- Home

- »

- Medical Devices

- »

-

IV Dressing Market Size, Share And Growth Report, 2030GVR Report cover

![IV Dressing Market Size, Share & Trends Report]()

IV Dressing Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Transparent, Translucent), By End-use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-247-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

IV Dressing Market Size & Trends

The global IV dressing market size was estimated at USD 834.54 million in 2023 and is anticipated to grow at a CAGR of 5.50% from 2024 to 2030. The increasing prevalence of target diseases, coupled with high awareness about preventative healthcare among the population is anticipated to contribute to market growth. Moreover, an increasing number of hospital admissions and growing cases of blood infections, such as central line-associated bloodstream infection (CLABSI) and catheter-related bloodstream infection (CRBSI), are expected to fuel the demand for IV dressing. For instance, according to the Australian Institute of Health and Welfare, the number of hospitalizations increased by 6.3 % in 2020-2021 to 11.8 million, an increase of 10.5% in private hospitals and 3.6% in public hospitals.

The primary factor influencing the use of IV dressing in healthcare facilities is their contribution to enhanced wound care. IV dressing allows oxygen & moisture transmission while maintaining a slightly damp wound healing environment. In addition, it also provides a barrier to external contaminants, such as germs and bacteria, to maintain a dry and clean catheter site by blocking the germs. Furthermore, the average rate of CRBSIs in 2021 was 2.6 per 1000 central line days. According to the National and State Healthcare-Associated Infections Progress Report 2021, the overall, increase in CLABSI between 2020 and 2021 was 7%, of which the largest increase with 10% was observed in ICUs.

Similarly, according to an article published on BioMed Central Ltd. in October 2022, the prevalence of CRBSIs was reported to be 2.2 to 2.79 infections per 1000 catheter days Thus, increasing cases of blood infections, such as CLABSI and CRBSI, are expected to increase the demand for IV dressings. The increasing prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular diseases, often requires long-term intravenous therapy. This drives the demand for IV dressings to secure IV lines and prevent complications.

For instance, according to the International Diabetes Federation, in 2021, approximately 537 million adults between the ages of 20 and 79 years were affected by diabetes, equating to 1 in 10 individuals. This number is estimated to rise to 643 million by 2030 and further to 783 million by 2045. Over 75% of these adults with diabetes reside in low- and middle-income countries. Key market players are offering advanced IV dressing products to prevent CLABSIs. During the COVID-19 pandemic, IV drugs, such as Veklury (remdesivir) and REGN-COV2, had proven to be effective in treating critically ill patients and were approved by the FDA. Thus, the demand for IV dressing has only been accelerating.

Market Concentration & Characteristics

The degree of innovation in the IV dressing market has been substantial, driven by advancements in materials, adhesives, and manufacturing processes. For instance, Covalon Technologies Ltd. offers IV Clear, which uses soft silicone adhesive technology to incorporate a safe amount of antimicrobials, preserve skin barrier functions, and minimize skin injuries. It is a dual-antimicrobial vascular access dressing that provides complete transparency around and at the insertion site for easy daily assessment

The level of mergers and acquisitions (M&As) in the market has been moderate, with several notable transactions occurring among key players seeking to strengthen their product portfolios and expand market reach

Regulations in the market play a big role in making sure products are safe and effective for patients. These rules set standards for things, such as materials used, how products are made, and how they're labeled. By following these regulations, companies help ensure that IV dressings meet quality standards and don't cause harm to patients. This helps build trust between healthcare providers and patients, making sure they feel confident in the products being used during their treatment

Product expansion is driven by a growing demand for innovative solutions that address specific needs and challenges in patient care. Manufacturers are considerably introducing new products with advanced features, such as improved adhesion, enhanced breathability, and antimicrobial properties, to meet the evolving requirements of healthcare providers and patients. For instance, in July 2018, 3M introduced the Tegaderm Antimicrobial IV Advanced Securement Dressing and Tegaderm Antimicrobial Transparent Dressing, expanding its range of PIV maintenance solutions and aiming to mitigate infection risks

Regional expansion in the market varies depending on factors, such as healthcare infrastructure, regulatory environment, and market demand. In regions with well-established healthcare systems and high demand for medical devices, such as North America and Europe, IV dressing manufacturers often focus on expanding their presence through strategic partnerships, distribution agreements, and acquisitions of local companies. These regions also tend to have stringent regulatory requirements, which may influence the pace and approach of expansion activities

