- Home

- »

- Medical Devices

- »

-

Invisible Orthodontics Market Size, Share Report, 2030GVR Report cover

![Invisible Orthodontics Market Size, Share & Trends Report]()

Invisible Orthodontics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Clear Aligners, Ceramic Braces, Lingual Braces), By Age (Teens, Adults) By Dentist Type (General Dentists, Orthodontists), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-160-6

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Invisible Orthodontics Market Summary

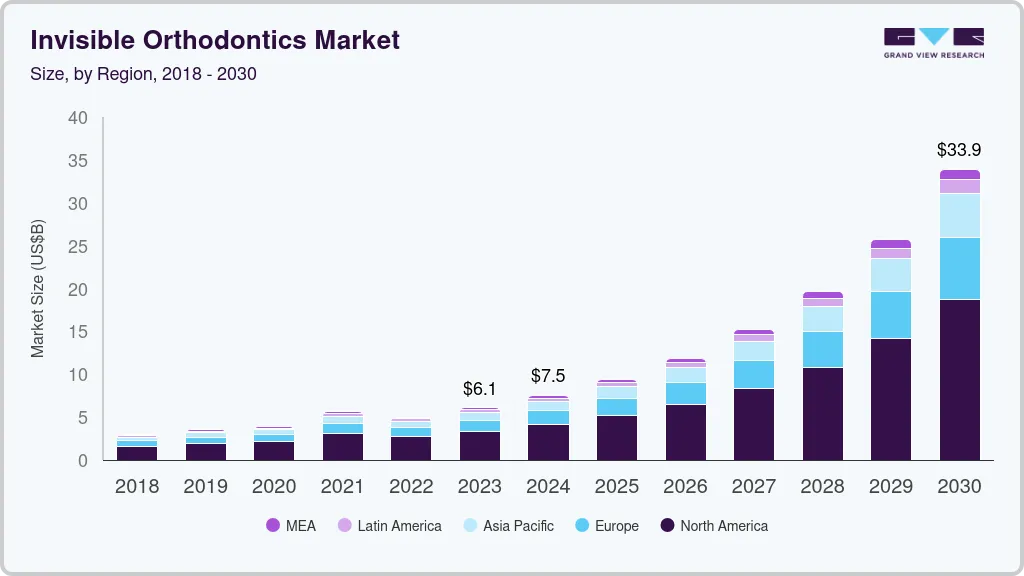

The global invisible orthodontics market size was estimated at USD 6.1 billion in 2023 and is projected to reach USD 33.9 billion by 2030, growing at a CAGR of 28.5% from 2024 to 2030. Rapidly growing patient population with malocclusion is a major factor contributing to the market growth.

Key Market Trends & Insights

- North America dominated the market and accounted for a 54.5% share in 2023.

- Asia Pacific is anticipated to witness significant growth in the market.

- In terms of product, clear aligners segment accounted for the largest revenue share of 84.1% in 2023.

- In terms of end use, Stand alone practices segment accounted for the largest revenue share in 2023.

- In terms of dentist type, Orthodontists segment accounted for the largest revenue share in 2023

Market Size & Forecast

- 2023 Market Size: USD 6.1 Billion

- 2030 Projected Market Size: USD 33.9 Billion

- CAGR (2024 - 2030): 28.5%

- North America: Largest market in 2023

According to the WHO, malocclusion is the 3rd most prevalent dental disease globally, after periodontal disease and dental caries. The prevalence of malocclusion is extremely variable and is estimated to be between 39% and 93% in children and adolescents. Growing demand for invisible orthodontics and rapid technological advancements in dental health are factors expected to drive market growth over the forecast period.The COVID-19 pandemic negatively impacted the invisible orthodontics industry.According to the list provided by the American College of Surgeons, all dental, surgical, or medical procedures that are non-essential and elective were postponed until further notice, except for medical emergencies. Procedures such as aesthetic dental procedures, radiographs, routine cleaning, oral examinations, and preventive therapies that do not involve pain management were postponed.

The prevalence of oral diseases & disorders is increasing. Thus, the need for advancements in orthodontics is also increasing. To create an accurate fit, digital computer imaging and 3D technology are increasingly used in orthodontic practices. Copper-titanium and nickel wires, digital scanning technology additive fabrication, temporary anchorage devices, 3D impression scanners, CAD/CAM appliances, incognito lingual braces, and clear aligners are among the latest advancements leading to the delivery of more efficient, customized, predictable, and effective orthodontic treatments.

