- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Italy Dietary Supplements Market Size, Industry Report, 2030GVR Report cover

![Italy Dietary Supplements Market Size, Share & Trends Report]()

Italy Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Form, By Type, By Application, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-660-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Italy Dietary Supplements Market Trends

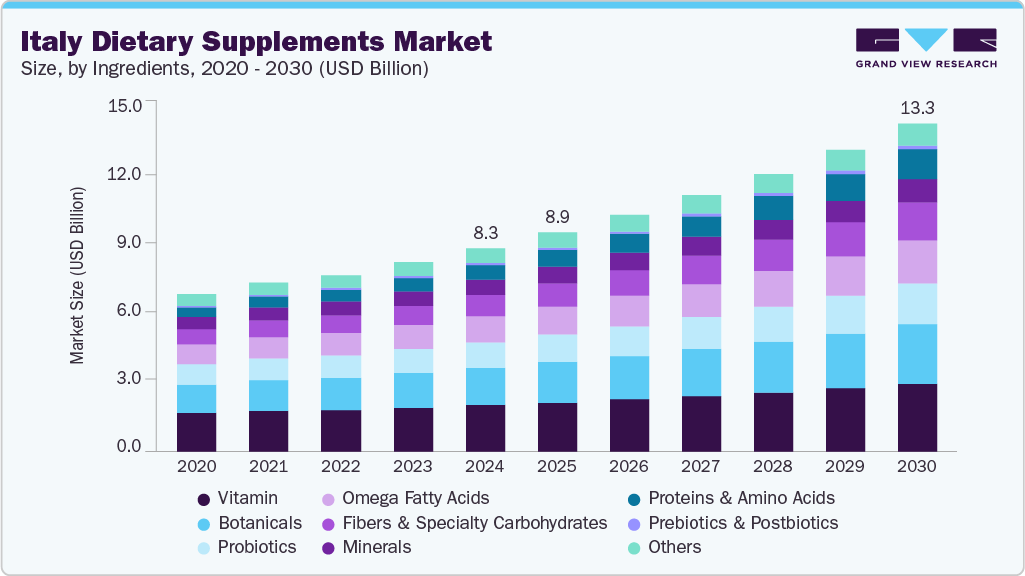

The Italy dietary supplements market size was estimated at USD 8.27 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. The market growth is attributed to the increasing consumer awareness regarding health and wellness. With a growing emphasis on preventive healthcare, individuals are actively seeking supplements that support immunity, digestion, mental well-being, and overall vitality. This trend is reinforced by rising concerns about lifestyle-related diseases, prompting people to integrate nutritional supplements into their daily routines.

A key factor influencing the market in Italy is the aging population. According to the World Health Data, by 2050, Italy's population is projected to decline to 51.9 million, reflecting a demographic shift toward an aging society. The elderly population will grow significantly, with 2.63 million women and 1.75 million men aged 85+, nearly doubling from 2023. The 75-79 age group will also expand, reaching 2.12 million women and 1.9 million men. As the country undergoes demographic changes, with a growing number of elderly individuals, the demand for supplements that support healthy aging-such as vitamins, minerals, and collagen-based products-is increasing significantly. Older consumers are seeking solutions to maintain joint health, cardiovascular function, and cognitive performance, contributing to the market's expansion.

The expansion of e-commerce and digital health platforms has made dietary supplements more accessible to a broader consumer base. Online shopping offers convenience, product variety, and the ability to compare brands and reviews, encouraging more purchases. Influencer marketing and personalized nutrition trends further influence consumer engagement, shaping buying behaviors and preferences. Italy has made significant strides in digital health, implementing electronic medical prescriptions, health records, telemedicine, and online healthcare services.

Consumer Insights

Italy’s demographic profile as of mid-2025 underscores a mature and urbanized society. With a population of 59.15 million, and nearly 72% living in urban areas, the nation strongly leans toward modern lifestyles and healthcare accessibility. The median age of 48.2 years positions Italy among the oldest populations globally.

