Japanese Whisky Market Size & Trends

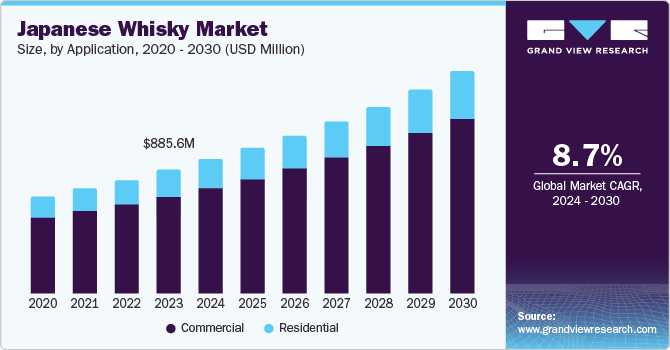

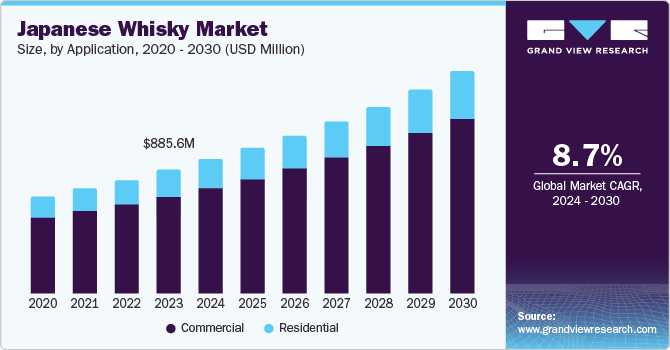

The global Japanese whisky market size was valued at USD 885.6 million in 2023 and is projected to grow at a CAGR of 8.7% from 2024 to 2030. The market is driven by increasing awareness regarding aged whisky and a growing taste for unique and imported spirits. The distinct taste profile of Japanese whiskey, often described as smooth, complex, and delicate, has captivated consumers worldwide.

There is an increasing global interest in high-quality and unique alcoholic beverages, particularly among consumers who appreciate craftsmanship and heritage. Japanese whisky has gained a reputation for its exceptional quality, often compared favorably with Scotch whisky. There is a notable trend towards aged whiskies as consumers become more educated about the nuances of different aging processes. The growing popularity of cocktails has increased the consumption of Japanese whisky as a key ingredient. The distinct taste profile, often described as smooth, complex, and delicate, has captivated consumers worldwide.

The proliferation of bars, restaurants, and pubs that serve premium spirits has significantly boosted the commercial segment of the market. Establishments are increasingly offering Japanese whisky as part of their drink menus, catering to consumer preferences for unique experiences. Japanese whiskies have consistently garnered prestigious awards, elevating their status as premium spirits. The rise of e-commerce platforms has made it easier for consumers worldwide to access Japanese whisky. This shift allows brands to reach a broader audience beyond traditional retail channels, facilitating greater sales opportunities.

Application Insights

The commercial segment dominated the market and accounted for a share of 78.5% in 2023. This is due to the increasing number of upscale bars, restaurants, and hotels aiming to offer premium spirits to their discerning clientele. The growing popularity of cocktail culture, with Japanese whisky as a key ingredient in innovative concoctions, has significantly boosted demand. The increasing popularity of whisky tastings and events also contributes to this growth as they create opportunities for consumers to experience these premium products firsthand.

The residential segment is expected to grow significantly with a CAGR of 8.5% during the forecast period. Rising disposable incomes and a growing appreciation for luxury goods have made Japanese whisky an aspirational product for many consumers. The trend of home bartending, fueled by the desire for personalized cocktail experiences, has increased demand for high-quality spirits such as Japanese whisky. Moreover, the influence of social media and online platforms has made consumers more aware of the diverse range of Japanese whiskies available.

