- Home

- »

- Medical Devices

- »

-

Japan Smoke Evacuation System Market Size Report, 2030GVR Report cover

![Japan Smoke Evacuation System Market Size, Share & Trends Report]()

Japan Smoke Evacuation System Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Capital Equipment, Consumables), By Application (Laparoscopic Surgeries), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-615-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

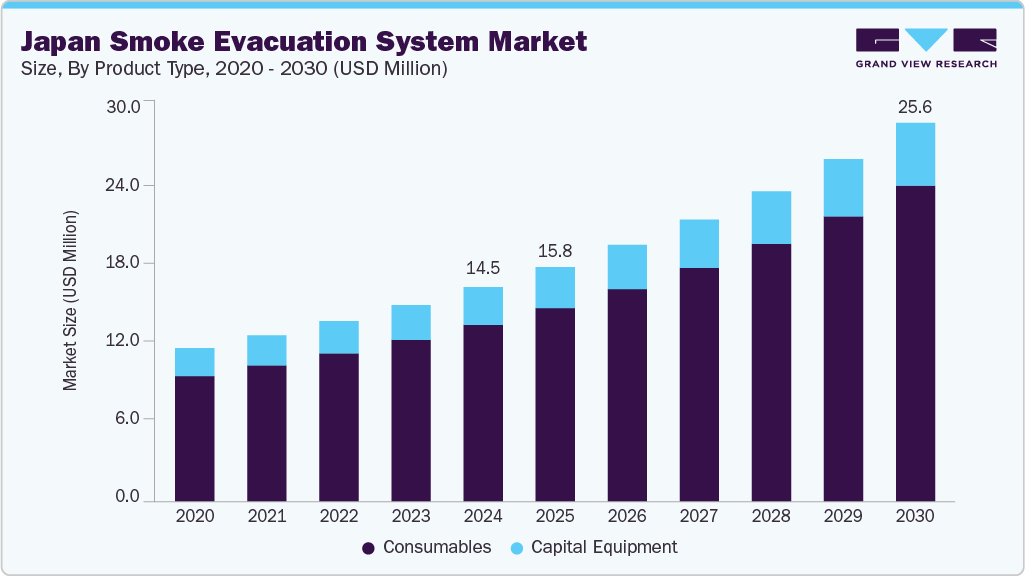

The Japan smoke evacuation system market size was estimated at USD 14.49 million in 2024 and is expected to grow at a CAGR of 10.08% from 2025 to 2030. Increasing adoption of minimally invasive surgeries is supplementing market growth. According to a 2023 article published in the Journal of Gynecologic Oncology, minimally invasive surgery (MIS) accounted for nearly 34% of surgical treatments for endometrial cancer in Japan. Furthermore, increasing awareness of surgical smoke hazards, along with ongoing technological advancements and the increasing availability of advanced products tailored to clinical requirements, are boosting market growth.

The country is witnessing a continuous rise in surgical procedures, largely driven by an aging population and a corresponding increase in chronic health conditions such as cancer, cardiovascular diseases, and gastrointestinal disorders. For instance, the report from the National Library of Medicine indicates that in 2023 in Japan, there were a total of 895,606 procedures related to gastroenterology and abdominal surgery documented in the National Clinical Database (NCD). The procedure that was most performed in this category was laparoscopic cholecystectomy, with 118,825 cases, followed by laparoscopic inguinal hernia surgery, which had 82,669 cases, and open inguinal hernia surgery, accounting for 63,234 cases.