Type Insights

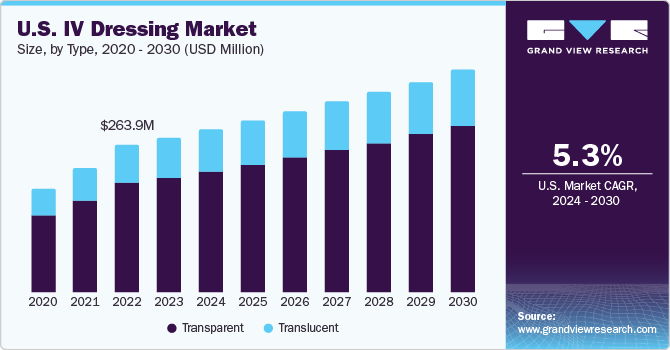

The transparent type segment dominated the market and accounted for the largest revenue share of 74.05% in 2023 and is expected to grow at the fastest CAGR of about 5.71% from 2024 to 2030. Owing to the advantages of transparent IV dressing, such as providing a barrier to air contaminants & external pathogens, allowing daily inspection without dressing removal, reducing the number of dressings, preserving skin integrity, and therefore lessening the risk of infection & trauma. In addition, transparent IV dressing also decreases the need for skin prepping at each dressing & reduces the additional cost & time incurred with this step. The recurrent application of prepping solutions can lead to skin irritation, especially when the skin is rendered more fragile by repeated tape removal. Furthermore, transparent IV dressings with extra securement features can reduce complications. Few bordered film dressings have been intentionally designed to be used with specific catheters.

For instance, 3M Tegaderm IV Transparent Film Dressing with Border with a notched design offers a better seal around the catheter, minimizes movement, and stabilizes the catheter. Such, capabilities are likely to drive segment growth. The translucent type segment held a considerable market share in 2023. The advancements in material science and manufacturing technologies have led to the development of translucent IV dressings with enhanced properties, such as breathability, flexibility, and moisture management, making them favorable choices for healthcare providers and patients alike. For instance, CovaView IV is a slim, waterproof polyurethane film dressing featuring a frame-style design with release paper. Serving as a protective shield against viruses, bacteria, and external contaminants, this dressing offers a permeable semi-occlusive PU film that promotes breathability, facilitating the efficient exchange of oxygen and moisture vapor.

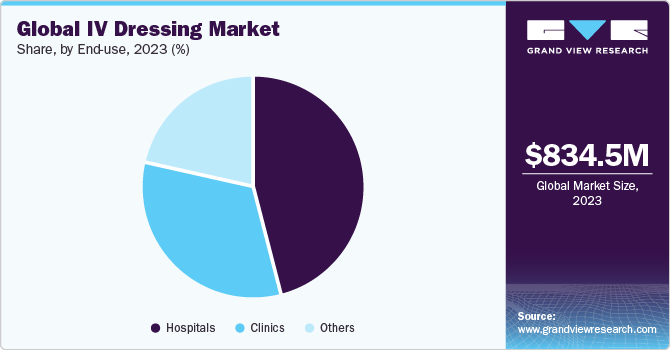

End-use Insights

The hospitals end-use segment captured the largest revenue share of over 45.39% in 2023 owing to the increasing incidence of chronic diseases, such as cancer, chronic kidney diseases, and autoimmune disorders coupled with increasing hospital admissions. For instance, according to the Canadian Institute of Health Information, in Canada, there were approximately 2.9 million acute inpatient hospitalizations in 2021-2022, up from 2.7 million visits in 2020-2021. According to the American Kidney Fund, Inc., in 2020, approximately 135,000 Americans were newly diagnosed with kidney failure and 97% of them began dialysis. Thus, an increased adoption of IV therapies by hospitals for the treatment of chronic diseases is expected to boost market growth.

The clinics end-use segment is anticipated to witness a significant CAGR of 5.70% from 2024 to 2030. Growing number of patients visiting clinics for taking IV therapy is expected to contribute to market growth. Thus, there is a need for IV dressing in clinics to secure IV cannula and catheters to the insertion point for various therapies including therapy nutritional, hydration therapy, and chemotherapy. Moreover, the rapid expansion of clinics coupled with cost-effective and quick services offered by them are expected to boost segment growth. For instance, in December 2022, REVIV launched a new clinic in Harrods and an exclusive IV drip therapy for nutritional health in the UK.

