- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Japan Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Japan Nutraceuticals Market Size, Share & Trends Report]()

Japan Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-650-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Japan Nutraceuticals Market Summary

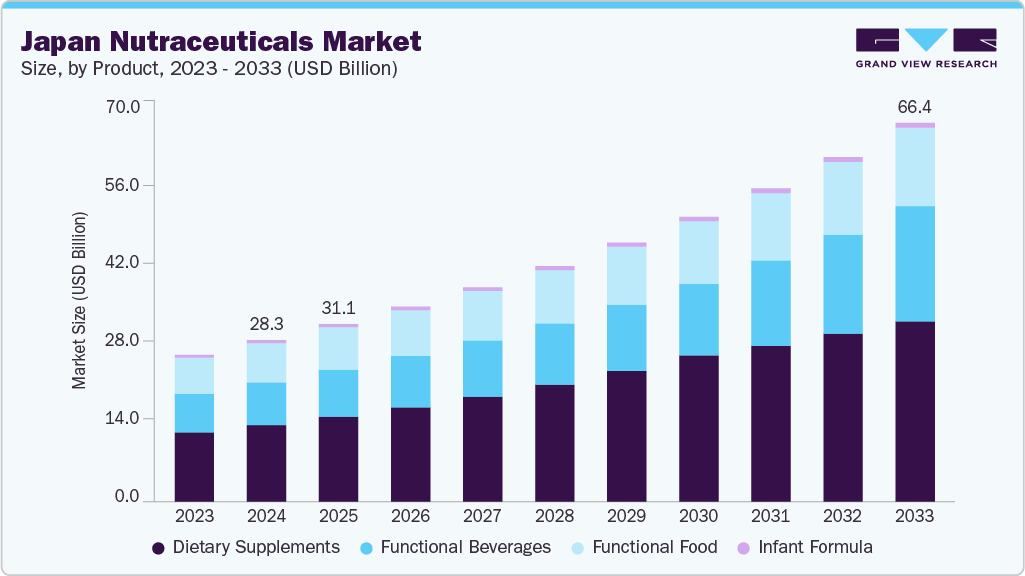

The Japan nutraceuticals market size was estimated at USD 28.31 billion in 2024 and is projected to reach USD 66.4 billion by 2033, growing at a CAGR of 9.9% from 2025 to 2033. This market is primarily driven by rising consumer demand for convenient, nutrient-dense liquid nutraceutical.

Key Market Trends & Insights

- By product, the dietary supplement segment held the highest market share of 47.4% in 2024.

- Based on application, the weight management & satiety segment held the highest market share in 2024.

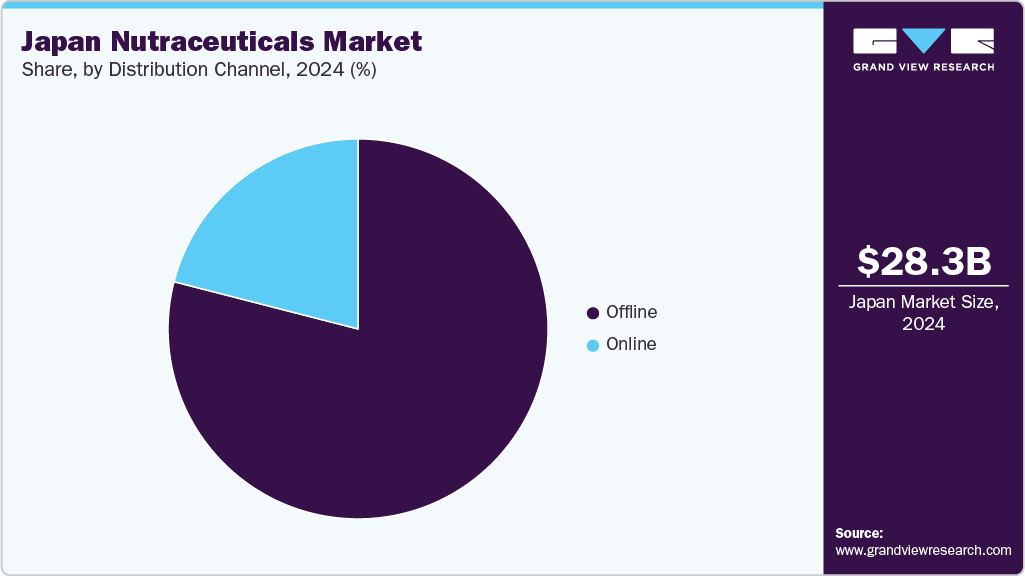

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 28.31 Billion

- 2033 Projected Market Size: USD 66.44 Billion

- CAGR (2025-2033): 9.9%

Formats across various health applications, from energy and immune support to weight management and healthy aging. Ready-to-drink supplements allow for easy intake of targeted nutrients, aligning with fast-paced urban lifestyles and heightened health awareness. Within this landscape, liquid delivery systems also enable enhanced bioavailability and rapid nutrient absorption, appealing to health-conscious demographics.

