- Home

- »

- Advanced Interior Materials

- »

-

Iron Casting Market Size And Share, Industry Report, 2030GVR Report cover

![Iron Casting Market Size, Share & Trends Report]()

Iron Casting Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Gray, Ductile, Malleable), By Application (Automotive, Machinery & Tools, Railways), By Region (North America, Europe, APAC, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68038-366-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Iron Casting Market Summary

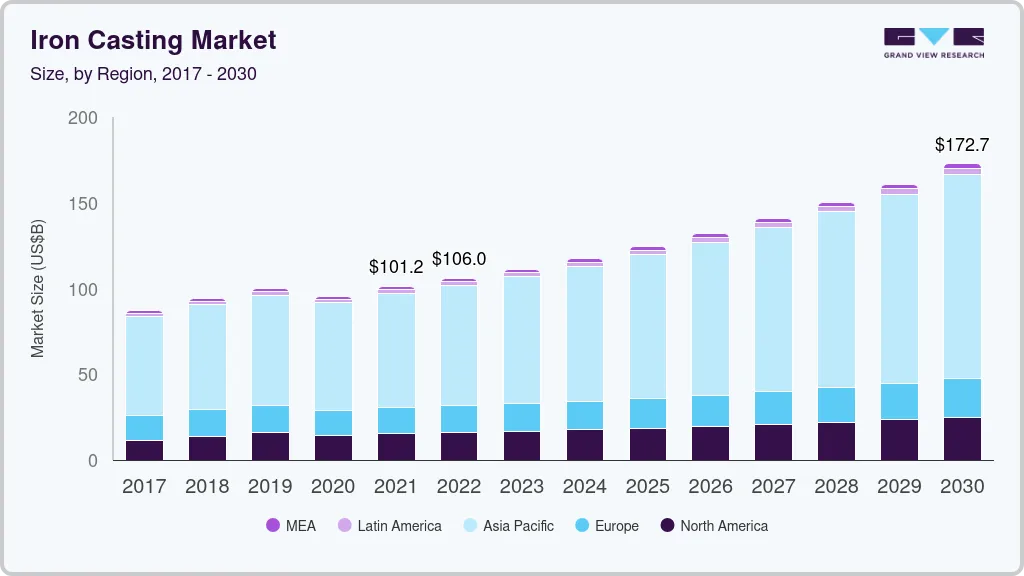

The global iron casting market size was estimated at USD 117.4 billion in 2024 and is projected to reach USD 172.4 billion by 2030, growing at a CAGR of 6.8% from 2025 to 2030. The market growth is anticipated to be driven by the rising investments in the railway industry worldwide and the demand for iron cast pipes from water-related infrastructure projects and oil & gas.

