- Home

- »

- Plastics, Polymers & Resins

- »

-

Italy Electronic Shelf Label Market, Industry Report, 2033GVR Report cover

![Italy Electronic Shelf Label Market Size, Share & Trends Report]()

Italy Electronic Shelf Label Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Displays, Batteries), By Type (LCDs, E-paper Displays), By Communication Technology, By Size, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-729-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Italy Electronic Shelf Label Market Summary

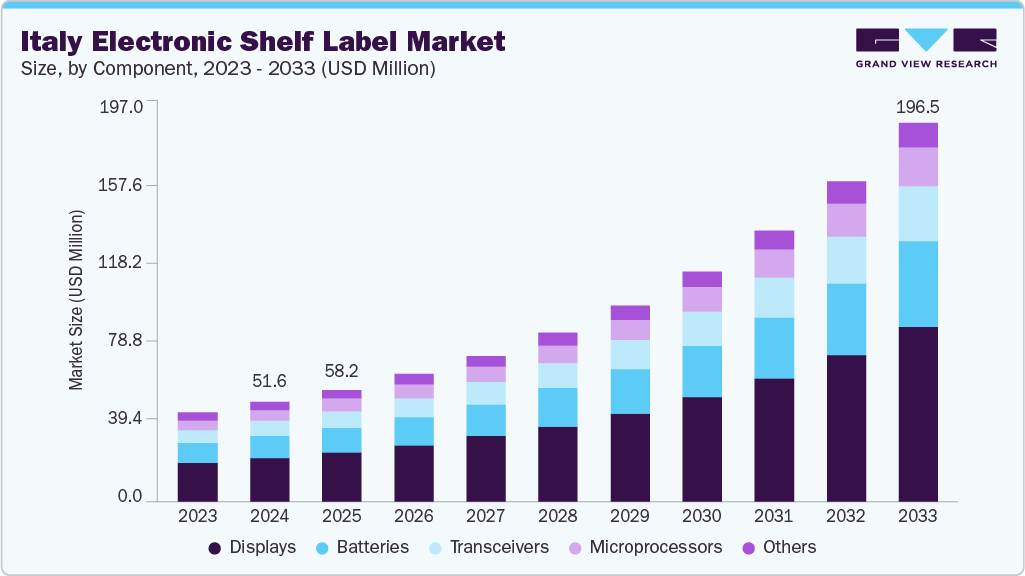

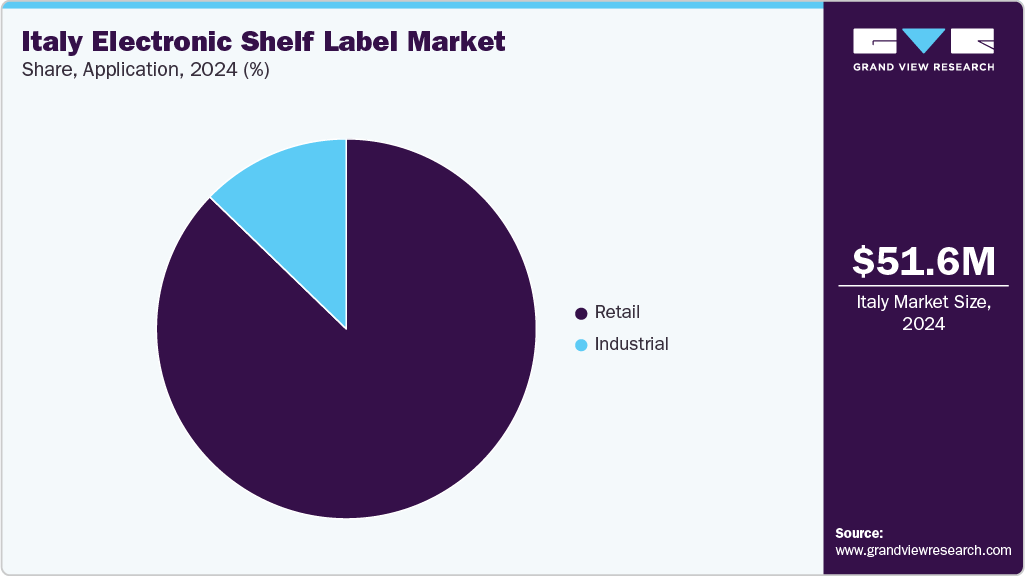

The Italy electronic shelf label market size was estimated at USD 51.6 million in 2024 and is projected to reach USD 196.5 million by 2033, growing at a CAGR of 16.4% from 2025 to 2033. The market is driven by the growing adoption of automation and digital retail technologies to improve pricing accuracy and operational efficiency.

