- Home

- »

- Next Generation Technologies

- »

-

IPTV Software Market Size & Share, Industry Report, 2033GVR Report cover

![IPTV Software Market Size, Share & Trends Report]()

IPTV Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (CMS, VoD Software), By Device Type (Smartphones & Tablets, Smart TVs), By End Use, By Region and Segment Forecasts

- Report ID: GVR-4-68040-751-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

IPTV Software Market Summary

The global IPTV software market size was estimated at USD 32.05 billion in 2024 and is projected to reach USD 115.13 billion by 2033, growing at a CAGR of 15.5% from 2025 to 2033. The Internet Protocol Television software market is driven by rising demand for on-demand and live streaming content, growing broadband penetration, and increasing adoption of smart devices.

Key Market Trends & Insights

- North America dominated the global IPTV software market with the largest revenue share of 31.0% in 2024.

- The IPTV software market in the U.S. led the North America market and held the largest revenue share in 2024.

- By type, Video-on-Demand (VoD) software led the market, holding the largest revenue share of 34.2% in 2024.

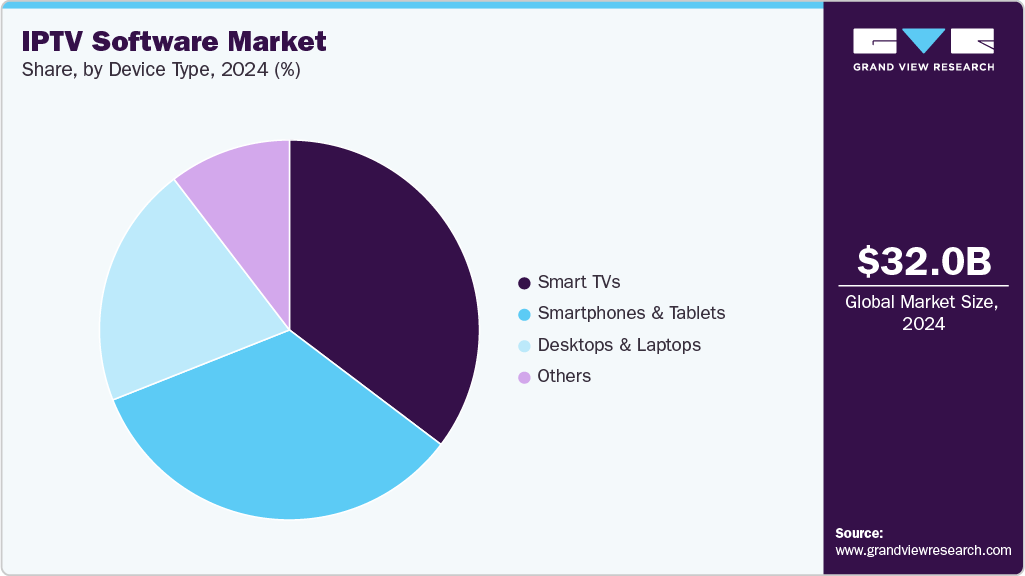

- By device type, smart TVs segment held the dominant position in the market.

- By end use, media and entertainment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 32.05 Billion

- 2033 Projected Market Size: USD 115.13 Billion

- CAGR (2025-2033): 15.5%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Advancements in cloud-based IPTV platforms, enhanced video compression technologies, and integration of AI-driven personalization further fuel growth, alongside expanding telecom infrastructure and bundled service offerings by operators. The surging demand for digital video streaming and personalized entertainment experiences primarily drives the market. Rapid urbanization, rising internet penetration, and widespread adoption of smartphones, tablets, and smart TVs have fueled user demand for high-quality on-demand and live content. IPTV software enables flexibility, scalability, and interactivity, making it increasingly suitable for consumers and service providers. In addition, the shift toward Over-The-Top (OTT) media services and growing preferences for bundled subscription packages are significantly boosting IPTV software adoption. Telecom operators and media companies leverage IPTV solutions to offer integrated services, expand customer bases, and strengthen revenue streams.