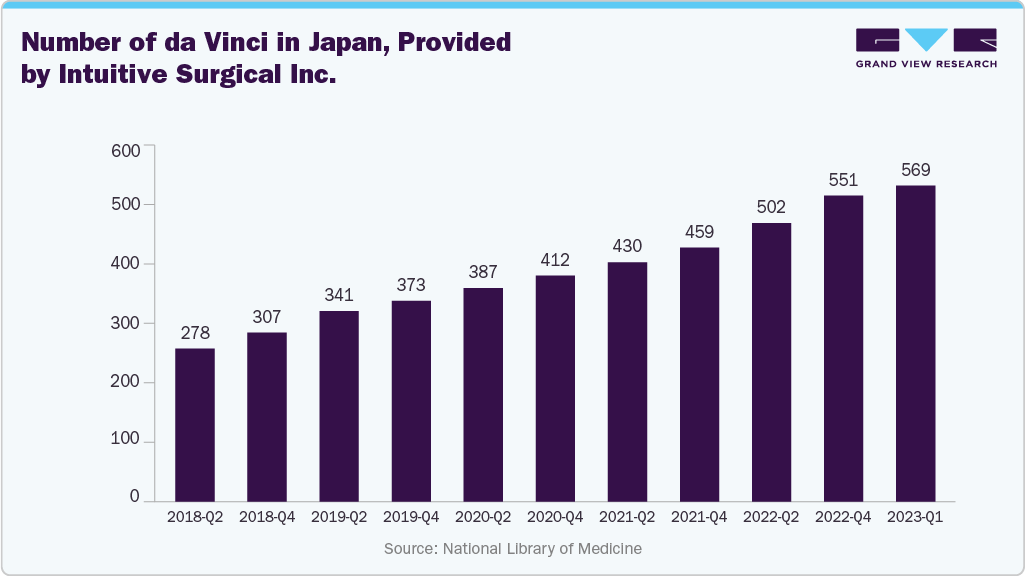

Furthermore, the increasing adoption of robotic surgery in Japan is further accelerating market growth. For instance, according to a report by Elsevier B.V., following the initial introduction of the Da Vinci system in Japan in 2009, over 450 units had been installed by 2022. There are around 1800 highly specialized care hospitals in Japan, and more than 80% of the leading 500 institutions have implemented the system.

Moreover, based on a report from Springer Nature Limited, by 2023, over 570 da Vinci units were in operation in Japan, highlighting the increasing acceptance of robotic surgery. The rise in robotic-assisted procedures has led to an increase in surgical smoke generated by energy-based devices, such as electrocautery, lasers, and ultrasonic scalpels. This emphasizes the need for effective smoke evacuation systems to protect the safety of both surgical teams and patients, thereby fostering market growth.

The below table below compares the characteristics of surgical smoke produced by different devices, highlighting the diversity of harmful particulates, viable cells, viruses, bacteria, and organic chemicals present in the plume.

The increasing elderly population in the region is driving market growth. According to data from Government of Japan, the elderly population has reached a record high of 36.25 million people, with those aged 65 or older accounting for almost one-third of the total population as of October 1, 2024. Japan’s Ministry of Internal Affairs and Communications announced that the elderly make up an estimated 29.3 percent of the population, the highest proportion of any country or region with more than 100,000 residents. In addition, the National Institute of Population and Social Security Research in Tokyo projects that elderly Japanese will comprise 34.8 percent of the country's population by 2040.

Moreover, the industry is witnessing significant growth, driven by strategic collaborations between global manufacturers and local distributors. These partnerships are crucial for navigating Japan's strict regulatory environment, addressing local market preferences, and promoting the adoption of advanced surgical technologies. For instance:

EMED and Amco Co., Ltd. Collaboration:

-

Partnership overview: EMED, a European manufacturer specializing in electrosurgery and surgical smoke evacuation systems, works with Amco Co., Ltd. to distribute its products in Japan.

-

Product focus: EMED’s smoke evacuation units, often integrated with its electrosurgical generators, provide automatic activation and high-efficiency particle filtration.

-

Market impact: Amco Co., Ltd.’s network within the Japan surgical equipment market facilitates faster adoption of EMED's integrated systems, particularly in facilities seeking bundled solutions for electrosurgery and smoke management.

Furthermore, there is a growing recognition of the health risks posed by surgical smoke, a byproduct generated during procedures involving energy-based devices such as electrocautery and lasers. This smoke contains a complex mixture of harmful substances, including volatile organic compounds (VOCs) such as formaldehyde and acetaldehyde, particulate matter (PM2.5), and potentially infectious agents. The health hazards of surgical smoke components are summarized below:

TABLE 1 The health hazards of surgical smoke

Components

The harmful effects

Carbon monoxide (CO)

Long-term exposure to low concentrations of CO can lead to dizziness and hypomnesia.

Acrylonitrile

Acrylonitrile may cause adverse reproductive effects.

PM2.5

Increase the incidence of respiratory and cardiovascular diseases.

Viable pathogens

Increase the possibility of disease transmission.

Viable cells

Provide a theoretical possibility of tumor metastasis.