Key Market Trends & Insights

- By component, the displays segment is expected to grow at a considerable CAGR of 17.0% from 2025 to 2033 in terms of revenue.

- By type, the e-paper displays segment is expected to grow at a considerable CAGR of 16.9% from 2025 to 2033 in terms of revenue.

- By communication technology, the infrared segment is expected to grow at a considerable CAGR of 17.0% from 2025 to 2033 in terms of revenue.

- By size, the ≤ 3 inches segment is expected to grow at a considerable CAGR of 16.8% from 2025 to 2033 in terms of revenue.

- By application, the retail segment is expected to grow at a considerable CAGR of 16.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 51.6 Million

- 2033 Projected Market Size: USD 196.5 Million

- CAGR (2025-2033): 16.4%

In addition, rising demand for real-time inventory management and enhanced customer experience in supermarkets and hypermarkets supports market growth. The expansion of hypermarkets, supermarkets, and convenience stores across Italy significantly drives the demand for electronic shelf labels (ESLs). These retail formats require highly efficient and dynamic pricing systems to manage frequent price changes, promotions, and product rotations. ESLs enable centralized and real-time price updates, reducing manual labor and pricing errors. With Italy’s retail sector becoming more competitive, particularly in urban and suburban areas, major retailers such as Coop Italia, Esselunga, and Carrefour Italia are investing heavily in store automation technologies, including ESLs, to enhance operational efficiency and maintain pricing accuracy across large inventories.The transformation in consumer buying behavior, favoring modern trade formats over traditional stores, has been a key catalyst in this growth. Shoppers increasingly prefer organized retail due to the wider assortment, competitive pricing, and improved shopping experiences. According to Federdistribuzione, the leading trade association representing large and modern retail companies in Italy, organized retail formats, comprising hypermarkets, supermarkets, superettes, discount stores, department stores, and large specialized stores, are significant players in the grocery and household goods market in Italy. The Italian food retail market includes around 26,000 stores (with over 7,400 franchising locations) and more than 150 different brands, demonstrating that these organized retail formats constitute a major part of the market. ESLs serve as a strategic tool for these retailers, helping them dynamically adjust pricing based on promotions, inventory levels, and competitor pricing strategies, ultimately improving profitability and customer satisfaction.

Dynamic pricing strategies are gaining significant traction in Italy’s retail landscape, particularly among supermarkets, hypermarkets, and specialty retailers. Dynamic pricing allows retailers to adjust prices in real-time based on market demand, competitor pricing, time of day, product availability, and consumer behavior. This strategy helps businesses stay competitive while optimizing revenue. ESLs are crucial for implementing such flexible pricing models, as they enable instant and centralized price updates across thousands of products, minimizing the need for manual intervention.

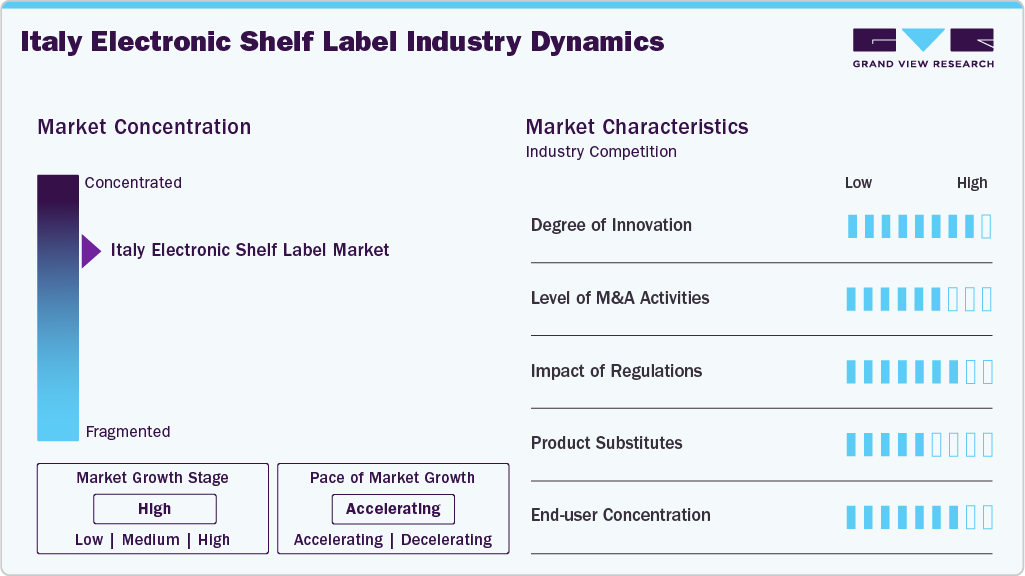

Market Concentration & Characteristics

The Italy ESL market is characterized by a high degree of innovation, driven by advancements in e-ink display technology, wireless communication (NFC, Bluetooth, Zigbee), and integration with retail management systems. Retailers are experimenting with ESLs that support dynamic pricing, QR codes, and even customer engagement features like product information or sustainability scores. For example, Italian supermarkets are adopting ESLs that display allergen or nutritional information to comply with EU regulations.