According to the Orthodontics Association, every year, almost 3.5 million kids and teens start wearing braces. These aspects boost the market. Malocclusion, commonly known as misaligned teeth, is a prevalent condition affecting a substantial portion of the population, particularly among children and adolescents. According to the NCBI report published in January 2023, the global prevalence of malocclusion is around 56%, with no significant gender differences. Interestingly, the prevalence varies across continents, with Africa leading the way at 81%, followed by Europe (71%), America (53%), and Asia (48%).

The impact of malocclusion extends beyond mere aesthetics, affecting various aspects of an individual's well-being. Malocclusion's growing prevalence and multifaceted impact have driven the demand for effective and discreet orthodontic solutions. Invisible orthodontics emerged as a compelling option, offering a combination of efficacy and discretion. Clear aligners, lingual braces, and aesthetic brackets are among the popular invisible orthodontics options, addressing malocclusion concerns without the conspicuousness of traditional metal braces. The rise of invisible orthodontics reflects the evolving needs and preferences of individuals seeking orthodontic treatment. As the demand for invisible orthodontics continues to grow, the market for these products is expanding rapidly.

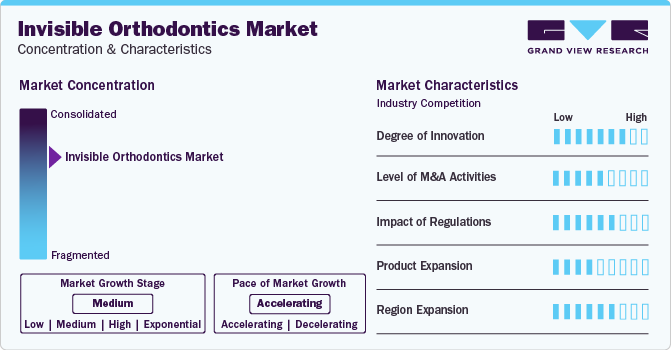

Market Characteristics

The market is a dynamic and innovative landscape, constantly evolving with new technologies and approaches to address the demand for discreet and effective orthodontic solutions. Companies actively invest in research and development, leading to continuous advancements that enhance treatment outcomes, improve patient comfort, and increase discretion.One of the key areas of innovation lies in the refinement of clear aligner technology.

Several market players, such as Angel Aligner; Dentsply Sirona; Institut Straumann AG; and SCHEU DENTAL GmbH, are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enter new territories. Companies are actively investing substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This results in increasing the cost of developing novel Invisible Orthodontics technologies.

The market rapidly expands as patients seek more discreet and effective solutions. Technological advancements, rising awareness, and evolving aesthetics drive the demand for invisible orthodontics. Product innovation focuses on personalized treatment, remote monitoring, material advancements, and treatment accelerants. New treatment modalities, such as accelerated orthodontics, retainer less orthodontics, and children's orthodontics, are also being developed. In the forecast period, the market is poised for further growth and innovation.

Product Insights

Clear aligners segment accounted for the largest revenue share of 84.1% in 2023. The increasing adoption of teledentistry and telemedicine has propelled the growth of clear aligners. Moreover, the growing awareness among the population about the availability of invisible orthodontics accelerates market growth. The growing success of clear aligners in treatment is anticipated to spur segment growth. According to the Parkwood Dental report, the success rate of Invisalign is high. The overall success rate of Invisalign is around 96%. Key players' increasing adoption of inorganic or organic strategies drives market growth. In July 2023, Angel Aligner launched its custom-made, clear aligners and aligner technology in the U.S.

Ceramic braces segment is anticipated to witness significant growth over the forecast period. Growing importance of aesthetics in orthodontic care is one of the major factors driving the demand for ceramic braces. Adults and teenagers are progressively seeking orthodontic solutions that effectively correct dental misalignments and blend seamlessly with their natural appearance. Ceramic braces, designed with brackets and wires that closely match the color of the patient’s teeth, offer a discreet alternative to traditional metal braces. Hence, key players are adopting various strategies to cater to the growing demand for ceramic braces. In August 2023, LightForce Orthodontics raised USD 80 million in Series D funding for ceramic AM dental brackets.

End-use Insights

Hospital segmentis estimated to register significant CAGR over the forecast period. According to the Dental Elf, although there are declarations that the clear aligners are effective, evidence for the same is generally lacking. Reduced treatment and chair time is currently the only significant proof of the effectiveness of clear aligners in mild-to-moderate malocclusion cases compared to conventional systems backed by strong evidence in treating all classes of malocclusion. Due to these factors, the adoption of clear aligners is low in hospitals. However, ceramic braces function like conventional metal braces and are used for various complex dental treatments, supporting their adoption in hospital facilities.

