- Home

- »

- Electronic & Electrical

- »

-

Italy Retail Vending Machine Market Size Report, 2033GVR Report cover

![Italy Retail Vending Machine Market Size, Share & Trends Report]()

Italy Retail Vending Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Snacks, Beverage, Food, Frozen, Tobacco), By Location (Offices, Public Places), By Mode Of Payment (Cash, Cashless), And Segment Forecasts

- Report ID: GVR-4-68040-669-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Italy Retail Vending Machine Market Summary

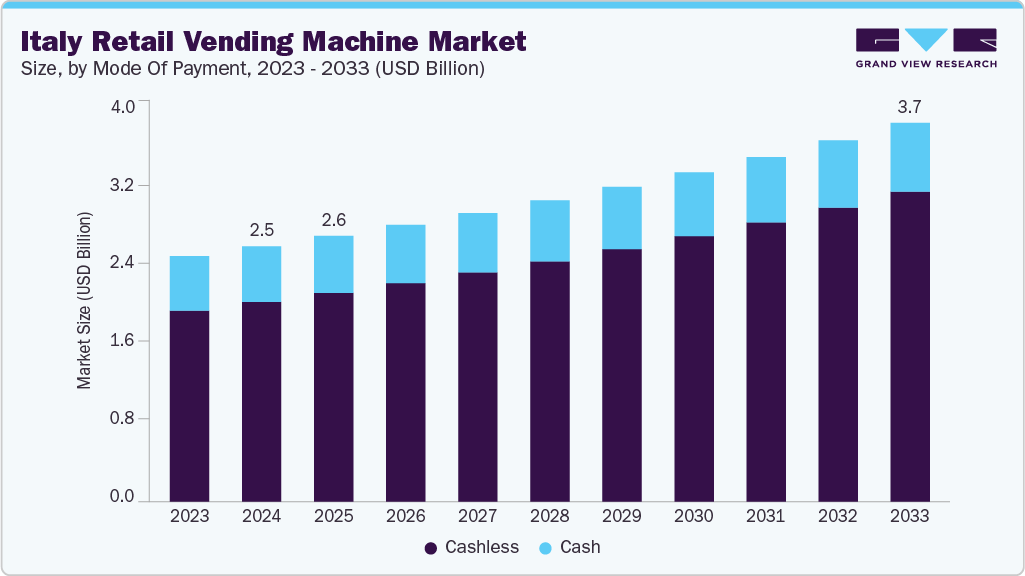

The Italy retail vending machine market size was estimated at USD 2.48 billion in 2024 and is projected to reach USD 3.68 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The market growth is driven by a shift toward high-margin, gourmet, and regional specialty products as operators capitalize on Italy’s mature vending infrastructure.

Key Market Trends & Insights

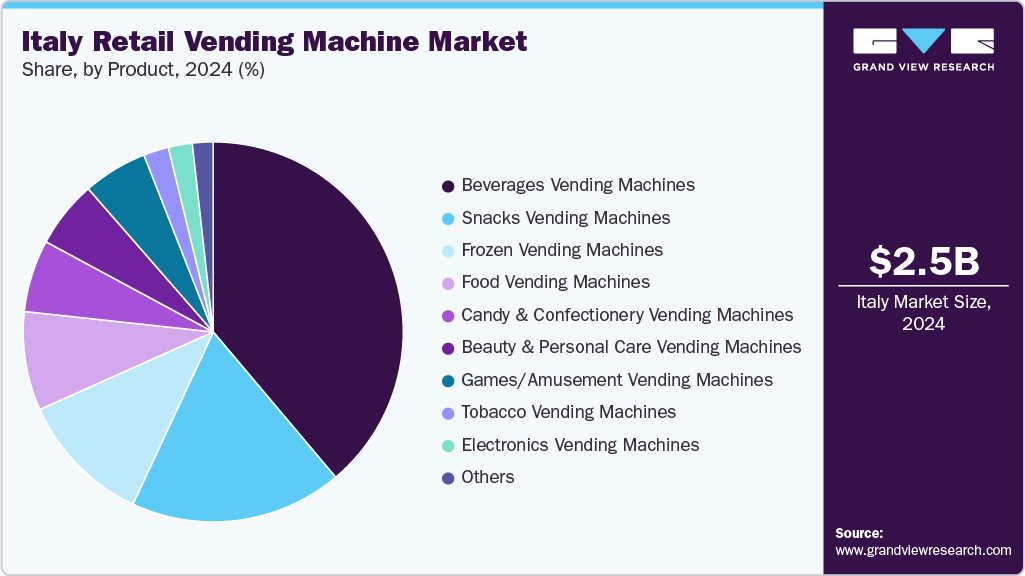

- By product, beverage vending machines accounted for a market share of 38.86% in 2024.