The industry sees moderate levels of mergers and acquisitions (M&A), as global ESL providers such as VusionGroup, Pricer, and Delfi Technologies A/S expand their presence in Italy through partnerships with local retailers. Italian system integrators and technology distributors often collaborate with these global players to bring ESL solutions to supermarkets, convenience stores, and specialty retail. This creates a mix of international expertise and local adaptation.

Component Insights

The displays segment recorded the largest market revenue share of over 43.0% in 2024 and is expected to grow at the fastest CAGR of 17.0% during the forecast period. Displays form the most visible and critical component of electronic shelf labels, enabling real-time price updates and product information. ESLs in Italy often use e-paper or LCD technology, offering high readability, low power consumption, and the ability to show clear text and images under varying store lighting conditions. As Italian retailers shift towards digitalized store management, display innovations become a key differentiator for enhanced customer experience.

Batteries power ESL devices, typically lasting 5-10 years, depending on usage. Long battery life is critical in minimizing operational costs and reducing maintenance requirements across large retail chains. In Italy, where supermarket and hypermarket penetration is high, minimizing downtime through reliable batteries is crucial for continuous retail operations. The growth in Italy’s ESL battery demand is driven by advancements in low-power e-paper displays and energy-efficient transceivers, which reduce the frequency of replacements.

Type Insights

The e-paper displays segment recorded the largest market revenue share of over 64.0% in 2024 and is expected to grow at the fastest CAGR of 16.9% during the forecast period. E-paper ESLs use electronic ink technology, offering high contrast, paper-like readability, and extremely low power consumption, making them suitable for long-term deployments. These are particularly popular in Italy’s premium retail sectors, including fashion, electronics, and pharmacies, where aesthetic appeal and energy efficiency are key. E-paper ESLs are driven by sustainability and operational efficiency in Italy, aligning with the country’s strong regulatory and consumer focus on reducing energy consumption and carbon footprints.

Graphic e-paper ESLs are an advanced type that allows text, logos, QR codes, barcodes, and promotional graphics. They are increasingly used in Italy’s large supermarkets, hypermarkets, and specialty stores to provide interactive, visually appealing product displays that can enhance brand engagement. The growth of graphic e-paper ESLs in Italy is driven by digital transformation in retail and omni-channel marketing strategies.

Communication Technology Insights

The radio frequency segment recorded the largest market revenue share of over 67.0% in 2024. RF technology is the most widely adopted communication method in the Italian ESL industry because it covers large store areas and enables seamless real-time updates across thousands of labels. RF-based ESLs use wireless communication to connect with a central system, ensuring efficient pricing and product information management. Large supermarket chains, hypermarkets, and discount retailers in Italy prefer RF solutions because they allow for high scalability and reliable communication over long distances within retail environments.

The infrared segment is expected to grow at the fastest CAGR of 17.0% during the forecast period. IR communication technology is used in ESLs to transmit pricing and product updates through light-based signals. Although IR requires a direct line of sight between transmitters and receivers, it is still relevant in small retail stores or specific zones within large stores where controlled, localized communication is necessary. In Italy, IR is often considered a cost-effective solution for specialty stores and pharmacies where coverage areas are limited, and precise updates are required.

Size Insights

The ≤ 3 inches segment recorded the largest market revenue share of over 59.0% in 2024 and is expected to grow at the fastest CAGR of 16.8% during the forecast period. The ≤ 3 inches ESL segment is primarily used for small retail items such as cosmetics, pharmaceuticals, convenience products, and packaged foods. These compact labels are ideal for dense shelf arrangements and small product facings where space optimization is critical. They offer clear price displays while consuming minimal shelf space, making them cost-effective for retailers handling high SKU volumes.

The 3 to 7 inches ESLs balance readability and shelf space utilization. These labels are widely used in supermarkets, hypermarkets, and specialty stores to display product details such as prices, promotions, QR codes, and even short product descriptions. The strong adoption of this segment is fueled by the expansion of modern retail formats in Italy, especially supermarkets and hypermarkets.

Application Insights

The retail segment recorded the largest market share of over 87.0% in 2024 and is expected to grow at the fastest CAGR of 16.9% during the forecast period. The retail segment of the ESL industry in Italy primarily includes supermarkets, hypermarkets, grocery stores, and specialty retail outlets. The adoption of ESLs in retail is driven by the need for digital transformation, increased automation, and the push for omnichannel strategies where price accuracy and instant updates are crucial for customer satisfaction. Moreover, increasing consumer preference for real-time price information and transparency has accelerated ESL adoption in the retail industry.