Stand alone practices segment accounted for the largest revenue share in 2023. An orthodontist has a better treatment plan, training, & expertise in case of providing invisible orthodontics therapy as they rely on their clinical experience, expert opinions, and limited published evidence-based results. Several orthodontists recommend invisible orthodontics as it provides healthy periodontal tissue and reduces the risk of enamel decalcification compared to metal brackets. Most private orthodontists have one practicing location. All these factors are expected to boost invisible orthodontics recommendations through standalone practice. These aspects are boosting the market.

Dentist Type Insights

General dentists segment is anticipated to grow at significant rate during the forecast period. With the rising demand for invisible orthodontics therapy and cosmetic restoration treatments, the adoption of invisible orthodontics services has considerably increased among general dentists (GD). Several manufacturers are now partnering with GDs and are providing them with training & assistance to use invisible orthodontics in their practices. Companies like Invisalign offer a certification program on dental aligners to teach the GDs the use of clear aligners as a tool to improve treatment outcomes. The Invisalign Assist treatment program also gives procedural and technical support throughout the treatment process to help them obtain effective patient results.

Orthodontists segment accounted for the largest revenue share in 2023, since most patients are referred to specialists for treatments like invisible orthodontics therapy. As per Canalyst, a data analytics site, GD prescribes Invisalign at an extremely lower rate than orthodontists. Moreover, According to the Dillehay orthodontics article, technological advancements and new technologies such as digital scanning and self-ligating bracket systems, 3D printing, and clear aligner therapy make orthodontic treatment more efficient, accurate, and comfortable than ever are boosting the market.

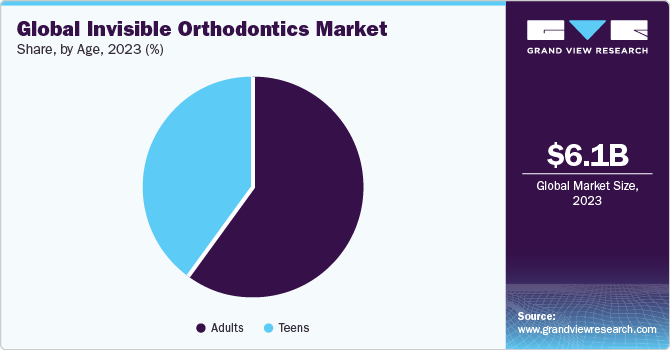

Age Insights

Teens segment is estimated to register the fastest CAGR over the forecast period. The invisible nature of ceramic, lingual braces, & clear aligners, and the comfort & control they provide patients have made them highly popular among teens who are more aware and want to avoid traditional treatments, such as metal braces. According to Becher & Gil Orthodontics, 80% of teenagers in the U.S. are currently undergoing orthodontic treatment. Recent advancements in the clear aligner systems, such as the introduction of Invisalign Teen with Mandibular Advancement for treating Class II dental conditions in teenagers, are helping dentists improve patients’ profiles by advancing the lower jaw. The 3D scans allow orthodontists to create trays based on their calculations of teeth’s position.

Adults segment accounted for the largest revenue share in 2023. Growing number of adults are opting for orthodontic treatment, increasing the demand for dental equipment with aesthetic appeal. Clear Aligner Therapy (CAT), a dynamic appliance system, includes a wide spectrum of applications with differing modes of applicability, methods of construction, and action to various malocclusion treatments. According to a Smile Doctors article, primarily younger people get braces 27% of Canadian and American adults get braces. That means in a room of 4 adults, at least 1 has them.

Regional Insights

North America dominated the market and accounted for a 54.5% share in 2023. High personal disposable income & expenditure on healthcare, availability of certified professionals, presence of well-established healthcare infrastructure, easy access to aesthetic services, high acceptance of aesthetic treatments, and increase in aesthetic consciousness are likely to propel the growth. According to Align Technology, utilization of invisible orthodontics among North American orthodontists has increased from 67.3 cases per doctor in 2020 to 89.2 cases per doctor in 2022. Similarly, the utilization among general practitioners (GPs) has grown from 9.6 cases per doctor in 2020 to 13.9 cases per doctor in 2022. This indicates a growing adoption of invisible orthodontics in orthodontic and general dentistry practices.

