- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Iron Oxide Pigments Market Size, Industry Report, 2021-2028GVR Report cover

![Iron Oxide Pigments Market Size, Share & Trends Report]()

Iron Oxide Pigments Market Size, Share & Trends Analysis Report By Product (Synthetic, Natural), By Color (Red, Yellow, Black, Blends), By Application (Construction, Coatings, Plastics, Paper), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-1-68038-057-6

- Number of Report Pages: 119

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Bulk Chemicals

Report Overview

The global iron oxide pigments market size was valued at USD 2.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2021 to 2028. The rapidly growing construction industry across emerging nations is expected to be the key growth factor for the market over the forecast period. Moreover, the growing utilization of iron oxide pigments in the coating industry owing to their excellent dispersibility and high strength, which make them suitable for use in different types of paints and coatings under extreme atmospheric and weather conditions, is expected to propel the market growth over the forecast period. Iron oxide pigments are widely used in various plastic products, including auto parts, fenders, soda bottles, food packaging, toys, and vinyl sidings. Iron oxide pigments are used as colorants in the aforementioned products.

Excellent dispersibility, high thermal stability, light and chemical stability, UV absorption, and other such beneficial properties are propelling the demand for iron oxide pigments in the plastics industry.

However, political instability in oil-producing countries, such as Saudi Arabia and Iraq among other countries in the Middle East, has resulted in extreme fluctuations in product prices. Social unrest and consumer fears in Nigeria, Iraq, Venezuela, Iran, and Libya have also adversely affected the crude oil supply over the recent past.

The growing demand for nitrobenzene, a major raw material, in various applications, such as lubricating oils, drugs, synthetic rubber, pesticides, and dyes, is anticipated to fuel its price and, in turn, affect the production cost of iron oxide pigments over the forecast period.

Product Insights

The synthetic product segment led the market and accounted for more than 69.0% share of the global revenue in 2020. This is attributed to their more popularity than natural iron oxide pigments owing to their good strength and highly stable nature. They possess resistance against UV rays and all kinds of atmospheric conditions owing to which they are used in various applications, such as coatings, plastics paper, and construction.

The coatings industry is the major application of synthetic iron oxide pigments, particularly for exterior and industrial coatings where durability, stability, and anti-corrosive properties are crucial. Rising demand for coatings from various industries, such as building and construction and oil and gas, is expected to have a positive impact on the demand for synthetic iron oxide pigments over the forecast period.

As compared to synthetic iron oxide pigments, natural iron oxide pigments are less commonly used owing to their lower tinting strength and the presence of contaminants that minimize their working efficiency. Natural iron oxide pigments are used in many applications, including house and barn paints, primers, structural coatings, and building materials.

Color Insights

Red iron oxide pigments led the market and accounted for more than 42.0% share of the global revenue in 2020. This is attributed to their pure hue, tinting strength, light fastness, and consistent properties, which make them highly suitable for several applications, such as paints and coatings, paper, rubber, ceramic, linoleum, wallpaper, polishing rouge, plastic asphalt, mosaic tiles, and flooring. The pigments are commercially available as a fine dry powder made by heat processing ferrous sulfate or grinding ore material.

Yellow iron oxide pigments are widely used in scagliola, paintings, and concrete owing to their pure and bright color, high opacity, excellent dimensional stability, and good weatherproof properties. They offer a dull buff shade that is opaque to visible light with low near-infrared (NIR) reflectance. Yellow iron oxide pigments are widely used as colorants in various end-use industries, such as rubber, building and construction, and paper.

Application Insights

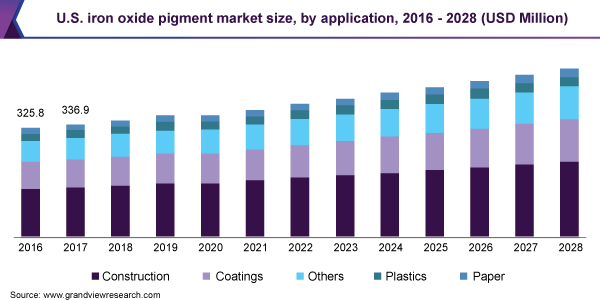

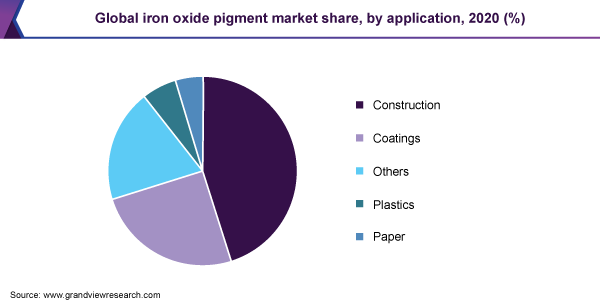

The construction application segment led the market and accounted for more than 45.0% share of the global revenue in 2020. The growing demand for decorative and finished materials in the construction sector, with traditional grey elements in walling, paving, and roofing materials being replaced by a variety of color schemes with the use of different colors is expected to drive the demand for iron oxide pigments over the forecast period.