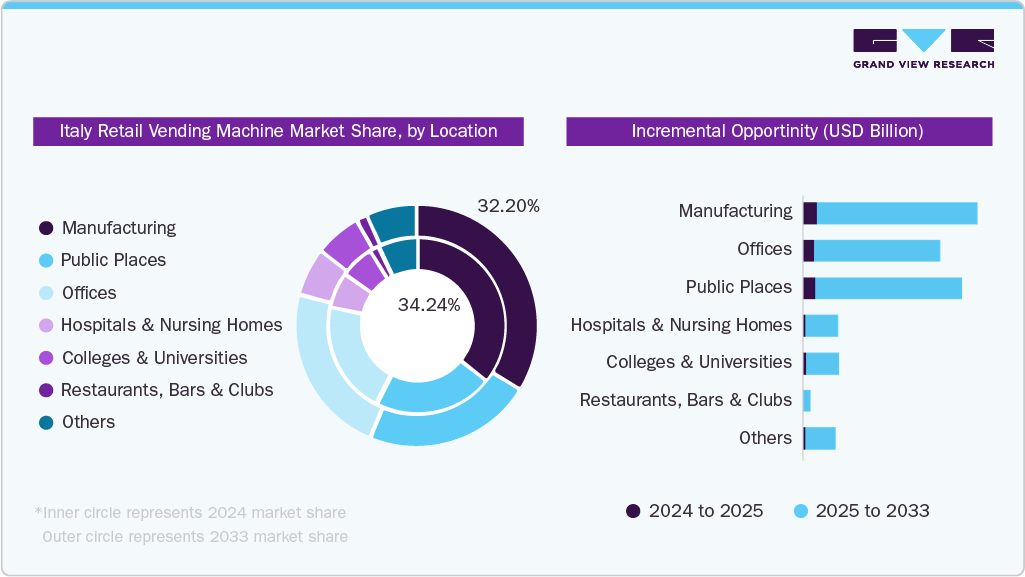

- By location, beverage machines for manufacturing accounted for a market share of 34.24% in 2024.

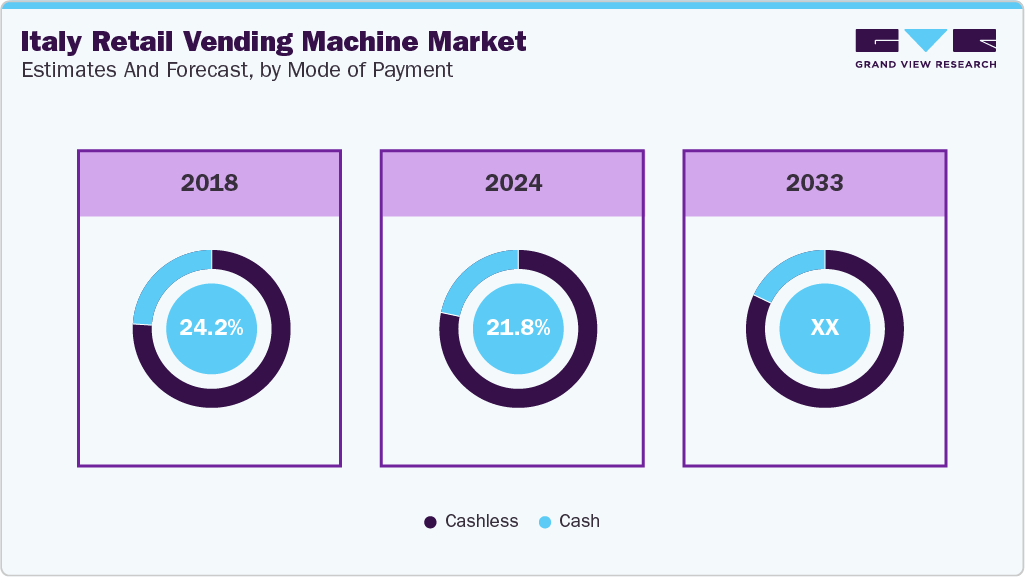

- By mode of payment, the cashless vending machines held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.48 Billion

