- Home

- »

- Next Generation Technologies

- »

-

IT Services Market Size And Share Analysis Report, 2030GVR Report cover

![IT Services Market Size, Share & Trends Report]()

IT Services Market Size, Share & Trends Analysis Report By Technology (AI & ML, Big Data Analytics), By Approach (Proactive, Reactive), By Deployment, By Enterprise Size, By End-use, By Type, By Application, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-931-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global IT services market size was estimated at USD 1.22 trillion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.7% from 2023 to 2030. Market is experiencing rapid growth driven by factors such as widespread adoption of cloud computing and digital technologies, high demand for cybersecurity solutions, and emphasis on innovation & automation. Increasing concerns regarding data security and privacy protection drive demand for IT services from companies across various industry verticals. Market growth is also driven by trends, such as increasing use of AI and machine learning (ML), high demand for data analytics & big data solutions, focus on IoT & connected devices, and rising need to comply with data privacy regulations.

As businesses and industries increasingly rely on technology, IT service providers stand to benefit from this thriving market. COVID-19 pandemic had a positive impact on market. A sudden shift to remote work created a need for IT solutions that supported this new work model, leading to increased demand for tools and infrastructure from IT companies. Cloud computing also experienced significant growth as businesses migrated their operations to cloud, necessitating IT services to manage and secure these environments. Moreover, rise in cyberattacks during pandemic increased demand for cybersecurity services as businesses sought to safeguard their data and systems from potential threats. Overall, pandemic accelerated adoption of IT services and technology solutions, driving growth in market.

In addition, rise in IT expenditures, with widespread adoption of software-as-a-service (SaaS) and growing availability of cloud-based solutions, is driving market demand. These services have increased efficiency of business processes while allowing firms to concentrate on their core competencies without worrying about installed IT infrastructure. Businesses use IT services for various purposes, from standard chores like handling employee records to complex corporate processes like supply chain and operations management. Market for IT services is anticipated to increase due to these factors.

Market Dynamics

The need for IT infrastructure from SMEs has grown significantly over recent years, boosting IT services market. SMEs heavily invest in IT support services across industries, including e-commerce, particularly start-ups such as Indian food ordering and delivery platform Swiggy, whose complete enterprise depends on IT infrastructure. Businesses of all sizes and industries increasingly provide their employees with digital tools. Digitalization brings cost savings by enhancing communication between personnel, suppliers, and networks, reducing transaction costs. For SMEs, this digital transformation facilitates easier integration into international markets by streamlining border and transportation procedures, creating vast opportunities for service commerce.

Moreover, digital tools grant easier access to a wide array of resources, including government services, training, finance, and recruitment channels, as these services rapidly move online. Furthermore, embracing digitalization fosters a culture of innovation by providing easier access to innovation resources. Businesses can leverage data and advanced analytics to gain fresh insights into their operations, improving performance and efficiency. Digitalization has become a strategic enabler for SMEs, empowering them to thrive in today's competitive business landscape. Small businesses have unique needs and goals compared to larger corporations due to human and technological resource limitations. To optimize their operations and drive growth, these firms can benefit from tailored solutions like security strategy and planning, systems and network implementations, and managed security services. Implementing these solutions enables businesses to streamline processes, enhance goods and services, and facilitate expansion. IT companies are crucial in monitoring systems and providing proactive advice to address issues before they escalate. This proactive approach prevents operational downtime, enhancing organization's perception as a well-managed corporation.

Furthermore, early problem prevention significantly reduces costs of repairing potential IT-related damages. Additionally, many IT support firms offer network operations center (NOC) services, enabling remote monitoring of IT systems and ensuring continuous oversight and quick response to potential challenges. Lockdowns and social estrangement revolutionized business patterns, forcing companies to quickly move operations online or create smart working solutions to stay in business and avoid supply chain interruptions. In February 2021, OECD released a global survey study stating that COVID-19 had led to an increase in digital technology use by SMEs of about 70%. Given investments and financial advantages of new models, many of these changes are meant to last. A survey confirms that 75% of firms surveyed in the U.K. have shifted to remote working over a period, and around a third have invested in new digital capabilities, while 55% of SMEs surveyed in Brazil recognized improvements in customer relationships, process agility, and customer acquisition due to digitalization during COVID-19.

