- Home

- »

- Beauty & Personal Care

- »

-

Italy Hairdresser Salon Market Size, Industry Report, 2030GVR Report cover

![Italy Hairdresser Salon Market Size, Share & Trends Report]()

Italy Hairdresser Salon Market (2025 - 2030) Size, Share & Trends Analysis Report By Region (Toscana, Liguria, Piemonteo, Trentino Alto Adige, Marche, Umbria, Abruzzo, Molise, Puglia), And Segment Forecasts

- Report ID: GVR-4-68040-055-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Italy Hairdresser Salon Market Size & Trends

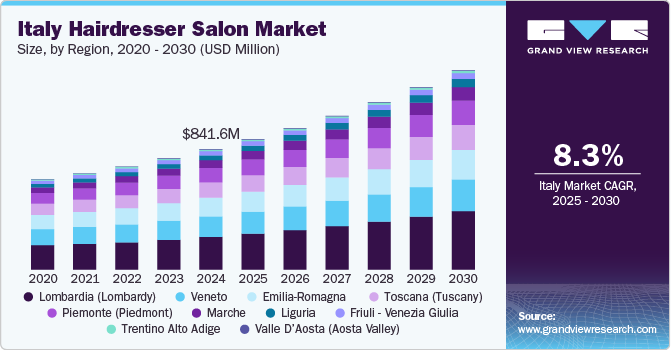

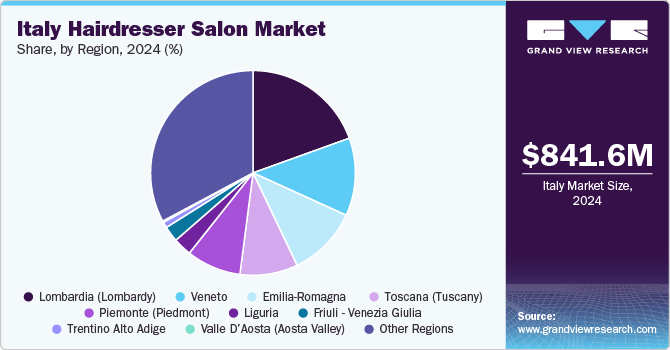

The Italy hairdresser salon market size was estimated at USD 841.6 million in 2024 and is expected to grow at a CAGR of 8.3% from 2025 to 2030. The market growth is predominantly driven by the increasing popularity of diverse styling trends across age groups and genders. Rising consumer expenditure on hair treatments and styling services reflects an improvement in living standards and purchasing power, which in turn fuels demand for premium, high-quality hair care products and services. In response, Italian hair salons are forming strategic alliances with renowned hair care brands to elevate service offerings, a trend expected to enhance the hairstyling landscape in the coming years.

For instance, Screen Hair Care-a brand under the Italian hair care company Nuova Fapam S.p.A.-has partnered with salons nationwide to supply a variety of professional hair styling products, including hair color, spray, and heat protectants for both men and women. Notable premium salon partners include Folie Sylvia, Vanity Mirror, Ritratto Di Donna, L’onda Acconciature, and Chic Di D’amico Valentina, solidifying their role in delivering elevated styling experiences. Additionally, the Italian government introduced enhanced safety protocols to mitigate the spread of COVID-19 while ensuring the continued operation of hair salons and beauty parlors. In January 2022, a mandate was implemented requiring customers to present a COVID-19 pass upon entry, establishing a safer environment for both clients and staff within these establishments.

With an increasing number of Italian consumers seeking premium hair treatments and styling services, the market has experienced a notable shift towards high-quality products and specialized services. This trend is especially prevalent among younger demographics, where fashion-forward, trend-driven choices are shaping market dynamics. As a result, salons are continuously upgrading their offerings, investing in new products, and enhancing customer experiences to cater to the diverse preferences of Italy’s modern clientele.

A significant factor driving this growth of the Italy hairdresser salon industry is the strategic collaboration between salons and leading hair care brands. Many salons are aligning with renowned companies to gain access to premium products and provide elevated service quality. For example, Screen Hair Care, a brand of Nuova Fapam S.p.A., has become a preferred choice for numerous high-end Italian salons. Through partnerships, Screen Hair Care supplies products like hair color, styling sprays, and thermal protection solutions, meeting the demand for both men’s and women’s styling needs. Similarly, global brands such as L'Oréal Professionnel and Davines have established long-standing partnerships with salons across Italy, enabling them to access exclusive product lines and professional expertise that enhance service standards. These alliances empower salons to position themselves as premium destinations for sophisticated hair care, adding value to the customer experience.

