- Home

- »

- Next Generation Technologies

- »

-

K-12 Testing And Assessment Market, Industry Report, 2033GVR Report cover

![K-12 Testing And Assessment Market Size, Share & Trends Report]()

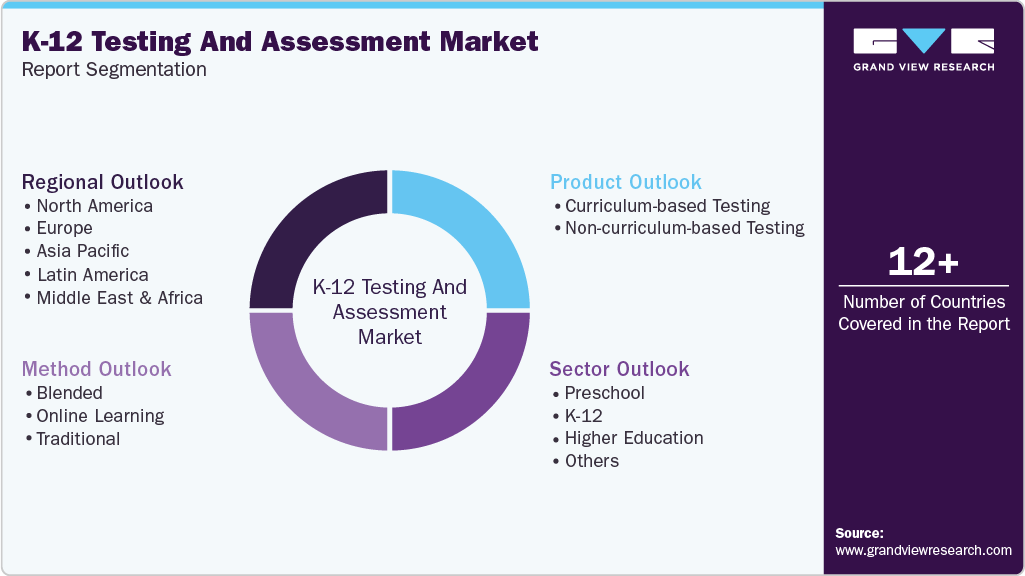

K-12 Testing And Assessment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Curriculum-based Testing, Non-curriculum-based Testing), By Method (Blended, Online Learning), By Sector (Preschool, K-12, Higher Education), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-785-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

K-12 Testing And Assessment Market Summary

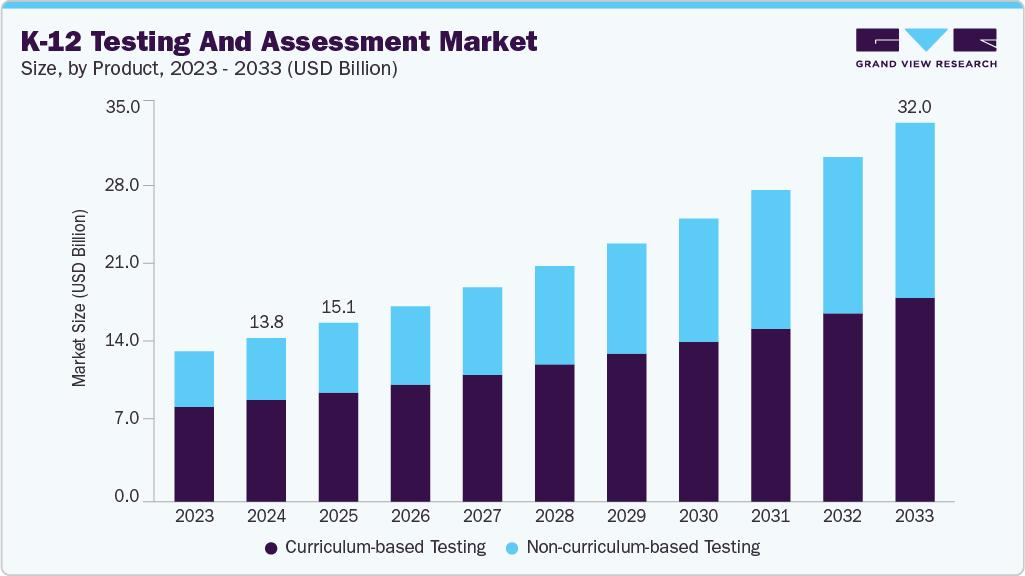

The global K-12 testing and assessment market size was estimated at USD 13.85 billion in 2024 and is projected to reach USD 32.04 billion by 2033, growing at a CAGR of 9.9% from 2025 to 2033. The market growth is driven by the rising emphasis on personalized learning, increasing adoption of digital and adaptive assessment tools, government initiatives for standardized testing, growing demand for data-driven insights in education, and expanding e-learning platforms that enhance remote and hybrid learning evaluation capabilities.

