- Home

- »

- Next Generation Technologies

- »

-

Intrinsically Safe Equipment Market, Industry Report, 2030GVR Report cover

![Intrinsically Safe Equipment Market Size, Share & Trends Report]()

Intrinsically Safe Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Zone (Zone 0, Zone 1), By Class (Class 1, Class 2), By Products, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-587-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intrinsically Safe Equipment Market Trends

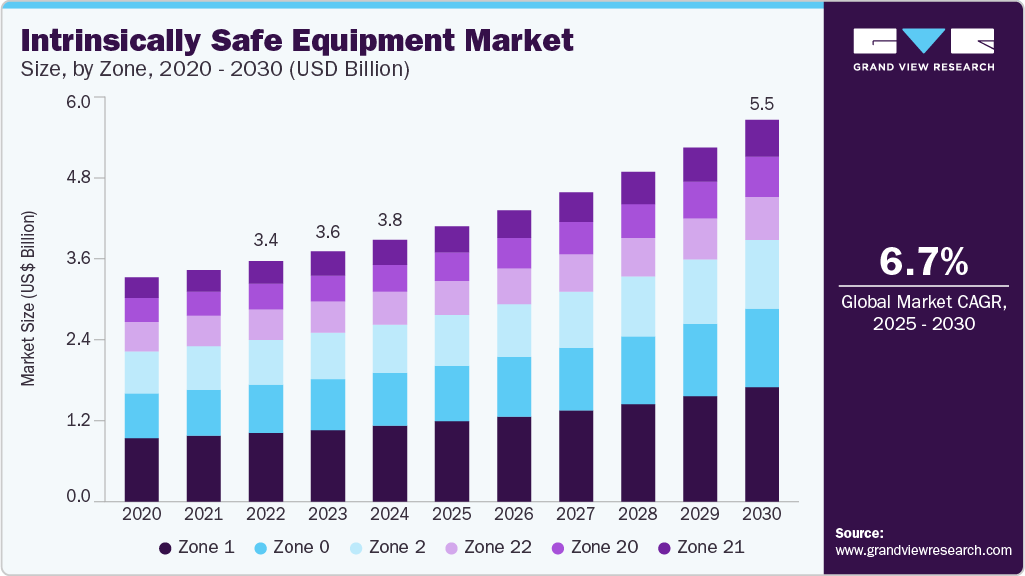

The global intrinsically safe equipment market size was estimated at USD 3.75 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. A primary driver of the intrinsically safe equipment industry is the increasing alignment of U.S. regulations with international standards.

Key Highlights:

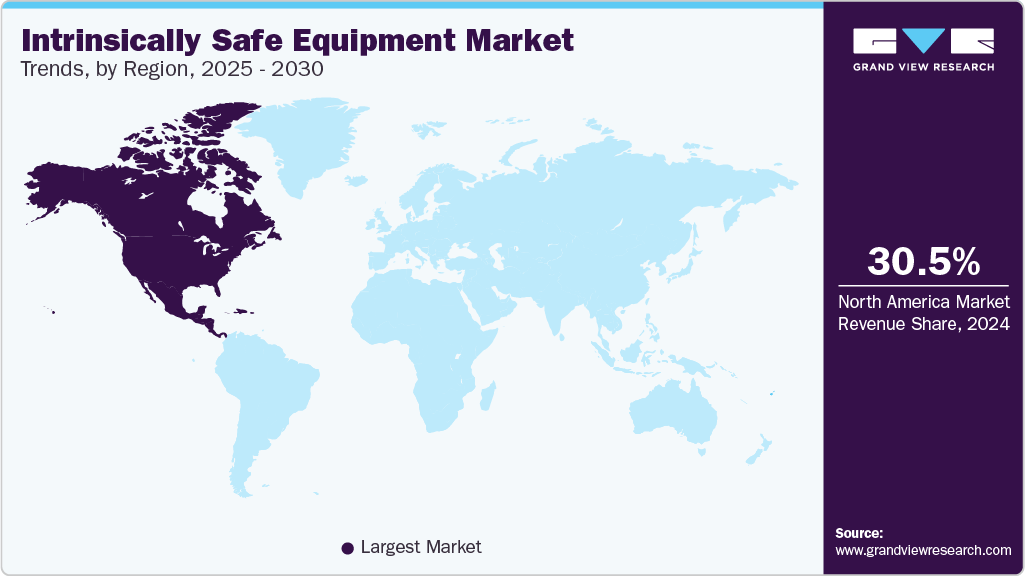

- North America dominated the intrinsically safe equipment market with the largest revenue share of 30.5% in 2024