Notably, 24.1% of Italians are aged 65 and above, reflecting a steady rise in elderly citizens who are more health-conscious and proactive in managing age-related conditions. This generational shift significantly drives demand for dietary supplements, particularly those aimed at joint support, cardiovascular health, bone strength, and immune function.

Consumer Demographics

Women in Italy generally consume dietary supplements more frequently than men. Women tend to prefer vitamin and mineral combinations, while men are more inclined towards protein and mineral-only supplements.

Ingredients Insights

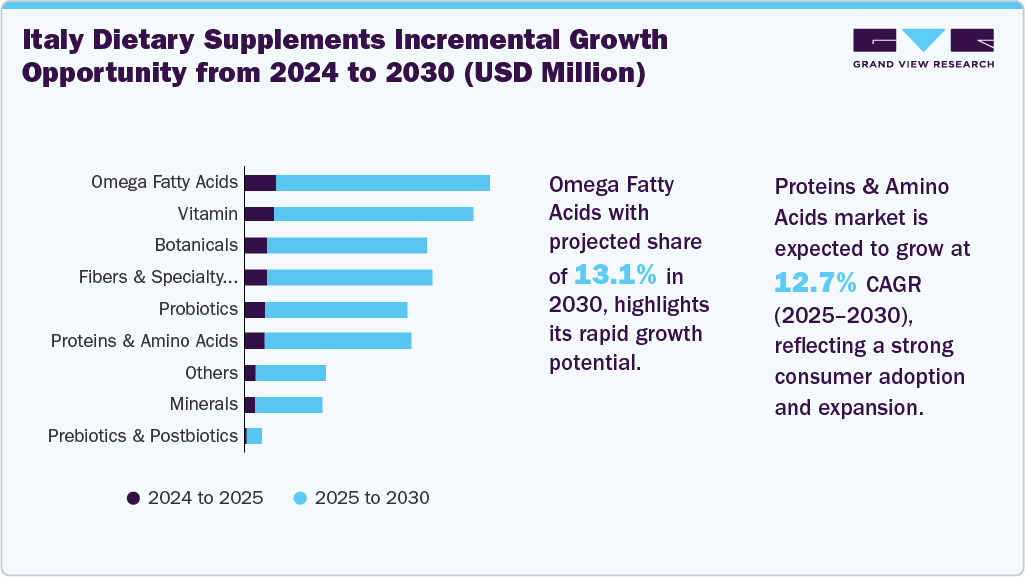

Vitamins dominated the Italian dietary supplements market and accounted for a share of 22.8% in 2024, owing to heightened consumer focus on immunity, energy, and overall wellness. Post-pandemic health consciousness has driven widespread adoption of vitamins like C, D, and B-complex, which are known to support immune function, bone health, and energy metabolism. Additionally, the ease of availability and variety of delivery forms-tablets, gummies, and effervescent powders-have made vitamins more accessible and appealing to diverse age groups. Growing recommendations by healthcare professionals and increased demand from Italy’s aging population further bolstered their market dominance.

The proteins & amino acids segment is expected to experience the fastest CAGR from 2025 to 2030. This surge is largely fueled by increasing consumer interest in fitness, muscle recovery, and active lifestyles, particularly among younger and middle-aged demographics. The rise of plant-based and clean-label protein sources has broadened the appeal of this segment beyond athletes to include health-conscious individuals and older adults seeking to preserve muscle mass and metabolic health.

Form Insights

Tablets dominated the market and accounted for a share of 31.6% in 2024, owing to their convenience, precise dosage, and extended shelf life. They are easy to store, transport, and consume, making them a preferred choice among consumers across all age groups. Their standardized format ensures consistent nutrient intake, which appeals to healthcare professionals and users seeking reliability in supplementation. Moreover, tablets often allow multiple active ingredients in a single unit, enhancing their cost-effectiveness and appeal in multivitamin and multi-nutrient formulations.

