- Home

- »

- IT Services & Applications

- »

-

IT Devices Market Size, Share & Growth Market Report 2030GVR Report cover

![IT Devices Market Size, Share & Trends Report]()

IT Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type, By Operating Systems (Mobile Devices, Peripheral Devices), By Distribution Channel, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-165-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

IT Devices Market Summary

The global IT devices market size was estimated at USD 1,736.70 billion in 2023 and is projected to grow at a CAGR of 9.5% from 2024 to 2030.The market for IT devices is being positively driven by the increasing number of connected devices and the smart accessory industry.

Key Market Trends & Insights

- Asia Pacific held the highest market share of more than 35% in 2023.

- By product type, the mobile devices segment accounted for the largest revenue share of more than 45.0% in 2023.

- By operating systems, the Android segment accounted for the largest revenue share of around 39.5% in 2023.

- By distribution channel, the offline segment held the highest market share of around 56.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,736.70 Billion

- 2030 Projected Market Size: USD 3,114.87 Billion

- CAGR (2024-2030): 9.5%

- Asia Pacific: Largest market in 2023

Further, Internet of Things (IoT) based IT devices that use sensor technology are becoming more affordable, sophisticated, and accessible. New sensor applications, such as large-scale monitoring and detection, are more feasible as a result of their accessibility and affordability.

The increasing investments in smart city projects across numerous developing countries such as China and India are anticipated to boost the market progress. Information and communication technologies are used by "smart city" technologies to effectively manage and run urban services like water supply, law and order, and transportation networks. The Internet of Things (IoT) is being incorporated with digital and mechanical objects with computing devices. Without requiring human intervention or much human-to-computer interaction, this system makes data transfer across a network possible. Computers and associated hardware are used in smart cities, which helps businesses in this industry.

Market players are seen to be adding advanced functionality to the IT devices while remaining true to the brand's core benefits such as interoperability, affordability, energy efficiency, ease of installation, and accessibility. For instance, in January 2023, Shelly, a provider of smart automation devices, announced the launch of a new smart home automation device, called Shelly Pro 3EM. Shelly Pro 3EM, is a three-phase energy meter that can be mounted on a DIN rack, connects via Bluetooth and LAN, and has measurement accuracy. It runs on Wi-Fi. It enables quick and simple deployment in already-existing industrial installations. In addition, with 60 days of historical data stored on the device, users can track the consumption of any household appliance, electric circuit, or piece of equipment separately. Thus, the launch of the new smart automation devices by market players is expected to drive the market demand in the forecasted period.

Cloud platforms and operating systems have grown rapidly over the forecasted period. Smart IT devices are likely to experience an increase in the use of IoT and cloud-based platforms. Target audiences in different global locations are adopting these during the forecast period. Thus, the market size and share of smart connected devices are expanding globally. Furthermore, developments like mobile edge computing, which lessens network congestion and boosts application performance, may simplify deployment and utilization.

The cloud computing power has grown significantly over the forecasted period. So, a range of technologies, including artificial intelligence and real-time analytics, can be incorporated into local devices. Furthermore, the introduction of 5G would enhance mobile connectivity and open up new applications for virtual and augmented reality experiences. Thus, significantly driving the market growth.

The globalization has accelerated the cross-border transfer of technology, directly driving the market. As, countries can now more easily access foreign knowledge and it increases global competition, which in turn makes businesses more motivated to innovate and adopt foreign technologies products, and services. Furthermore, due to globalization, the usage of connected devices increased significantly. Moreover, the cross-border flow of digital information searches, transactions, and communications has increased significantly. By strengthening the incentives for firms to innovate and adopt foreign technologies, globalization intensifies international competition, due to the rise of emerging market firms. Therefore, more consumers are expected to adopt IT devices, the market is expected to grow significantly.

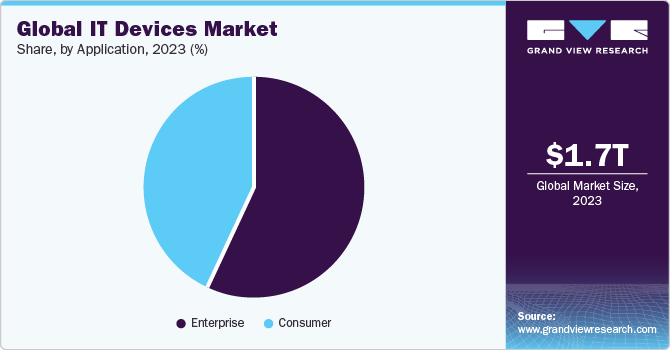

Application Insights

The enterprise segment accounted for the largest revenue share of over 57.0% in 2023. To enable insight and data accessibility, enterprises require IT devices across departments and workgroup networks. It facilitates device and system interoperability, streamlines communication protocols, and enhances enterprise data management both internally and externally. Every system in an enterprise network requires IT devices to be able to communicate and send and receive data. As a result, physical systems and equipment need to be able to sustain and offer adequate security, dependability, and performance.