- 2033 Projected Market Size: USD 3.68 Billion

- CAGR (2025-2033): 4.5%

The growth of the Italy vending machine market is attributed to several key factors despite its market maturity. Operators are increasingly focusing on product diversification, offering premium, organic, and regionally sourced items to meet evolving consumer preferences. The integration of digital technologies-such as mobile payments, telemetry systems, and real-time inventory tracking-is enhancing operational efficiency and user experience. In addition, vending machines are expanding beyond traditional urban settings into semi-urban and tourist-heavy areas, supported by Italy’s strong vending culture. Rising demand for convenient, 24/7 access to food and beverages, especially among commuters and younger demographics, continues to sustain market momentum.

As Italy already has the highest vending machine density in Europe, market growth is now driven by diversification of offerings rather than machine proliferation. Operators are shifting toward high-margin, premium, and health-oriented products, including organic snacks, fresh juices, gluten-free options, and regional specialties like artisanal panini or locally sourced beverages. For instance, companies such as Dallmayr and Argenta are increasingly stocking vending machines with fresh food options, targeting health-conscious consumers and office-goers who seek quick yet quality meals.

The adoption of advanced technologies is another key growth driver. Smart vending machines equipped with touchscreen interfaces, cashless and mobile payment options (e.g., Apple Pay, Google Pay), and remote monitoring systems are becoming standard. These features not only improve the user experience but also allow operators to track inventory, optimize restocking routes, and personalize offerings. For instance, Selecta and Serim have implemented telemetry solutions that provide real-time data analytics to manage product mix more efficiently across locations.

Beyond dense urban centers, vending machines are now being installed in non-traditional settings such as hospitals, schools, airports, and even rural tourist areas. This geographic spread taps into untapped demand while serving a growing number of consumers seeking convenience and 24/7 access. Changing work patterns, increased commuting, and the rise of “grab-and-go” culture-especially among younger Italians-continue to support the relevance of vending. Additionally, during and post-COVID, the perception of vending machines as safe, contact-minimized retail points has reinforced their appeal.

