and acquisitions to expand their product portfolios, enter new markets, and enhance their competitive positions. For instance, in January 2023, Bausch + Lomb acquired AcuFocus, integrating the IC-8 Apthera IOL, a small aperture EDOF lens addressing cataract patients with presbyopia. This strategic move enhances Bausch + Lomb's IOL offerings, focusing on unmet medical needs in eye care for improved vision outcomes.

“Cataracts are the largest contributor to global blindness in adults aged 50 years and older, with more than 15 million individuals, or approximately 45 percent of the more than 33 million cases of global blindness. the IC-8 Apthera EDOF IOL will support surgical portfolio by enhancing our IOL offerings”

“Joseph C. Papa, CEO, Bausch + Lomb”

Contact lenses or glasses for individuals who prefer non-surgical vision correction methods can be a substitute for IOL. Contact lenses and glasses can provide visual correction for refractive errors like myopia, hyperopia, astigmatism, and presbyopia without the need for IOL implantation.

The IOL industry is experiencing regional expansion, driven by the high incidence of cataracts and supportive regulatory and reimbursement environments. This expansion is further fueled by increased awareness of advanced treatments and the influx of patients from developed nations seeking affordable healthcare options. For instance, in December 2021, Alcon expands its suite of advanced technology IOL with Clareon Toric and extended parameters for AcrySof IQ Vivity, offering enhanced vision correction options for cataracts, astigmatism, and presbyopia, ensuring exceptional clarity and rotational stability.

Product Insights

The multifocal intraocular lenses segment accounted for the largest market share of 53.56% in 2023 and shows the fastest CAGR over the forecast period due to their effectiveness in addressing complex retinal issues and providing patients with clear vision at different distances. These lenses offer precision and accuracy for near, intermediate, and distance vision, making them a preferred choice for patients seeking comprehensive visual correction. In addition, product approvals, new product launches, and R&D for more innovation have contributed to the segment's dominance. For instance, in July 2022, Lenstec Inc.'s SBL-3 Multifocal Intraocular Lens approved by the FDA for cataract surgery. Such initiatives by industry players have further solidified the segment's market share.

Toric intraocular lens segment is expected to exhibit the fastest growth during the forecast period due to their ability to correct astigmatism, a common refractive error. The rising demand for astigmatism correction, coupled with advancements in toric lens technology, is driving the rapid growth of this segment, catering to patients seeking comprehensive vision correction solutions.

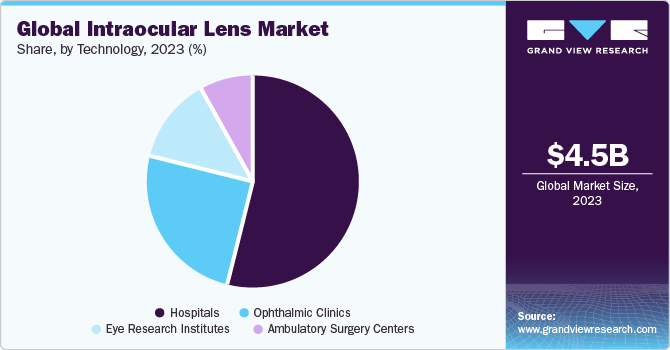

End-use Insights

The hospitals segment accounted for the largest market share of 54.27% in 2023 due to their role as primary centers for cataract and vision restoration surgeries. Most of these procedures are performed in hospitals, making them the primary end-users, ensuring their significant share and influence in the industry. Hospitals are preferred over ophthalmic clinics, ambulatory surgery centers, and eye research institutes for cataract surgery due to their comprehensive services, specialized staff, advanced equipment, and capacity to handle complex cases effectively. Hospitals offer a wide range of medical specialties, emergency care, and advanced facilities, ensuring optimal patient care and outcomes. Patients benefit from the multidisciplinary approach, access to specialized resources, and a higher level of care coordination available in a hospital setting, making it the preferred choice for cataract surgeries.

Eye research institute segment is projected to witness fastest growth rate over the forecast period. These institutes excel in driving innovation through dedicated research, training ophthalmologists in advanced techniques, collaborating with industry for product development, and benefiting from government support. For instance, in April 2024, The WVU Eye Institute will expand its clinical, educational, and research efforts by relocating to a new 150,000-square-foot facility in Morgantown, funded by a USD 233.5 million investment from the WVU Health System. The new facility will significantly increase exam rooms, testing rooms, and surgical suites to better serve patients in West Virginia and surrounding regions. With specialized facilities and a focus on cutting-edge technologies, eye research institutes are at the forefront of advancing IOL technology, positioning them for significant growth during the forecast period.

“Located in a state with the second highest rate of visual disability in the nation, we are discovering new ways to prevent, treat, and slow the progression of incurable eye diseases.”