The gummies segment is expected to experience the fastest CAGR of 9.9% from 2025 to 2030. This rapid expansion is driven by rising consumer preference for more enjoyable and palatable supplement formats. Gummies are particularly appealing to children, young adults, and older individuals who may struggle with swallowing tablets or capsules. Their fruity flavors, appealing textures, and perceived convenience make them a favored alternative to traditional dosage forms. The clean-label and vegan gummy trend is gaining momentum, aligning with demand for natural ingredients and transparent formulations in the health and wellness space.

Type Insights

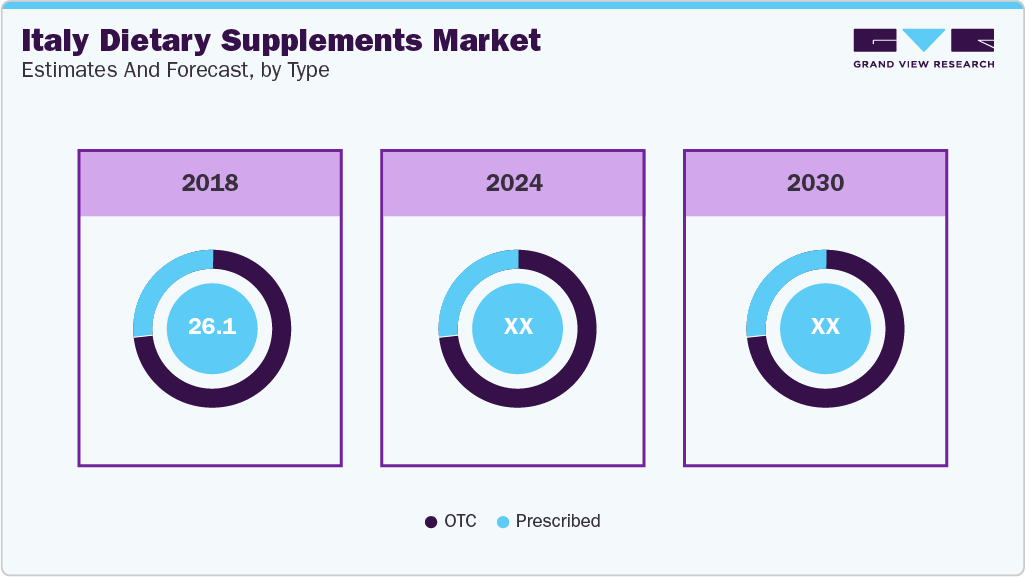

OTC supplements dominated the market and accounted for a share of 73.2% in 2024, owing to their ease of accessibility, affordability, and consumer trust. These products can be purchased without a prescription from pharmacies, supermarkets, and online platforms, making them highly convenient for self-directed health management. The growing trend toward preventive healthcare and wellness routines has empowered consumers to proactively address nutritional needs without medical consultations. Additionally, broad marketing efforts, attractive packaging, and endorsements by influencers and health experts have enhanced OTC supplement visibility and appeal.

The prescribed segment is expected to experience the fastest CAGR from 2025 to 2030. Factors contributing to market growth are increased medical recommendations, a rise in chronic lifestyle conditions, and heightened trust in physician-guided supplementation. As healthcare providers increasingly incorporate supplements into treatment protocols for conditions such as osteoporosis, anemia, and cardiovascular disorders, demand for prescription-based products is gaining momentum. Italy’s aging population is more inclined to seek personalized medical advice, particularly for condition-specific formulations. Integrating these supplements within official healthcare channels lends credibility and reinforces consumer confidence, fueling robust growth in this segment.

Application Insights

Immunity dominated the market and accounted for a share of 11.0% in 2024, driven by heightened public health awareness and the impact of the COVID-19 pandemic. Consumers increasingly prioritized immune resilience, turning to supplements rich in vitamins C and D, zinc, and echinacea to bolster their defenses against infections and seasonal illnesses. The aging population, more susceptible to immune decline, contributed to sustained demand, alongside busy urban consumers seeking preventive health solutions. Marketing campaigns and endorsements from health professionals further amplified the appeal of immunity-boosting products, solidifying their dominance across retail channels.