Key Market Trends & Insights

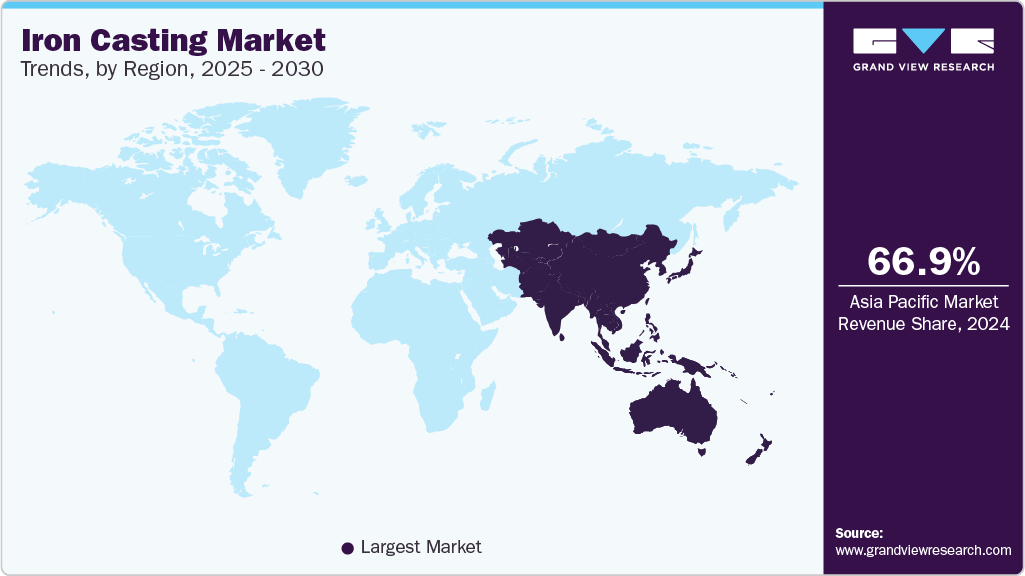

- Asia Pacific dominated the industry with a revenue share of 66.9% in 2024.

- By product, the gray cast iron held a revenue share of over 64.0% in 2024.

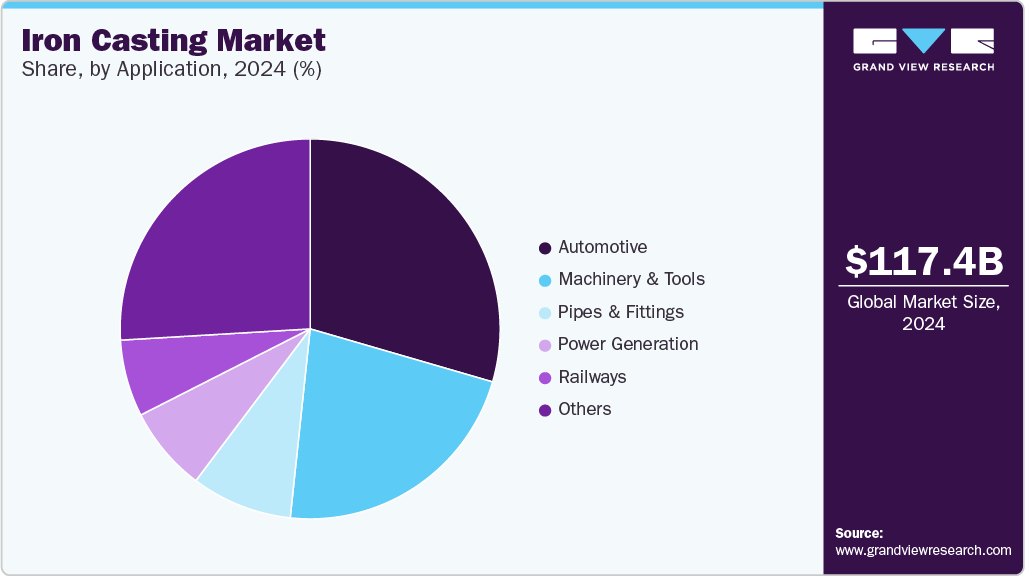

- By application, the automotive industry held the revenue share of over 29% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 117.4 Billion

- 2030 Projected Market Size: USD 172.4 Billion

- CAGR (2025-2030): 6.8%

- Asia Pacific: Largest market in 2024

In terms of application, the railway is anticipated to register a CAGR of 8.1% in terms of revenue during the forecast period. Rising investments in railway infrastructure are anticipated to positively impact the iron casting market growth over the forecast period. For instance, in April 2025, the 135-year-old rail bridge over the Mithi River in Bandra, Mumbai, one of the last remaining cast-iron screw-pile bridges on Indian Railways, began to be dismantled and replaced, marking the end of the cast-iron era in Indian railway infrastructure. Built in 1888, the bridge featured eight massive cast iron pillars weighing 8-10 tons and extending 15-20 meters deep into the riverbed to anchor the structure. This transition is significant in the context of iron casting, as the bridge’s original screw-pile design exemplified the 19th-century engineering marvels made possible by cast iron technology.

Cast iron, known for its compressive strength and moldability, was widely used in bridge construction during the industrial era. However, the material’s brittleness and susceptibility to corrosion over time have led to structural vulnerabilities, especially in critical infrastructure like railways. The replacement of the Mithi River Bridge with RCC reflects the broader shift in civil engineering from cast iron toward more durable and resilient materials, ensuring greater safety and longevity for modern rail networks.