“Thomas Mauger, MD, executive chairman of the WVU Eye Institute and chairman of the WVU Department of Ophthalmology and Visual Sciences”

Regional Insights

North America intraocular lens market dominated the overall global market and accounted for the 36.12% revenue share in 2023. The strong need for quality assurance measures for ophthalmic devices arises from the well-established healthcare infrastructure. Moreover, ongoing technological advancements, increasing awareness among end-users regarding eye health, and strict regulatory standards are anticipated to drive industry expansion in future.

U.S. Intraocular Lens Market Trends

The U.S. intraocular lens market held a significant share of North America's intraocular lens market in 2023, aging demographics, leading to a higher incidence of cataracts, are a primary driver and technological advancements in IOLs, offering better visual outcomes and reduced recovery times, attract more patients. Additionally, the rise in diabetes cases increases the demand for IOLs due to associated eye complications. For instance, in April 2023, ZEISS announce approval of CT LUCIA 621P Monofocal IOL by FDA, featuring the patented ZEISS Optic Asphericity Concept, which compensates for spherical aberrations and optimizes visual outcomes in cases of decentration and lens misalignments for the U.S. market.

“The CT LUCIA 621P Monofocal IOL is a great example of how latest ophthalmic innovations are driving efficiency and better patient outcomes in the U.S.”

“Euan S. Thomson, PhD, President of Ophthalmology Strategic Business Unit and Head of the Digital Business Unit for ZEISS Medical Technology”

Europe Intraocular lens Market Trends

The European intraocular lens market is witnessing growth fueled by increasing demand for intraocular lenses, driven by factors such as aging populations increasing the demand for cataract surgeries, advancements in IOL technology offering better vision post-surgery, rising healthcare expenditure facilitating access to advanced medical procedures, and growing awareness about eye health leading to early detection and treatment of eye diseases. Additionally, the market benefits from the presence of key players investing in research and development to enhance product offerings, and regulatory approvals encouraging innovation in field.

The UK intraocular lens market expansion is fueled by an aging population necessitating cataract surgery, technological advancements improving surgical outcomes, increased healthcare spending allowing broader access to treatments, and rising public awareness regarding eye health, prompting earlier intervention. Key industry players' investments in R&D further drive innovation, alongside favorable regulatory environments that support new product developments.

The intraocular lens market in France is expected to grow over the forecast period. This growth can be attributed to an aging demographic requiring cataract surgery, technological progress enhancing surgical precision, increased healthcare investment broadening treatment accessibility, and rising public awareness about eye health leading to early detection.

Germany intraocular lens market is expected to expand in foreseeable future due to improving surgical techniques, increased healthcare funding expanding treatment options, and increasing public awareness on eye health promoting early interventions.

Asia Pacific Intraocular Lens Market Trends

The intraocular lens market in Asia Pacific region is projected to experience notable expansion driven by the rising prevalence of cataracts and glaucoma in the region, leading to strong demand for IOLs. Government and non-government initiatives to clear cataract surgery backlogs have further boosted product demand. Product approvals for advanced IOLs, such as extended-depth-of-focus IOLs, and the upsurge in cataract procedures also contribute to market expansion.

Japan intraocular lens market is poised for substantial growth, driven by awareness of eye health, increasing cataract procedures, and the rising adoption of intraocular lenses. Furthermore, the presence of prominent players in Japan, particularly those focusing on pioneering lens technologies, further fuels the expansion of the industry.

The intraocular lens market in China is expected to grow, driven by the rising prevalence of cataracts and myopia in the country, leading to strong demand for IOLs. Government initiatives to reduce avoidable blindness and increase adoption of IOLs have further boosted product demand.

India intraocular lens market is set to expand during the forecast period. Key drivers fueling this growth include the increasing prevalence of ophthalmic diseases, technological advancements in IOLs, and initiatives to raise awareness about the benefits of these lenses. The market is also influenced by factors such as the rise in cataract surgeries, better access to cutting-edge technology, and a growing number of eye care specialists and hospitals focusing on eye care.

Latin America Intraocular Lens Trends

The intraocular lens market in Latin America is experiencing significant growth. Increasing efforts in research and development coupled with rapid technological advancements are predicted to drive growth in the region. Domestic firms concentrate on cost-conscious market sectors by delivering economical inspection solutions. Their familiarity with local regulations and business practices could enable them to offer more customized support and services, thereby fueling market growth.

Middle East & Africa Intraocular Lens Market Trends

The intraocular lens market in the Middle East and Africa (MEA) is witnessing steady growth, fueled by increasing demand for corrective eyewear, increasing cataract procedures, rising awareness about eye health, and technological advancements. With a growing population and increasing disposable income levels in the region.

The intraocular lens market in Saudi Arabia is anticipated to expand during the forecast period. This is attributed to the government's encouragement of private sector involvement in healthcare, as outlined in the National Transformation Plan (NTP). Additionally, the projected rise in disposable income from economic expansion and urban development is expected to generate favorable growth prospects.