Regional Insights

The North America IV dressing market was the dominant regional market and accounted for the largest revenue share of 45.46% in 2023. Some of the key factors contributing to regional market growth include the accessibility of advanced healthcare facilities and a higher preference for technologically improved medical care. Furthermore, increased awareness and adoption of IV therapies in the region is expected to drive market growth. The regional market is also driven by the presence of prominent players, such as 3M, Cardinal Health, and McKesson Corporation.

U.S. IV Dressing Market Trends

The IV dressing market in the U.S. is expected to witness considerable growth from 2024 to 2030. Local presence of key players, such as 3M, Coloplast Corp., Medline Industries, and Smith & Nephew, is expected to boost the market’s growth significantly. Collaboration between these companies is a pivotal factor in driving market growth. These collaborations often involve partnerships between medical device manufacturers, pharmaceutical companies, and research institutions to develop and commercialize innovative IV dressing. In addition, growing aging population in the U.S. is contributing to higher demand for healthcare services, including IV therapy, leading to an increased need for IV dressings to support patient care. For instance, by 2050, it is anticipated that the number of elderly Americans aged 65 years and above will grow from the current 58 million to 82 million, representing a significant 47% increase. Consequently, this age group's proportion within the overall population is expected to climb from the current 17% to 23%.

Europe IV Dressing Market Trends

The Europe IV dressing market is expected to witness considerable growth, driven by several factors, including rising prevalence of chronic disorders, such as diabetes. For instance, as per the European Commission's recent findings, over one-third (36.1%) of individuals within the European Union disclosed experiencing a persistent (chronic) health issue in the year 2022. This demographic trend may potentially impact the market growth, as an increased prevalence of chronic health conditions could lead to higher demand for IV therapies, medications, and related healthcare services.

The UK IV dressing market can be attributed to several factors, including technological advancements within the country. As innovative solutions and improved products are developed, the market experiences increased demand for better and more efficient I.V. dressings, leading to its overall growth and expansion. These technological advancements play a crucial role in enhancing patient comfort, reducing the risk of infections, and ensuring effective administration of intravenous treatments.

The IV dressing market in Germany growth is significantly influenced by the presence of local players, such as Germanos Medicals, Mediplast, and Praxisdienst, These domestic companies contribute to the market's expansion by introducing innovative products, investing in R&D, and catering to the specific needs of the German healthcare sector. In addition, high prevalence of chronic disorders in the country is another key factor expected to drive market growth. For instance, according to the ZfKD, in 2019, Germany witnessed approximately 502,655 new cancer cases; out of which 71,375 were breast; 68,579 were prostate; 58,967 were colon, and 59,221 were lung cancer.

Asia Pacific IV Dressing Market Trends

The IV dressing market in Asia Pacific is expected to witness the fastest CAGR of 6.14% from 2024 to 2030 owing to supportive government initiatives for improving healthcare infrastructure in the region. Moreover, the large patient pool and rising geriatric population in the region are expected to spur regional growth. The presence of a large population with low per capita income in Asia Pacific countries has led to a high demand for affordable treatment choices. In addition, economic development in countries, such as India and China, is expected to facilitate market growth.

The China IV dressing market growth is driven by the increasing volume of surgical procedures in the country. As the healthcare industry in China expands and modernizes, more patients are undergoing surgeries, which, in turn, boosts the demand for intravenous solutions, dressings, and other related products. This rising demand encourages market growth and drives local & international players to invest in the Chinese market, ultimately benefiting both the healthcare sector and patients in need of these essential medical services.

The IV dressing market in Japan will witness considerable growth in the future. The hospital admission population plays a significant role in the Japanese market growth. As more individuals require medical attention and undergo surgeries or treatments, the demand for I.V. dressings and other medical supplies increases. A study published by the National Institutes of Health (NIH) in 2022 revealed that over a span of 4 years, 1,379,618 Intensive Care Unit (ICU) patients were admitted to 495 hospitals across Japan, which were equipped with a total of 5,341 ICU beds. These hospitals accounted for 75% of all ICU beds in the country. On average, ICU occupancy remained at 60% on any given day, with a fluctuation ranging from 45.0% to 72.5%. This growing demand fosters a thriving market environment, with both domestic and international companies investing in the development and production of advanced IV dressings to cater to the evolving needs of the Japanese healthcare sector.

