- Home

- »

- Alcohol & Tobacco

- »

-

Irish Whiskey Market Size, Share & Growth Report, 2030GVR Report cover

![Irish Whiskey Market Size, Share & Trends Report]()

Irish Whiskey Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Blended, Single Malt, Single Pot Still, Single Grain), By Price (Mass, Premium), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-447-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Irish Whiskey Market Summary

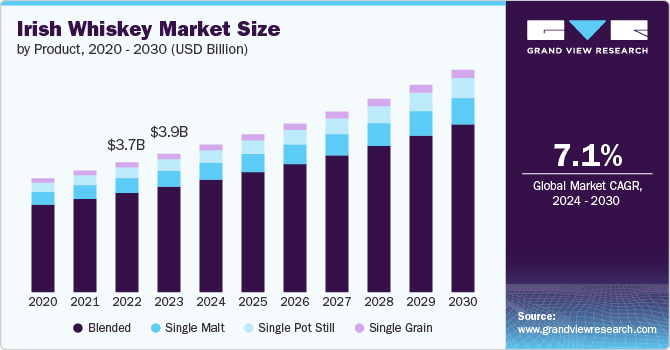

The global Irish whiskey market size was estimated at USD 3.98 billion in 2023 and is projected to reach USD 6.40 billion by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The growth is driven by several key factors, including the growing consumer demand for healthier and more nutritious food options.

Key Market Trends & Insights

- The Irish whiskey market in North America held the largest revenue share of 41.7% in 2023.

- By product, the blended Irish whiskey segment led, with the largest revenue share of 80.99% in 2023.

- By price, the mass priced Irish whiskey segment led, with the largest revenue share of 71.55% in 2023.

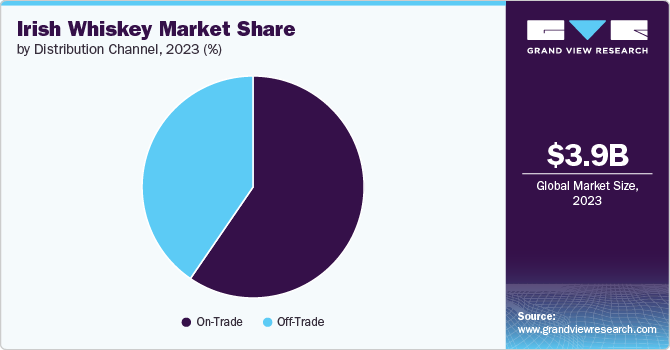

- By distribution channel, the on-trade segment held the largest revenue share of 59.21% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.98 Billion

- 2030 Projected Market Size: USD 6.40 Billion

- CAGR (2024-2030): 7.1%

- North America: Largest market in 2023

Irish whiskey, which is rich in healthy fats, vitamins, and minerals, fits well into this trend. Its high content of monounsaturated fats, which are known for their heart health benefits, appeals to health-conscious consumers looking for alternatives to traditional butters and spreads.Additionally, the rise in popularity of plant-based diets and the increasing awareness of food allergies and intolerances are contributing to the growth of the Irish whiskey market. As more people seek plant-based or allergen-friendly natures, Irish whiskey offers a viable alternative to dairy-based, and nut butters, which might not be suitable for everyone. The creamy texture and rich form of Irish whiskey also make it a desirable option for those looking to diversify their diet.

The expansion of the specialty food sector, including premium and artisanal natures, has further fueled interest in Irish whiskey. Consumers are increasingly willing to pay a premium for unique and high-quality food items, and Irish whiskey's exotic appeal fits this demand. Moreover, the rise of e-commerce has made it easier for niche natures like Irish whiskey to reach a wider audience, increasing its availability and market reach.

Product Insights

Blended Irish whiskey accounted for a share of 80.99% of the global revenues in 2023. The market for blended Irish whiskey is driven by its affordability, accessibility, and versatility. Blended Irish whiskey, which combines pot still and grain whiskeys, appeals to a broad audience due to its smoother and lighter taste profile compared to single malt varieties. Its lower price point makes it more accessible to consumers, while its versatility makes it suitable for both sipping and mixing in cocktails, catering to a wide range of preferences and occasions. This broad appeal, combined with the global trend of rising interest in premium spirits and Irish whiskey's growing international reputation, fuels the demand for blended Irish whiskey.

Single Pot Still Irish whiskey is anticipated to grow at a CAGR of 8.4% from 2024 to 2030. The market for Single Pot Still Irish whiskey is driven by a growing appreciation for its unique and complex flavor profile, which results from a traditional production method using a mix of malted and unmalted barley in a pot still. This distinctive style, historically significant to Ireland, is being rediscovered by connoisseurs and new consumers alike, drawn to its rich, spicy character and creamy texture. Additionally, the premiumization trend in the spirits industry and the global rise in demand for high-quality, artisanal alcoholic beverages further bolster its popularity.

Price Insights

Mass priced Irish whiskey accounted for a share of 71.55% of the global revenue in 2023. The market for mass-priced Irish whiskey is driven by its growing global popularity, fueled by a resurgence in interest in Irish culture and heritage, competitive pricing, and the perception of quality and smoothness associated with Irish whiskey. This demand is bolstered by effective marketing campaigns, increased availability, and the expansion of distilleries producing accessible, affordable options. Additionally, the rise in cocktail culture has popularized Irish whiskey as a versatile base for mixed drinks, further boosting its appeal among a broader audience.

The premium priced Irish whiskey segment is anticipated to grow at a CAGR of 7.4% from 2024 to 2030. Consumers are increasingly willing to pay more for unique flavors and aged varieties, which are often perceived as superior in quality. Additionally, marketing efforts highlighting the heritage and authenticity of Irish whiskey, along with its association with luxury and exclusivity, have also contributed to the rise in demand and premium pricing.