In the industrial sector, ESLs are increasingly used in warehouses, logistics centers, and manufacturing units for inventory management, product tracking, and workflow optimization. They provide real-time visibility of stock levels, reduce human errors, and facilitate just-in-time operations. Moreover, integrating ESLs with ERP systems and warehouse management software enables seamless communication and real-time updates, strengthening operational efficiency and decision-making capabilities.

Key Italy Electronic Shelf Label Company Insights

The competitive environment of the Italy ESL industry is moderately consolidated, characterized by a mix of global ESL technology providers and local specialized players catering to retail and industrial sectors. The market also witnesses collaboration and partnerships with system integrators and retail chains to enhance adoption. Competitive pressures are driven by technological innovation, cost efficiency, and the need for seamless integration with existing retail management systems, while emerging startups are gradually challenging established players by offering more flexible and AI-enabled ESL solutions.

Key Italy Electronic Shelf Label Companies:

- Pricer

- Panasonic Connect Co., Ltd.

- VusionGroup

- DIGI Italia Srl

- Opticon

- Delfi Technologies A/S

- FasThink Srl

- Dahua Italy

- TENENGA SRL

- Dinja

- Nicolis Project

- K.F.I. Srl

- Solum ESL

Recent Developments

-

In December 2024, Italian grocery retailer Coop Alleanza 3.0 partnered with VusionGroup to advance the digitalization of its stores across Italy, aiming to optimize operations, reduce waste, and enhance the customer experience. The collaboration involves rolling out VusionGroup’s comprehensive suite of solutions, including digital and multicolor electronic shelf labels, cloud-based IoT management via VusionCloud, and the Captana AI-powered real-time shelf monitoring system.

-

In January 2024, Prezzemolo & Vitale (P&V), an upscale Italian delicatessen, partnered with Pricer to implement digital shelf labels across its London stores. This collaboration aims to enhance operational efficiency and improve customer service by utilizing electronic shelf labels (ESLs) allowing real-time pricing updates and better inventory management.

-

In February 2023, LP Distribuzione Bevande, an Italian food and beverage distributor operating in Catania and Sicily, collaborated with Delfi Technologies A/S to implement electronic shelf labels in its cash & carry shop. This partnership enables automatic, real-time updates of product information and prices through wireless connection to the store's ERP system, enhancing the efficiency and accuracy of product display for thousands of items serving the HoReCa sector.

Italy Electronic Shelf Label Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 58.2 million

Revenue forecast in 2033

USD 196.5 million

Growth rate

CAGR of 16.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Component, type, communication technology, size, application

Key companies profiled

Pricer; Panasonic Connect Co., Ltd.; VusionGroup; DIGI Italia Srl; Opticon; Delfi Technologies A/S; FasThink Srl; Dahua Italy; TENENGA SRL; Dinja; Nicolis Project; K.F.I. Srl; Solum ESL

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Italy Electronic Shelf Label Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Italy electronic shelf label market report based on component, type, communication technology, size, and application:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Displays

-

Batteries

-

Transceivers

-

Microprocessors

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

LCDs

-

E-paper Displays

-

Graphic E-paper Displays

-

-

Communication Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Radio Frequency

-

Infrared

-

Near-field Communications

-

Others

-

-

Size Outlook (Revenue, USD Million, 2021 - 2033)

-

≤ 3 inches

-

3 to 7 inches

-

7 to 10 inches

-

≥ 10 inches

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail

-

Industrial

-

Frequently Asked Questions About This Report

b. The Italy electronic shelf label market was estimated at around USD 51.6 million in the year 2024 and is expected to reach around USD 58.2 million in 2025.

b. The Italy electronic shelf label market is expected to grow at a compound annual growth rate of 16.4% from 2025 to 2033 to reach around USD 196.5 million by 2033.

b. The retail segment emerged as the dominating application segment in the Italy electronic shelf label market due to the need for real-time price accuracy, frequent promotions, and labor cost savings in supermarkets and hypermarkets.

b. The key players in the Italy electronic shelf label market include Pricer; Panasonic Connect Co., Ltd.; VusionGroup; DIGI Italia Srl; Opticon; Delfi Technologies A/S; FasThink Srl; Dahua Italy; TENENGA SRL; Dinja; Nicolis Project; K.F.I. Srl; and Solum ESL

b. The Italy electronic shelf label (ESL) market is driven by the growing adoption of automation and digital retail technologies to improve pricing accuracy and operational efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.