Approach Insights

Reactive IT services segment led market in 2022, accounting for over 56.0% share of global revenue. Reactive IT services are witnessing significant growth due to increasing complexity of IT systems, which makes it challenging to prevent issues, prompting businesses to adopt robust reactive IT solutions. In addition, rising cost of downtime pushes companies to invest in such services to avoid productivity and revenue losses. Cloud-based services further facilitate implementation of reactive IT measures through monitoring, alerting, and incident management capabilities. As a result, demand for reactive IT services is expected to continue increasing as organizations prioritize safeguarding their IT assets and maintaining uninterrupted operations during problems.

The proactive IT services segment is estimated to grow significantly over forecast period, driven by multiple factors, including complexity of IT systems, escalating threat of cybercrime, and desire for enhanced IT performance and agility. These services play a crucial role in helping businesses identify and resolve potential issues before they lead to downtime or data loss, bolster their security, optimize IT resources, and achieve greater IT agility. Moreover, it plays a crucial role in supporting remote work, maintaining compliance with regulations, improving customer experience, and optimizing costs, making it an essential investment for businesses. Thus, businesses are increasingly adopting proactive IT services to stay ahead of challenges and ensure smoother and more secure operations.

Application Insights

Application management segment held largest revenue share of over 31.5% in 2022. Businesses can leverage application management to enhance application performance and reliability, reduce ownership costs, strengthen application security, and maximize overall value of their applications. Application management solutions play a pivotal role in effectively monitoring, optimizing, and maintaining applications. In addition to enhancing performance and reliability, application management offers business cost-saving benefits. Moreover, robust application management practices help identify and mitigate potential security vulnerabilities, safeguard sensitive data, and ensure compliance with industry regulations.

Data management segment is predicted to foresee significant growth in forecast period owing to an increasing volume of data generated by businesses and individuals, coupled with a need to leverage data for improved decision-making and gaining a competitive edge. Growing adoption of cloud computing, offering cost-effective and scalable data management solutions, further boosts segment's expansion. Key growth areas within data management include cloud-based data management, big data handling, data analytics services, and data governance solutions. As these trends persist, demand for data management services is anticipated to continue growing in foreseeable future.

Technology Insights

AI and ML segment held largest revenue share of over 31.0% in 2022. Vast availability of data empowers AI to analyze extensive datasets, extract valuable insights, and optimize decision-making processes, leading to enhanced personalized customer experiences and streamlined operations. As computing power costs decrease, businesses are adopting AI solutions more affordably, facilitating real-time fraud detection and predictive maintenance. Growing demand for automation drives implementation of AI and ML in streamlining tasks, such as customer service, and freeing human resources for more intricate roles, thereby fueling market expansion.

Big data analytics segment is estimated to grow significantly over forecast period. Rise of edge computing, where computation and data storage are brought closer to data sources, offers reduced latency and improved performance, creating new opportunities for specialized big data analytics providers. In addition, increasing importance of real-time analytics for quick decision-making in response to market changes presents prospects for IT service providers offering real-time analytics solutions. Moreover, growing demand for cloud-based big data analytics solutions, with their scalability, flexibility, and cost-effectiveness advantages, offers lucrative opportunities for IT service providers.

Deployment Insights

On-premises segment held largest revenue share of over 54.0% in 2022, as many businesses prefer on-premise deployment method. It gives them greater control over their IT infrastructure, enabling them to manage data and applications more effectively. On-premises solutions offer advantage of customization to meet specific business needs, allowing them to tailor their IT infrastructure precisely to their specific needs. In addition, some companies perceive on-premises solutions to be more secure, as data is not stored on remote servers that could be susceptible to cyberattacks. Thus, on-premises approach offers businesses control, customization, and security that aligns with their unique requirements.

Cloud segment is poised for substantial growth as businesses of all sizes increasingly adopt cloud computing, driving up demand for cloud-based services, such as disaster recovery, business continuity, and big data analytics. Availability of cloud-based infrastructure and platforms is also rising, further fueling cloud’s expansion. Moreover, declining cost of cloud computing and adoption of hybrid cloud and multi-cloud environments contribute to its popularity. Cloud-based managed services, analytics solutions, and security solutions are experiencing a surge in demand. Thus, cloud segment is growing as businesses embrace its flexibility, scalability, and efficiency for their IT needs.

