- Home

- »

- Medical Devices

- »

-

Contact Lenses Market Size, Share & Growth Report, 2030GVR Report cover

![Contact Lenses Market Size, Share & Trends Report]()

Contact Lenses Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Hybrid Lens, Silicone Hydrogel), By Design (Spherical Lens, Toric Lens), By Application (Corrective, Therapeutic), By Distribution Channel, By Usage, And Segment Forecasts

- Report ID: 978-1-68038-094-1

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Contact Lenses Market Summary

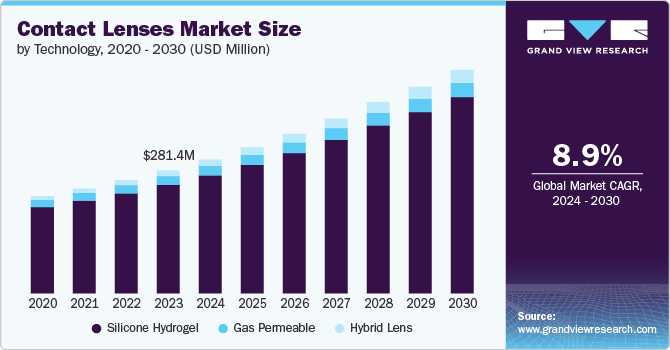

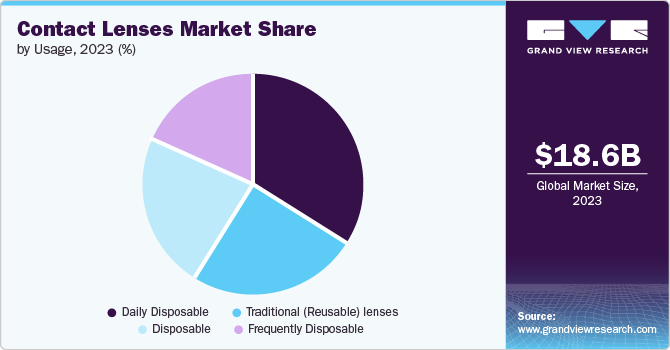

The global contact lenses market size was estimated at USD 18.6 billion in 2023 and is projected to reach USD 33.8 billion by 2030, growing at a CAGR of 8.9% from 2024 to 2030. The increasing cases of refractive errors, such as myopia, hyperopia, presbyopia, and astigmatism, are the major factors driving the demand for contact lenses globally.

Key Market Trends & Insights

- The North America accounted for the largest share, over 38.18%, in 2023.

- In the U.S., the market is characterized by rapid innovation and strategic mergers and acquisitions among leading manufacturers.

- By material, the silicone hydrogel lens segment accounted for the largest revenue share of more than 88.2% in 2023.

- By design, the spherical lens segment captured the largest revenue share of over 60.8% in 2023.

- By usage, the daily disposable lens segment held the largest revenue share, more than 33.5%, in 2023.

Market Size & Forecast

- 2023 Market Size: USD 18.6 Billion

- 2030 Projected Market Size: USD 33.8 Billion

- CAGR (2024-2030): 8.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The growing aging population, which is prone to eye disease, has also created the demand for contact lenses. In May 2023, during Vision Health Month, the Canadian Ophthalmological Society (COS) emphasized the significance of vision health care, especially among the country's senior citizens.Numerous research and development initiatives in optics and optometry have been undertaken to enhance technology. Innovations like introducing dynamic soft contact lenses with advanced features have driven market growth. For instance, in July 2022, Mojo Vision announced that it had successfully performed testing on its newest prototype of the Mojo Lens, which is designed for one eye. This innovative augmented reality (AR) contact lens incorporates advanced features such as medical-grade micro batteries, a micro-LED display, and upgraded hardware. Additionally, it integrates various technologies, including communication capabilities, eye tracking, and specialized software.

Testing has been conducted for one lens in one eye. However, the company aims to have two lenses operating as a pair, allowing users to obtain a 3D view similar to AR and virtual reality (VR). The growing awareness among people regarding eye health, coupled with supportive government initiatives, is expected to create ample growth opportunities for the market shortly. In December 2022, the U.S. government announced that USD 6.5 million would be allocated for vision and eye health programs conducted by the Centers for Disease Control and Prevention (CDC). The fund comes as a part of the government’s initiative toward the prevalence of vision impairment and eye disease across the country.