Growing concerns among individuals about the potential health risks from non-stick cookware and increasing global demand for toxin-free kitchen cookware have led cast iron cookware manufacturers to increase their production capacity. This is expected to positively influence the growth of the gray cast iron segment of the market over the forecast period. For instance, in September 2024, Caraway announced the launch of its new Enameled Cast Iron Cookware Collection, marking a significant expansion of its non-toxic, design-driven kitchenware offerings. This collection combines traditional cast iron durability and heat retention with a unique three-layer enamel coating that eliminates seasoning and ensures easy cleaning.

Drivers, Opportunities & Restraints

The global iron casting industry rebounded in 2024, driven by resurgent demand from end use sectors such as machinery & tools, railway, and energy infrastructure. A notable development during this time was the French government's commitment to invest EUR 170 million (~USD 188.2 million) annually until 2024 to enhance rail freight transportation as part of a broader sustainability initiative. This effort followed an earlier investment of EUR 3.5 billion (~USD 3.87 billion) over six years to regenerate trains and rail routes.

Additionally, the machine tools sector recorded a robust recovery. In Q4 2021, Italy posted double-digit growth in machine tool orders, with a 70.1% increase in the order index to 130.4 compared to 2020. This was driven by foreign demand, an active domestic market, and government support for industrial modernization.

The automotive sector, historically a key consumer of gray iron castings, has seen a gradual decline in gray iron usage due to the growing emphasis on vehicle lightweighting and fuel efficiency. Automakers increasingly adopt aluminum and other lightweight materials to meet stringent emission and performance standards, which has constrained gray iron demand in automotive applications.

Aluminum castings are preferred mainly in various industries, especially automotive, which affects the consumption of iron castings. Automakers are under regulatory pressure to improve vehicle efficiency and reduce the environmental impact of greenhouse gas emissions. Aluminum is considered a sustainable material owing to its contribution to reducing carbon dioxide (CO2). It prevents around 70 million tons of unwanted CO2 from mixing into the air. In vehicles, using 100 kilograms of aluminum can help save 46 liters of fuel per year.

Product Insights & Trends

Gray cast iron held a revenue share of over 64.0% in 2024. Its growing applications in various industries, including railways, pipes & fittings, propel the segment growth in the iron casting industry. It has graphite particles that precipitate in a spherical form, resulting in high strength and toughness of ductile iron. Ductile cast iron is anticipated to register a CAGR of 7.0% in terms of revenue across the forecast period, ranging from 2025 to 2030.

Ductile cast iron is widely used for manufacturing tractors and implement parts, crankshafts, cylinder heads, switch boxes, electrical fittings, motor frames, flywheels, drive pulleys, work rolls, and circuit breakers. Its microstructure results in more ductile cast iron than gray or white cast iron, making it suitable for producing water and sewage pipes.

Malleable cast iron is widely used in numerous industries, including agriculture, tools and equipment, automotive, and metal and mining. It manufactures electrical fittings and equipment, washers, brackets, hand tools, mining hardware, pipe fittings, farm equipment, bearing caps, steering gear housing, and machine parts.

Application Insights & Trends

In 2024, the automotive industry held the largest revenue share of the global iron casting market. Engine blocks are usually cast from aluminum alloy or cast iron. Although aluminum offers weight reduction, cast iron is preferred owing to factors such as durability, the ability to resist high internal pressure, more strength, more horsepower, and cost-efficiency. In 2024, the automotive industry held the revenue share of over 29% in 2024 in global iron casting market.

In January 2025, Tata Motors is set to launch Avinya as an all-electric luxury brand positioned above its existing Tata lineup and below Land Rover. The connection to iron casting lies in the manufacturing and structural requirements of premium electric vehicles like Avinya. While the EMA platform emphasizes lightweight materials and advanced battery integration, iron casting remains crucial for specific components that require high strength and durability, such as subframes, suspension mounts, and specific drivetrain elements.