Enterprise Size Insights

Large enterprises segment held largest revenue share of over 60.0% in 2022. As IT systems and infrastructure become more complex, specialized expertise and resources are essential for effective management, making large enterprises better equipped to handle these demands. Moreover, larger enterprises are better positioned to invest in new IT services, including cloud computing and other technologies, owing to their financial resources and scale of operations. Furthermore, with a growing focus on digital transformation, there is increased demand for IT services that can enhance agility, efficiency, and customer experience, driving large enterprises to lead market in seeking these solutions.

Small and medium enterprises (SMEs) segment is estimated to grow significantly over forecast period. Availability of cloud-based IT services has played a crucial role in this growth, making it more accessible and affordable for SMEs to adopt new technologies. Cloud-based solutions offer on-demand access, which is advantageous for SMEs with limited resources to invest in costly IT infrastructure. Moreover, a rise of mobile technology has opened up new opportunities for SMEs, enabling them to utilize mobile devices for customer communication, inventory management, and sales tracking. Thus, SME segment continues to grow as SMEs leverage technology to boost their growth and competitiveness in market.

End-use Insights

IT & telecom segment held largest revenue share of over 17.5% in 2022. IT & telecom sector is experiencing rapid growth as telecom operators increasingly adopt cloud computing and other digital technologies to modernize their infrastructure and services. Growing demand for managed services and IT solutions from these operators also expands sector. Moreover, a convergence of IT and telecom technologies is becoming more prevalent, leading to an increased need for specialized IT services that cater to industry’s evolving requirements. Thus, IT & telecom sector is poised for substantial growth as it continues to adapt and integrate various technologies.

Retail segment is estimated to grow significantly over forecast period. Rising adoption of e-commerce and omnichannel retail strategies drives demand for IT solutions in a retail sector that can support seamless online and offline customer experiences. Need for automation and streamlined operations also contributes to increased demand for IT services in this sector. For instance, customer relationship management (CRM) systems enable retailers to build stronger customer relationships and provide personalized services, while inventory management solutions help retailers track inventory levels and prevent stockouts. Thus, retail industry’s growing focus on efficiency and customer satisfaction drives a significant surge in demand for specialized IT services tailored to its unique needs.

Type Insights

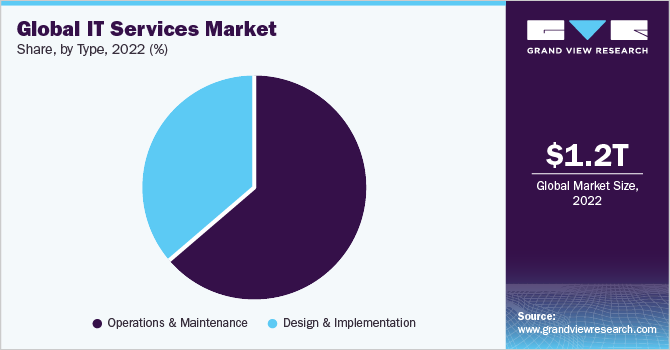

Operations & maintenance segment led market in 2022, accounting for over 63.0% share of global revenue. Segment is growing as cloud computing has driven a shift toward cloud-based operations & maintenance solutions, offering scalability and cost savings. Automation technologies, such as RPA, ML, and AI, enhance efficiency and resource utilization. Moreover, growing importance of data analytics enables organizations to gain insights into IT system performance, preventing disruptions. In addition, heightened security concerns prompt investments in robust security solutions to safeguard against evolving cyber threats. These trends continue to shape IT services landscape, with businesses striving to optimize their operations & maintenance strategies for improved performance and resilience.

Design & implementation segment is anticipated to register significant growth over forecast period owing to a combination of technological advancements, increasing demand for user-centric solutions, and a pressing need for rapid IT deployment. Businesses are actively seeking IT service providers to assist them in designing and implementing their IT systems and applications. They are becoming indispensable partners for organizations seeking to navigate complexities of modern technology landscapes and achieve seamless digital experiences, resulting in rising demand for these services and subsequent market expansion.