The expansion of the contact lens market is significantly influenced by the rising trend of cosmetic and colored lenses, which are increasingly sought after for aesthetic purposes. Additionally, individuals who lead active lifestyles, including athletes and those participating in various physical activities, are turning to contact lenses for their enhanced convenience and comfort. These users favor contact lenses over traditional glasses for their advantages, such as unrestricted vision and greater freedom of movement.

Moreover, the appeal of contact lenses continues to grow among those with dynamic lifestyles, as these lenses provide a practical solution that aligns with their needs. The ongoing innovation from market players also contributes to this trend, as new product launches are expected to stimulate demand within the sector further.

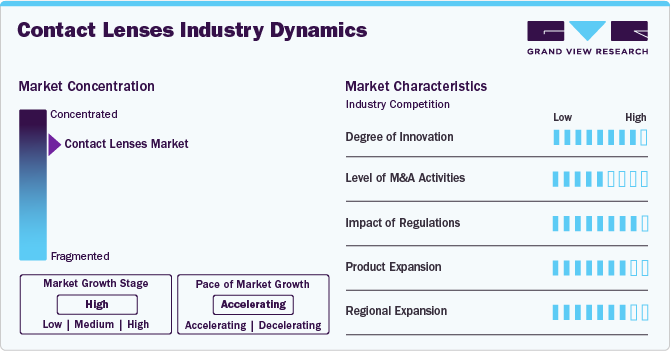

Market Concentration & Characteristics

The degree of innovation in the contact lens market is high, driven by advancements in materials science and technology. The development of smart contact lenses that can monitor glucose levels for diabetic patients represents a groundbreaking shift towards integrating health monitoring with everyday wearables. For instance, in August 2023, a Nanyang Technological University (NTU) Singapore team developed a flexible battery as thin as a human cornea designed to power smart contact lenses. This innovative battery generates electricity when immersed in saline solution, potentially enabling the functionality of intelligent lenses that can display information and access augmented reality.

The level of merger and acquisition (M&A) activities in the contact lenses market is considered medium. The industry has seen notable consolidations as companies seek to expand their product portfolios and enhance their technological capabilities. For instance, in June 2022, CooperVision acquired EnsEyes, a provider of scleral contact lenses and orthokeratology in the Nordic region of Europe.

The impact of regulations on the market is assessed as high, given that this sector is heavily regulated due to health concerns associated with eye care products. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) impose stringent requirements on manufacturing practices, safety testing, and labeling for contact lenses. For instance, in March 2022, Johnson & Johnson Vision Care made an announcement regarding the U.S. Food and Drug Administration (FDA) giving its nod to ACUVUE Theravision with Ketotifen.

Product expansion within the market is rated high, with manufacturers continuously introducing new products tailored to various consumer needs. The rise in myopia among children led companies such as EssilorLuxottica to develop specialized myopia control lenses to slow disease progression. Furthermore, there was an increase in multifocal lens options catering to an aging population seeking solutions for presbyopia. Launching innovative products such as daily disposable multifocal lenses by brands, including Acuvue, demonstrates this trend towards diversification and meeting specific consumer demands.

The region expansion within the market is classified as high, particularly in emerging markets where increasing awareness about eye health drives demand for corrective solutions. Regions such as North America are witnessing rapid growth due to rising disposable incomes and urbanization, leading to higher rates of myopia among children and young adults. For instance, in June 2024, Bausch + Lomb introduced its INFUSE for Astigmatism silicone hydrogel daily disposable contact lenses in the U.S. These lenses are designed with advanced materials infused with ProBalance Technology and the proprietary OpticAlign design, providing astigmatic patients with precise, stable vision and all-day comfort while minimizing dryness.

Material Insights

The silicone hydrogel lens segment accounted for the largest revenue share of more than 88.2% in 2023, primarily due to increasing user preference for these lenses. They offer numerous advantages, including enhanced comfort and flexibility compared to other types of lenses. Additionally, silicone hydrogel lenses maintain optimal oxygen levels, ensuring breathability throughout their wear. These lenses are suitable for extended use, making them ideal for individuals who spend long hours in front of screens, are prone to dry eyes, or lead active lifestyles. For instance, in September 2023, Hubble Contacts unveiled its inaugural daily contact lens, SkyHy, made from silicone hydrogel. This innovative product marks a significant advancement in contact lenses, combining comfort and convenience for users who prefer daily disposable options.