The increasing convergence of digital services and growing investments by telecom and media companies also drive market growth. Operators are bundling IPTV with broadband, voice, and mobile services to create value-added packages and strengthen customer retention. Enterprises, educational institutions, and hospitality sectors also deploy IPTV solutions to improve communication, training, and entertainment experiences, broadening the market scope beyond residential consumers. Furthermore, regulatory support for digital broadcasting in several regions and strategic collaborations and mergers between software developers and service providers foster market expansion. These factors collectively create a strong foundation for sustained growth in the global IPTV software landscape.

Advancements in technology also play a crucial role in driving IPTV software industry growth. Developments in cloud computing, AI-driven recommendation systems, and advanced video compression techniques such as HEVC are enhancing streaming quality and reducing latency, even under limited bandwidth conditions. These innovations improve user experience while lowering operational costs for providers. Moreover, the rollout of 5G networks is expected to accelerate IPTV adoption by ensuring seamless, high-speed connectivity, thereby supporting real-time streaming, ultra-HD content delivery, and multi-device compatibility. Enhanced middleware solutions that support scalability and integration with existing telecom infrastructure further encourage IPTV deployments across diverse geographies and customer segments.

Type Insights

The video-on-demand (VoD) software segment dominated the market with a share of over 34.2% in 2024, fueled by the rising demand for personalized, flexible, and on-demand content consumption. Consumers increasingly prefer streaming platforms over traditional broadcasting due to convenience, cost-effectiveness, and the ability to access a wide variety of movies, series, and live events anytime across multiple devices. Advancements in cloud-based delivery, adaptive streaming technologies, and AI-driven recommendation engines enhance user experiences, boosting adoption. The growing penetration of high-speed internet, smart TVs, and mobile devices also accelerates VoD adoption worldwide. Strategic partnerships between telecom providers, OTT players, and content creators also foster market growth, positioning VoD as a central revenue-generating segment within the IPTV ecosystem.

The streaming & encoding software segment is expected to register a significant CAGR over the forecasted period, driven by the rising demand for high-quality, on-demand content and seamless live broadcasting. The proliferation of smart TVs, mobile devices, and high-speed broadband has intensified consumer expectations for uninterrupted, buffer-free streaming experiences. Broadcasters and content providers increasingly rely on advanced encoding technologies to optimize bandwidth usage while delivering high-definition and ultra-high-definition content. Moreover, the surge in OTT platforms, cloud-based streaming solutions, and personalized content services is accelerating the adoption of streaming and encoding software. Strategic collaborations between software vendors and telecom operators further strengthen market expansion.

End Use Insights

Media and entertainment accounted for the largest revenue share, fueled by the increasing demand for high-quality, on-demand content across multiple devices. Broadcasters, streaming platforms, and content creators leverage IPTV solutions to deliver personalized viewing experiences, interactive services, and seamless content distribution. The rise of smart TVs, OTT platforms, and mobile viewing has intensified the need for advanced software capable of managing large-scale content libraries, ensuring minimal latency, and providing analytics for viewer engagement. Moreover, advertising opportunities through targeted content delivery and integration of AI-driven recommendations are boosting adoption, positioning this segment as a significant contributor to market growth.

The gaming segment is expected to register the highest CAGR over the forecast period, driven primarily by the rising demand for immersive, interactive entertainment experiences. Gamers increasingly seek high-quality, low-latency streaming solutions that support real-time gameplay and multiplayer interactions, prompting IPTV providers to enhance platform performance and reliability. The proliferation of cloud gaming, eSports, and mobile gaming has intensified the need for seamless content delivery, cross-platform compatibility, and personalized recommendations. Furthermore, integrating AI-powered analytics and recommendation engines helps deliver tailored content, improving user engagement. Rising internet penetration, affordable high-speed broadband, and increasing adoption of smart TVs also contribute to this segment’s rapid expansion.

Device Type Insights

The smart TVs segment dominated the market in 2024, fueled by rising consumer demand for seamless, on-demand entertainment experiences directly integrated into television sets. Increasing internet penetration, availability of affordable high-speed broadband, and growing adoption of 4K and UHD content have significantly boosted the demand for IPTV-enabled Smart TVs. Manufacturers are embedding IPTV applications into Smart TVs, eliminating the need for additional hardware and creating a more user-friendly ecosystem. Furthermore, integrating advanced features such as voice assistants, AI-based recommendations, and multi-device connectivity enhances user engagement. The expanding popularity of subscription-based streaming platforms and live TV services further accelerates Smart TV-driven IPTV software adoption.