The consumer segment is expected to exhibit the highest CAGR of around 10.0% over the forecast period. One of the most used technical consumer goods in homes is electronic devices. There has been an increase in consumers choosing televisions with larger screens, but electrical component miniaturization is also on the rise. Due to the growing demand, businesses are concentrating on creating high-performing and user-friendly gadgets. As a result, the rise of digitalization and technology will probably increase demand for electronics and other IT devices. Thus, driving the market growth of the segment.

Regional Insights

Asia Pacific held the highest market share of more than 35% in 2023. Asia Pacific is considered one of the world's largest markets for IT devices. The expanding telecom industry and the region's quickly increasing population are expected to fuel growth in the Asia Pacific IT device market over the projected period. The demand for tech products like laptops, tablets, and smartphones increased in the Asia Pacific region due to the rising presence of IT companies in countries like China, Japan, and India. Furthermore, it is expected that the increase in people's disposable income will lead to an increase in regional demand. Subsequently, driving the demand of the market in the region.

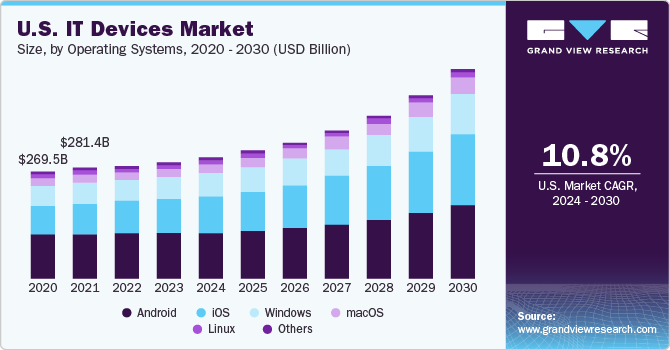

North America is expected to register the fastest CAGR of more than 11.0% over the forecast period. Over the projection period, the North American IT device market is anticipated to grow due to the increasing use of laptops and mobile devices in the region. In addition, another factor influencing growth in this region is the purchasing power of people. The U.S. has more disposable income than any other nation in the world. High-income nations have the potential to see growth in the IT device industry. Moreover, developed countries such as the U.S. and Canada are increasingly adopting improved technologies. Thus, driving the market growth of the segment.

Product Type Insights

The mobile devices segment accounted for the largest revenue share of more than 45.0% in 2023. The market for mobile devices is expected to expand due to rising disposable income across developing countries, better telecommunications infrastructure, more reasonably priced smartphones, and regular product releases. Moreover, market players are seen to be undertaking strategic initiatives such as new product launches, partnerships, and collaborations, to improve services and stay competitive. 5G network technology is being incorporated into devices by manufacturers due to growing consumer interest in 5G mobile devices. Therefore, driving the market growth of the segment.

The peripheral devices segment is expected to register the CAGR of more than 11.0% over the forecast period. Advancements in computer peripheral devices to meet changing consumer requirements for connected devices are expected to drive market growth. Additional factors such as rising demand for external storage devices, decreasing costs of consumer peripherals, and increasing disposable income are also driving the growth of the segment.It is anticipated that USB devices, such as USB flash drives, will become useful tools for sharing and storing data more rapidly. Therefore, driving the growth of the segment.

Operating Systems Insights

The Android segment accounted for the largest revenue share of around 39.5% in 2023. Android operating system can be built in open-source software. Furthermore, businesses can customize Android operating systems to enhance customer experiences. Application developers now have access to a worldwide user base. Most importantly, as Android operating systems are open source, device manufacturers could freely install Android on their products without having to pay for a license or create a proprietary operating system. Thus, these factors collectively drive the segment’s growth.

The iOS segment is expected to exhibit the highest CAGR of more than 11.5% over the forecast period. There is growing demand for iOS operating systems among end users. Furthermore, various factors such as, reaching out to high-end iPhone users, creating extremely reliable and secure applications ,and the introduction of flexible software development kits (SDKs) that enable the development of feature-rich iOS applications with few lines of code. Therefore, there is high growth of the market in the segment.

