- Home

- »

- Medical Devices

- »

-

Intravascular Warming Systems Market Size Report, 2030GVR Report cover

![Intravascular Warming Systems Market Size, Share & Trends Report]()

Intravascular Warming Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Acute Care, Perioperative Care), By End-use (Operating Rooms, ICUs, Emergency Rooms), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-764-3

- Number of Report Pages: 71

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intravascular Warming Systems Market Summary

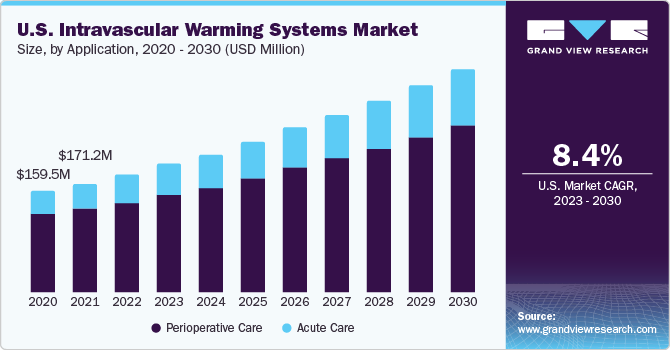

The global intravascular warming systems market size was valued at USD 557.8 million in 2022 and is anticipated reach a value of USD 1,198.5 million by 2030, growing at a compound annual growth rate (CAGR) of 10.1% from 2023 to 2030. These systems are utilized in surgical and critical care settings to keep patients' body temperatures stable.

Key Market Trends & Insights

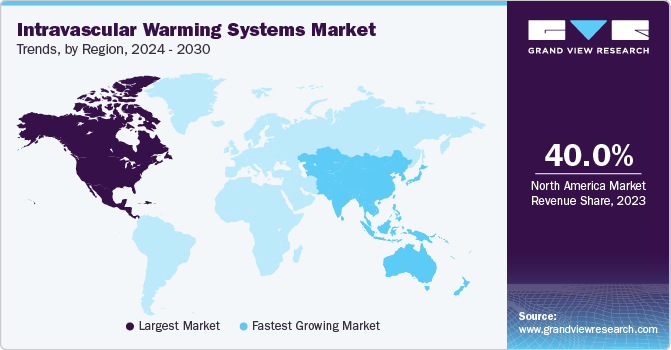

- North America dominated the market and accounted for the largest revenue share of around 40% in 2022.

- By application, the perioperative care segment accounted for the largest revenue share of 78.3% in 2022.

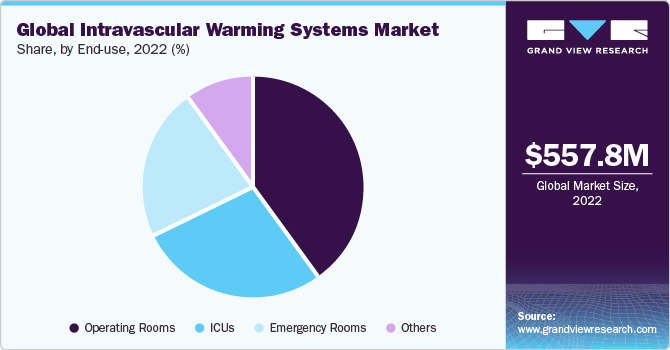

- By end-use, the operating rooms segment accounted for the largest revenue share of 40.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 557.8 Million

- 2030 Projected Market Size: USD 1,198.5 Million

- CAGR (2023-2030): 10.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

An increasing number of surgical procedures is one of the major drivers expected to propel market growth, these systems are commonly utilized in cardiovascular, abdominal, and neurological surgeries. For instance, according to National Center for Biotechnology Information (NCBI), around 234 million major surgical operations are conducted globally. Patients may experience unexpected hypothermia during the perioperative period due to various factors, such as anesthesia, cold room temperature, as well as the use of cold intravenous fluids and blood transfusions.