Smartphones & tablets is expected to register a significant CAGR over the forecast period, fueled by rising mobile internet penetration, widespread 4G/5G adoption, and increasing consumer preference for on-the-go entertainment. Enhanced display technologies, faster processors, and larger storage capacities in modern devices have improved the user experience, making them ideal platforms for streaming high-quality IPTV content. Integrating advanced apps, cloud-based video delivery, and AI-driven personalized recommendations further boosts engagement and retention. In addition, the affordability of data plans, coupled with the popularity of OTT platforms and mobile-exclusive content, drives demand. As younger demographics increasingly prefer mobile viewing over traditional TV, IPTV providers are focusing on optimizing software for smartphones and tablets to capture this expanding audience base.

Regional Insights

North America dominated the IPTV software market with a revenue share of 31.0% in 2024, driven by the rapid adoption of high-speed broadband networks and the increasing demand for on-demand and personalized content consumption. Consumers are shifting from traditional cable and satellite TV to IP-based solutions due to flexibility, interactive features, and multi-screen viewing capabilities. The proliferation of smart TVs, OTT, and connected devices further accelerates market growth, enabling seamless streaming experiences. In addition, content providers and telecom operators are leveraging IPTV software to offer value-added services such as video-on-demand, cloud DVR, and targeted advertising, enhancing user engagement. Strategic partnerships, technological advancements, and the rising preference for subscription-based models are also key market catalysts.

U.S. IPTV Software Market Trends

The IPTV software market in the U.S. is expected to grow significantly in 2024, driven by the rapid adoption of high-speed broadband and fiber-optic networks, enabling seamless streaming of high-definition and 4K content. Rising consumer demand for on-demand and personalized entertainment experiences has accelerated IPTV platform deployment among telecom operators and content providers. Moreover, the growing integration of advanced analytics, artificial intelligence, and machine learning in IPTV software allows service providers to offer tailored recommendations, improve content delivery efficiency, and enhance viewer engagement. The shift toward smart TVs, connected devices, and multi-screen consumption further fuels market growth, alongside the expansion of OTT services and strategic partnerships between telecom operators and content creators, strengthening the IPTV ecosystem in the U.S.

Europe IPTV Software Market Trends

The IPTV software market in Europe is expected to grow significantly over the forecast period. The European market is witnessing significant growth driven by rising consumer demand for high-quality, on-demand digital content and the rapid adoption of smart TVs and connected devices. Telecom operators and broadcasters increasingly leverage IPTV solutions to offer personalized and interactive services, enhancing viewer engagement. Furthermore, expanding high-speed broadband and 5G networks across the region facilitates seamless streaming experiences, further boosting market adoption. Regulatory support for digital media services and growing investments in cloud-based and AI-enabled IPTV platforms enable scalable and flexible service delivery. These factors collectively position Europe as a dynamic and rapidly evolving market.

Asia Pacific IPTV Software Market Trends

The IPTV software market in the Asia Pacific region is anticipated to be at the fastest CAGR over the forecast period. The APAC market is propelled by rapid digital transformation, increasing internet penetration, and widespread adoption of smart TVs and connected devices. Rising consumer demand for on-demand, high-quality content and interactive services encourages service providers to enhance IPTV offerings. In addition, government initiatives promoting digital infrastructure and growing investments in broadband networks facilitate seamless content delivery. The surge in mobile video consumption, advanced analytics, and AI-driven personalization further boosts market growth. Increasing partnerships between telecom operators and OTT platforms also expand service reach, while competitive pricing strategies drive subscriber acquisition, positioning APAC as a high-growth region in the global market.

Key IPTV Software Company Insights

Some key companies in the IPTV software industry areAkamai Technologies and AT&T Intellectual Property.