The hybrid lenses segment is estimated to register a growth rate of over 12.5% from 2024 to 2030 due to the increasing demand among patients with astigmatism and keratoconus. A hybrid lens is a combination of gas-permeable and silicone hydrogel. It comprises an RGP central zone with a soft peripheral of soft or silicone hydrogel material. Moreover, they retain their shape better than soft contact lenses, providing sharp and consistent vision. Hybrid contact lenses disinfect quickly, are easier to manage, less prone to dehydration, and last longer than soft lenses.

Design Insights

The spherical lens segment captured the largest revenue share of over 60.8% in 2023. Spherical contact lenses are most commonly used for treating hyperopia (farsightedness), myopia (nearsightedness), and presbyopia (age-related farsightedness). They are widely available and come in a variety of prescriptions. Moreover, they are comfortable to wear as they can quickly settle into the correct position on the eye. Unlike their counterparts, spherical lenses have the same optical power throughout each lens, instigating their demand among the users. For instance, in August 2022, Bausch + Lomb introduced a new range of customizable soft contact lenses called Revive. This innovative lineup features options, including spherical lenses.

The toric lenses segment is estimated to observe a CAGR of over 11.4% over the forecast period. These lenses correct astigmatism problems that arise from a variation in the cornea's curvature. Moreover, toric lenses provide protection from blue light, especially coming from digital devices, which progressively damages the eyes. For instance, in January 2023, Alcon launched TOTAL30 for Astigmatism, a premium reusable toric lens designed for astigmatic contact lens wearers. This innovative lens is the first to feature Water Gradient technology, providing enhanced comfort and moisture retention. TOTAL30 aims to address the common issues of dryness and discomfort experienced by astigmatic lens users, offering a high-quality wearing experience. The lens will be available in the U.S. and Europe in early 2023.

Usage Insights

The daily disposable lens segment held the largest revenue share, more than 33.5%, in 2023. This can be credited to the increased consumer preference for daily disposable lenses, which provide greater comfort to the user. Moreover, these lenses are considered healthiest by most users and are being increasingly prescribed by eye care professionals, as they avoid problems associated with longer lens replacements. Hence, many players initiated the development of daily disposable lenses. For instance, in June 2023, Bausch + Lomb Corporation (listed on NYSE and TSX as BLCO) announced the launch of its Bausch + Lomb INFUSE Multifocal silicone hydrogel daily disposable contact lenses in the United States.

Daily disposable lenses are made of soft and flexible plastic, widely used by individuals involved in sports activities or leading an active lifestyle. They also offer various health benefits, such as a fresh pair of contact lenses being used daily, making them less likely to cause irritation, infections, itchiness, etc., by preventing the accumulation of proteins, lipids, or bacteria.

Distribution Channel Insights

The corrective lens segment accounted for the largest revenue share, more than 45.2%, in 2023 and is anticipated to record substantial growth over the forecast period. These lenses offer several advantages over conventional eyeglasses. They fix directly on the eye surface and provide a natural field of view without obstructions. They effectively correct vision for patients with nearsightedness, farsightedness, presbyopia, and astigmatism. Some recognized corrective lenses are multifocal, bifocal, toric, and spherical.

The cosmetic segment is estimated to record a CAGR of over 9.4% from 2024 to 2030 due to the increasing popularity of these lenses, especially among the young population. They are available in various designs and colors, providing users with several options for their outfits, accessories, and events. Some cosmetic lenses are available in natural colors for a subtle look, while others come in dramatic, fantasy-based designs. For instance, in April 2022, Johnson & Johnson Vision launched its latest range of colored contact lenses, BUBBLE POP, designed to meet the growing trend of makeovers among the youth population in India.

Regional Insights

North America accounted for the largest share, over 38.18%, in 2023 and is expected to grow significantly over the coming years. The higher penetration of contact lenses in the region urges researchers and companies to explore the diverse applications of contact lenses through continuous product innovation. For instance, in March 2023, CooperVision introduced its MyDay Energys daily disposable contact lenses in the United States. These lenses are designed to provide enhanced comfort for patients experiencing pervasive digital eye strain.

U.S. Contact Lenses Market Trends

In the U.S., the market is characterized by rapid innovation and strategic mergers and acquisitions among leading manufacturers. Major companies are investing heavily in research and development to introduce advanced products that enhance user experience; for instance, recent launches have included intelligent contact lenses equipped with sensors to monitor health metrics like glucose levels. This trend increased demand for corrective solutions such as ortho-k (orthokeratology) lenses designed to reshape the cornea overnight. Additionally, the senior population’s growing need for vision correction due to age-related conditions such as cataracts and macular degeneration further fuels market expansion.