- The intrinsically safe equipment market in the U.S. accounted for the largest market revenue share in North America in 2024

- By zone, the zone 1 segment led the market with the largest revenue share of 28.9% in 2024

- By class, the class 1 segment accounted for the largest market revenue share in 2024

- By product. the sensors segment accounted for the largest market revenue share in 2024

MSHA’s ACRI2001 criteria, which govern the certification of two-fault intrinsically safe equipment for underground mining, have historically diverged from the global ANSI/ISA-60079-11 standard. This discrepancy created delays in deploying new safety technologies post-2006 Mine Improvement and New Emergency Response (MINER) Act, prompting calls for harmonization from the National Academy of Sciences. Recent evaluations by the National Institute for Occupational Safety and Health (NIOSH) highlight that ANSI/ISA-60079-11 offers equivalent or greater protection levels compared to ACRI2001, particularly in energy-limiting safety factors and fault tolerance. OSHA’s 1910.307 regulation further bolsters adoption by permitting intrinsically safe equipment in Class I-III hazardous locations, provided it meets ANSI/UL 913 standards. These regulatory synergies are streamlining global trade and encouraging manufacturers to design universally compliant devices, reducing development costs and accelerating market penetration.

The mining and oil, and gas sectors are adopting intrinsically safe equipment to enhance operational safety in explosive atmospheres, which is propelling the market growth. For instance, the CDC’s National Institute for Occupational Safety and Health (NIOSH) has endorsed advanced wireless communication systems, such as the Dräger X-plore 8000 PAPR, which features R59550 intrinsically safe blowers certified for use in methane-rich environments. These systems enable real-time tracking and communication in underground mines, addressing a critical need highlighted by the MINER Act. Similarly, oil refineries are integrating intrinsically safe sensors and controllers to monitor volatile organic compounds, reducing ignition risks during drilling and processing. The shift from traditional explosion-proof enclosures to intrinsically safe designs-which offer orders-of-magnitude lower failure probabilities reshaping safety protocols in these industries, which further boosts the market growth.

Heightened focus on worker safety is propelling demand for intrinsically safe equipment across manufacturing and emergency services. NFPA 1970’s 2023 revisions mandate that self-contained breathing apparatus (SCBA) and personal alert safety systems (PASS) used by firefighters meet non-incendive or intrinsically safe standards for Class I-III hazardous locations. Although no recorded explosions involving firefighting gear exist, the NFPA’s proactive stance underscores the importance of preemptive risk mitigation. In mining, MSHA’s enforcement of two-fault intrinsic safety criteria ensures that equipment like gas detectors and communication devices cannot ignite methane-air mixtures, even after multiple component failures. These protocols are reducing fatalities in gassy mines, where explosion-proof enclosures were previously the norm despite higher inherent risks.

The transition toward globally recognized intrinsic safety standards is eliminating regional market barriers. IEC 60079-11, the international benchmark for two-fault intrinsic safety, now informs U.S. regulations through ANSI/ISA adoptions, despite early disagreements over safety factors. For instance, IEC’s 1.5× safety factor for energy limitation contrasts with MSHA’s historical 2.25× factor, yet NIOSH analyses confirm both approaches provide adequate miner protection. This harmonization is particularly impactful in emerging economies, where adopting IEC-aligned standards allows local manufacturers to compete in export markets while attracting foreign investment in sectors like chemical processing and pharmaceuticals.

Intrinsically safe designs are becoming indispensable in firefighting gear, driven by NFPA’s rigorous certification requirements, which propelled the market growth. The 2023 NFPA 1970 standard mandates that SCBA and PASS devices either meet nonincendive criteria for Division 2 hazardous locations or achieve full intrinsic safety certification for Division 1 zones. This shift reflects an acknowledgment that traditional explosion-proof certifications do not withstand the extreme conditions of active firefighting, where equipment is exposed to heat, debris, and mechanical stress.

