- Home

- »

- Beauty & Personal Care

- »

-

J-Beauty Products Market Size, Share & Trends Report, 2030GVR Report cover

![J-Beauty Products Market Size, Share & Trends Report]()

J-Beauty Products Market Size, Share & Trends Analysis Report By Product (Skincare, Haircare, Color Cosmetics), By Type (Conventional, Organic), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-100-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global J-beauty products market size was estimated at USD 33.11 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. A key factor driving the growth is the emphasis on quality and innovation in J-beauty products. Japanese brands are well-known for their attention to detail and dedication to manufacturing high-quality beauty products. This commitment to quality has given J-beauty products a reputation for efficacy and dependability, attracting consumers looking for long-lasting skincare and high-quality beauty solutions. In addition, the growing trend towards the simplicity and minimalism of skincare steps is also driving the market. J-beauty products offer a minimalist approach to skincare that focuses on essential steps including effective ingredients such as green tea, rice bran, and others promoting a less-is-more philosophy instead of lengthy and complicated routines.

According to the Ministry of Economy, Trade, and Industry (METI), in 2019, Japan was the third-largest cosmetics and personal care products market in the world, with a 2019 market value of around USD 35 billion. There are around 3,000 beauty care brands in Japan, including well-known names like Shiseido Co., Ltd., Kao Corporation, Kosé Corporation, and POLA ORBIS HOLDINGS INC.

The growing skincare concerns, evolving consumer preferences, and lifestyle changes have shaped the J-beauty products market. Consumers today are more informed and conscious about their skincare needs, seeking solutions for specific concerns such as aging, acne, hyperpigmentation, and sensitivity. J-beauty brands have responded to these concerns by developing targeted products and formulations that address these issues effectively. As per METI, brightening, moisturizing and anti-aging products are in high demand in the Japanese market and worldwide.

The ability of J-beauty products to address specific skincare concerns has attracted consumers looking for customized and results-driven solutions. Moreover, the Japanese market players keep implementing technology for product customization and modification.

The rise of social media and influencer marketing has also played a significant role in popularizing J-beauty products. Influencers and beauty enthusiasts have shared their positive experiences and results with J-beauty products, creating a buzz and generating curiosity among their followers. The accessibility of information through social media platforms such as Instagram, Facebook, and YouTube has facilitated product discovery and encouraged consumers to explore J-beauty offerings.

Key market players such as Shiseido Co.,Ltd. and Kosé Corporation are also benefitting from this marketing trend and are launching newer products. In April 2022, Shiseido Co.,Ltd., launched its J-beauty show on YouTube which was hosted by Candice Kumai, the fitness expert, TV personality, and New York Times bestselling author. Such strategies help brands to capture a large audience and effectively informed the target audience about the benefits and uses of their products.

The COVID-19 pandemic had a significant impact on the market for J-beauty products. While there have been some challenges, there also have been opportunities and shifts in consumer behavior. The pandemic led to disruptions in global supply chains, factory shutdowns, shipping delays, and restrictions on organic trade impacted the availability of certain products and ingredients. This disruption caused temporary shortages and logistical challenges for J-beauty brands.

However, with lockdowns and social distancing measures in place, consumers turned to online shopping for their skincare needs. This shift to e-commerce created opportunities for J-beauty brands to reach a wider audience and expand their online presence. In addition, there was a heightened focus on self-care and wellness. Many people turned to skincare as a form of self-care and a way to maintain a sense of normalcy during uncertain times. Following the trend many J-beauty brands launched products as per consumer demand. In October 2020, Otsuka Pharmaceutical Co., Ltd., launched its InnerSignal skin care product line in South Korea for wrinkle improvement and skin brightening.

Product Insights

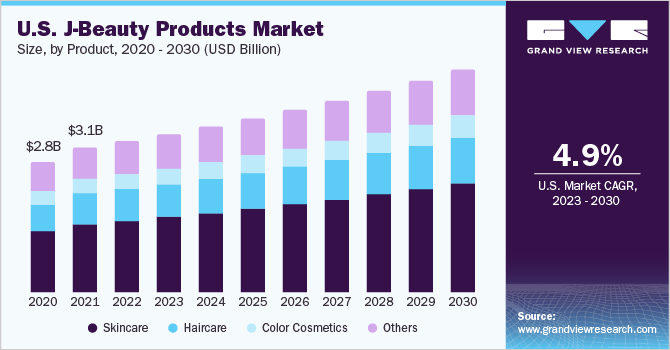

Based on product, the market has been segmented into skincare, haircare, color cosmetics, and others. The skincare segment held the largest market share of 46.6% in 2022. Japanese skincare products have become increasingly popular among consumers due to their distinctive components, inventive formulations, and efficient outcomes. J-beauty places a strong emphasis on a holistic approach to skincare, by focusing on the hydration, defense, and nourishment of the skin. Some popular skin care products are under-eye creams, deep cleansing oils, sheet masks, and others.

The skin care segment is expected to grow at the fastest CAGR of 4.4% over the forecast period, due to increasing skin concerns regarding acne, pimples, dark spots, and hectic work-life schedules. In April 2023, keomi beauty, a popular Japanese skincare brand announced the launch of three new skin care products in the Indian market based on the Japanese concept to cater to the common key skin concerns of Indian consumers.

Type Insights

Based on type, the market is segmented into conventional and organic. The conventional segment held the largest market share of 90.8% in 2022. This can be attributed to the usage of a lot of chemicals and traditional ingredients such as retinoid and hydroquinone in J-beauty products to address specific skin concerns such as fine lines and hyperpigmentation. The organic segment is expected to grow at the fastest CAGR of 6.0% over the forecast period. The rising demand for clean and green beauty, sustainable and ethical practices, and certifications and standards for beauty products are some of the factors driving the organic segment over the coming years.