Case study: Prospective randomized study evaluating the usefulness of a surgical smoke evacuation system in operating rooms for breast surgery

Background:

No prior global studies have assessed surgical smoke evacuation systems. This randomized study aimed to evaluate their effectiveness in reducing pollutants in operating room air and minimizing occupational exposure for surgical staff to harmful substances, including surgical smoke, VOCs, and formaldehyde.

Methods:

The study compared environmental conditions in the operating room with and without the smoke evacuation system. It monitored exposure levels for doctors and nurses during breast-conserving surgery and mastectomies, with random assignment of the evacuation system to ensure balanced results.

Results:

The use of the evacuation system significantly decreased the total concentration of volatile organic compounds and formaldehyde in the operating room. Additionally, healthcare professionals’ exposure to formaldehyde and acetaldehyde was notably reduced.

Conclusion:

The study demonstrates that surgical smoke evacuation systems effectively reduce airborne pollutants and occupational exposure, highlighting their importance for healthcare worker safety and supporting their implementation in Japan.

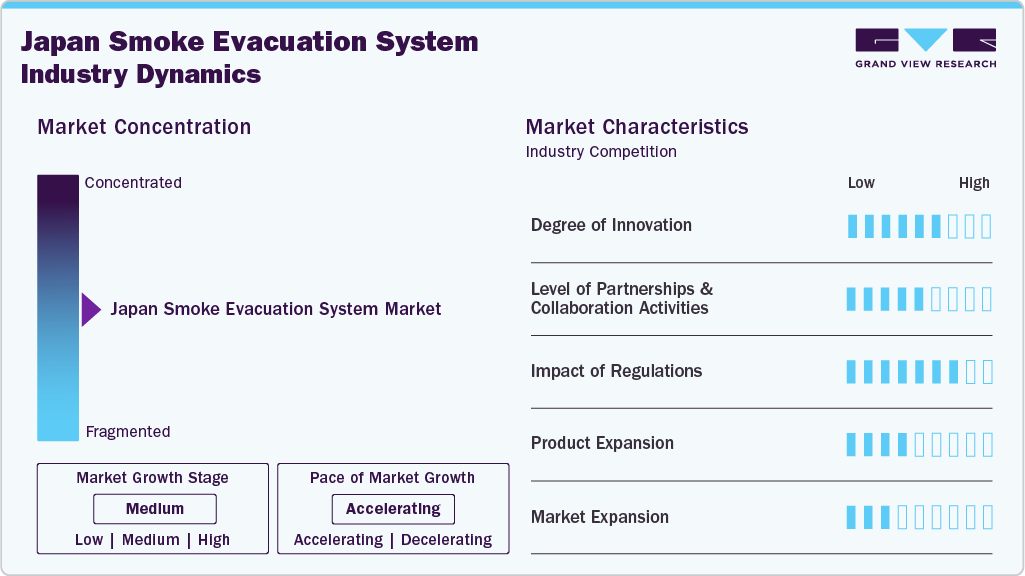

Market Concentration & Characteristics

The industry is experiencing a high degree of innovation, driven by the need for cost savings, improved member experience, and adaptability to changing regulatory landscapes. Innovations include variable suction power control and ergonomic handheld evacuation wands. For instance, Olympus’ UHI-4 High Flow Insufflation Unit supports high-speed insufflation up to 45 L/min and integrates automatic smoke evacuation, making it particularly useful in laparoscopic surgeries.

The market saw notable consolidations as larger operators sought to expand their reach and capabilities. Companies such as Olympus Corporation, Stryker, and other specialized medical device manufacturers contribute significantly to the innovation of smoke evacuation systems. Collaborations with universities and research institutes support continuous improvement and adaptation of cutting-edge technologies. Furthermore, global manufacturers often partner with local distributors or establish joint ventures to align products with Japan-specific healthcare requirements and standards.

In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour and Welfare (MHLW) are the main regulatory bodies overseeing the approval and monitoring of medical devices, including smoke evacuation systems used in healthcare.

MHLW: Sets policies, enforces regulations, and maintains the list of approved products.

PMDA: Evaluates medical devices for safety, efficacy, and quality before they can be marketed.