Innovation and product personalization are driving a new generation of liquid dietary supplements in Japan. In November 2024, DSM-Firmenich and Rohto Pharmaceutical jointly launched "Vision R," a multivitamin liquid supplement tailored for elderly consumers in Japan, leveraging DSM's proprietary "Sprinkle It Technology" to address micronutrient gaps and support healthy aging.

Consumer Insights

Rising consumer awareness around health risks, increased demand for clean-label formulations, and growing scrutiny over unverified health claims are key drivers shaping the evolution of Japan’s functional food and supplement market.

Rising consumer demand for credible, science-backed supplements and stricter regulatory oversight drive quality innovation across Japan’s nutraceutical landscape. In November 2024, NXT USA, in collaboration with Octroll, received official Foods with Function Claims (FFC) registration from the country’s Consumer Affairs Agency for its joint health ingredient TamaFlex. .

Product Insights

Dietary supplements dominated the market with a revenue share of 47.4% in 2024. Growth of this segment is primarily driven by increasing demand for products that provide benefits beyond basic nutrition levels and rising awareness regarding the role of food intake in preventing gut health issues and other major illnesses.

The functional beverage segment is projected to experience the fastest CAGR of 11.9% from 2025 to 2033. This growth can be attributed to brands' innovation with targeted health claims and convenient formats. In April 2023, Kirin Beverage collaborated with FANCL to introduce KIRIN x FANCL Amino SUPLI Plus, a functional amino acid drink. Such product innovations explain the growing trends toward convenient, efficacy-driven beverages that cater to busy lifestyles, signaling strong demand in this dynamic segment.

Application Insights

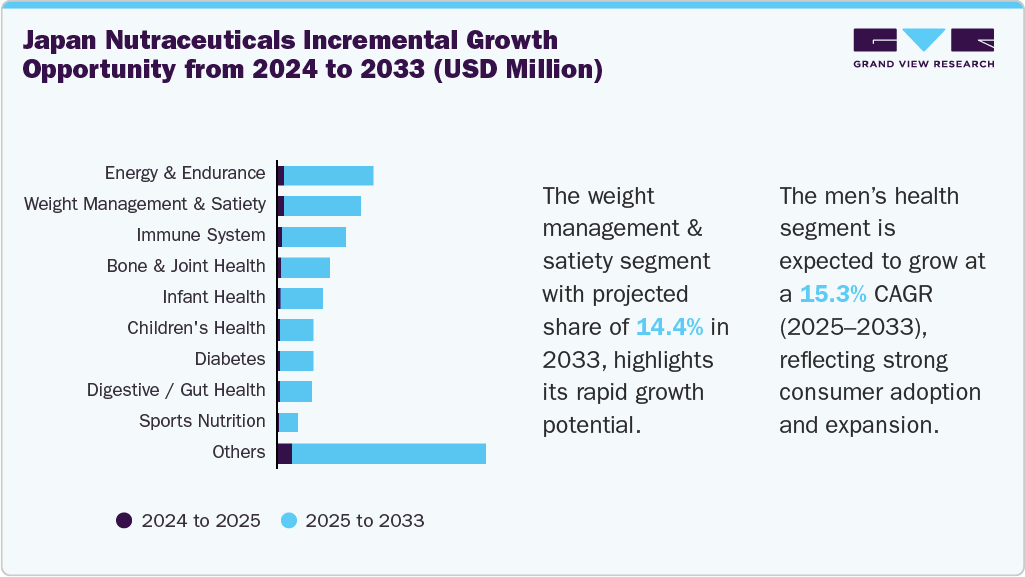

The weight management & satiety segment held the largest revenue share of the Japan nutraceuticals market in 2024. This can be attributed to a growing focus on metabolic health, aging-related fat accumulation, and lifestyle-related disorders. This demand is further accelerated by modern lifestyle patterns such as prolonged sedentary behavior, increasing screen time, and the rise of indoor entertainment activities like gaming, all contributing to reduced physical activity and growing consumer interest in convenient, functional solutions for managing weight.

In November 2023, Kirin launched its iMUSE Immune Care & Healthya Visceral Fat Down, a functional beverage that combines LC‑Plasma and tea catechins to support immune function and reduce visceral fat catering to rising consumer demand for convenient solutions targeting weight management and metabolic health. It retails in drugstores and mail-order channels, demonstrating that consumers seek functional beverages that support weight and immune health in convenient formats.