The India IV dressing market is expected to have significant growth from 2024 to 2030. In India, the prevalence of chronic disorders has a direct impact on the growth of the IV dressing market. As more individuals suffer from chronic conditions, such as diabetes, hypertension, and kidney diseases, the demand for IV dressings and other medical supplies increases. This growing demand fosters a thriving market environment, with both domestic and international companies investing in the development and production of advanced IV dressings to cater to the evolving needs of the Indian healthcare sector. This market growth ultimately contributes to improved patient care and outcomes across the country.

Key IV Dressing Company Insights

Some of the leading players operating in the I.V. dressing market include 3M, Smith+Nephew, Cardinal Health, McKesson Corp., Richardson Healthcare, Inc., Medline Industries, and Paul Hartmann AG. These players are heavily investing in technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

DermaRite Industries, LLC, Bsn Medical, DeRoyal Industries, Inc. Dynarex Corp., Komal Health Care Pvt. Ltd., Sentry Medical, and Shandong Dermcosy Medical Co., Ltd. are emerging players in the I.V. dressing market These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key IV Dressing Companies:

The following are the leading companies in the IV dressing market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Smith+Nephew

- Cardinal Health

- McKesson Corporation

- Covalon Technologies Ltd.

- Richardson Healthcare, Inc.

- Medline Industries

- Paul Hartmann AG

- Lohmann & Rauscher (L&R)

- Mölnlycke Health Care AB

- DermaRite Industries, LLC

- Bsn Medical

- DeRoyal Industries, Inc.

- Dynarex Corporation

- Komal Health Care Pvt. Ltd.

- Sentry Medical

- Shandong Dermcosy Medical Co., Ltd.

Recent Developments

-

In February 2023, Covalon Technologies Ltd. participated in the Conference for Neonatology (NEO) to better understand and utilize the leading approaches to neonatal intensive care to protect children and infants from infection. Covalon’s infection prevention solutions include IV clear, a transparent antimicrobial vascular access dressing. Thus, this initiative was expected to boost the company’s IV dressing offerings

-

In June 2023, Advanced Medical Solutions Group Plc., a leading company specializing in surgical and advanced wound care, declared that they had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for their innovative LiquiBand Rapid product. LiquiBand Rapid, an exciting addition to AMS's LiquiBand portfolio, boasts a significantly faster drying time compared to its counterparts and holds immense potential for use in various settings, such as operating rooms and emergency departments

IV Dressing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 879.57 million

Revenue forecast in 2030

USD 1.21 billion

Growth rate

CAGR of 5.50% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M; Smith+Nephew; Cardinal Health; McKesson Corp.; Covalon Technologies Ltd.; Richardson Healthcare, Inc.; Medline Industries; Paul Hartmann AG; Lohmann & Rauscher (L&R); Mölnlycke Health Care AB; DermaRite Industries, LLC; Bsn Medical; DeRoyal Industries, Inc.; Dynarex Corp..; Komal Health Care Pvt. Ltd.; Sentry Medical; Shandong Dermcosy Medical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IV Dressing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented IV dressing market report on the basis of type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Transparent

-

Translucent

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global IV dressing market size was estimated at USD 834.54 million in 2023 and is expected to reach USD 897.57 million in 2024.

b. The global IV dressing market is expected to grow at a compound annual growth rate of 5.50% from 2024 to 2030 to reach USD 1.21 billion by 2030.

b. Transparent segment dominated the global IV dressing type market with a share of 74.05% in 2023. This is attributable to various advantages offered by transparent dressing.

b. Some key players operating in the global IV dressing market include 3M; Smith+Nephew; Cardinal Health; McKesson Corporation; Covalon Technologies Ltd; Richardson Healthcare, Inc.; Medline Industries; Paul Hartmann AG; Lohmann & Rauscher (L&R); Mölnlycke Health Care AB; DermaRite Industries, LLC; Bsn Medical; DeRoyal Industries, Inc.; Dynarex Corporation.; Komal Health Care Pvt. Ltd.; Sentry Medical; Shandong Dermcosy Medical Co.,Ltd.

b. Key factors that are driving the market growth include increasing prevalence of target diseases, coupled with the increased awareness about preventative healthcare among the population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.