Product Type Insights

The consumables segment held the largest revenue share of 82.43% in 2024 and is expected to grow at the fastest CAGR over the forecast period. Its dominance is attributed to their flexibility, broader provider network, and lower cost-sharing for in-network services. PPO plans do not require a primary healthcare barrier to screen for specialists and hospital visits, offering lower cost-sharing for in-network services. This flexibility is a significant factor in their popularity, as employees value the freedom to choose their healthcare providers. PPO plans offer a broader provider network compared to other plan types like Health Maintenance Organizations (HMOs). According to the Kaiser Family Foundation's (KFF) Employer Health Benefits 2024 Annual Survey Report, it remained the most common plan type, covering 48% of workers.

The capital equipment segment is expected to grow at a significant CAGR over the forecast period. The capital equipment segment includes smoke evacuating systems, stationary systems, and portable systems, which are expected to dominate the market. These systems are essential for maintaining a safe surgical environment, as they effectively remove surgical smoke and hazardous particles generated during surgical procedures. The demand for capital equipment is driven by the growing number of orthopedic surgeries, laparoscopic procedures, and medical aesthetic surgeries in Japan.

Application Insights

The laparoscopic surgeries segment accounted for the largest revenue share of 27.14% in 2024. This minimally invasive technique is widely preferred across various medical specialties, including general surgery, gynecology, and urology, due to its benefits, such as reduced recovery time, lower risk of infection, and shorter hospital stays. However, the use of energy-based devices such as electrocautery and ultrasonic scalpels during laparoscopic procedures generates a significant amount of surgical smoke, leading to an increased demand for smoke evacuation systems. The growth of laparoscopic procedures in Japan, driven by an aging population and a rising prevalence of chronic conditions, is further supporting the expansion of this market.

The general surgery segment is expected to grow at a lucrative CAGR over the forecast period. Its growth is attributed to the increasing awareness of surgical smoke hazards, stricter regulatory guidelines, and technological advancements. Surgical smoke, a byproduct of tissue interaction with energy-based devices, contains hazardous chemicals, biological material, and viruses, posing risks to patients, surgeons, and operating room staff. The widespread use of electrocautery is fundamental to many general surgical procedures, providing hemostasis and tissue dissection.

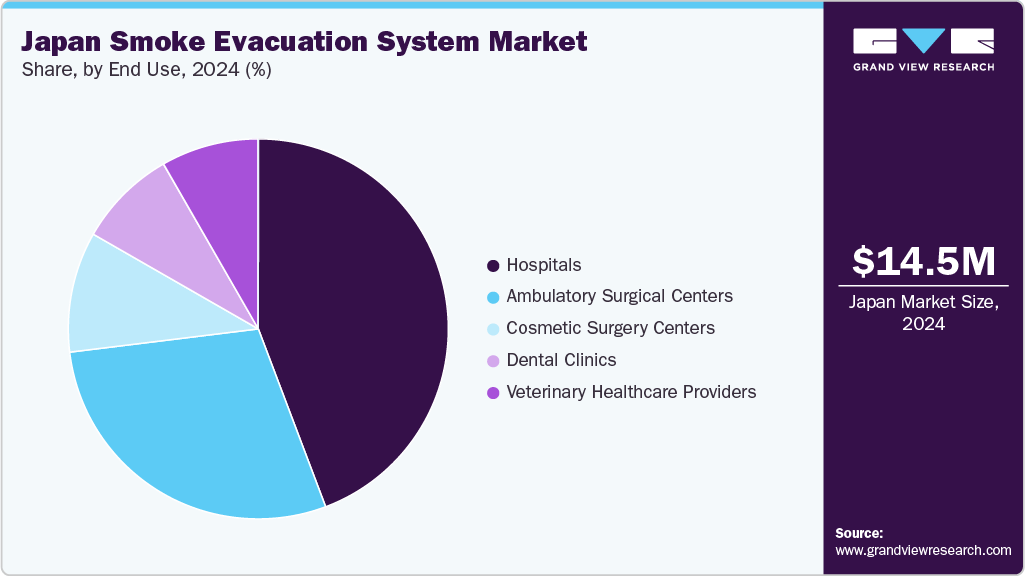

End Use Insights

The hospitals segment held the largest revenue share of 44.21% in 2024. As the country modernizes its healthcare infrastructure, hospitals, particularly large public and university-affiliated institutions, are making significant investments in advanced surgical equipment and operating room safety technologies. Due to the high volume of complex procedures such as laparoscopic, orthopedic, and robotic surgeries, hospitals in Japan are increasingly exposed to surgical smoke, which is leading them to adopt effective smoke management solutions.