Kuwait intraocular lens market is expected to grow over the forecast period due to rising requirements for precise and dependable inspection testing services. Intraocular lens control is crucial in guaranteeing the effectiveness and precision of tests in Kuwait, aligning with the nation's emphasis on quality assurance and adherence to standards. Kuwait's dedication to enhancing healthcare services, fostering research and development, and adhering to global quality benchmarks propels the market. Consequently, the growing healthcare focus is forecasted to elevate the adoption of such equipment, thereby stimulating overall market growth.

Key Intraocular Lens Company Insights

The competitive scenario in the intraocular lens market is highly competitive, with key players such as Alcon, Inc., Johnson and Johnson Vision Care, Inc., Bausch & Lomb Incorporated, and Carl Zeiss Meditec AG (ZEISS International). holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

STAAR Surgical Company, HOYA CORPORATION, and among others are some of the emerging market participants in the intraocular lens market. These companies focus on achieving funding support from government bodies and healthcare organizations aided by novel product launches to capitalize on untapped avenues.

Key Intraocular Lens Companies:

The following are the leading companies in the intraocular lens market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon, Inc.

- Johnson and Johnson Vision Care, Inc.

- Bausch & Lomb Incorporated

- Carl Zeiss Meditec AG (ZEISS International)

- Rayner

- EyeKon Medical, Inc.

- Lenstec, Inc.

- HumanOptics AG

- STAAR Surgical Company

- HOYA CORPORATION

Recent Developments

-

In October 2023, AffaMed Technologies has obtained exclusive rights from SIFI to manufacture, develop, and commercialize EVOLUX, an extended monofocal intraocular lens (IOL), in Greater China. EVOLUX provides improved intermediate vision while maintaining distance vision, making everyday activities easier for patients.

-

In March 2024, Alcon launches the Clareon family of intraocular lenses (IOLs) in India, offering clarity, glistening-free material, and presbyopia-correcting technologies like PanOptix and Vivity, designed to deliver consistent visual outcomes and spectacle independence.

-

In May 2024,Adaptilens secured USD 17.5 million in Series A financing led by PXV Funds to advance their Accommodating Intraocular Lens (A-IOL) technology. The A-IOL aims to provide near, intermediate, and distance vision without glasses, reducing reliance on corrective eyewear and restoring natural focusing ability.

Intraocular Lens Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.71 billion

Revenue forecast in 2030

USD 6.17 billion

Growth rate

CAGR of 4.63% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Alcon; Inc.; Johnson and Johnson Vision Care, Inc.; Bausch & Lomb Incorporated; Carl Zeiss Meditec AG (ZEISS International); Rayner; EyeKon Medical Inc.; Lenstec, Inc.; HumanOptics AG; STAAR Surgical Company; HOYA CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intraocular Lens Market Report Segmentation

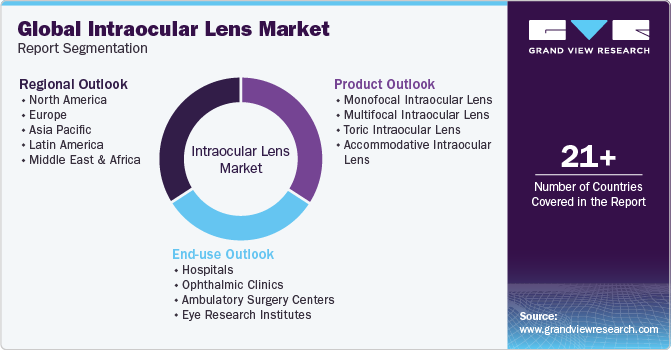

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the intraocular lens market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Monofocal Intraocular Lens

-

Multifocal Intraocular Lens

-

Toric Intraocular Lens

-

Accommodative Intraocular Lens

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Clinics

-

Ambulatory Surgery Centers

-

Eye Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intraocular lens market size was estimated at USD 4.47 billion in 2023 and is expected to reach USD 4.71 billion in 2024.

b. The global intraocular lens market is expected to grow at a compound annual growth rate of 4.63% from 2024 to 2030 to reach USD 6.17 billion by 2030.

b. North America dominated the intraocular lens market with a share of 36.1% in 2023. This is attributable to the increasing prevalence of cataracts and growing Medicare expenditure to enhance eye care in the region.

b. Some of the key players operating in the intraocular lens market include Alcon, Inc. (division of Novartis AG), Johnson & Johnson, Valeant, Carl Zeiss Meditec AG, Rayner, EyeKon Medical, Inc., Lenstec, Inc., HumanOptics AG, STAAR Surgical, and HOYA GROUP.

b. Key factors that are driving the intraocular lens market growth include an increase in the diabetic population and a growing incidence of visual impairments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.