The prenatal health segment is expected to experience the fastest CAGR from 2025 to 2030. Expectant mothers are becoming more proactive about ensuring optimal nutrition during pregnancy, leading to rising demand for supplements rich in folic acid, iron, calcium, omega-3 fatty acids, and other essential micronutrients. Healthcare professionals also increasingly recommend prenatal formulations to reduce the risk of birth defects and support healthy development. Moreover, advancements in supplement delivery-like chewable tablets and flavored gummies-are making prenatal health solutions more accessible and user-friendly.

End Use Insights

The adult segment accounted for the largest market share of 62.7% in 2024. The market growth is attributed to the broad consumer base seeking support for immunity, energy, digestive health, and chronic condition management. Adults-particularly those in their 30s to 60s-increasingly incorporate supplements into preventive health routines to mitigate stress, improve nutrition, and maintain long-term vitality. Additionally, lifestyle-driven choices, growing awareness about age-related deficiencies, and accessibility of targeted formulations through OTC channels have solidified this segment’s leading position. Tailored marketing and product innovation continue reinforcing adults as the core demographic in supplement consumption.

The infants segment is anticipated to grow at the fastest CAGR during the forecast period. This growth is driven by increasing parental awareness of early-life nutrition, pediatrician recommendations, and rising concerns about developmental health and immunity in newborns and toddlers. Products fortified with essential nutrients such as vitamin D, calcium, iron, and omega-3 fatty acids are in high demand to support bone development, cognitive function, and immune resilience. Additionally, introducing innovative and palatable formats like drops and dissolvable powders is making supplementation more convenient for parents and safer for infant consumption.

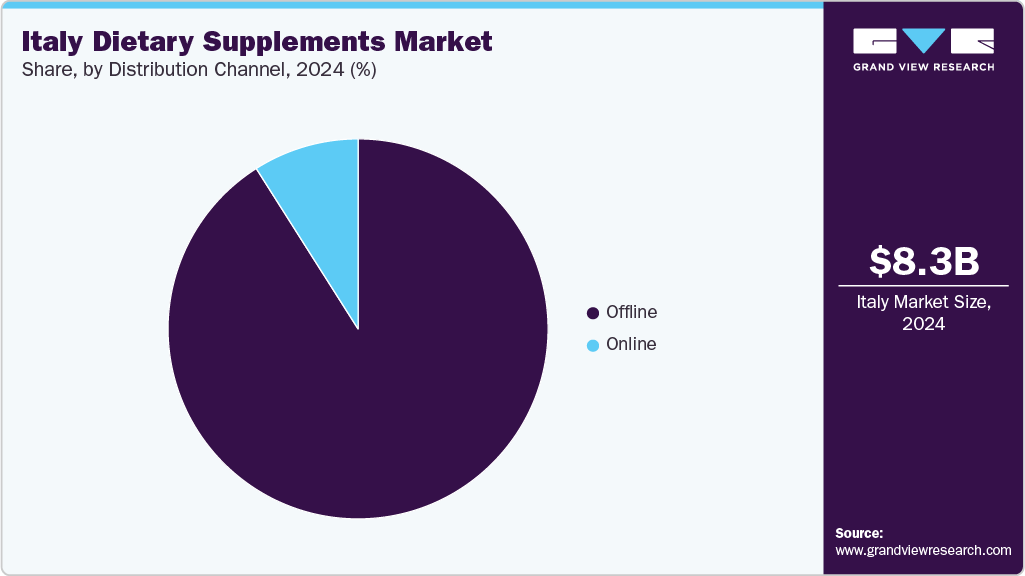

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024. Italian consumers continue to value the in-person experience, where they can seek guidance from pharmacists or store staff, physically inspect products, and make informed choices. This traditional retail presence also benefits from strong brand visibility, promotional campaigns, and consumer loyalty programs. Furthermore, the widespread availability of OTC supplements across urban and rural regions helps maintain the dominance of offline retail, despite the growing momentum of e-commerce.