Europe Contact Lenses Market Trends

The European market is witnessing a significant shift towards innovative products catering to the growing demand for comfort and convenience. One of the key trends is the rise of daily disposable lenses, which gained popularity due to their hygiene benefits and ease of use. Additionally, advancements in lens technology, such as the development of smart contact lenses that can monitor health metrics like glucose levels, are emerging. Major players invest heavily in research and development to create lenses that address specific vision problems associated with aging populations, such as presbyopia. For instance, in October 2023, Alcon launched TOTAL30 Multifocal contact lenses, the first and only monthly water gradient multifocal lenses designed for patients with presbyopia. This innovative product is now available globally, including in the United States and select international markets.

The market in the UK is characterized by a growing awareness of eye health and an increasing prevalence of myopia among younger populations. This trend led to a surge in demand for specialized lenses for myopic control. Furthermore, there is a notable rise in online sales channels for contact lenses, driven by consumer preferences for convenience and competitive pricing. The UK market is also experiencing innovation through product launches that focus on sustainable materials and eco-friendly packaging, reflecting broader societal trends towards sustainability. Additionally, the aging population is influencing product development as companies introduce multifocal lenses tailored for older adults who require vision correction for both distance and near tasks.

A strong emphasis on fashion, aesthetics, and functionality marks France’s market growth. French consumers are increasingly seeking colored contact lenses for vision correction and as a fashion accessory. The market saw several new product launches aimed at this demographic, including customizable options that allow users to express their style. Moreover, there is a rising incidence of ocular diseases such as dry eye syndrome, prompting manufacturers to develop moisture-retaining lenses that enhance comfort for users suffering from this condition.

Asia Pacific Contact Lenses Market Trends

The market in the Asia Pacific region is experiencing significant growth driven by increasing awareness of eye health and rising disposable incomes. Innovations such as smart contact lenses that monitor glucose levels for diabetic patients are also emerging, reflecting a shift towards technologically advanced products. According to WHO, the senior population is expanding rapidly; by 2030, it is projected that over 20% of the population in countries like China will be 60 or older. This demographic shift leads to increased age-related vision problems such as presbyopia, further boosting demand for multifocal and toric lenses.

The market in Japan is strongly influenced by a preference for high-quality products and advanced technology. For instance, in March 2024, Japanese contact lens manufacturer Menicon plans to utilize advanced technology to examine molecular structures to explore next-generation materials and methods for recycling plastic waste. The country saw a surge in the popularity of colored and cosmetic lenses. Furthermore, Japanese consumers are increasingly concerned about eye health issues related to prolonged screen time and digital device usage. This leads to a rise in demand for lenses designed to reduce digital eye strain. The market is also witnessing innovations such as moisture-retaining materials that enhance comfort for users with dry eyes-a common issue among Japan’s aging population.

India’s market is rapidly evolving due to changing lifestyles and increased urbanization. A significant factor driving this change is the rising prevalence of myopia among children and young adults. Moreover, product launches focusing on affordability without compromising quality are gaining traction among Indian consumers who are price-sensitive yet increasingly health-conscious. For instance, in March 2024, Alcon, an eye care industry player, launched the Clareon series of intraocular lenses (IOLs) in India. These Clarion lenses are designed to deliver reliable visual results and maintain outstanding clarity over time. Compared to other leading IOL brands, the material used for the IOLs in the Clarion line exhibits some of the lowest haze levels and subsurface nano glistening (SSNGs).

Latin America Contact Lenses Market Trends

The market in Latin America is experiencing significant growth, driven by increasing awareness of eye health and the rising prevalence of vision-related issues. One notable trend is the shift towards daily disposable lenses, which are gaining popularity due to their convenience and hygiene benefits. Additionally, there is a growing demand for specialty lenses, including toric lenses for astigmatism and multifocal lenses catering to presbyopia, reflecting a more educated consumer base that seeks tailored solutions for their specific vision needs. The region’s urbanization and changing lifestyles are also contributing factors, as more individuals are exposed to digital screens, leading to increased conditions such as dry eye syndrome.

Brazil stands out within the Latin American context due to its large population and diverse demographics. The Brazilian contact lens market is characterized by a robust growth rate fueled by lens technology and materials innovations. Notably, silicone hydrogel lenses revolutionized comfort and oxygen permeability, making them increasingly popular among consumers. Moreover, Brazil saw a rise in e-commerce platforms that facilitate more accessible access to contact lenses, particularly among younger populations who prefer online shopping. The country’s healthcare initiatives to improve eye care awareness also contributed positively to the market dynamics.