Iron castings are widely used in machinery and tools owing to their good wear resistance, high strength, and good machinability. Although steel is an alternative to cast iron, ductile iron is preferred over steel for manufacturing machine tools as it has good vibration-damping capacity.

Regional Insights

The North America iron casting market is set to experience steady growth, driven by robust economic indicators and substantial investments in infrastructure. For instance, according to the International Monetary Fund (IMF), in 2023, the real GDP growth in North America was estimated at 2.3%, with a slight decline to 2.0% in 2024 and 2025. The U.S. economy is a key contributor to this growth, highlighting the region's commitment to enhancing its economic landscape through significant construction and infrastructure initiatives.

U.S. Iron Casting Market Trends

In the U.S., infrastructure revitalization projects-spurred by the Bipartisan Infrastructure Law-boosted the need for ductile and gray iron castings used in piping, bridges, and heavy machinery. U.S. dominated the North America iron casting market with revenue share of over 84% in 2024. U.S.-based foundries like Waupaca Foundry and Neenah Enterprises ramped production capacity to meet increased domestic demand and reduce dependency on imported components. Simultaneously, the rise of electric vehicle (EV) manufacturing in Michigan and other automotive hubs led to increased investment in precision castings, particularly for lightweight and heat-resistant iron components.

Asia Pacific Iron Casting Market Trends

Asia Pacific dominated the industry with a revenue share of 66.9% in 2024. Asia Pacific is one of the world's largest consumers of iron castings. The increasing demand for iron castings in various industries, such as infrastructure and construction, automotive, renewables, machine tooling, and pipes, is anticipated to augment the demand over the forecast period. The countries in the region are investing in improving railway connectivity, which is anticipated to augment the demand for iron castings. For instance, in October 2021, the Vietnam government announced to invest USD 10.5 billion to build and upgrade rail infrastructure across the country by 2030.

Europe Iron Casting Market Trends

The iron casting industry in Europe is characterized by a strong industrial base, advanced manufacturing technologies, and a significant presence in end user industries such as automotive, construction, and machinery. Countries like Germany, Italy, France, and the UK are leading contributors, with Germany holding a dominant position due to its well-established automotive and engineering sectors. European foundries benefit from stringent quality standards and environmental regulations that have led to the adoption of cleaner and more efficient casting techniques. The emphasis on lightweight and high-strength components, particularly in automotive and transportation, drives innovation in material formulations and process automation.

Key Iron Casting Company Insights

Some of the key players operating in the market include Proterial Ltd., LIAONING BORUI MACHINERY CO., LTD (DANDONG FOUNDRY), and Brakes India.

-

Proterial Ltd., originally founded as Tobata Foundry in 1910, has evolved into a global leader in high-performance materials manufacturing. The company has a rich history marked by key mergers and acquisitions, including collaborations with Hitachi Metals and other specialized firms.

-

Dandong Foundry has nearly 70 years of experience in producing grey iron and ductile iron castings. The company’s annual output reaches 8,000 tons, and 50% of its products are exported to markets such as the U.S., Germany, Australia, UK, Italy, and Japan, reflecting our strong global presence.

Key Iron Casting Companies:

The following are the leading companies in the iron casting market. These companies collectively hold the largest market share and dictate industry trends.

- Proterial Ltd.

- LIAONING BORUI MACHINERY CO., LTD (DANDONG FOUNDRY)

- Brakes India

- OSCO Industries Inc.

- Chamberlin

- Crescent Foundry

- Georg Fischer Ltd

- Grupo Industrial Saltillo (GIS)

- Newby Holdings Limited

- Castings P.L.C.

- CALMET

Recent Developments

-

In June 2022, Brakes India pioneered by collaborating with Volvo Group to produce 'green castings' for engine components. These castings are manufactured using 100% renewable energy and sustainable practices to reduce carbon emissions significantly. The initiative is expected to produce over 180,000 tons of iron castings annually, potentially reducing CO₂ emissions by 210 million tons across the industry if widely adopted. This collaboration underscores the growing emphasis on eco-friendly manufacturing processes in the automotive sector.