The online distribution segment is projected to experience the fastest CAGR from 2025 to 2030. Consumers increasingly favor digital channels for their ability to offer product variety, competitive pricing, and doorstep delivery. Enhanced trust in online purchases, influencer marketing, and social media promotion further bolsters digital engagement. Additionally, personalized recommendations, subscription models, and growing mobile commerce adoption are transforming how supplements are discovered and purchased online, accelerating the segment’s growth.

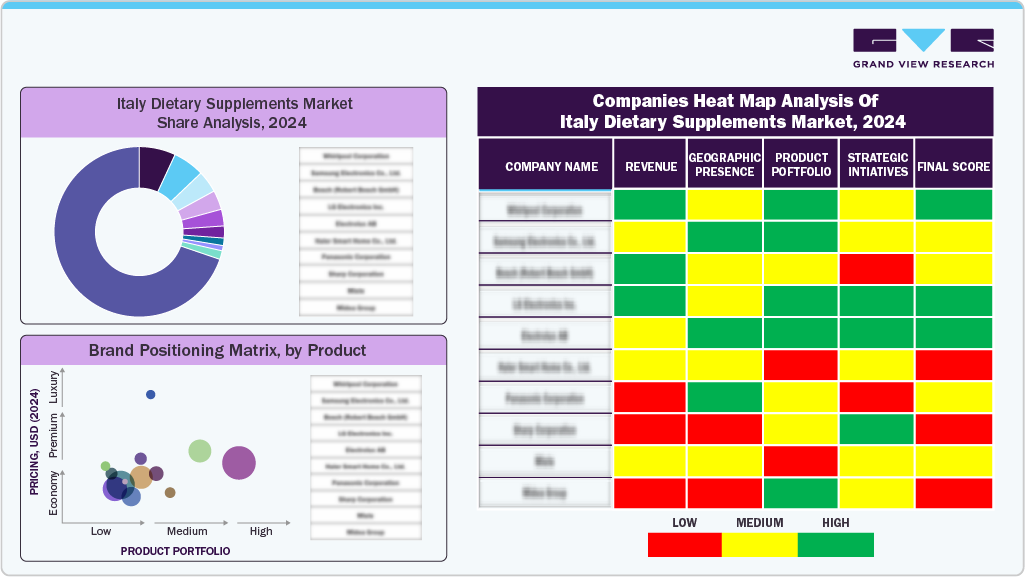

Key Italy Dietary Supplements Company Insights

Some of the key companies operating in Italy dietary supplements industry include Bayer AG, Nestlé, Amway Corp., Pfizer Inc., and others.

-

Bayer AG operates in Italy through its Consumer Health division, offering a wide range of over-the-counter dietary supplements to support immunity, energy, and general wellness.

-

Nestlé provides a comprehensive portfolio of dietary supplements and medical nutrition products in Italy. Its offerings include vitamins, minerals, herbal supplements, and condition-specific formulations targeting digestive health, metabolic balance, and healthy aging.

Key Italy Dietary Supplements Companies:

- Bayer AG

- Nestlé

- Amway Corp.

- Pfizer Inc.

- Solgar Inc.

- Arkopharma

- GSK plc.

Recent Developments

-

In October 2024, PharmaNutra unveiled Sidevit D3 and B12-its first Sucrosomial vitamin supplements-at CPHI Milan 2024.

Italy Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.91 billion

Revenue forecast in 2030

USD 13.32 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, distribution channel

Country scope

Italy

Key companies profiled

Bayer AG; Nestlé; Amway Corp.; Pfizer Inc.; Solgar Inc.; Arkopharma; GSK plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Italy Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Italy dietary supplements market report based on ingredients, form, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Frequently Asked Questions About This Report

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.