Asia Pacific is anticipated to witness significant growth in the market. Surge in patient numbers and the increasing presence of prominent healthcare providers in swiftly developing economies like India and China create opportunities for expansion. According to an article published by Express Healthcare, the desire among Indians to look young, presentable, and contemporary has led to growth in cosmetic procedures. Increasing queries for such services exhibit the growing adoption of cosmetic procedures, which were previously considered only for celebrities. These factors have encouraged foreign and domestic companies to invest in the market.

Key Companies & Market Share Insights

Some of the key players operating in the market include Angel Aligner; Dentsply Sirona; Institut Straumann AG, and SCHEU DENTAL GmbH.

-

Angelalign Technology, Inc., also known as Angel Aligner, is a global provider of clear aligner technology. The company has over 150 patents in processing, clear aligners, manufacturing, and 3D printing technology.

-

Dentsply Sirona is a manufacturer and marketer of various oral & dental health products and other consumables for dental procedures.

-

K Line Europe GmbH; DB Orthodontics Limited, and G&H Orthodontics are some of the emerging market participants in the invisible orthodontics industry.

-

K Line Europe GmbH manufactures transparent clear aligners for teeth straightening and offers doctor-directed clear aligners to dentists & orthodontists.

-

DB Orthodontics provides a variety of innovative orthodontic products and services. The company’s product portfolio includes consultation products, infinitas mini implant systems, Ixion instruments, and wire products.

Key Invisible Orthodontics Companies:

- Angel Aligner

- SmarTee

- Dentsply Sirona

- Institut Straumann AG

- SCHEU DENTAL GmbH

- Ormco Corporation (Envista)

- Henry Schein, Inc.

- SmileDirectClub

- Align Technology, Inc.

- TP Orthodontics, Inc.

- K Line Europe GmBH

- 3M

- ClearPath Healthcare Services Pvt Ltd

- DB Orthodontics, Inc.

- G&H Orthodontics

- Orthodontics SDC

Recent Developments

-

In February 2023, SmileDirectClub introduced CarePlus, a new premium aligner treatment offering, that helps customers manage and start aligner care in-person or remotely.

-

In April 2023, Henry Schein, Inc. completed the acquisition of a majority ownership stake in Biotech Dental, a provider of clear aligners, dental implants, and digital dental software.

-

In July 2023, Angel Aligner launched custom-made, clear aligners and aligner technology into the U.S. market.

-

In October 2022, Align Technology introduced the latest iteration of its iTero-exocad Connector, seamlessly integrating NIRI images and iTero intraoral camera into exocad DentalCAD 3.1 Rijeka software.

-

In January 2021,Dentsply Sirona has expanded its footprint in the clear aligner market by acquiring Straight Smile LLC (BYTE), a provider in the direct-to-consumer, doctor-directed clear aligner space.

Invisible Orthodontics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.5 billion

Revenue forecast in 2030

USD 33.9 billion

Growth rate

CAGR of 28.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, age, end-use,dentist type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Angel Aligner; SmarTee; Dentsply Sirona; Institut Straumann AG; SCHEU DENTAL GmbH; Ormco Corporation (Envista); Henry Schein, Inc.; SmileDirectClub; Align Technology, Inc.; Argen Corporation; TP Orthodontics, Inc.; K Line Europe GmBH; 3M; ClearPath Healthcare Services Pvt Ltd; DB Orthodontics, Inc.; G&H Orthodontics; Orthodontics SDC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Invisible Orthodontics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global invisible orthodontics market report based on product, age, end-use, dentist type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Clear Aligners

-

Ceramic Braces

-

Lingual Braces

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

Teens

-

Adults

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Stand Alone Practices

-

Group Practices

-

Others

-

-

Dentist Type Outlook (Revenue, USD Million, 2018 - 2030)

-

General Dentists

-

Orthodontists

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global invisible orthodontics market size was estimated at USD 6.1 billion in 2023 and is expected to reach USD 7.5 billion in 2024.

b. The global invisible orthodontics market is expected to grow at a compound annual growth rate of 28.5% from 2024 to 2030 to reach USD 33.9 billion by 2030.

b. North America dominated the invisible orthodontics market with a share of 54.5% in 2023. This is attributable to the region's advanced healthcare infrastructure, increasing awareness about oral health, and increase in demand for clear aligners.

b. Some key players operating in the invisible orthodontics market include Angel Aligner, Dentsply Sirona, Institut Straumann AG, SCHEU DENTAL GmbH and Ormco Corporation (Envista).

b. Key factors that are driving the invisible orthodontics market growth include the rising number of dental disorders, increase in technological advancements in cosmetic dentistry, and surge in public awareness towards oral care treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.