Regional Insights

North America dominated the market in 2022, accounting for over 36% share of global revenue owing to technological advancements, digital transformation initiatives, and increasing reliance on technology across various industries. Growing implementation of smart technologies and swelling security investment are major factors driving demand for IT services in region. In addition, as part of ongoing response, agencies throughout the U.S. released new resources and approaches to protect American communities and businesses from cyberattacks. For instance, in July 2021, the U.S. Department of Homeland Security (DHS) and the U.S. Department of Justice (DOJ), along with federal partners, revealed a new website, StopRansomware.gov, to combat ransomware threats. A new website is first joint website created by the federal government to assist public and private organizations in eliminating their ransomware risk.

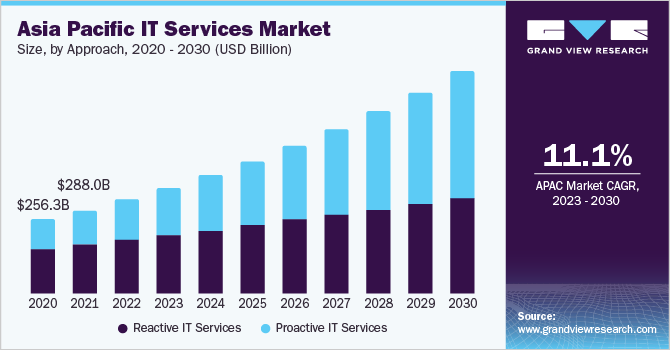

Asia Pacific market is expected to register fastest CAGR over forecast period. This expansion can be attributed to a rise in IT service spending from enterprises in the Asia Pacific region. Organizations in this region have effectively demonstrated enhanced advantages of integrating technology at all levels of business and society for more connected, effective, and simplified operations. For instance, in May 2021, the Australian Government unveiled its Digital Economy Strategy, a USD 1.2 billion investment to ensure the country has an appropriate policy framework, infrastructure, and capability to support digital transformation. Strategy highlights measures and policies government is implementing to position Australia as a contemporary and leading digital economy by 2030, building on its skills, infrastructure, laws, cyber security, and digital trade investments.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase market share. Companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in June 2023, IBM Corporation acquired Agyla SAS, a cloud professional services company based in France. This strategic move enhances IBM Corporation’s hybrid multi-cloud service offerings and strengthens its hybrid cloud and AI approach within the region. Further, it enables IBM Corporation to offer clients in France a more comprehensive and integrated set of hybrid cloud services. Some of the prominent players in global IT services market include:

-

Amazon Web Services, Inc.

-

Avaya

-

Cisco Systems, Inc.

-

DXC Technology Company

-

Fortinet, Inc.

-

Hewlett Packard Enterprise Development LP

-

Huawei Technologies Co., Ltd.

-

IBM Corp.

-

Juniper Networks, Inc.

-

Microsoft

-

Broadcom (Symantec Corporation)

-

Oracle

IT Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.36 trillion

Revenue forecast in 2030

USD 2.59 trillion

Growth rate

CAGR of 9.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion/trillion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Approach, type, application, technology, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Amazon Web Services, Inc.; Avaya; Cisco Systems, Inc.; DXC Technology Company; Fortinet, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM Corp.; Juniper Networks, Inc.; Microsoft; Broadcom (Symantec Corp.); Oracle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IT Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the IT services market report based on approach, type, application, technology, deployment, enterprise size, end-use, and region:

-

Approach Outlook (Revenue, USD Billion, 2017 - 2030)

-

Reactive IT Services

-

Proactive IT Services

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Design & Implementation

-

Operations & Maintenance

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Systems & Network Management

-

Data Management

-

Application Management

-

Security & Compliance Management

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

AI & Machine Learning

-

Big Data Analytics

-

Threat Intelligence

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Media & Communications

-

Retail

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IT services market size was estimated at USD 1.22 trillion in 2022 and is expected to reach USD 1.36 trillion in 2023.

b. The global IT services market is expected to grow at a compound annual growth rate of 9.7% from 2023 to 2030 to reach USD 2.59 trillion by 2030.

b. North America dominated the IT services market with a share of 36.8% in 2022. This is attributable to technological advancements, digital transformation initiatives, and the increasing reliance on technology across various industries.

b. Some key players operating in the IT services market include Amazon Web Services, Inc.; Avaya; Cisco Systems, Inc.; DXC Technology Company; Fortinet, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM Corporation; Juniper Networks, Inc.; Microsoft; Broadcom (Symantec Corporation) ; Oracle

b. Key factors that are driving the IT services market growth include increase in demand for cloud services, and increased investment by small and medium enterprises in IT support services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."