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033. Key drivers include a growing awareness of preventative healthcare and an increased understanding of how nutrition impacts performance, vitality, and long-term health. As demand grows, manufacturers are expanding liquid blends with ingredients such as L-citrulline, zinc and maca, aligning with changing male consumer preferences for personalized, performance-led nutraceutical solutions.

Distribution Channel Insights

The offline distribution segment dominated the Japanese nutraceuticals market in 2024. Manufacturers rely on efficient offline distribution networks to enhance their market share and improve brand visibility. Pharmacies, drugstores, and supermarkets dominate Japan’s nutraceuticals market, providing widespread consumer access and trust.

The online segment is anticipated to experience the fastest CAGR from 2025 to 2033. Young consumers are increasingly inclined to purchase dietary supplements and food products through online platforms. The fastest-growing distribution pathway in the Japanese nutraceuticals industry is driven by convenience, transparency, and direct-to-consumer strategies.

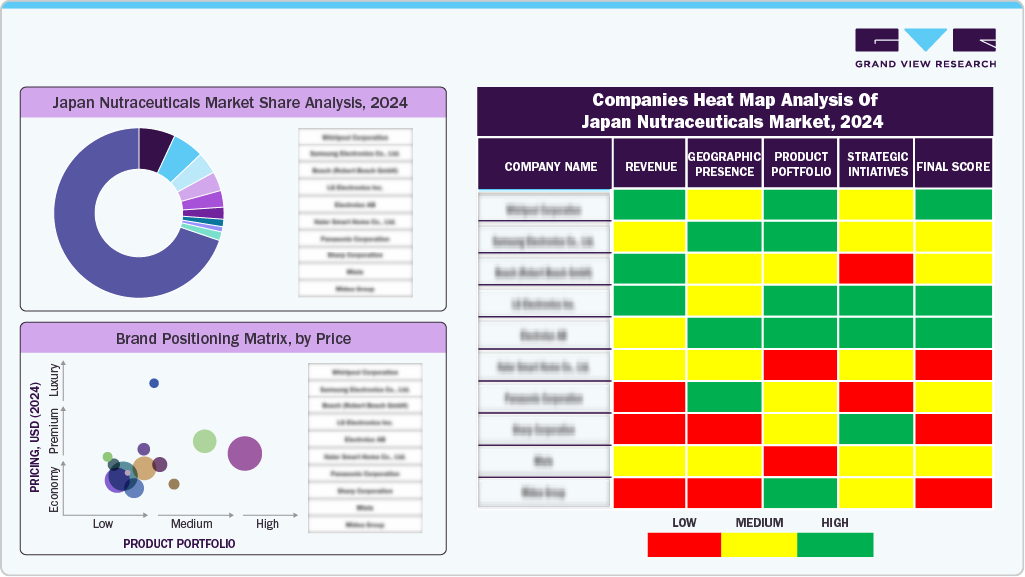

Key Japan Nutraceuticals Company Insights

Some of the key players in the Japan nutraceuticals market include Amway Corp., orthomol, Danone Yakult Honsha Co., Ltd. , Otsuka Pharmaceutical Co., Ltd., and others. Major players embrace strategies such as innovation, new product development, distribution partnerships, and more to address changing consumer preferences and growing demand for extensive product portfolios by diverse consumer groups.

-

orthomol offers an extensive portfolio of dietary supplements associated with various categories, including brain & energy metabolism, children’s health, gut health, eye health, heart and immune system, men’s health, sleep, tiredness & exhaustion, women’s health, vegan nutrition, and sports.

-

Amway Corp. is a global company specializing in multiple product categories, including nutrition, beauty, home, and personal care. Its nutrition portfolio features offerings such as targeted food supplements, foundational food supplements, personalized solutions, sports nutrition products, and more.

Key Japan Nutraceuticals Companies:

- Nestlé Health Science

- Amway Japan G.K.

- Herbalife International of America, Inc.

- Abbott.

- Otsuka Pharmaceutical Co., Ltd.

- FANCL CORPORATION

- Kirin Holdings Company, Limited.

- SUNTORY HOLDINGS LIMITED.

- Yakult Honsha Co., Ltd.

Japan Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.31 billion

Revenue forecast in 2033

USD 66.43 billion

Growth rate

CAGR of 9.9% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

Nestlé Health Science ; Amway Japan G.K.; Herbalife International of America, Inc. ; Abbott. ; Otsuka Pharmaceutical Co., Ltd.; FANCL CORPORATION; Kirin Holdings Company, Limited.; SUNTORY HOLDINGS LIMITED. ; Yakult Honsha Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Nutraceutical Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Japan nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.