Inadvertent perioperative hypothermia (IPH) is prevalent in unwarmed perioperative patients and is associated with severe morbidity and mortality. Monitoring temperature levels and preventing IPH through active techniques are crucial to avoid its repercussions, which might include surgical site infection, prolonged recovery from wounds, poor cardiac results, and increased bleeding. Procedures such as cardiac surgery require constant maintenance of a patient's normal body temperature. Hence, there is a need for blood-warming devices, which helps warm the blood infused in a patient's body. Other factors, such as the rising prevalence of cancer and cardiovascular disorders, contribute significantly to the market's growth.

Furthermore, introducing technologically advanced products, such as portable and battery-powered warming devices, is expected to boost market growth. For instance, in 2018, the International Agency for Research on Cancer (IARC) estimated that there were approximately 17.0 million new cancer cases and 9.5 million cancer-related deaths worldwide. However, by 2040, these numbers are projected to increase to 27.5 million new cancer cases and 16.3 million cancer deaths, mainly due to the population's growth and aging.

The COVID-19 pandemic has exerted a substantial influence on the healthcare sector as a whole, and the healthcare equipment industries are not exempted. The pandemic impaired worldwide supply chains, affecting medical device manufacturing and distribution. According to an article by NCBI, multiple healthcare systems globally postponed or canceled elective medical procedures and surgeries to prioritize COVID-19 patients and maintain resources. As a result, surgical volume was low, particularly for heart procedures.

Application Insights

The perioperative care segment accounted for the largest revenue share of 78.3% in 2022. One factor contributing to this market's growth is the increasing number of surgical procedures such as open heart surgery, neurosurgery, abdominal surgery, and vascular surgery. For instance, according to an article published by the American Heart Association in 2020, roughly 19.1 million deaths worldwide were linked to Cardiovascular Disease (CVD). Furthermore, intravascular systems prevent accidental perioperative hypothermia (IPH) at several surgical operation stages, including preoperative warming, intraoperative use, and postoperative recovery, followed by the quick advancement of systems aided by the market's expansion.

On the basis of application, the intravascular warming systems market is segmented into perioperative care and acute care. The acute care segment is expected to advance at the fastest CAGR of 11.3% during the forecast period. This is due to the growing incidence of trauma cases and accidents worldwide. According to the CDC, traumatic brain injury is a leading cause of mortality and disability in the U.S., with approximately 190 Americans dying from TBI-related injuries every day in 2021. Also, the rise of patients needing critical care is increasing globally due to the prevalence of heart attacks and strokes. Using intravascular warming devices prevents any adverse effects caused during acute care, avoiding prolonged recovery, which is expected to boost market growth.

End-use Insights

The operating rooms segment accounted for the largest revenue share of 40.0% in 2022. High usage of intravascular warming systems for pre-, intra-, and postoperative care in cancer, cardiac, and other diseases accounted for the growth of this segment. According to an article by the National Center for Biotechnology Information (NCBI), the complications that occur in patients during temperature management affect the cardiovascular systems due to the prevalence of cardiovascular disease in 80% of the patients. In addition, the rising adoption of advanced medical devices fuels the demand for intravascular warming systems.

On the basis of end use, the market is segmented into operating rooms, ICUs, emergency rooms, and others. The emergency rooms segment is estimated to register the fastest CAGR of 11.3% over the forecast period. The key factor that can be attributed to the growth of this segment is the increasing adoption of intravascular warming systems for treating accident and trauma patients.

For instance, according to an article published by NCBI in August 2021, major trauma accounted for 10% of all deaths worldwide, with two-thirds suffering from hypothermia upon admission to the emergency department. It is essential to allocate the correct level of care for treating patients with trauma care and managing temperature during perioperative care.

Regional Insights

North America dominated the market and accounted for the largest revenue share of around 40% in 2022. The government of the U.S. is undertaking significant investment initiatives to develop healthcare infrastructure and services for hospitals. According to a Centers for Medicare & Medicaid Services article, healthcare spending in the U.S. increased by 2.7 percent in 2021, reaching USD 4.3 trillion, or USD 12,914 per person. Health spending accounted for 18.3 percent of the nation's Gross Domestic Product. High investment in the development of hospitals in the U.S. is directed toward the overall well-being of patients, which is further anticipated to result in a positive impact on the market's growth in the near future.