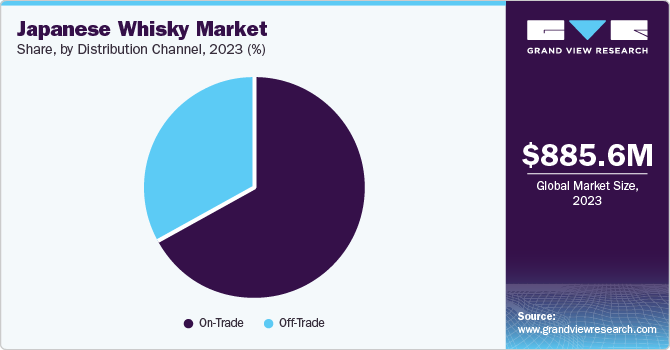

Distribution Channels Insights

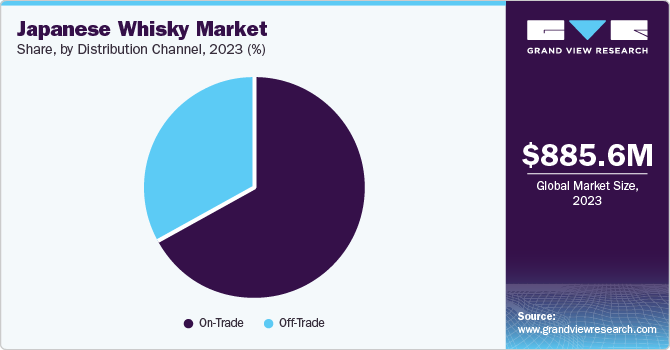

On-trade dominated the market and accounted for a share of 67.1% in 2023. This is due to increasing popularity of premium bars, restaurants, and lounges. These establishments are increasingly incorporating Japanese whisky into their beverage offerings to cater to sophisticated palates and elevate their brand image. Moreover, the rising trend of cocktail culture has significantly boosted demand, with bartenders experimenting with Japanese whisky to create unique and flavorful drinks.

Off-trade is expected to register a significant CAGR of 8.4% during the forecast period due to the growing number of whisky enthusiasts and collectors. The increasing availability of Japanese whisky in specialized liquor stores, supermarkets, and online platforms has made it more accessible to consumers. In addition, the rise of e-commerce has facilitated cross-border sales, expanding the market reach of Japanese whisky to a global audience.

Country Insights

North America Japanese Whisky Market Trands

The North America Japanese whisky market is anticipated to witness significant growth in the coming years. Japanese whisky, known for its meticulous craftsmanship and balance of flavors, appeals to this demographic. As consumers become more adventurous and discerning in their drinking habits, they seek out distinctive offerings that stand apart from traditional Scotch or American whiskies.

The U.S. Japanese whisky market is expected to grow rapidly in the coming years due thriving economy, coupled with a sophisticated palate for spirits. The country's extensive distribution network and robust on-trade and off-trade channels have facilitated easy access to Japanese whisky.

Asia Pacific Japanese Whisky Market Trends

Asia Pacific Japanese whisky market dominated with a share of 60.4% in 2023. This can be attributed to the presence of the largest production facility in Japan and high product penetration in the region. The expected increase in population, urbanization, and disposable income in countries such as China, India, and Thailand is predicted to be a key factor in boosting the alcohol market and will have a beneficial effect on the demand for Japanese whiskey in the coming years.

The India Japanese whisky market dominated Asia Pacific market in 2023 due to changing consumer preferences towards premium alcoholic beverages and an increasing trend of whisky consumption among younger demographics.

Europe Japanese Whisky Market Trands

The Europe Japanese whisky market was identified as a lucrative region in 2023 due to rising popularity of premium spirits, increased consumer interest in unique and artisanal products, and the influence of Japanese culture. The growing number of whisky festivals and tasting events across Europe has also contributed to heightened awareness and appreciation for Japanese whisky, further fueling its demand.

The UK Japanese whisky market is expected to grow rapidly in the coming years. The surge in demand for Japanese whisky can be attributed to several key factors, including a burgeoning interest in craft spirits and an expanding palate among consumers.

Key Japanese Whisky Company Insights

Some key companies in Japanese whisky market SUNTORY HOLDINGS LIMITED., THE NIKKA WHISKY DISTILLING Co., LTD., Flaviar Group, Louisville Distilling Co. LLC, ASAHI GROUP HOLDINGS, LTD. and others. Companies are focusing on expanding their reach by producing a variety of Japanese whiskies in order to leverage the ongoing consumption trend across world.

Key Japanese Whisky Companies:

- SUNTORY HOLDINGS LIMITED.

- THE NIKKA WHISKY DISTILLING Co., LTD.

- Chichibu Distillery

- Venture Whisky, Ltd.

- Flaviar Group

- Louisville Distilling Co. LLC

- ASAHI GROUP HOLDINGS, LTD.

- Jf Hillebrand Japan Kk

- Hombo Shuzo Co.,Ltd.

- Yoshino Spirits

Recent Developments

-

In June 2024, Suntory Holdings announced a new subsidiary formation in India that would sell wellness products and non-alcoholic beverages in India.

-

In March 2022, Kirin Brewery announced that it will begin the Kirin Single Grain Japanese Whiskey Fuji sales in Australia and China in April. It is a blend of grain and malt whiskies, whose whiskies are from single distillery.

Japanese Whisky Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 961.01 million

|

|

Revenue forecast in 2030

|

USD 1.58 billion

|

|

Growth Rate

|

CAGR of 8.7% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, distribution channel, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Brazil, and South Africa

|

|

Key companies profiled

|

SUNTORY HOLDINGS LIMITED.; THE NIKKA WHISKY DISTILLING Co., LTD.; Chichibu Distillery; Venture Whisky, Ltd.; Flaviar Group; Louisville Distilling Co. LLC; ASAHI GROUP HOLDINGS, LTD.; Jf Hillebrand Japan Kk, Hombo Shuzo Co.,Ltd.; Yoshino Spirits

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Japanese Whisky Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Japanese Whisky market report based on application, distribution channel and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)