Middle East & Africa Contact Lenses Market Trends

The market in the Middle East and Africa (MEA) is experiencing significant growth, driven by increasing awareness of eye health and rising disposable incomes. One notable trend is the growing preference for daily disposable lenses, which are perceived as more hygienic and convenient compared to traditional reusable options. Additionally, the region saw a surge in demand for specialty lenses, including toric lenses for astigmatism and multifocal lenses catering to presbyopia, particularly among the aging population.

The market in Saudi Arabia is witnessing rapid expansion fueled by lifestyle changes and technological advancements. Introducing innovative products such as colored contact lenses and smart contact lenses equipped with sensors is capturing consumer interest. Moreover, there is an increasing focus on eye care due to rising incidences of ocular diseases such as diabetic retinopathy and dry eye syndrome, which are becoming prevalent due to lifestyle factors like increased screen time. The senior population in Saudi Arabia is also growing; projections indicate that by 2030, around 10% of the population will be over 60 years old. This demographic shift necessitates tailored vision correction solutions to address age-related vision issues.

Key Contact Lenses Company Insights

Companies operating within the industry are concentrating on mergers, partnerships, acquisitions, and introducing new products to enhance their presence in the market. For instance, in September 2022, Johnson & Johnson Vision Care, Inc., a division of Johnson & Johnson MedTech, unveiled its newest product: the ACUVUE OASYS MAX 1-DAY contact lenses along with the ACUVUE OASYS MAX 1-Day MULTIFOCAL contact lenses specifically designed for individuals experiencing presbyopia.

Key Contact Lenses Companies:

The following are the leading companies in the contact lenses market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc. (Johnson & Johnson Vision Care, Inc.)

- Bausch + Lomb

- ALCON INC.

- CooperCompanies (CooperVision)

- Contamac

- HOYA CORPORATION (HOYA Corporation Contact Lens Division)

- SEED Co., Ltd.

- EssilorLuxottica

- Menicon Co., Ltd.

- Euclid Vision Group

Recent Developments

-

In January 2023, Carter Ledyard’s client CooperVision, Inc. finalized its acquisition of SynergEyes, Inc., which offers a diverse array of specialty contact lenses, including unique hybrid lenses. These products enhance CooperVision’s portfolio, particularly its Onefit scleral lenses.

-

In October 2023, XPANCEO, a deep tech startup, raised $40 million in a seed funding round to develop the first contact lenses featuring augmented reality (AR) capabilities. Opportunity Ventures (Asia), based in Hong Kong, led this funding round. The capital will be utilized to advance the next prototype, which aims to integrate multiple features into a single device.

Contact Lenses Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.2 billion

Revenue forecast in 2030

USD 33.8 billion

Growth Rate

CAGR of 8.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, design, application, distribution channel, usage, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Johnson & Johnson Services, Inc. (Johnson & Johnson Vision Care, Inc.), Bausch + Lomb, ALCON INC., CooperCompanies (CooperVision), Contamac, HOYA CORPORATION (HOYA Corporation Contact Lens Division), SEED Co., Ltd., EssilorLuxottica, Menicon Co., Ltd., Euclid Vision Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contact Lenses Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contact lenses market report based on material, design, application, distribution channel, usage, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Gas Permeable

-

Silicone Hydrogel

-

Hybrid Lens

-

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Spherical Lens

-

Toric Lens

-

Multifocal Lens

-

Other Lens

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Corrective

-

Therapeutic

-

Cosmetic

-

Prosthetic

-

Lifestyle-oriented

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Eye Care Professionals

-

Retail

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Daily Disposable

-

Disposable

-

Frequently Disposable

-

Traditional (Reusable) lenses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global contact lenses market size was estimated at USD 18.60 billion in 2023 and is expected to reach USD 20.2 billion in 2024.

b. The global contact lenses market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 33.80 billion by 2030.

b. North America dominated the contact lenses market with a share of more than 38 % in 2023. This is attributable to the rise in the number of visual inaccuracies and rising product innovations.

b. Some key players operating in the contact lenses market include Essilor International S.A.; Alcon Vision LLC; Abbott Medical Optics, Inc.; CooperVision, Inc.; Bausch & Lomb, Incorporated; ZEISS International; Contamac; and Hoya Corporation.

b. Key factors that are driving the contact lenses market growth include an increase in the purchasing power of consumers in developing countries and the need for eliminating the use of spectacles along with the rising adoption of contact lenses to enhance aesthetic appearance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.