-

Akamai Technologies is a key market player due to its advanced content delivery network (CDN) and edge computing solutions that ensure seamless video streaming at scale. Its expertise in reducing latency, enhancing security, and optimizing bandwidth makes it a trusted partner for global IPTV providers.

-

AT&T Intellectual Property leads through its extensive IPTV offerings under the U-verse and DIRECTV platforms, delivering bundled internet and TV services. Its strong network infrastructure, large customer base, and continuous investment in next-generation IPTV and streaming technologies reinforce its dominant position in the IPTV software and services ecosystem.

Key IPTV Software Companies:

The following are the leading companies in the IPTV software market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- AT&T Intellectual Property

- Cisco Systems, Inc.

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Verizon Communications Inc.

- Broadcom Inc.

- Bharti Airtel Limited

- MatrixStream Technologies Inc.

- Tripleplay Services Ltd.

Recent Developments

-

In September 2025, KT Corp., SK Broadband Co., Ltd., and LG Uplus Corp., three major South Korean IPTV operators, jointly financed a USD 28 million fund to be managed by Solaire Partners (a subsidiary of K Wave Media). The fund is intended to invest in high-quality content optimized for IPTV platforms, including film and VFX, aiming to strengthen the VOD content pipeline and compete better against OTT services.

-

In August 2025, Vodafone Group PLC, a telecommunications company, extended partnership with Kaltura, a video technology software company, to expand Cloud TV Services. Under the partnership, Vodafone and Kaltura aim to enhance the platform’s capabilities and functionalities, extending its reach to more subscribers and potentially new markets. They also plan to introduce AI-driven Kaltura solutions to elevate user engagement, interactivity, and personalization, while improving monetization and operational efficiency.

-

In August 2025, Nokia, a consumer electronics company, rolled out its 400G routing tech and software-defined access network (SDAN) platform to Netplus Broadband Services Pvt. Ltd., an Indian broadband and digital entertainment service provider, to scale broadband & IPTV services in India. This deployment supports shifting from linear TV to on-demand IPTV offerings and enhances network scalability, energy efficiency, and service flexibility.

IPTV Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.29 billion

Revenue forecast in 2033

USD 115.13 billion

Growth rate

CAGR of 15.5% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, device type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Akamai Technologies; AT&T Intellectual Property; Cisco Systems, Inc.; Ericsson AB; Huawei Technologies Co., Ltd.; Verizon Communications Inc.; Broadcom Inc.; Bharti Airtel Limited; MatrixStream Technologies Inc.; Tripleplay Services Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IPTV Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global IPTV software market report based on type, device type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Content Management System (CMS)

-

Video-on-Demand (VoD) Software

-

Streaming & Encoding software

-

Others

-

-

Device Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Smartphones & Tablets

-

Smart TVs

-

Desktops and Laptops

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Advertising and Marketing

-

Media and Entertainment

-

Gaming

-

Online Stores

-

IT & Telecom

-

Healthcare and Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IPTV software market size was estimated at USD 32.05 billion in 2024 and is expected to reach USD 36.29 billion in 2025.

b. The global IPTV software market is expected to grow at a compound annual growth rate of 15.5% from 2025 to 2033 to reach USD 115.13 billion by 2033.

b. North America dominated the IPTV software market with a share of 31.0% in 2024. This is attributable to the the rapid adoption of high speed broadband networks and the increasing demand for on-demand and personalized content consumption. The proliferation of smart TVs, OTT devices, and connected devices further accelerates market growth, enabling seamless streaming experiences.

b. Some key players operating in the IPTV software market include Akamai Technologies; AT&T Intellectual Property; Cisco Systems, Inc.; Ericsson AB; Huawei Technologies Co., Ltd.; Verizon Communications Inc.; Broadcom Inc.; Bharti Airtel Limited; MatrixStream Technologies Inc.; and Tripleplay Services Ltd.

b. Key factors that are driving the IPTV software market growth include the rising demand for on-demand and live streaming content, growing broadband penetration, and increasing adoption of smart devices. Advancements in cloud-based IPTV platforms, enhanced video compression technologies, and integration of AI-driven personalization further fuel growth, alongside expanding telecom infrastructure and bundled service offerings by operators.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.