-

Crescent Foundry has emerged as a leading cast iron product manufacturer, emphasizing quality and technological advancement. With a production capacity of 2,500 tons per month, the company caters to over 50 countries, supplying products for various sectors, including agriculture, telecom, and infrastructure. Their commitment to innovation is evident in their use of advanced technologies and adherence to international standards, positioning them as a key player in the global market.

Iron Casting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 124.2 billion

Revenue forecast in 2030

USD 172.4 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

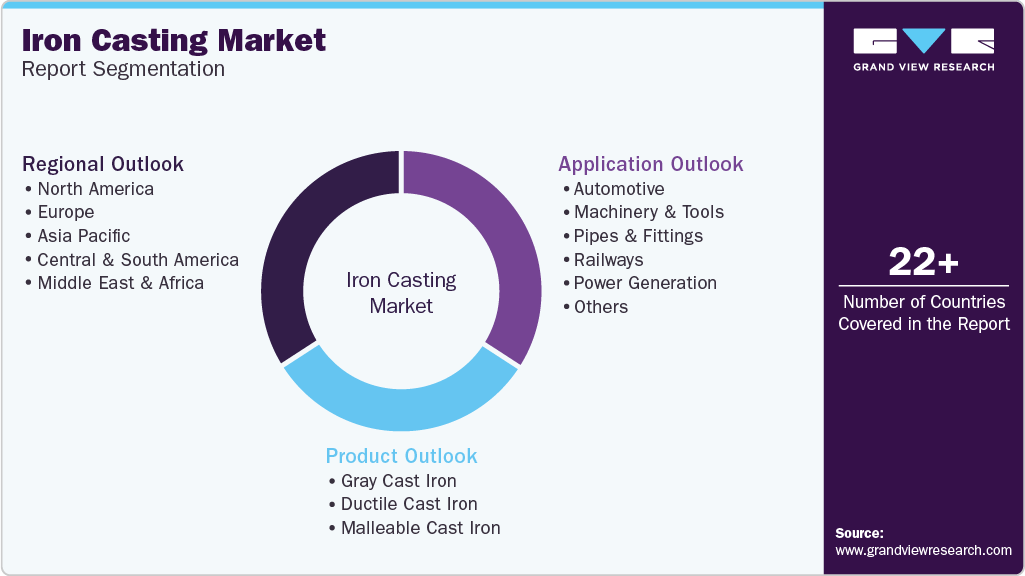

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia, Türkiye, China; India; Japan; South Korea; Indonesia; Brazil; Argentina; South Africa

Key companies profiled

Proterial Ltd.; LIAONING BORUI MACHINERY CO., LTD (DANDONG FOUNDRY); Brakes India; OSCO Industries Inc.; Chamberlin; Crescent Foundry; Georg Fischer Ltd.; GIS (Grupo Industrial Saltillo); Newby Holdings Limited; Castings P.L.C.; CALMET

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Iron Casting Market Report Segmentation

This report forecasts volume & revenue growth at the global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global iron casting market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gray Cast Iron

-

Ductile Cast Iron

-

Malleable Cast Iron

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Machinery & tools

-

Pipes & fittings

-

Railways

-

Power generation

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Russia

-

Türkiye

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global iron casting market was valued at USD 117.4 billion in 2024 and is expected to reach USD 124.19 billion in 2025.

b. The global iron casting market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030 to reach USD 172.3 billion by 2030.

b. In 2024, the automotive application held the largest revenue share of the global iron casting market.

b. Some of the key vendors in the global iron casting market are Proterial Ltd., LIAONING BORUI MACHINERY CO., LTD (DANDONG FOUNDRY), Brakes India, OSCO Industries Inc., Chamberlin, Crescent Foundry, Georg Fischer Ltd., GIS (Grupo Industrial Saltillo), Newby Holdings Limited, Castings P.L.C., and CALMET.

b. The global iron casting market rebounded in 2024, driven by resurgent demand from end-use sectors such as machinery and tools, railway, and energy infrastructure. Also, growing investments in the railway industry worldwide, coupled with rising demand for iron cast pipes from water-related infrastructure projects and oil and gas, are increasing the demand for cast iron.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.