The surge in consumer spending on personal care has been paralleled by an increase in the number of boutique and specialty salons, especially in urban centers like Milan, Rome, and Florence. Many of these salons cater to high-income clientele who prioritize quality over cost, with demand steadily growing for specialized services like color treatments, precision cuts, and restorative hair therapies. Boutique salons such as Folie Sylvia, Vanity Mirror, and Ritratto Di Donna have built strong reputations by offering personalized services with a focus on meticulous styling techniques and exclusive product ranges. By continuously innovating their service offerings and embracing luxury-oriented approaches, these salons have become sought-after destinations for discerning clients.

The business models for Italian hairdresser salons are steadily transforming, particularly with a stronger focus on enhancing digital accessibility. Innovations like mobile-based booking platforms have introduced new levels of convenience, allowing clients to select appointments based on their schedules seamlessly. For example, UALA, a comprehensive web and mobile application, enables customers to locate nearby salons, review profiles, and book appointments at establishments that best match their preferences. This digital shift is reshaping customer expectations and enhancing the user experience in Italy’s hair salon industry.

In response to Italy’s thriving tourism industry, many prominent salons are also investing in multilingual services to better serve an international clientele. Notably, in May 2022, the well-regarded salon chain Le Pettinose launched a new location in Rome’s vibrant Garbatella district, staffed by professionals with extensive national and international experience, including fluency in English. This strategic approach enables salons to cater to global visitors more effectively, positioning Italy’s salons as attractive destinations for tourists seeking high-quality hair services during their stay.

The popularity of mobile booking options and integrated social media platforms has also surged, with many salons incorporating booking links and real-time updates on social media to simplify client engagement in the Italy hairdresser salon industry. For instance, in June 2022, KEVIN.MURPHY Italia, a brand specializing in professional hair care products, introduced a direct booking feature through its Instagram page, @Kevinmurphy.italia, offering clients an effortless way to arrange hairstyling and coloring appointments. These digital enhancements are making salon services increasingly accessible, aligning with consumer demand for streamlined, efficient booking experiences.

Regional Insights

Lombardia (Lombardy) captured a market share of 19.50% in 2024. In Lombardy, particularly within Milan, the demand for hairdresser salons is surging due to the region's role as Italy's fashion and business epicenter, attracting residents and tourists who prioritize high-end personal grooming. With Milan’s reputation as a global style hub, consumers have come to expect premium, trend-forward salon services that align with the city’s fashionable ambiance. Top salon chains, like Cotril and Aldo Coppola, are responding by offering specialized treatments such as precision cuts and advanced color techniques, catering to a clientele that includes business professionals, fashion enthusiasts, and international visitors who seek quality hair services in an upscale setting.

The demand for hairdresser salon services in Marche is anticipated to grow at a CAGR of 9.8% from 2025 to 2030. In Marche, demand is being driven by shifting lifestyle preferences and an increasing emphasis on high-quality, personalized beauty services among locals. As disposable income rises and more consumers focus on wellness and sustainable beauty, boutique salons in Marche-particularly in cities like Pesaro and Ancona-are thriving. Salons like Studio Nucis have gained popularity by emphasizing organic, eco-friendly hair products and treatments that align with health-conscious values. This regional emphasis on tailored and environmentally mindful grooming has strengthened Marche’s position in the Italian beauty industry, appealing to residents and visitors alike who value bespoke and holistic beauty experiences.

Key Italy Hairdresser Salon Company Insights

The competitive landscape of the Italy hairdresser salon industry is characterized by a dynamic mix of both established salon chains and independent boutique salons, each striving to capture a share of the growing demand for premium and personalized hair care services. Major national and international salon brands, such as Aldo Coppola, Jean Louis David, and Toni&Guy, maintain a strong presence in key metropolitan areas like Milan, Rome, and Florence. These salons often cater to high-end clientele by offering sophisticated, trend-setting services, such as precision cutting, luxury color treatments, and bespoke styling options. Their competitive edge lies in their ability to leverage brand recognition, extensive marketing strategies, and global expertise to establish themselves as market leaders.