Key Market Trends & Insights

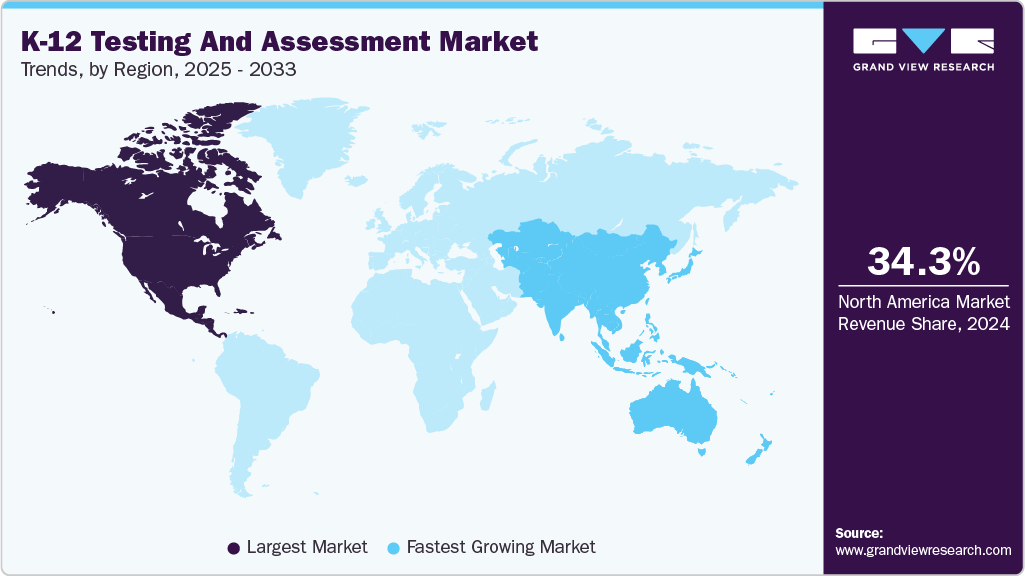

- North America dominated the global K-12 testing and assessment market with the largest revenue share of 34.3% in 2024.

- The K-12 testing and assessment industry in the U.S. led North America with the largest revenue share in 2024.

- By product, curriculum-based testing led the market, holding the largest revenue share of 62.2% in 2024.

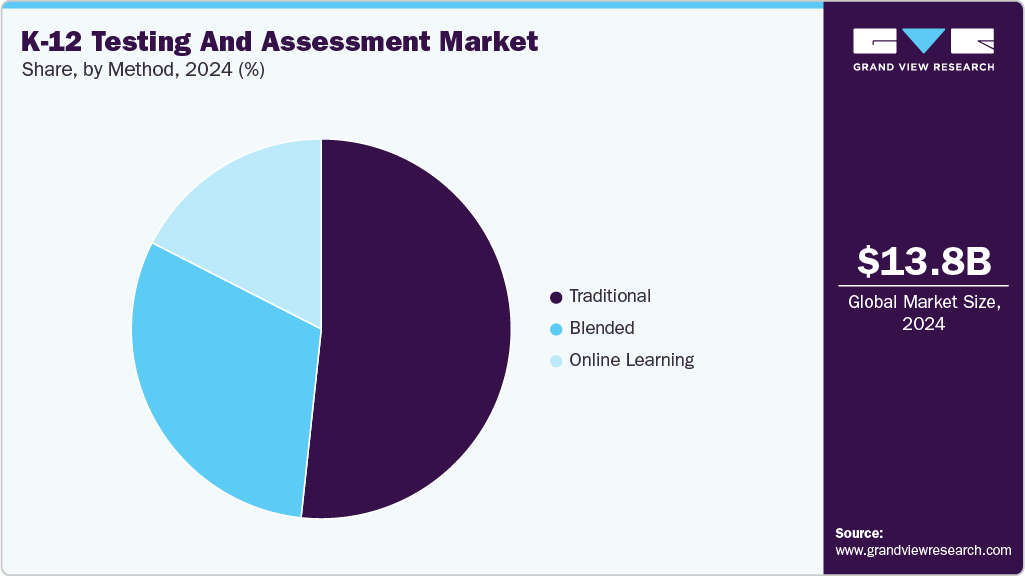

- By method, the traditional segment held the dominant market position in 2024.