Zone Insights

The Zone 1 segment led the market with the largest revenue share of 28.9% in 2024. The Zone 1 segment, which encompasses areas where explosive gas atmospheres are likely to occur during normal operations, continues to drive the largest market share of the market. Growth in this segment is fueled by rapid offshore and onshore oil & gas development, expansion of petrochemical and refining facilities, and the continual tightening of IECEx and ATEX safety standards across Europe and North America. Manufacturers are investing heavily in advanced intrinsically safe lighting, communication devices, and instrumentation certified for Zone 1 to ensure compliance and minimize the risk of ignitions in these high-hazard environments.

The Zone 21 segment is expected to grow at the fastest CAGR during the forecast period. Zone 21 covers locations where combustible dust clouds are likely under normal conditions common in food processing, grain handling, cement production, and mining. Recent regulatory updates around dust explosion prevention (e.g., NFPA 654 in the U.S., EN 60079-20-2 in Europe) have prompted end-users to retrofit plants with intrinsically safe sensors and switchgear. The rising automation of material handling systems and the need for continuous monitoring of dust concentration have further accelerated demand for Zone 21-certified equipment, particularly in Asia-Pacific manufacturing hubs.

Class Insights

The Class 1 segment accounted for the largest market revenue share in 2024. Class 1 equipment, designed for atmospheres containing flammable gases or vapors, leads the market due to the prevalence of gas-processing, petrochemical, and refining operations globally. Stringent OSHA regulations in the U.S. (29 CFR 1910.307) and similar directives in the EU mandate intrinsic safety for critical monitoring and control devices, driving investments in certified instruments. The emergence of smart Class 1 devices with built-in diagnostics and wireless capabilities is a key trend, enabling predictive maintenance and reducing unscheduled downtime in high-risk zones.

The Class 2 segment is projected to grow at the fastest CAGR over the forecast period. Class 2 pertains to environments containing combustible dust. While traditionally smaller than Class 1, this segment is expanding rapidly alongside growth in the pharmaceutical, food & beverage, and mineral processing sectors. Enhanced regulations on dust safety, coupled with increasing plant modernization, have led to wider adoption of intrinsically safe detectors, sensors, and isolators. Innovations in low-profile, high-sensitivity Class 2 sensors now allow for more accurate real-time dust monitoring and automated shutdown protocols, boosting safety and regulatory compliance.

Products Insights

The sensors segment accounted for the largest market revenue share in 2024. Intrinsically safe sensors are at the forefront of digital transformation in hazardous industries. Demand is driven by the integration of Industrial 4.0 concepts, real-time data analytics, IoT connectivity, and cloud-based monitoring platforms. New-generation sensors offer multi-parameter measurement (e.g., pressure, temperature, gas concentration) with embedded diagnostics, enabling predictive insights and reducing maintenance costs. Their compact designs and wireless modules tailored for Zone 1/Class 1 and Zone 21/Class 2 environments have accelerated uptake, especially in brownfield retrofits, where minimizing downtime is critical.

The transmitters segment is projected to grow at the fastest CAGR over the forecast period. Transmitters play a pivotal role in conveying critical field data from hazardous areas to control rooms. The shift toward digital HART and Foundation Fieldbus protocols has propelled intrinsic-safety transmitter sales, as end-users’ upgrade legacy 4-20 mA loops to achieve higher accuracy and two-way communication. Advances in low-power electronics and explosion-proof enclosures certified for multiple zones/classes are enabling seamless integration into existing process control systems, driving strong growth in this segment.