In addition to large chains, Italy’s hairdressing market is also populated by a growing number of independent salons, particularly in regional areas, which are increasingly focusing on niche services to differentiate themselves. These salons tend to prioritize personalized customer experiences, with offerings that emphasize organic, sustainable, and wellness-oriented treatments. For example, smaller, boutique salons like Studio Nucis in Ancona have captured attention by offering eco-friendly hair products and individualized services, appealing to a clientele seeking environmentally conscious and tailored beauty solutions. The rise of digital platforms, such as UALA, has also contributed to the competitive landscape by enabling salons of all sizes to enhance their visibility and simplify the booking process for clients, creating more direct competition in an increasingly digitalized market.

Moreover, the growing trend of salons integrating digital tools, including mobile booking apps and social media promotions, has intensified competition by offering customers greater convenience and personalized engagement. Salons are now employing social media channels to promote their services, showcase their expertise, and offer real-time booking features, further driving competition. With the increasing influence of digital technology, salons are compelled to innovate not only in their service offerings but also in their customer engagement strategies, making the competitive landscape in Italy’s hairdresser salon market both multifaceted and rapidly evolving.

Key Italy Hairdresser Salon Companies:

- MY PLACE HAIR STUDIO

- Les Garcons de la rue

- Never on Monday hair salon

- Brera13 Milano

- BLANCHE S.R.L

- Aldo Coppola

- Colonna Metropolitan Beauty Makers

- ZiZiAi di Simone Marlazzi

- Noi Salon

- Vertigine Hair Dresser

Recent Developments

- In February 2022, Colonna Metropolitan Beauty Makers provided hairstyling and makeup services for Flora Contrafatto, the esteemed actor, dancer, TV presenter, and model, during a high-profile photo shoot for Brooke Magazine.

Italy Hairdresser Salon MarketReport Scope

Report Attribute

Details

Market size value in 2025

USD 907.3 million

Revenue forecast in 2030

USD 1,349.4 million

Growth rate

CAGR of 8.3% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Region

Regional scope

Italy

Regional scope

Toscana (Tuscany); Liguria; Piemonte (Piedmont); Emilia - Romagna; Veneto; Lombardia (Lombardy); Valle D’Aosta (Aosta Valley); Trentino Alto Adige; Friuli - Venezia Giulia; Marche; Umbria; Lazio (Latium); Abruzzo; Molise; Puglia; Campania; Basilicata; Calabria; Sicilia; Sardegna

Key companies profiled

MY PLACE HAIR STUDIO; Les Garcons de la rue; Never on Monday hair salon; Brera13 Milano; BLANCHE S.R.L; Aldo Coppola; Colonna Metropolitan Beauty Makers; ZiZiAi di Simone Marlazzi; Noi Salon; Vertigine Hair Dresser

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Italy Hairdresser Salon Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Italy hairdresser salon market report based on region:

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Toscana (Tuscany)

-

Liguria

-

Piemonte (Piedmont)

-

Emilia - Romagna

-

Veneto

-

Lombardia (Lombardy)

-

Valle D’Aosta (Aosta Valley)

-

Trentino Alto Adige

-

Friuli - Venezia Giulia

-

Marche

-

Umbria

-

Lazio (Latium)

-

Abruzzo

-

Molise

-

Puglia

-

Campania

-

Basilicata

-

Calabria

-

Sicilia

-

Sardegna

-

Frequently Asked Questions About This Report

b. The Italy hairdresser salon market was estimated at USD 841.6 million in 2024 and is expected to reach USD 907.3 million in 2025.

b. The Italy hairdresser salon market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2030 to reach USD 1,349.4 million by 2030.

b. Lombardia (Lombardy) dominated the Italy hairdresser salon market with a share of around 19.54% in 2024. Increasing consumer spending on beauty care services, including hairdressing and styling will support the market in the region.

b. Some of the key players operating in the Italy hairdresser salon market include MY PLACE HAIR STUDIO; Les Garcons de la rue; Never on Monday hair salon; Brera13 Milano; BLANCHE S.R.L; Aldo Coppola; Colonna Metropolitan Beauty Makers; ZiZiAi di Simone Marlazzi; Noi Salon; Vertigine Hair Dresser

b. Key factors that are driving the Italy hairdresser salon market growth include increasing number of hairdresser salons in the country, and increasing technological innovations and online penetration of hair salons.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.