Distribution Channel Insights

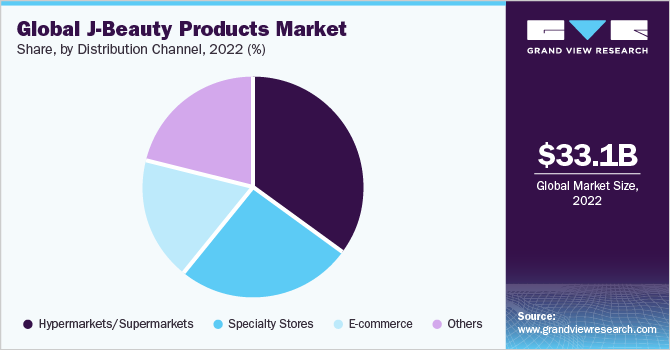

Based on distribution channel, the market is segmented into specialty stores, hypermarkets/supermarkets, e-commerce, and others. The hypermarkets/supermarkets segment held the largest market share of 34.6% in 2022. This can be attributed to the benefits that hypermarkets/supermarkets offer to customers, including cheaper costs and a greater variety of options.

The e-commerce segment is expected to grow at the fastest CAGR of 4.9% over the forecast period due to the growing penetration of online platforms and the availability of a wide range of products on e-commerce platforms as compared to physical stores. In February 2021, Japanese skincare brand Shiseido Co., Ltd., launched a new e-commerce platform for making its J-beauty products more widely available to consumers.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of 69.4% in 2022. This can be attributed to the increasing popularity of J-beauty products, the availability of a large number of brands, the increasing female population, and changing lifestyles. Women in Japan, India, South Korea, and other countries in the region are increasingly shifting towards shorter regimes for skin care, and J-beauty offers products that provide multiple benefits in one product.

The launch of new brands and products in the Asia Pacific region by several key players also drives market growth. For instance, in December 2021, Procter & Gamble and A.S. Watson entered into a partnership to launch the new Japan skincare brand "aio". As per Procter & Gamble and A.S. Watson combined product testing results have shown that 84% of users of aio Super Essence agree that the essence can help skin stay hydrated and reduce excessive sebum production and 90% of users believed that their skin looks radiant and youthful with smaller pores.

North America is the second largest market for J-beauty products driven by the increasing focus on achieving healthy and radiant skin. Some popular J-beauty brands having a presence in the U.S. include Tatcha, LLC., ROHTO-MENTHOLATUM (M) SDN. BHD, and Ryohin Keikaku Co., Ltd. These brands offer a wide range of products, including cleansers, moisturizers, serums, and masks.

Key Companies & Market Share Insights

The J-beauty products market features various players which makes it a competitive market. The world’s leading companies including Shiseido Co., Ltd., Kao Corporation, Kosé Corporation, POLA ORBIS HOLDINGS INC, and others are undertaking strategies such as partnerships, collaborations, new product launches, and agreements to withstand the intense competition and increase their market share. Some prominent players in the global J-beauty products market include:

-

Shiseido Co.,Ltd.

-

mandom corp.

-

Unilever

-

L'Oreal Groupe (Nihon L’Oreal)

-

Procter & Gamble Company

-

Kao Corporation

-

Lion Corporation

-

POLA ORBIS HOLDINGS INC.

-

FANCL CORPORATION

-

CANMAKE

-

Kosé Corporation

J-beauty Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 34.26 billion

Revenue forecast in 2030

USD 45.01 billion

Growth rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East & Africa

Country scope

U.S.; UK; France; Germany; China; India; Japan; Brazil; UAE

Key companies profiled

Shiseido Co.,Ltd.; mandom corp.; Unilever; L'Oreal Groupe (Nihon L’Oreal); Procter & Gamble Company; Kao Corporation; Lion Corporation; Kosé Corporation; POLA ORBIS HOLDINGS INC.; FANCL CORPORATION; CANMAKE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global J-beauty Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global J-beauty products market report based on product, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Skincare

-

Haircare

-

Color Cosmetics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Specialty Stores

-

Hypermarkets/Supermarkets

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Europe

-

UK

-

France

-

Germany

-

Asia Pacific

-

China

-

India

-

Japan

-

Central & South America

-

Brazil

-

Middle East & Africa

-

UAE

-

Frequently Asked Questions About This Report

b. The global J-beauty products market size accounted for USD 33.11 billion in 2022 and is expected to reach USD 34.26 billion in 2023.

b. The global J-beauty products market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2023 to 2030 to reach USD 45.01 billion by 2030.

b. Asia Pacific dominated the J-beauty products market with a revenue share of 69.4% in 2022. This can be attributed to the presence of numerous J-beauty brands, growing skincare rituals and self-care culture among the women population, and the increasing influence of social media and influencer marketing.

b. Some of the key players operating in the J-beauty products market include Shiseido Company, Limited, mandom corp., Unilever, L'Oreal Groupe (Nihon L’Oreal), Procter & Gamble Company, Kao Corporation, Lion Corporation, KOSÉ Corporation, POLA ORBIS HOLDINGS INC., FANCL CORPORATION, CANMAKE among others.

b. The key factors that are driving the global J-beauty products market are the increasing trend of a minimalist and simplified approach to skincare, growing skincare concerns, and growing interest in natural and traditional ingredients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."