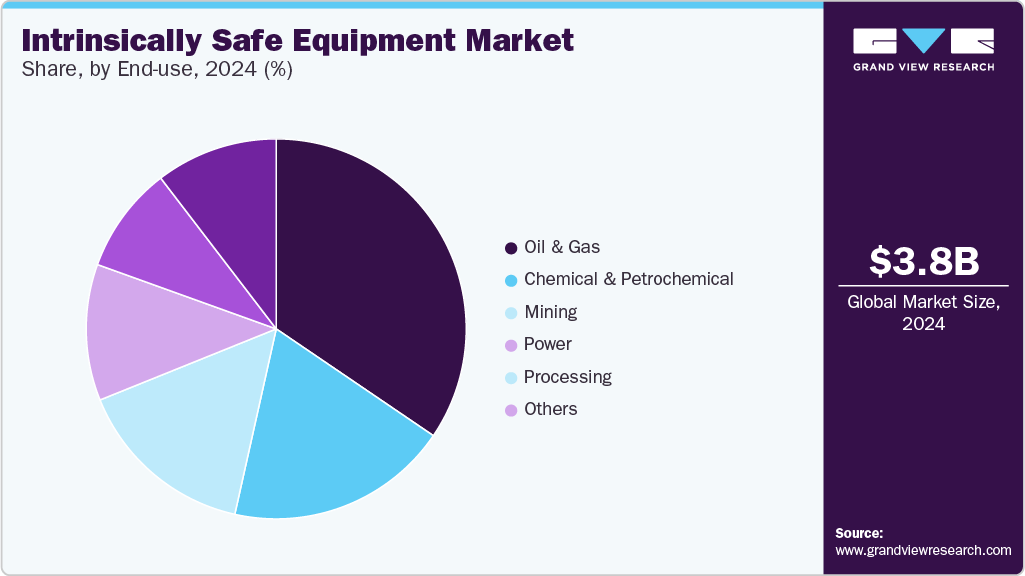

End Use Insights

The oil and gas segment accounted for the largest market revenue share in 2024 and is projected to grow at a significant CAGR over the forecast period. Continued exploration and production activities, particularly in deep-water and shale plays, alongside expansion of LNG liquefaction and refining capacities, underpin robust demand for intrinsically safe instrumentation. Major operators are adopting wireless field networks and intrinsically safe mobile devices for remote monitoring of wellheads, pipelines, and processing units, aiming to enhance safety and operational efficiency in high-risk zones.

The mining segment is projected to grow at the fastest CAGR over the forecast period. Mining operations, especially underground metal and non-metal mines, are increasingly deploying intrinsically safe equipment to monitor methane levels, dust concentration, and equipment condition. Stricter mine safety regulations, such as Canada’s Mining Safety and Health Amendments (2021) and Australia’s Dangerous Goods Safety Act updates, are driving the replacement of conventional devices with certified intrinsically safe alternatives. Moreover, the push toward automation and unmanned vehicles in mines is fueling demand for rugged, intrinsically safe communication devices and sensors capable of operating in confined, explosive atmospheres.

Regional Insights

North America dominated the intrinsically safe equipment market with the largest revenue share of 30.5% in 2024, primarily driven by stringent safety regulations and advanced industrial practices. Government agencies such as the Occupational Safety and Health Administration (OSHA) and the National Institute for Occupational Safety and Health (NIOSH) are central to this trend. These agencies emphasize the mandatory use of explosion-proof and intrinsically safe devices in sectors such as oil & gas, mining, and chemical manufacturing. According to OSHA's electrical safety standards under 29 CFR 1910, industries operating in hazardous locations must utilize equipment classified for use in explosive atmospheres, ensuring minimal risk to human life and assets. Moreover, NIOSH supports the development and testing of intrinsically safe technologies for underground mining and combustible environments, further encouraging market growth through innovation and safety initiatives.

U.S. Intrinsically Safe Equipment Market Trends

The intrinsically safe equipment market in the U.S. accounted for the largest market revenue share in North America in 2024.Within the U.S., the intrinsically safe equipment industry is tightly regulated, with consistent emphasis on workplace safety in high-risk industries. OSHA regulations require employers to ensure that electrical equipment used in potentially hazardous areas (such as those with flammable gases, vapors, or combustible dust) meets safety classifications. These classifications are defined under Hazardous Locations (HazLoc), which prescribe specific engineering and usage guidelines for explosion-proof equipment. In addition, the Mine Safety and Health Administration (MSHA) mandates intrinsically safe certification for mining equipment, significantly influencing procurement trends. The U.S. government's regulatory framework directly supports the adoption of advanced, intrinsically safe products, particularly as energy production shifts toward automation and digital monitoring systems in hazardous zones.

Europe Intrinsically Safe Equipment Market Trends

The intrinsically safe equipment market in Europe was identified as a lucrative region in 2024. Europe is a leading region in terms of legislation and enforcement concerning intrinsically safe equipment, primarily through the ATEX directives governed by the European Commission. These directives, ATEX 2014/34/EU for equipment and ATEX 1999/92/EC for workplace safety, form the backbone of explosive atmosphere regulation. The ATEX directives are harmonized across the EU, requiring all electrical and mechanical devices used in explosive atmospheres to be certified accordingly. This robust legal framework promotes widespread adoption of intrinsically safe equipment in industries like petrochemicals, pharmaceuticals, and manufacturing. Moreover, Europe's strong emphasis on sustainability and worker safety complements market growth, pushing manufacturers to invest in ATEX-compliant product lines.

