- Home

- »

- Medical Imaging

- »

-

Japan Medical Imaging Market Size, Industry Report, 2030GVR Report cover

![Japan Medical Imaging Market Size, Share & Trends Report]()

Japan Medical Imaging Market Size, Share & Trends Analysis Report By Technology (X-Ray, Ultrasound, Nuclear Imaging), By End-use (Hospitals, Diagnostic Imaging Centers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-226-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Japan Medical Imaging Market Size & Trends

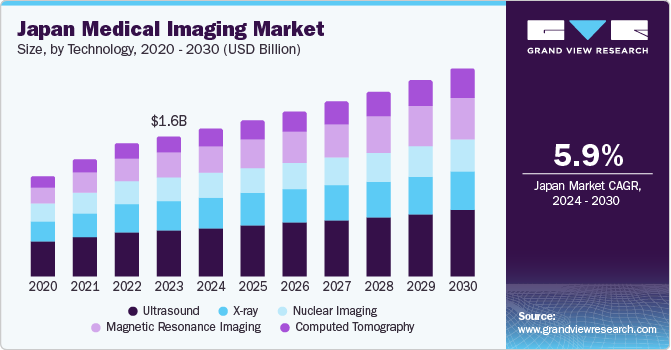

The Japan medical imaging market size was estimated at USD 1.61 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. The rising prevalence of lifestyle-related diseases, the increased demand for early detection tools, technological advancements to improve shift time, increased government investments, and supportive reimbursement initiatives are significantly contributing to the market growth. The Japan market for medical imaging held around 4% revenue share in the global medical imaging market.

The COVID-19 pandemic significantly affected Japan’s healthcare sector. The country registered a huge number of patients with various diseases, thus driving the demand for diagnostic imaging. As per the study conducted by the National Center for Biotechnology Information (NCBI), May 2021, diagnostic imaging techniques have become crucial to determining the major manifestation of COVID-19-related lung disease and the tissue distribution of the angiotensin-converting enzyme 2 (ACE 2) receptor.

Tech giants such as GE Healthcare, Koninklijke Philips N.V., Siemens Healthineers, Canon Medical Systems Corporation, Mindray Medical International, and Samsung Medison Co., Ltd. are investing significantly in the research and development of medical imaging technology. These companies are working to make medical imaging and diagnostic imaging more accessible for healthcare and business use cases.

The key market players are highly contributing to the market growth in the country by their continuous initiatives and launches propelling the demand for medical imaging. For instance, in November 2023, Canon Medical Systems Corp. is boosting clinical research to support the practical implementation of Photon Counting CT (PCCT) across the globe due to its anticipated potential as a diagnostic imaging technique in the near future.

The growing demand for non-invasive diagnostic techniques and increasing incidences of heart disorders is driving growth of the market for cardiovascular ultrasound, hence contributing to the expansion of Japan’s medical imaging market. Moreover, companies focusing on the development of innovative and revolutionary cardiovascular ultrasound products are proving to be one of the primary factors impacting the market growth.

The growing prevalence of coronary heart disease, cerebrovascular disease, and carotid artery disease are some of the common cardiovascular diseases. As per the BMC Musculoskeletal Disorders study published in August 2022, a Japanese study, the overall prevalence of chronic musculoskeletal pain was over 35.0%. The majority of cases occurred in males (36.0%) and women (42.0%), and the prevalence increased with age. Due to this, it is anticipated that the high frequency of chronic diseases in and the rising aging population is expected to boost the application of ultrasound instruments for diagnostic imaging and fuel market expansion.

In the coming years, the market growth is anticipated to be significantly impacted by various market trends including the rising demand for advanced imaging techniques from educational universities and hospitals to offer training in the latest technologies. Increased use of AI to automate the processes of image recognition and quantification is also expected to fuel market expansion. According to Multidisciplinary Digital Publishing Institute (MDPI) in June 2021, Japan declared that rules regulating medical AI software are expected to be modified, and the authorization procedure for AI diagnostic imaging equipment may be accelerated. The government launched the "Society 5.0" program to enhance people's quality of life. It aims to establish a society that integrates revolutionary technologies including (AI) and the Internet of Things (IoT).

The COVID-19 pandemic caused a decline in the market despite technological advancements and increased use of advanced imaging techniques. Several factors are contributing to the market decline, including a reduction in imaging quantities, a decrease in the economy that has restricted the adoption of modern imaging technology, a reduction in staff at hospitals and radiology centers, and an increase in the use of telecommunications services. The market for computed tomography experienced an upsurge as more individuals were diagnosed with COVID-19 with the help of CT scans. Leading companies in the industry, such as Siemens Healthineers, said that the pandemic period doubled their CT scanner sales volume, contributing to the overall growth in the CT market.