- By sector, the K-12 segment held the dominant market position in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.85 Billion

- 2030 Projected Market Size: USD 32.04 Billion

- CAGR (2025-2030): 9.9%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

Technological advancement is a primary driver shaping the global K-12 testing and assessment industry. It includes rapid adoption of digital platforms, cloud-based delivery, and adaptive assessment technologies that provide real-time analytics and personalized feedback. These tools enable scalable remote proctoring, automated scoring, and integration with learning management systems, reducing administrative burden and turnaround time. Schools and districts prioritize data-driven insights for formative and summative evaluations, fueling demand for interoperable solutions and API-driven services. Vendors investing in AI, item-banking, and secure encryption techniques capture market share by offering efficient, flexible, and cost-effective assessment ecosystems that support learning outcomes and policy compliance.

Policy reforms and accountability requirements significantly propel K-12 assessment spending worldwide. Governments and accrediting bodies increasingly mandate standardized testing, competency-based evaluations, and frequent reporting to monitor learning recovery and achievement gaps. Funding initiatives such as public budgets, grants, and stimulus packages for education technology accelerate procurement of assessment platforms, data dashboards, and professional development. Stakeholders demand aligned content standards, psychometrically valid assessments, and transparent metrics to inform policy decisions, teacher evaluation frameworks, and resource allocation. As education systems pivot toward competency and outcomes-focused models, vendors offering compliant, customizable assessments, training, and long-term maintenance contracts see heightened adoption across diverse regions and procurement cycles.

Changing pedagogical approaches and stakeholder expectations are reshaping demand in the K-12 assessments market globally. Educators emphasize formative, competency-based, and project-oriented assessments that measure critical thinking, socio-emotional learning, and 21st-century skills beyond rote testing. Parents, employers, and higher-education institutions expect actionable evidence of student readiness, prompting districts to adopt richer performance tasks, portfolio assessments, and blended evaluation models. Private tutoring, adaptive test-prep ecosystems, and diagnostic tools increasingly integrate with formal assessments to enable targeted interventions, early-warning systems, and personalized learning pathways. This shift toward holistic, continuous assessment models expands opportunities for providers who deliver multimodal, accessible, and inclusive testing solutions, localized content, and professional services.

Product Insights

The curriculum-based testing segment dominated the K-12 testing and assessment industry with a share of over 62.2% in 2024, driven by the growing emphasis on aligning assessments with national and regional academic standards to ensure measurable learning outcomes. Rising government mandates for standardized evaluations, the integration of digital and adaptive testing tools, and the increasing focus on competency-based education are key enablers. Additionally, schools’ demand for data-driven insights to improve teaching effectiveness and student performance further fuels adoption. The expansion of online learning platforms and personalized learning initiatives also supports sustained market growth.

The non-curriculum-based testing segment is expected to register the fastest CAGR over the forecast period. Schools are increasingly focused on evaluating holistic skills such as critical thinking, creativity, and socio-emotional learning beyond traditional academics. Education policies and district initiatives are promoting performance-based and through-year assessments to gain comprehensive learning insights. Technological advancements, including AI-driven analytics and adaptive platforms, are enabling scalable and personalized testing solutions. Post-pandemic digital transformation has further accelerated online assessment adoption, while the growing focus on college and career readiness continues to drive demand for aptitude and competency evaluations.

Method Insights

The traditional segment held the largest share of the K-12 testing and assessment market in 2024, driven by the continued reliance on standardized paper-based examinations and in-person evaluation methods, especially in developing regions with limited digital infrastructure. Educational institutions and government bodies favor traditional testing for its perceived fairness, reliability, and ease of administration. Moreover, existing assessment frameworks, regulatory mandates, and familiarity among teachers and students support its sustained adoption. The segment also benefits from lower implementation costs and consistent performance tracking in large-scale national or regional assessments.