The Germany intrinsically safe equipment market is anticipated to grow at a significant CAGR during the forecast period. Germany, as the largest economy in Europe and a leader in industrial automation, enforces strict compliance with the ATEX directives. Its strong engineering sector and focus on high-precision manufacturing have led to the widespread deployment of intrinsically safe devices in automotive, chemical, and industrial sectors. Germany’s Federal Institute for Occupational Safety and Health (BAuA) works in conjunction with the European regulatory framework to ensure that workplaces maintain the highest safety standards in hazardous environments. This adherence to ATEX standards, along with Germany’s leadership in developing IECEx-compatible technologies, drives strong domestic demand for intrinsically safe equipment, especially in the energy and utilities sector.

The intrinsically safe equipment market in the UK is anticipated to grow at a substantial CAGR during the forecast period. Post-Brexit, the UK has established its equivalent to the ATEX directive called UKEX. The Health and Safety Executive (HSE) enforces regulations under the Dangerous Substances and Explosive Atmospheres Regulations 2002 (DSEAR), requiring risk assessments and the use of intrinsically safe equipment in hazardous areas. UK-based industries such as offshore oil & gas, energy, and pharmaceuticals remain significant users of these systems. The HSE provides comprehensive guidelines and compliance frameworks that industries must follow to maintain safety in workplaces with explosive atmospheres. The continuation of ATEX-aligned practices under UKEX ensures that the UK remains closely integrated with international standards.

Asia Pacific Intrinsically Safe Equipment Market Trends

The intrinsically safe equipment market in Asia Pacific is anticipated to grow at a significant CAGR during the forecast period. The APAC region shows strong growth, driven by rapid industrialization, rising safety standards, and government-led safety campaigns. Countries like China, Japan, and India have adopted international standards such as IECEx while also developing localized certifications. Across APAC, the use of intrinsically safe equipment is increasing in sectors such as mining, oil & gas, transportation, and chemicals. The region’s commitment to safety in high-risk industries is further strengthened by regulations issued by respective national agencies. Moreover, international investors and exporters are compelled to meet local safety certifications to enter these rapidly growing markets.

The China intrinsically safe equipment has emerged as a major consumer and manufacturer of intrinsically safe equipment. Regulatory bodies such as the State Administration of Market Regulation (SAMR) and the State Administration of Work Safety (SAWS) oversee the certification of explosion-proof equipment, ensuring compliance with national standards like GB 3836, which align with IECEx guidelines. The government has been promoting industrial safety through the enforcement of safety codes in coal mining, petroleum refining, and chemical plants. The push toward localization and modernization of safety equipment has led to the expansion of domestic production and the integration of smart intrinsically safe devices in industrial automation.

The intrinsically safe equipment market in India is growing rapidly, driven by expanding oil & gas exploration, mining activities, and a national focus on industrial safety. Regulatory oversight is provided by bodies such as the Directorate General of Mines Safety (DGMS), which mandates the use of intrinsically safe equipment in underground coal and metal mines. India follows both IECEx and IS (Indian Standard) codes for equipment approvals. The Petroleum and Explosives Safety Organisation (PESO) also plays a role in certifying equipment used in oil and chemical installations. With the Make in India initiative, domestic manufacturing of intrinsically safe devices is expanding, and international firms must meet Indian safety requirements to operate in these sectors.

Key Intrinsically Safe Equipment Company Insights

Some of the major players in the intrinsically safe equipment industry include Pepperl+Fuchs Inc., Fluke Corporation, Honeywell International Inc., R. STAHL AG, and Eaton, among others, due to a combination of technological expertise, regulatory compliance capabilities, and established global distribution networks. These companies consistently invest in research and development to engineer products that meet stringent international safety standards such as IECEx, ATEX, and regional certifications like OSHA (U.S.), UKEX (U.K.), and TIIS (Japan). Their ability to develop highly reliable, durable, and advanced solutions for use in hazardous environments, such as oil & gas, mining, manufacturing, and chemicals, has positioned them as preferred vendors across critical industries.

Furthermore, their long-standing relationships with regulatory bodies, robust certification processes, and comprehensive after-sales service enable them to maintain trust and continuity with clients operating in high-risk zones. Their presence in both mature markets (North America, Europe, Japan) and emerging economies (India, China, Southeast Asia) also allows them to scale operations while adapting to evolving regional safety requirements, further reinforcing their leadership in the global intrinsically safe equipment industry.