Apart from construction, iron oxide pigments are widely used in various end-use industries, such as plastics, coatings, and paper. In the paper industry, iron oxide pigments are extensively used as colorants for various purposes, such as decorative papers, standard papers, cigarette papers, and printing papers (calendars and magazines). The majority of pigments processed by the paper industry are used for decorative papers. These pigments are directly added to pulp or paper, which are further used as laminates or decorative films in the packaging and furniture industries. The rising inclination toward aesthetically appealing products is anticipated to boost the demand for iron oxide pigments in the paper segment.

Regional Insights

Asia Pacific dominated the market and accounted for over 39.0% share of the global revenue in 2020. The growing construction activities are expected to boost the demand for iron oxide pigments in the region significantly.

The industrial and manufacturing sectors in the Asia Pacific have been attracting significant investments from leading MNCs. The availability of cheap labor and proximity to raw material suppliers are further luring investors to the region. China and India are expected to majorly fuel the regional market growth over the forecast period. Thus, the growing manufacturing and industrial sectors are fuelling the growth of the construction industry in the region, which, in turn, is expected to generate a demand for iron oxide pigments, in turn, triggering the market growth over the forecast period.

Key Companies & Market Share Insights

The market is fragmented in nature with the presence of various key players. The companies are increasingly adopting strategies, such as new product developments, production capacity expansion, agreements, and partnerships, to boost their revenue and increase their market shares.

Integration across the stages of the value chain results in continuous raw material supply as well as low manufacturing costs. R&D initiatives by a few companies to enhance their product specifications and expand the market reach are expected to further augment the product demand in the years to come. Some prominent players in the global iron oxide pigments market include:

-

Huntsman International LLC

-

Venator Materials PLC

-

Applied Minerals, Inc.

-

CATHAY INDUSTRIES

-

Lanxess

-

BASF SE

-

KRONOS Worldwide, Inc.

-

Hunan Sanhuan Pigment Co., Ltd.

-

Titan Kogyo, Ltd. (Titanium Industry Co., Ltd.)

Iron Oxide Pigments Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.3 billion

Revenue forecast in 2028

USD 3.1 billion

Growth Rate

CAGR of 4.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, color, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; China; India

Key companies profiled

Huntsman International LLC.; Venator Materials PLC; Applied Minerals, Inc.; Lanxess; BASF SE; KRONOS Worldwide, Inc.; Hunan Sanhuan Pigment Co., Ltd.; Titan Kogyo, Ltd. (Titanium Industry Co., Ltd.); Kolorjet Chemicals Pvt. Ltd.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global iron oxide pigments market report on the basis of product, color, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

-

Synthetic

-

Natural

-

-

Color Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

-

Red

-

Yellow

-

Black

-

Blends

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

-

Construction

-

Coatings

-

Plastics

-

Paper

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global iron oxide pigments market size was estimated at USD 2.2 billion in 2020 and is expected to reach USD 2.3 billion in 2021.

b. The global iron oxide pigments market is expected to grow at a compound annual growth rate of 4.7% from 2021 to 2028 to reach USD 3.1 billion by 2028.

b. Red iron oxide pigments led the global iron oxide pigments market and accounted for more than 42.0% share of the global revenue in 2020.

b. The construction application segment led the global iron oxide pigments market and accounted for more than 45.0% share of the global revenue in 2020.

b. Asia Pacific dominated the global iron oxide pigments market and accounted for over 39.0% share of the global revenue in 2020.

b. The synthetic segment dominated the iron oxide pigments market with a share of 69.2% in 2020. This is attributable to its excellent purity and quality level.

b. Some key players operating in the iron oxide pigments market include Applied Minerals Inc, LANXESS AG, Cathay Industries, Huntsman Corporation, Hunan Three-Ring Pigments Co. Ltd, Kronos Worldwide, BASF SE, Jiangsu Yuxing Industry & Trade Co., Ltd, Titan Kogyo, Ltd, and Kolorjet Chemicals Pvt Ltd.

b. Key factors that are driving the iron oxide pigments market growth include the growing construction industry across Asia-Pacific and the Middle East region. Favorable government regulations regarding environmentally friendly products coupled with technological advancements are expected to have a positive impact on market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."