- Home

- »

- Medical Devices

- »

-

Intubation Tubes Market Size, Share & Growth Report, 2030GVR Report cover

![Intubation Tubes Market Size, Share & Trend Report]()

Intubation Tubes Market (2023 - 2030) Size, Share & Trend Analysis Report By Product Type (Trachea Intubation, Gastric Intubation), By End-use (Hospitals, Ambulatory Surgical Centers, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-021-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

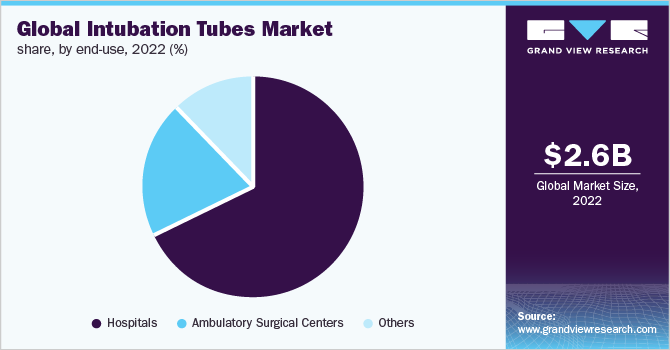

The global intubation tubes market size was estimated at USD 2.6 billion in 2022 and is expected to witness a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. The increasing prevalence of hospital-acquired infections such as ventilator-associated pneumonia and rising admissions in the healthcare settings such as hospitals and clinics are propelling the revenue of the market. The beginning of COVID-19 resulted in significant revenue losses, especially in the first and second quarters of 2020. In March 2020, there was a rapid increase in critically ill patients diagnosed with the COVID-19 virus requiring emergency intubation tubes at various healthcare centers. Intubation tubes are the approved way of providing breathing support to COVID-19 patients.

According to clinical guidelines from the American Society of Anesthesiologists, non-invasive mechanical ventilation like CPAP machines used for sleep apnea is not compatible with COVID-19 patients. Intubation tubes and ventilation supports a COVID-19 patient's breathing so the body can survive until the immune system fights the virus.

Some of the most common respiratory diseases are pulmonary hypertension, asthma, chronic obstructive pulmonary disease (COPD), and occupational lung diseases. In addition to tobacco smoke, other risk factors include occupational chemicals and dust, air pollution, and frequent lower respiratory infections during childhood. COPD is one of the world's leading causes of death. The proportion of all deaths caused by lung diseases is influenced by population age and age-specific death rates from respiratory and non-respiratory causes.

Ventilator-associated pneumonia (VAP) is an infection of the lower respiratory tract that occurs after 48 hours of mechanical ventilation. Despite significant advances in diagnostic techniques and management, the morbidity and mortality rates associated with VAP remain high. VAP is reported to affect 5-40% of patients receiving invasive mechanical ventilation for more than 2 days, with large variations depending on criteria used to identify VAP, country, and ICU type.

VAP rates have been reported to be as low as 2.5 cases per 1000 ventilator days in North American hospitals. On the other hand, European centers reported much higher rates. VAP is still one of the most common ICU-acquired infections, and it is linked to increased mortality. Moreover, apart from VAP, the procedure of intubation tube is generally safe and common in a healthcare setting that can help save a patient’s life. Most patients improve in a few hours or days, but some people experience vomiting, breathing problems, or infections.

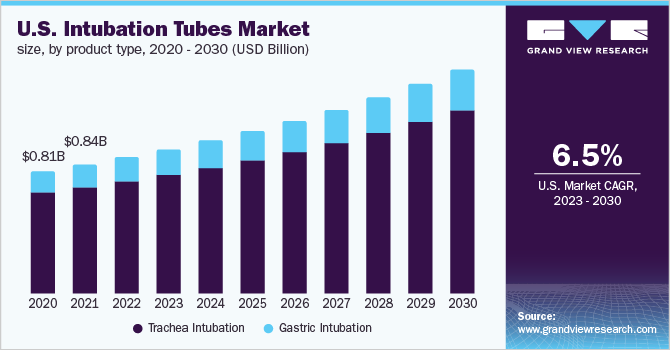

Product Type Insights

The trachea intubation segment held the largest revenue share of 82.8% in 2022. Based on product type, the market is segmented into trachea intubation and gastric intubation. Tracheal intubation maintains a patent airway, preventing obstruction caused by loss of consciousness, edoema, or compression. The most common method of tracheal intubation is rigid direct laryngoscopy. It is an urgent need of creating standardized evidence-based protocols for airway management in the ICU. As a result, implementing an intubation care bundle, as well as a pre-planned approach to difficult airways, is critical for safe TI in the ICU.