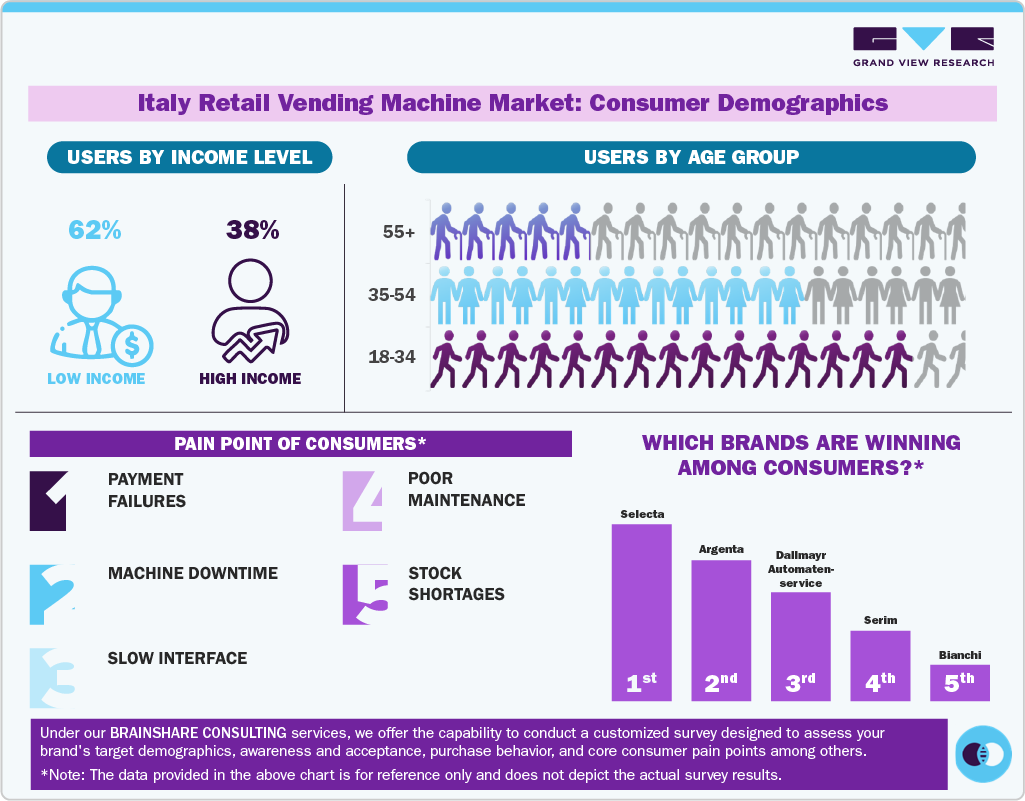

Consumer Insights

The Italian retail vending machine market shows a clear divide by income level. Lower-income users frequently rely on vending for its affordability and convenience, especially in transit hubs, schools, and industrial zones. In contrast, high-income users are more selective, preferring premium machines offering fresh food, gourmet coffee, and healthy snacks-often located in offices, airports, and hospitals. For them, vending is about quality, novelty, and seamless digital payment.

Age also plays a key role in usage patterns. Consumers aged 18-35 are the most active, attracted by mobile payments, digital interfaces, and 24/7 availability. Those aged 35-55 use vending machines primarily in workplaces and public institutions, while users over 55 represent a smaller segment, often limited by unfamiliarity with modern tech and payment methods.

Despite advancements, key pain points remain. Consumers report issues with product freshness, machine downtime, limited variety, and inconsistent cashless payments. Frustrations are higher in older or non-urban installations lacking modern interfaces or clear product information.

Leading domestic popular brands include IVS Italia and Gruppo Argenta, known for wide networks and reliable service. Serim and DF Italia are gaining ground with sustainable, health-focused offerings. Meanwhile, equipment manufacturers like Evoca, Bianchi Industry, and Rheavendors are enhancing consumer experience with sleek, smart, and eco-friendly machine designs.

Product Insights

Beverage vending machines segment accounted for a revenue share of 38.86% in 2024, driven primarily by strong demand for cold, ready-to-drink options such as bottled water, soft drinks, juices, and energy beverages. With Italy’s warm climate and high foot traffic in public spaces, such as train stations, schools, and tourist hubs, cold drink vending machines offer a convenient hydration solution. Brands such as Coca-Cola, San Benedetto, and PepsiCo maintain high visibility in these machines, while operators ensure frequent restocking to meet continuous demand, especially during peak summer months. The impulse nature of beverage purchases also contributes significantly to consistent revenue generation.

Snack vending machines segment is expected to grow at a CAGR of 4.7% from 2025 to 2033, supported by the country's deeply rooted vending culture and increasing consumer preference for convenient, ready-to-eat options. With a high density of machines already in place, operators are focusing on upgrading snack selections to include healthier and locally sourced items, reflecting growing health awareness among Italians. Companies like Argenta and IVS Italia are expanding their snack portfolios beyond traditional products, including organic chips, protein snacks, and Italian-made artisanal treats. Vending machines in high-traffic areas such as universities, metro stations, and business districts ensure steady demand, especially during work and school hours.

Location Insights

Vending machines for manufacturing accounted for a market share of 34.24% in 2024, driven by the country's large base of factory and shift-based workers who rely on quick, round-the-clock access to food and beverages. Industrial sites often operate beyond standard retail hours, making vending machines an essential source of refreshments during breaks. Employers in regions such as Lombardy, Emilia-Romagna, and Piedmont-Italy’s manufacturing hubs-partner with operators such as IVS Italia and Serim to install machines offering snacks, cold drinks, and sometimes fresh meals. These machines improve worker satisfaction and reduce downtime by eliminating the need to leave the facility for food access.