The Ambulatory Surgical Centers (ASCs) segment is expected to grow at the fastest CAGR over the forecast period, driven by the ASCs are becoming increasingly popular due to their ability to provide cost-effective, efficient surgical procedures with shorter recovery times compared to traditional hospital settings. This trend is driven by a growing preference among patients for outpatient surgeries, which often involve electrosurgical and laser procedures that generate harmful surgical smoke. As awareness of the health risks associated with surgical smoke rises, ASCs are recognizing the necessity of implementing smoke evacuation systems to ensure a safer environment for both patients and medical staff.

Key Japan Smoke Evacuation System Company Insights

The market is moderately consolidated, with the presence of small and large providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Japan Smoke Evacuation System Companies:

- CONMED Corporation

- EMED

- IC Medical

- Medtronic

- Stryker

- Beijing Taktvoll Technology

- ALSA APPARECCHI MEDICALI SRL

- Fairmont Medical

- Karl Storz

- Shuyou Surgical

- UNIONMEDICAL Co., Ltd.

- Olympus Corporation

- Erbe Elektromedizin GmbH

- Steris

- KLS Martin Group

Recent Developments

-

In September 2024, Alesi Surgical successfully raised USD 5.59 million in a funding round led by Mercia Ventures, with participation from existing investors IP Group and Panakès Partners. This latest investment brings the total funding raised by Alesi to over USD 23.52 million. The funds are likely to be utilized to enhance sales efforts in the U.S. market and to pursue regulatory approvals for its innovative products in Europe and Japan. Dominic Griffiths, CEO of Alesi Surgical, commented:

“We have been overwhelmed with the positive feedback we received from surgeons during the development of the IonPencil. As they have been reluctant to adopt the current systems, we believe our device will greatly improve compliance with new legislation."

Japan Smoke Evacuation System Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 25.60 million

Growth rate

CAGR of 10.08% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end use

Country scope

Japan

Key companies profiled

CONMED Corporation; EMED; IC Medical; Medtronic; Stryker; Beijing Taktvoll Technology; ALSA APPARECCHI MEDICALI SRL; Fairmont Medical; Karl Storz; Shuyou Surgical; UNIONMEDICAL Co., Ltd.; Olympus Corporation; Erbe Elektromedizin GmbH; Steris; KLS Martin Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Smoke Evacuation System Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan smoke evacuation system market report based on product type, application, and end use.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Capital Equipment

-

Smoke Evacuating Systems

-

Stationary Systems

-

Portable Systems

-

-

-

Consumables

-

Smoke Evacuation Filters

-

Ultra-low Penetration Air (ULPA) Filters

-

Charcoal Filters

-

In-line Filters

-

Pre-filters

-

-

Smoke Evacuation Pencils & Wands

-

Smoke-Evac Fusion Products (Shrouds)

-

Smoke Evacuation Tubings

-

Accessories

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Laparoscopic Surgeries

-

Orthopedic

-

Medical Aesthetic Surgeries

-

General Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Public Hospital

-

Private Hospital

-

Small Hospital

-

Large Hospital

-

-

Universities/Academic Medical Centers

-

-

Ambulatory Surgical Centers

-

Cosmetic Surgery Centers

-

Dental Clinics

-

Veterinary Healthcare Providers

-

Frequently Asked Questions About This Report

b. The Japan smoke evacuation system market size was estimated at USD 14.49 million in 2024 billion in 2024.

b. The Japan smoke evacuation system market is expected to grow at a compound annual growth rate of 10.08% from 2025 to 2030 to reach USD 25.60 billion by 2030.

b. The consumables segment held the largest revenue share of 82.43% in 2024 and is expected to grow at the fastest CAGR over the forecast period. Its dominance is attributed to their flexibility, broader provider network, and lower cost-sharing for in-network services.

b. Some of the key players in the global legal services market include CONMED Corporation, EMED, IC Medical, Medtronic, Stryker, Beijing Taktvoll Technology, ALSA APPARECCHI MEDICALI SRL, Fairmont Medical, Karl Storz, Shuyou Surgical, UNIONMEDICAL Co.,Ltd., Olympus Corporation, Erbe Elektromedizin GmbH, Steris, and KLS Martin Group.

b. Key factors that are driving the market growth include increasing adoption of minimally invasive surgeries, and increasing awareness of surgical smoke hazards, along with ongoing technological advancements and the increasing availability of advanced products tailored to clinical requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.