The gastric intubation segment is expected to exhibit the highest growth of 7.1% over the forecast period. The growth can be attributed to the fact that it is a tube that is inserted in the patient’s nose, down to the throat and esophagus, and ends in the stomach. It is also used to provide liquid food, medications, and liquids, as well as to remove elements from the stomach. A gastric intubation insertion is typically performed in a hospital or at home, and it also allows the doctor to treat an intestinal obstruction in less invasive ways than intestinal surgery.

End-use Insights

The hospitals segment held the largest revenue share of 67.9% as of 2022. With the growing demand for surgeries performed annually, the number of patient admissions is increasing. The high number of users are patients with chronic conditions or severe illnesses and the high flow of patients into the hospitals for treatment and are the factors to support the segment growth. According to the statistics of Statista, in 2019, there were over 36.2 million hospital admissions in the U.S.

The ambulatory surgical centers segment is anticipated to witness a lucrative growth of 6.4% in the forecast period. The growth can be attributed to the fact that these centers are cost-effective as the surgery is performed on an outpatient basis and requires no overnight stay, there is a significant reduction in cost. There is an availability of a wide range of specialized services in these facilities. There is a lower risk of infection and contracting other illnesses in these centers due to the fewer number of patients.

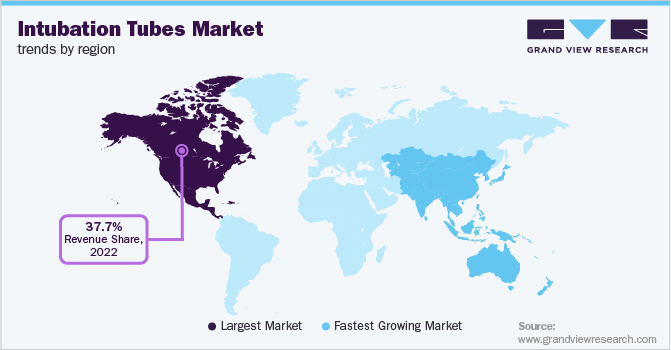

Regional Insight

North America dominated the global intubation tubes market in terms of the revenue share of 37.7% in 2022. The incidence of chronic and respiratory disorders including cancer and asthma is rising in the region. According to the Asthma and Allergy Foundation of America, in the U.S., about 20 million U.S. adults aged 18 and older have asthma and more than 25 million people have asthma. Approximately 40.4% of adults aged 18 and above who had asthma stated having more than one asthma attack in the past year in the U.S. in 2019. Europe held the second-largest share and is expected to show lucrative growth in the coming years.

Asia Pacific is expected to show the highest growth of 8.1% over the forecast period. The growth can be attributed to the increasing pollution causing respiratory diseases among the people and the growing aging population with chronic diseases in this region is further increasing the demand for surgeries.

Key Companies & Market Share Insights

The industry is marked by the presence of various industry players. The market is highly fragmented and competitive in nature. The industry growth is directly associated with the rising investments by manufacturers in the development of cost-effective, innovative products, and the rising prevalence of chronic diseases. The players are constantly involved in strategic initiatives such as acquisitions, new product launches, technological advancements, and collaborations in order to gain deeper penetration. For instance, in August 2022, Teleflex Incorporated announced the acquisition of Standard Bariatrics, Inc. which has commercialized an innovative powered stapling technology for bariatric surgery. The acquisition is likely to expand its surgical portfolio. Some of the prominent players in the global intubation tubes market include:

-

Teleflex Corporation

-

Medtronic

-

Medline Industries

-

Venner Medical

-

Sonoma Pharmaceutical

-

Hospiteknik Healthcare

-

Armstrong Medical

-

Airway Innovations

-

Smiths Group

-

ConvaTec, Inc.

Intubation Tubes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.7 billion

Revenue forecast in 2030

USD 4.3 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million and CAGR from 2023 to 2030

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teleflex Corporation; Medtronic; Medline Industries; Venner Medical; Sonoma Pharmaceutical; Hospiteknik Healthcare; Armstrong Medical; Airway Innovations; Smiths Group; ConvaTec, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intubation Tubes Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intubation tubes market report based on product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Trachea Intubation

-

Gastric Intubation

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intubation tubes market size was estimated at USD 2.6 billion in 2022 and is expected to reach USD 2.7 billion in 2023.

b. The global intubation tubes market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 4.3 billion by 2030.

b. North America dominated the intubation tubes market with a share of 37.7% in 2022. This is attributable to the fact of the high prevalence of respiratory diseases in the region.

b. Some key players operating in the intubation tubes market include Teleflex Corporation, Medtronic, Medline Industries, Venner Medical, Sonoma Pharmaceutical, Hospiteknik Healthcare, Armstrong Medical, Airway Innovations, Smiths Group, and ConvaTec, Inc.

b. Key factors that are driving the intubation tubes market growth include the rising prevalence of chronic diseases and the increasing number of surgical procedures in the healthcare setting.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.