Asia Pacific is expected to expand at the fastest CAGR of 12.4% during the forecast period. The region has witnessed a significant increase in healthcare expenditure due to the geriatric population. According to the Economic Survey of 2023, in 2021-22, India's public spending on healthcare accounted for 2.1% of GDP. Furthermore, the increasing prevalence of cardiovascular diseases (CVD) in this region accounts for the demand for intravascular warming systems. For instance, NLM published an article on January 2020 stating that India contributes to one-fifth of the total 17.7 million deaths caused globally due to CVDs.

Key Companies & Market Share Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. The companies are majorly focused on launching new products to strengthen their position in this sector. The market players provide a range of quality systems with innovations.

For instance, in July 2023, ZOLL Medical Corporation expanded its temperature management portfolio to include the IQool System, a high-quality surface option developed by BrainCool. The IQool System is a FDA-cleared, single-use, closed-loop surface warming system that uses heated air to warm the patient's skin. It is designed to prevent hypothermia in patients who are at risk, such as those who are undergoing surgery or who have been injured.

Key Intravascular Warming Systems Companies:

- ZOLL Medical Corporation

- BD (Becton, Dickinson and Company)

- Geratherm Medical AG

- Medtronic

- Stryker

- Estill Medical Technologies, Inc.

- Smiths Group plc

- Inspiration Healthcare Group plc

- 3M

Intravascular Warming Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 612.0 million

Revenue forecast in 2030

USD 1,198.5 million

Growth Rate

CAGR of 10.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ZOLL Medical Corporation; BD (Becton, Dickinson and Company); Geratherm Medical AG; Medtronic; Stryker; Estill Medical Technologies, Inc.; Smiths Group plc; Inspiration Healthcare Group plc; 3M

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

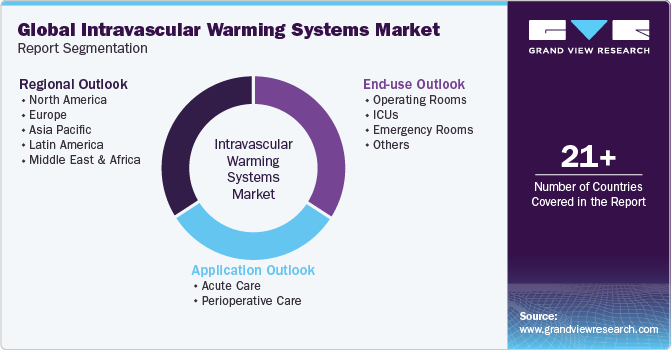

Global Intravascular Warming Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global intravascular warming systems marketreport on the basis of application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute care

-

Perioperative care

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Operating Rooms

-

ICUs

-

Emergency Rooms

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intravascular warming systems market size was estimated at USD 557.8 million in 2022 and is expected to reach USD 612.0 million in 2023.

b. The global intravascular warming systems market is expected to grow at a compound annual growth rate of 10.1% from 2023 to 2030 to reach USD 1,198.5 million by 2030.

b. North America dominated the intravascular warming systems market with a share of 39.0% in 2022. This is attributable to the growing geriatric population, increasing adoption of advanced products, and significant investment initiatives to develop advanced healthcare infrastructure.

b. Some of the players operating in this market are 3M; The 37 Company; Stryker Corp.; Smiths Medical, Inc.; Inditherm Plc.; Geratherm Medical AG; Becton, Dickinson and Company; and Estill Medical Technologies, Inc.

b. Key factors that are driving the intravascular warming systems market growth include the rising prevalence of cancer and cardiovascular disorders, technological advancements in intravascular warming systems, and increasing adoption of intravascular warming systems for the treatment of accident and trauma patients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.