The online learning segment is expected to register the fastest CAGR over the forecasted period, due to the increasing adoption of digital education tools, growing demand for flexible, personalized learning experiences. Schools and districts are leveraging online platforms to conduct assessments efficiently, enabling real-time performance tracking and data-driven interventions. Integration of adaptive testing technologies, cloud-based infrastructure, and interactive content further enhances engagement and learning outcomes. Rising investments in EdTech and government initiatives supporting digital classrooms also contribute significantly to this segment’s expansion.

Sector Insights

The K-12 segment held the largest share of the K-12 testing and assessment industry in 2024, driven by increasing emphasis on personalized learning, performance-based evaluations, and data-driven insights for student outcomes. Governments and educational institutions are adopting standardized and digital assessments to improve learning efficiency, track academic progress, and identify skill gaps early. Rising integration of AI and analytics in assessments, along with the shift toward online and remote testing, further fuels demand. Additionally, initiatives to align curricula with global competency standards and enhance teacher effectiveness are key growth factors in this segment.

The higher education segment is expected to register growth at a significant CAGR over the forecast period, driven by the increasing emphasis on bridging K-12 learning outcomes with university readiness, alongside the rising adoption of standardized assessments to ensure academic alignment and competency-based evaluations. Universities and colleges are leveraging advanced analytics and adaptive testing to improve admissions accuracy, student placement, and curriculum effectiveness. Additionally, government initiatives promoting quality education, growing demand for lifelong learning credentials, and the integration of digital assessment platforms further accelerate higher education-focused assessment adoption globally.

Regional Insights

North America dominated the K-12 testing and assessment market with a revenue share of over 34.3% in 2024, driven by strong government mandates emphasizing accountability and student performance measurement, along with widespread adoption of digital learning and adaptive assessment technologies. The region’s focus on personalized learning, competency-based education, and data-driven instruction further fuels market expansion. Additionally, the integration of AI and analytics to enhance assessment accuracy and learning insights supports continuous improvement in educational outcomes. Growing investments in EdTech infrastructure, demand for remote and hybrid testing solutions, and partnerships between educational institutions and technology providers are also key drivers shaping the North American market growth.

U.S. K-12 Testing and Assessment Market Trends

The U.S. K-12 testing and assessment industry is expected to grow significantly, propelled by the growing emphasis on personalized learning, standardized performance measurement, and data-driven educational decision-making. Federal and state mandates such as Every Student Succeeds Act (ESSA) encourage accountability and the adoption of adaptive and formative assessments. Increasing integration of digital platforms, AI-based analytics, and remote learning tools further supports market growth. Additionally, the demand for competency-based education, early intervention programs, and technology-enabled assessment systems from edtech providers and schools continues to expand, fostering innovation and steady market advancement across the U.S. education sector.

Europe K-12 Testing and Assessment Market Trends

The K-12 testing and assessment industry in Europe is expected to grow significantly over the forecast period, due to the region’s strong focus on educational quality, standardized learning outcomes, and digital transformation in classrooms. Governments and educational authorities are emphasizing competency-based learning and national performance benchmarking, leading to increased adoption of digital and adaptive assessment platforms. The rapid integration of AI, data analytics, and cloud-based solutions enhances personalized learning and performance tracking. Additionally, the growing demand for multilingual assessments, remote learning tools, and continuous evaluation models post-pandemic further accelerates market growth across major European economies such as the UK, Germany, France, and the Nordic countries.

Asia Pacific K-12 Testing and Assessment Market Trends

The Asia Pacific K-12 testing and assessment industry is anticipated to be at the fastest CAGR over the forecast period. The market is experiencing strong growth due to the rapid digitization in education, increasing government initiatives to enhance learning outcomes, and growing adoption of adaptive and personalized learning tools. Expanding internet penetration and the integration of AI and analytics in educational platforms are improving assessment efficiency and data-driven insights. Rising investments in EdTech startups and the widespread adoption of e-learning post-COVID-19 have further accelerated demand. Additionally, the emphasis on competency-based education, continuous assessment, and international curriculum adoption across schools supports market growth across developing economies such as India, China, and Indonesia.