Vending machines for public places are expected to grow at a CAGR of 5.6% from 2025 to 2033, driven by high tourist footfall, urban mobility, and increasing demand for 24/7 convenience. Locations such as train stations, airports, metro platforms, and city centers see constant traffic from commuters, travelers, and tourists, creating strong demand for on-the-go access to snacks, beverages, and personal care items. Italian cities such as Rome, Milan, and Florence are expanding smart city infrastructure, encouraging the deployment of modern vending machines with cashless payments and touchless interfaces. Operators like Gruppo Argenta and GeSA are leveraging this trend by upgrading machines in public zones to offer more diverse and premium products, enhancing consumer experience, and driving higher transaction volumes.

Mode Of Payment Insights

Cashless vending machines segment accounted with a market share of 75.0% in 2024 in Italy due to widespread adoption of digital payment methods and the growing consumer preference for speed, hygiene, and convenience. Contactless cards, mobile wallets, and QR code-based apps have become mainstream in urban Italy, especially among younger users and commuters in cities like Milan, Rome, and Bologna. Operators such as IVS Italia and Gruppo Illiria have rapidly modernized their machines to support cashless transactions, aligning with national and EU-level digitalization initiatives. The COVID-19 pandemic further accelerated this shift by reinforcing consumer concerns around handling physical cash.

The cash vending machine market is expected to grow at a CAGR of 1.5% from 2025 to 2033 in Italy, primarily due to sustained demand in rural areas, small towns, and among older demographics less comfortable with digital payments. Cash-based transactions remain relevant in regions with limited internet connectivity or populations over 55, especially in hospitals, local transport stations, and community centers. As a result, while the overall shift is toward cashless, a niche but stable demand for cash-operated machines remains.

Vending machines today operate in both cash and cashless formats, with payment modes often aligning with the type of product offered and the location. Cash vending machines remain common for low-cost items like candy, snacks, and beverages, especially in public places and manufacturing sites. In contrast, cashless machines-accepting cards, mobile payments, or QR codes-are increasingly preferred for higher-value or tech-driven products like electronics, beauty items, pharmaceuticals, and books, typically found in offices, colleges, and airports. The shift toward cashless vending is especially prominent in urban and high-security locations, where convenience and hygiene are key.

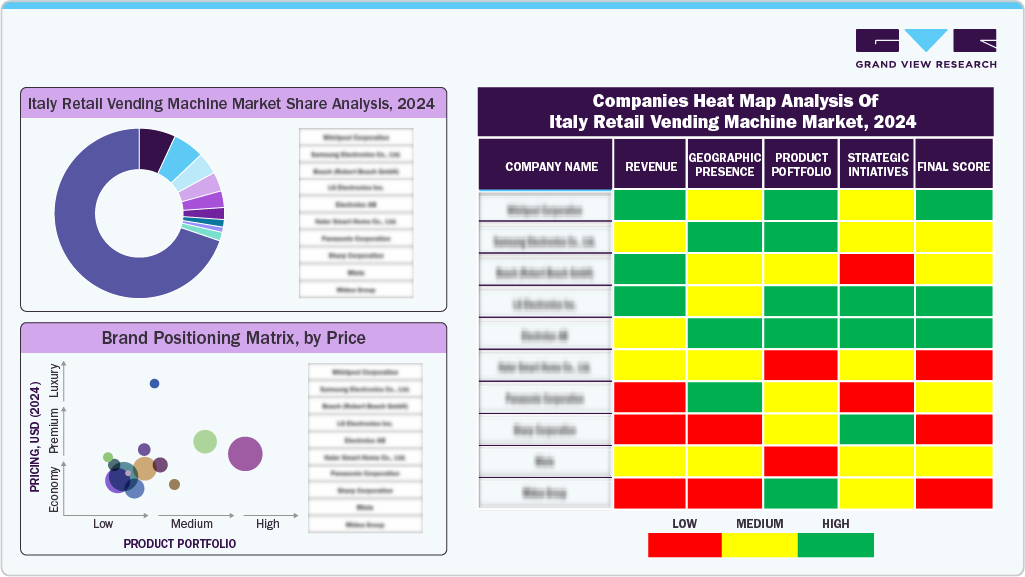

Key Italy Retail Vending Machine Company Insights

The Italy retail vending machine market features a strong presence of established players that benefit from widespread brand recognition, long-standing industry experience, and strategic placement across high-traffic areas. These companies operate vast machine networks in offices, airports, train stations, hospitals, and industrial zones, allowing them to maintain consistent visibility and consumer reach. Their partnerships with local and international food and beverage brands further enhance product variety and appeal.