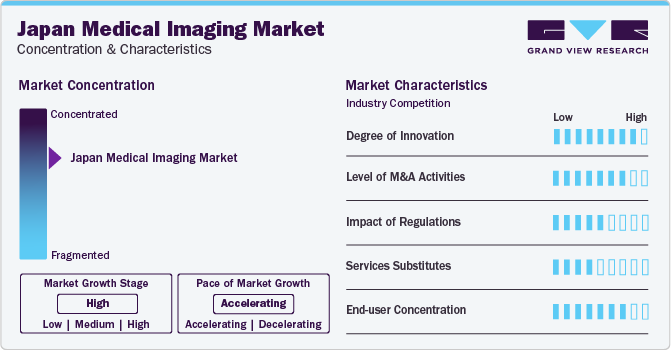

Market Concentration & Characteristics

Themarket growth stage is high, and the pace of growth is accelerating. The Japan medical imaging market is characterized by a high degree of innovation owing to the aging population, the government's focus on promoting healthcare and medical technology has created a favorable environment for growth. The increasing prevalence of chronic diseases, such as cancer and cardiovascular diseases, and the rapid technological advancements. Subsequently, innovative AI applications are constantly emerging, disrupting existing industries and creating new ones.

The Japan medical imaging industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new imaging technologies and talent for medical use, need to consolidate in a rapidly growing market, and the increasing strategic importance of enhanced technical products.

The market for medical imaging in Japan is also subject to increasing regulatory scrutiny to ensure the safety and efficacy of these devices, such as design, testing, and labeling. As a result, governments around the world are developing regulations to govern the development and regular inspections of medical device manufacturers and distributors to ensure compliance with the concerned regulations.

There are a limited number of direct product substitutes for AI. However, there are a number of technologies that can be used to achieve similar outcomes to medical imaging in Japan, such as telemedicine, point-of-care testing, and wearable devices. These technologies can be used as substitutes for medical imaging in certain applications including video conferencing, remote monitoring, blood glucose testing, urine analysis, rapid antigen tests, track a variety of health metrics, such as heart rate, blood pressure, and activity levels, but they typically do not offer the same level of performance or flexibility and accuracy as medical imaging.

End-user concentration is a significant factor in the Japan medical imaging industry. There are a number of end-user industries that are driving demand for medical imaging solutions including hospitals, clinics, diagnostic centers, and research institutions. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing medical or diagnostic imaging products for these industries. However, it also creates challenges for companies that are trying to compete in a crowded market.

Technology Insights

The ultrasound segment dominated the market and accounted for a share of over 30% in 2023 and is anticipated to register lucrative growth over the forecast period. The increasing number of ultrasound applications contributes to the segment’s growth. Due to recent advancements in sophisticated ultrasound transducers, ultrasound devices are experiencing new cardiology and medical imaging applications. Incorporation of AI into ultrasound devices to automate the imaging quantification and selection process is expected to fuel market demand.

The CT segment is anticipated to expand at the fastest CAGR over the forecast period. CT systems are one of the primary tools for diagnosis of COVID-19 patients. The segment’s growth is attributed to the increasing demand for point-of-care CT devices and the development of a high-precision CT scanner using the combination of advanced visualization systems and AI & ML. Japan aims to accelerate connected industries’ growth and enhance medical quality by using AI technologies more rapidly.

Moreover, Japan has taken the initiative to expedite the approval process for medical technology, including artificial intelligence driven diagnostic imaging software, before approving it for widespread usage. For instance, as per the article published in Nikkie Asia, December 2022, software as a medical device (SaMD), or AI software, helps doctors make medical diagnoses. This includes devices that can automatically identify shadows or suspicious lesions from X-ray and endoscopic pictures of the large intestine.

According to the Pharmaceutical and Medical Device Act, an organization must undergo an approval process that could require up to five years to complete before it is permitted to distribute such software in Japan. As per the Cabinet Office in Japan, there are currently 30 approved instances, which is significantly less than in the U.S., China, and South Korea. Under the new, two-stage system software with AI capabilities may be allowed to be sold if it has passed the basic safety evaluation processes.

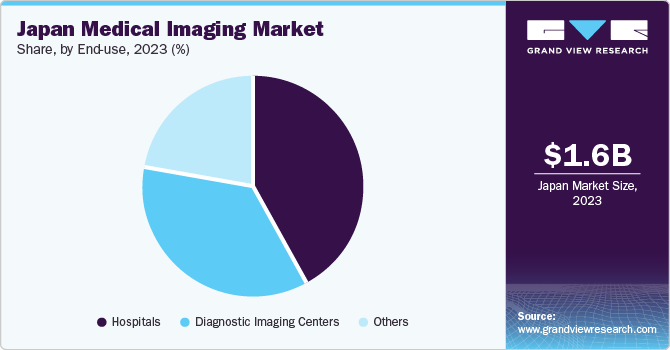

End-use Insights

The hospitals segment held the largest revenue share of in 2023. The increasing need for advanced imaging methods and the incorporation of imaging technologies into surgical equipment are the primary factors propelling the market growth. Some of the countries in developed regions have registered a higher demand in teaching hospitals than in general or specialty hospitals for these modalities.

The number of new hospitals in Asia has risen significantly for developing nations owing to the entrance of international healthcare service suppliers. In these nations, private companies dominate the healthcare industry. New hospitals usually offer consecrated space for imaging modalities. Growing demand for superior healthcare services and growing competition are the two primary factors driving the segment's growth in the forecast period. The diagnostic imaging category experienced the greatest growth rate of 6.0%, attributed to the increased adoption of advanced technology, enhanced infrastructure, and major funding for these centers' expansion.