Distribution Channel Insights

Sales of Irish whiskey through on-trade accounted for a share of 59.21% of the global revenues in 2023. The resurgence of cocktail culture, increased consumer interest in unique and high-quality drinking experiences, and the popularity of Irish whiskey brands in international markets contribute significantly. Additionally, marketing efforts and brand collaborations with on-trade establishments enhance visibility and consumer engagement, further boosting sales.

Sales of Irish whiskey through off-trade are anticipated to grow at a CAGR of 7.2% from 2024 to 2030. The market for sales of Irish whiskey through off-trade channels is primarily driven by the growing consumer preference for home consumption, convenience, and the availability of a wider range of products at competitive prices. The trend is further bolstered by the increasing adoption of e-commerce platforms, enabling consumers to purchase Irish whiskey easily online. Additionally, the rise in popularity of premium and innovative whiskey variants, coupled with aggressive marketing and promotional activities by key market players, is contributing to the robust growth in off-trade sales.

Regional Insights

The Irish whiskey market in North America is expected to grow at a CAGR of 7.0% from 2024 to 2030. The market for Irish whiskey in North America is driven by increasing consumer demand for premium and craft spirits, a growing interest in unique and high-quality alcoholic beverages, and the successful marketing and branding efforts by Irish whiskey producers. Additionally, the trend towards premiumization, where consumers are willing to pay more for higher quality and distinctive products, has significantly boosted the popularity of Irish whiskey. The rise of cocktail culture and the expanding availability of Irish whiskey in bars and retail outlets also contribute to its growing market presence in North America.

U.S. Irish Whiskey Market Trends

The Irish whiskey market in U.S. is expected to grow at a CAGR of 7.3% from 2024 to 2030. The rise in disposable income and the millennial generation's preference for high-quality, unique products have contributed significantly. Additionally, effective marketing campaigns and an increase in Irish-themed bars and events have boosted visibility and appeal. The versatility of Irish whiskey in cocktails and its smooth, approachable flavor profile also make it a popular choice among American consumers.

Asia Pacific Irish Whiskey Market Trends

The Irish whiskey market in Asia Pacific held a share of over 13.96% of the global market in 2023. The market for Irish whiskey in the Asia Pacific region is being driven by a growing appetite for premium and craft spirits, rising disposable incomes, and a burgeoning interest in Western beverages among younger consumers. Increased availability through expanded distribution channels and targeted marketing efforts have further fueled the demand. Additionally, the unique appeal of Irish whiskey's heritage and distinctive flavor profiles contribute to its popularity in this diverse and expanding market.

Europe Irish Whiskey Market Trends

The Irish whiskey market in Europe is expected to grow at a CAGR of 6.8% from 2024 to 2030. The market for Irish whiskey in Europe is driven by a growing appreciation for premium spirits, increased consumer interest in craft and heritage products, and effective marketing by Irish whiskey producers. The trend towards premiumization, coupled with successful branding and the expansion of Irish whiskey's presence in bars and retail channels, has significantly boosted its popularity. Additionally, European consumers' desire for unique and high-quality drinking experiences contributes to the rising demand for Irish whiskey.

Key Irish Whiskey Company Insights

The market for Irish whiskey is highly competitive, with a range of companies offering various forms. Many big players are increasing their focus on new form launches, partnerships, and expansion into new markets to compete effectively.

Key Irish Whiskey Companies:

The following are the leading companies in the irish whiskey market. These companies collectively hold the largest market share and dictate industry trends.

- Jameson

- Bushmills

- Redbreast

- Green Spot

- Tullamore D.E.W.

- Teeling

- Kilbeggan

- Dingle Distillery

- The Shed Distillery

- Cooley Distillery

Recent Developments

-

In May 2024, Michael Flatley launched signature Irish whiskey, Flatley Whiskey ‘The Dreamer’. This whiskey, created in partnership with Master Blender Noel Sweeney, is currently available in over 175 SuperValu stores across Ireland. There are also plans for international distribution later this year.

-

In February 2024, Roe & Co announced the launch of their inaugural distillery release, the Roe & Co Solera Single Malt Irish Whiskey. This whiskey utilizes a unique solera method, allowing for a complex layering of flavors through fractional finishing across various cask types.

Irish Whiskey Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.25 billion

Revenue forecast in 2030

USD 6.40 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; France; China; India; Japan; Australia; South Korea; Brazil; South Africa; Saudi Arabia

Key companies profiled

Jameson; Bushmills; Redbreast; Green Spot; Tullamore D.E.W.; Teeling; Kilbeggan; Dingle Distillery; The Shed Distillery; Cooley Distillery

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Irish Whiskey Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Irish whiskey market report based on product, price, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Blended

-

Single Malt

-

Single Pot Still

-

Single Grain

-

-

Price Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global Irish whiskey market size was estimated at USD 3.98 billion in 2023 and is expected to reach USD 4.25 billion in 2024.

b. The global Irish whiskey market is expected to grow at a compounded growth rate of 7.1% from 2024 to 2030, reaching USD 6.40 billion by 2030.

b. Blended Irish whiskey accounted for a share of 80.99% of the global revenues in 2023. The market for blended Irish whiskey is driven by its affordability, accessibility, and versatility

b. Some of the key players in Irish whiskey market are Jameson, Bushmills, Redbreast, Green Sports, and Others

b. The market for Irish whiskey is being driven by several key factors. First and foremost, there is a growing consumer demand for healthier and more nutritious food options. Irish whiskey, which is rich in healthy fats, vitamins, and minerals, fits well into this trend. Its high content of monounsaturated fats, which are known for their heart health benefits, appeals to health-conscious consumers looking for alternatives to traditional butter and spreads

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.