Competition in the market is fueled by innovation, with companies increasingly adopting smart technologies such as AI-powered inventory tracking, real-time analytics, and digital payment integration.

Companies are aligning their marketing and product development efforts accordingly as consumer expectations evolve, particularly around convenience, nutrition, and sustainability. Investments in targeted promotions, data-driven product curation, and regional customization help brands stay relevant. The market’s competitive dynamics are shaped not only by pricing and scale but also by how well players adapt to changing consumer behaviors and workplace needs.

Key Italy Retail Vending Machine Companies:

- IVS Italia

- Gruppo Argenta

- Evoca

- Rheavendors Industries

- Bianchi Industry

- N&W Global Vending

- DF Italia

- Moretti Vending

- Adimac Vending Machines

- Gruppo Illiria

Recent Developments

-

In December 2024, SandenVendo has introduced new vending solutions designed to operate at -25°C, targeting the Italian and global markets. These solutions are likely aimed at expanding the range of products that can be dispensed through vending machines, potentially including items that require ultra-low temperature storage and dispensing.This innovation suggests a focus on technological advancements within the vending industry, allowing for the sale of frozen goods or other temperature-sensitive products.

-

In October 2024, Necta launched the Gusto 8 Lift, a sustainable and flexible vending machine for the Snack & Food segment. It features high energy efficiency (Class C), an eco-friendly R290 cooling system, and bio-circular plastics. Its Vertical Flex (V-Flex) system supports up to seven movable trays and dispenses heavier items. The machine includes touchless payments via Breasy, a 4.3″ TFT display, and LED lighting, offering a premium experience at a competitive price point.

Italy Retail Vending Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.58 billion

Revenue forecast in 2033

USD 3.68 billion

Growth rate (Revenue)

CAGR of 4.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, location, mode of payment

Key companies profiled

IVS Italia; Gruppo Argenta; Evoca; Rheavendors Industries; Bianchi Industry; N&W Global Vending; DF Italia; Moretti Vending; Adimac Vending Machines; Gruppo Illiria

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Italy Retail Vending Machine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Italy retail vending machine market report based on product, location, and mode of payment.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Beverages Vending Machines

-

Hot Beverage Vending Machines

-

Cold Beverage Vending Machines

-

-

Snack Vending Machines

-

Food Vending Machines

-

Frozen Vending Machines

-

Tobacco Vending Machines

-

Games/Amusement Vending Machines

-

Beauty & Personal Care Vending Machines

-

Candy & Confectionery Vending Machines

-

Pharmaceuticals Vending Machines

-

Electronics Vending Machines

-

Book & Magazine Vending Machines

-

-

Location Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Offices

-

Colleges & Universities

-

Hospitals & Nursing Homes

-

Restaurants, Bars & Clubs

-

Public Places

-

Others

-

-

Mode of Payment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cash

-

Cashless

-

Frequently Asked Questions About This Report

b. The Italy retail vending machine market size was estimated at USD 2.48 billion in 2024 and is expected to reach USD 2.58 billion in 2025.

b. The Italy retail vending machine market is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2033 to reach USD 3.68 billion by 2033.

b. Beverage vending machine accounted for a revenue share of 38.86% in 2024, due to their high demand in transit hubs, workplaces, and public areas where quick, on-the-go refreshment is essential.

b. Some key players operating in the Italy retail vending machine market include IVS Italia; Gruppo Argenta; Evoca; Rheavendors Industries; Bianchi Industry; N&W Global Vending; DF Italia; Moretti Vending; Adimac Vending Machines; Gruppo Illiria

b. The growth of Italy’s retail vending machine market is primarily driven by a shift toward high-margin, gourmet, and regional specialty products as operators capitalize on Italy’s mature vending infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.