Key Japan Medical Imaging Company Insights

Some of the key market players include GE Healthcare; Canon Medical Systems Corporation; Samsung Medison Co. Ltd.; Koninklijke Philips N.V.; and FUJIFILM VisualSonics Inc.

-

GE Healthcare Corporation provides a wide range of products and services in areas such as medical imaging, monitoring, biomanufacturing, and cell therapy. It aims to improve healthcare outcomes by developing innovative technologies and solutions for healthcare providers and patients worldwide.

Siemens Healthineers; Koning Corporation; Hologic, Inc.; and Cubresa Inc. are some of the other market participants.

-

Siemens Healthineers is a leader in the field of medical imaging and offers a wide range of other medical devices, including X-ray machines, mammography systems, and laboratory diagnostics. In addition to its medical devices.

-

Cubresa Inc specializes in the development of preclinical and clinical PET (Positron Emission Tomography) and SPECT (Single Photon Emission Computed Tomography) imaging systems. Cubresa's innovative imaging technology is designed to provide high-resolution, real-time imaging for a variety of applications.

Key Japan Medical Imaging Companies:

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Hologic, Inc.

- Samsung Medison Co., Ltd.

- Koning Corporation

- FUJIFILM VisualSonics Inc.

- Cubresa Inc.

Recent Developments

-

In November 2023, Canon Inc., and Cleveland Clinic announced a partnership agreement. The strategy is aimed to create innovative IT solutions for healthcare and imaging with the objective to enhance patient outcomes, treatment, and diagnosis and to create a comprehensive center for imaging research.

-

In November 2023, RapidAI, a health technology firm specializing in image analysis software, obtained a Class III Shonin authorization in Japan and initiated a hybrid technology program. The new platform provides non-contrast CT offering, and rapid edge cloud for stroke detection.

-

In July 2023, FUJILFILM Corp., declared to restructure its Medical System companies’ group, Japan indulge in the medical system dealings built on their operational responsibilities, such as sales & maintenance, R& D, and corporate strategy services. The restructuring is estimated to be finished by 2024.

-

In July 2023, Canon Medical Systems Corp. declared that it has acquired the Resonac Corporation. The agreement is aimed to acquire Minaris Medical America, Inc., Resonac subsidiaries Minaric Medical Co., Ltd. Following this share acquisition, Minaris Medical, which runs companies dealing with automated analytical tools and in vitro diagnostic reagents, may amalgamate under Canon Medical.

-

In April 2023, Astellas Pharma Inc. declared that it has acquired complete share of Iveric bio, Inc. The acquisition was done through Berry Merger Sub, Inc., a wholly owned subsidiary of Astellas US Holding, Inc., as it agreed to acquire all of the outstanding shares of Iveric Bio. As per the agreement Astellas is going to receive the entire regulation of Iveric Bio.

-

In April 2023, Nikon introduced ECLIPSE Ui, a digital imaging microscope which is Japan’s first microscope for medical uses. ECLIPSE Ui offers exclusive design without an eye piece lens including in the microscope. a model which enhances the diagnostician’s opinion posture and permits the observation images sharing on the display.

-

In December 2021, Taiyo Pharma Tech & GE Healthcare Pharma announced that they have entered into an agreement to produce “Contrast Media” applied for image diagnosing.

Japan Medical Imaging Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.4 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use

Country scope

Japan

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation; Hologic, Inc.; Samsung Medison Co., Ltd.; Koning Corporation; FUJIFILM VisualSonics Inc.; Cubresa Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Medical Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan medical imaging market report based on technology and end-use:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

X-ray

-

By Modality

-

Radiography

-

Fluoroscopy

-

Mammography

-

-

-

Ultrasound

-

By Portability

-

Handheld

-

Cart/Trolley Based

-

-

-

Computed Tomography

-

By Technology

-

High End Slice

-

Mid End Slice

-

Low End Slice

-

Cone Beam

-

-

-

Magnetic Resonance Imaging

-

By Architecture

-

Closed System

-

Open System

-

-

-

Nuclear Imaging

-

By Product

-

SPECT

-

PET

-

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

Frequently Asked Questions About This Report

b. The Japan medical imaging market size was estimated at USD 1.61 billion in 2023.

b. The Japan medical imaging market is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030 to reach USD 2.4 billion by 2030.

b. The ultrasound segment dominated the market with the largest market share of over 30% in 2023. This high share is attributable to recent advancements in sophisticated ultrasound transducers, and incorporation of AI into ultrasound devices to automate the imaging quantification and selection process.

b. Some key players operating in the Japan medical imaging market include GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation; Hologic, Inc.; Samsung Medison Co., Ltd.; Koning Corporation; FUJIFILM VisualSonics Inc.; Cubresa Inc.

b. Key factors that are driving the market growth are the rising prevalence of lifestyle-related diseases, the increased demand for early detection tools, technological advancements to improve shift time, and increased government investment and reimbursement initiatives in Japan.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."