Distribution Channel Insights

The offline segment held the highest market share of around 56.0% in 2023. Various IT device manufacturers such as Apple Inc., and Microsoft Corporation prefer to promote or launch new devices offline via trade shows and seminars to interact with the target audience in person. Furthermore, end users can experience products, and can accurately access the value of the products through offline channels. Therefore, the offline distribution demand is rising significantly.

The online segment is expected to hold the highest CAGR of more than 10.0% over the forecast period. Online distribution channel enables IT device manufacturers to track inventory levels at each branch and measure sales performance throughout the entire distribution network. Moreover, it uses information gathered from distributors' sales systems to automatically generate comprehensive stock and sales reports that assist businesses in making better business decisions. Thus, demand for the online distribution channel is rising significantly. Furthermore, end users are increasingly choosing online channels due to better discount deals, thorough product information, and better convenience. Thus, there is a growing interest in online distribution channels among IT device manufacturers.

Key Companies & Market Share Insights

The key market players in the market include Microsoft Corporation Dell Technologies Inc., and Samsung Electronics Co Ltd. These companies maintain an exhaustive product portfolio and are employed to maintain a competitive edge in the market, their product offerings, the applications segment they serve, their strategy to differentiate their products, and their industry impact. The key strategies include strategic collaborations, partnerships, and agreements; new product development; capability expansion; mergers & acquisitions; and research & development initiatives. For instance, in November 2023, L&T Technology Services, a smart products manufacturer, partnered with Nvidia Corporation, a provider of AI-based products, to develop software-defined architectures that will improve image quality and scalability for endoscopic medical devices. The architecture offers a scalable platform for multiple applications and real-time decision-making tools in the medical industry. Such initiatives by market players are expected to drive the market growth.

Key IT Devices Companies:

- ABB Ltd.

- Apple Inc.

- Cisco Systems

- Dell Technologies Inc.

- Eaton Corporation

- Honeywell International Inc.

- Landis Gyr Inc.,

- Lenovo Group Limited

- Microsoft Corporation

- Open Systems International Inc.,

- Rockwell Automation Inc.,

- S & C Electric Company,

- Samsung Electronics Co Ltd

- Schneider Electric S.E.

- Siemens AG

IT Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,805.24 billion

Revenue forecast in 2030

USD 3,114.87 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product type, operating systems, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Spain; France; Italy; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

ABB Ltd.; Apple Inc.; Cisco Systems; Dell Technologies Inc.; Eaton Corporation; Honeywell International Inc.; Landis Gyr Inc.; Lenovo Group Limited; Microsoft Corporation; Open Systems International Inc.; Rockwell Automation Inc.; S & C Electric Company; Samsung Electronics Co Ltd; Schneider Electric S.E.; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IT Devices Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018–2030. For this study, Grand View Research has segmented the global IT devices market report based on product type, operating systems, distribution channel, application, and region:

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Computers and Laptops

-

Mobile Devices

-

Peripheral Devices

-

Networking Equipment

-

-

Operating Systems Outlook (Revenue, USD Billion, 2018 - 2030)

-

Windows

-

macOS

-

Linux

-

iOS

-

Android

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer

-

Enterprise

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IT devices market size was estimated at USD 1,736.70 billion in 2023 and is expected to reach USD 1,805.2 billion in 2024.

b. The global IT devices market is expected to witness a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 3,114.9 billion by 2030.

b. The mobile devices segment accounted for the largest revenue share in 2023, contributing more than 45.0% of the overall revenue. The market for mobile devices is expected to expand due to rising disposable income across developing countries, better telecommunications infrastructure, more reasonably priced smartphones, and regular product releases. Moreover, market players are seen to be undertaking strategic initiatives such as, new product launch, partnerships, and collaborations, to improve services and stay competitive. 5G network technology is being incorporated into devices by manufacturers due to growing consumer interest in 5G mobile devices. Therefore driving the market growth of the segment.

b. The key players in the IT devices market are ABB Ltd., Apple Inc., Cisco Systems, Dell Technologies Inc., Eaton Corporation, Honeywell International Inc., Landis Gyr Inc., Lenovo Group Limited, Microsoft Corporation, Open Systems International Inc., Rockwell Automation Inc., S & C Electric Company, Samsung Electronics Co Ltd, Schneider Electric S.E., and Siemens AG.

b. The market for IT devices is being positively driven by the increasing number of connected devices and the smart accessory industry. Further, Internet of Things (IoT) based IT devices that use sensor technology are becoming more affordable, sophisticated, and accessible. New sensor applications, such as large-scale monitoring and detection, are more feasible as a result of their accessibility and affordability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.