Key K-12 Testing And Assessment Company Insights

Some key companies in the K-12 testing and assessment market areAkamai Technologies and Amazon Web Services, Inc.

-

Pearson is a key player in the global market for K-12 testing and assessment due to its extensive portfolio of standardized tests, digital platforms, and curriculum-aligned assessments. Its strong global presence, deep expertise in educational content, and continuous investment in adaptive and technology-driven solutions enable schools to enhance learning outcomes efficiently. Pearson’s integration of analytics and AI further strengthens its market dominance.

-

ETS dominates the K-12 testing and assessment industry due to its research-based assessments, widely adopted in K-12 education worldwide. Its large-scale testing expertise, reliable scoring systems, and commitment to innovation in digital and adaptive assessments ensure accurate evaluation of student performance, making it a trusted partner for schools, governments, and educators globally.

Key K-12 Testing And Assessment Companies:

The following are the leading companies in the K-12 testing and assessment market. These companies collectively hold the largest market share and dictate industry trends.

- Pearson

- ETS

- McGraw Hill

- HMH Education Company

- NWEA

- Renaissance Learning, Inc.

- Cambium Learning Group

- Scantron

- Edmentum, Inc.

- PowerSchool

Recent Developments

-

In August 2025, Savvas Learning Company LLC, education technology company, partnered with Renaissance Technologies LLC, education technology company, to integrate core curriculum and assessment data to help educators enhance instruction and support student progress. By connecting the Savvas Learning Company LLC Realize and Renaissance Technologies LLC Next platforms, educators gain unified experience with direct access to assessment results and related instructional materials, allowing more effective use of class time while addressing diverse student needs.

-

In June 2025, Pearson and McGraw Hill signed an agreement to integrate Pearson’s interim-assessment product (PRoPL / assessment capabilities) into McGraw Hill’s core K-12 curriculum offerings, with an initial roll-out planned for California for the 2025-26 school year. The deal is positioned as a curriculum + assessment integration to give districts richer, actionable instructional recommendations tied to student performance.

-

In June 2025, Pearson partnered with Google LLC, to accelerate development of Next-Generation AI Tools for students and educators. The partnership also embed advanced AI learning tools across K-12 products, including functionality to personalize instruction, help teachers monitor performance, and support formative/assessment workflows. Pearson has also signaled multiple AI collaborations to accelerate assessment personalization.

K-12 Testing And Assessment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.10 billion

Revenue forecast in 2033

USD 32.04 billion

Growth rate

CAGR of 9.9% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, sector, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Pearson; ETS; McGraw Hill; HMH Education Company; NWEA; Renaissance Learning, Inc.; Cambium Learning Group; Scantron; Edmentum, Inc.; PowerSchool

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global K-12 Testing And Assessment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented global K-12 testing and assessment market report based on product, method, sector, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Curriculum-based Testing

-

Non-curriculum-based Testing

-

-

Method Outlook (Revenue, USD Billion, 2021 - 2033)

-

Blended

-

Online Learning

-

Traditional

-

-

Sector Outlook (Revenue, USD Billion, 2021 - 2033)

-

Preschool

-

K-12

-

Higher Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the K-12 testing and assessment market growth include the rising emphasis on personalized learning, increasing adoption of digital and adaptive assessment tools, government initiatives for standardized testing, growing demand for data-driven insights in education, and expanding e-learning platforms that enhance remote and hybrid learning evaluation capabilities.

b. The global K-12 testing and assessment market size was estimated at USD 13.85 billion in 2024 and is expected to reach USD 15.10 billion in 2025.

b. The global K-12 testing and assessment market is expected to grow at a compound annual growth rate of 9.9% from 2025 to 2033 to reach USD 32.04 billion by 2033.

b. North America dominated the K-12 testing and assessment market with a share of 34.3% in 2024. This is attributable to the strong government mandates emphasizing accountability and student performance measurement, along with widespread adoption of digital learning and adaptive assessment technologies.

b. Some key players operating in the K-12 testing and assessment market include Pearson; ETS; McGraw Hill; HMH Education Company; NWEA; Renaissance Learning, Inc.; Cambium Learning Group; Scantron; Edmentum, Inc.; and PowerSchool.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.