-

Pepperl+Fuchs Inc., a German multinational founded in 1945, is a pioneer in proximity sensors and explosion protection systems. The company’s leadership stems from its extensive portfolio of intrinsically safe barriers, surge protection devices, and wireless communication solutions tailored for hazardous areas. Its global manufacturing footprint and adherence to ATEX and IECEx certifications ensure compatibility with diverse regulatory frameworks, making it a preferred supplier for oil refineries and chemical plants. Pepperl+Fuchs Inc.’s focus on R&D has led to innovations like modular I/O systems that simplify installation in Zone 1/21 environments.

-

Honeywell International Inc.'s Safety and Productivity Solutions division leverages its expertise in automation to address hazardous area challenges. The Zone 1/21 IO system, a recent innovation, integrates intrinsically safe and non-intrinsic field devices into a single remote cabinet, reducing cabling costs and enhancing diagnostics. By aligning with Experion DCS and ControlEdge PLCs, Honeywell International Inc. offers end-to-end automation solutions that streamline compliance with IECEx and ATEX standards. Strategic acquisitions, such as the integration of RAE Systems’ gas detection technologies, further expand its footprint in industrial safety.

Key Intrinsically Safe Equipment Companies:

The following are the leading companies in the intrinsically safe equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Pepperl+Fuchs Inc.

- Fluke Corporation

- Honeywell International Inc.

- R. STAHL AG

- Eaton

- Emerson Electric Co.

- Siemens AG

- Rockwell Automation

- ABB

- Extronics

Recent Developments

-

In May 2025, Pepperl+Fuchs Inc. announced a partnership with Samsung to develop intrinsically safe mobile devices for hazardous environments. This collaboration aims to integrate Samsung’s 5G connectivity with Pepperl + Fuchs’ explosion-proof enclosures, enabling real-time data transmission in oil refineries and chemical plants. The initiative addresses the growing demand for connected worker solutions in Zone 1 areas, enhancing both safety and operational efficiency.

-

In 2024, Honeywell International Inc.'s Zone 1/21 IO system, launched, which simplifies hazardous area automation by supporting mixed device integration. Certified for ATEX and IECEx, the system reduces installation costs by 30% through minimized cabling and junction boxes. Field trials in Middle Eastern oil fields demonstrated a 40% reduction in maintenance downtime due to its diagnostic capabilities.

Intrinsically Safe Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.95 billion

Revenue forecast in 2030

USD 5.47 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Zone, class, products, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Pepperl+Fuchs Inc.; Fluke Corporation; Honeywell International Inc.; R. STAHL AG; Eaton; Emerson Electric Co.; Siemens AG; Rockwell Automation; ABB; Extronics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intrinsically Safe Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intrinsically safe equipment market report based on zone, class, products, end use, and region.

-

Zone Outlook (Revenue, USD Million, 2018 - 2030)

-

Zone 0

-

Zone 20

-

Zone 1

-

Zone 21

-

Zone 2

-

Zone 22

-

-

Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Class 1

-

Class 2

-

Class 3

-

-

Products Outlook (Revenue, USD Million, 2018 - 2030)

-

Sensors

-

Detectors

-

Switches

-

Transmitters

-

Isolators

-

LED Indicators

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil and Gas

-

Mining

-

Power

-

Chemical and Petrochemical

-

Processing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global intrinsically safe equipment market size was estimated at USD 3.75 billion in 2024 and is expected to reach USD 3.95 billion in 2025.

b. The global intrinsically safe equipment market size is expected to grow at a significant CAGR of 6.7% to reach USD 5.47 billion in 2030.

b. North America held the largest market share of 30.5% in 2024. This is due to stringent safety regulations and advanced industrial practices. Government agencies such as the Occupational Safety and Health Administration (OSHA) and the National Institute for Occupational Safety and Health (NIOSH) are central to this trend.

b. Some of the players in the intrinsically safe equipment market include Pepperl+Fuchs Inc., Fluke Corporation, Honeywell International Inc., R. STAHL AG, Eaton, Emerson Electric Co., Siemens AG, Rockwell Automation, ABB, Extronics.

b. A primary driving factor for the intrinsically safe equipment market is the enforcement of stringent safety regulations across industries such as oil and gas, mining, and chemicals, compelling companies to adopt certified equipment to prevent ignition risks in hazardous environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.