- Home

- »

- Petrochemicals

- »

-

Keratin Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Keratin Market Size, Share & Trend Report]()

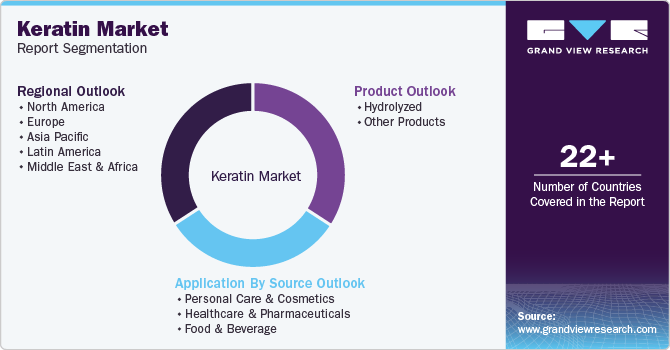

Keratin Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Hydrolyzed), By Application, By Source (Personal Care & Cosmetics, Healthcare & Pharmaceuticals, Food& Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-972-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Keratin Market Summary

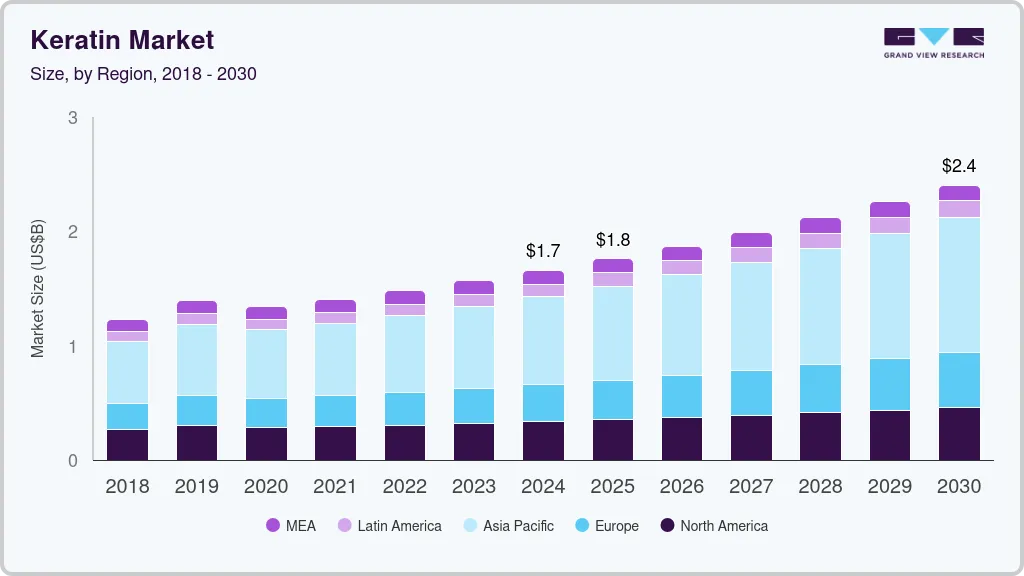

The global keratin market size was estimated at USD 1,660.1 Million in 2024 and is projected to reach USD 2,404.4 Million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The increasing consumption of keratin in the personal care and cosmetics industry is a key factor driving market growth.

Key Market Trends & Insights

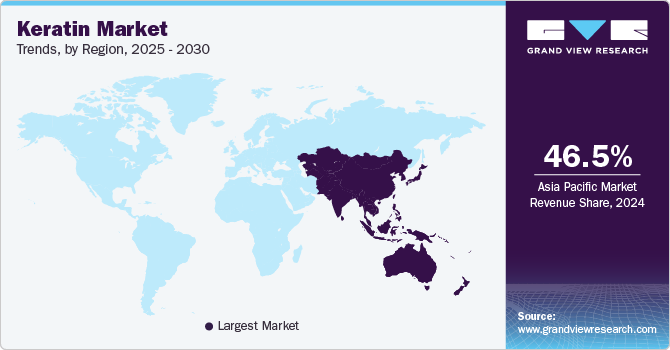

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, the market in China is expected to grow significantly during the forecast period.

- By product, the hydrolyzed segment accounted for the largest revenue market share, 79.4%, in 2024.

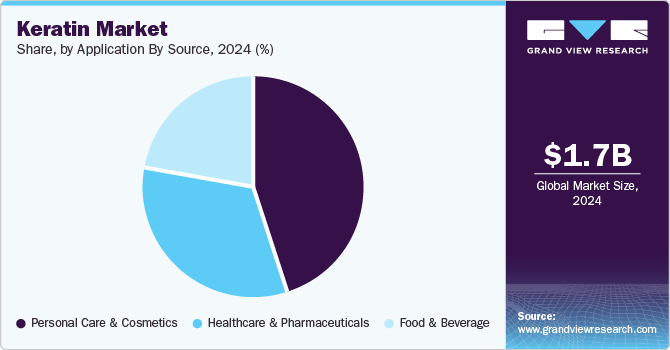

- By application by source, the personal care & cosmetics segment dominated the market with a share of 45.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,660.1 Million

- 2030 Projected Market Size: USD 2,404.4 Million

- CAGR (2025-2030): 6.4%

- Asia Pacific: Largest market in 2024

Keratin is commonly used in skincare and hair care products, including conditioners and shampoo, to reduce oiliness, eliminate dead skin cells, repair damage, and minimize blemishes caused by chemicals and heat. Being insoluble in water, keratin can be sourced from horns, feathers, the outer skin layer, hair, wool, nails, and claws.

The demand for keratin is rising in personal care and cosmetics because it is a sustainable, safe, and multifunctional alternative to other acids used in cosmetic products. Its revitalizing effects on hair and skin will further boost demand for keratin in this industry. A significant factor driving the growth of the keratin industry is the increasing preference for bio-based products among consumers, mainly due to rising disposable incomes. Manufacturers are consistently upgrading their product offerings to meet the growing needs of end users, resulting in higher keratin consumption. The expanding global population and ongoing urbanization and industrialization in emerging economies like India have prompted various governments to increase their manufacturing investments to meet the rising demand for keratin.

The global cosmetics industry is gradually shifting toward innovative ingredients that are effective and have fewer adverse effects. As a result, using keratin in cosmetics has led to a higher demand for hair care products. This industry benefits from an increased interest in hair care regimens as more individuals seek effective hair solutions.

Drivers, Opportunities & Restraints

The product market is experiencing significant growth as consumers increasingly seek premium hair care products, indicating a shift toward specialized and high-quality personal grooming options. In March 2023, Procter & Gamble responded to this rising demand by launching a new collection of hair care items containing keratin under the Pantene brand. This move capitalized on consumer interest in products that promote stronger and healthier hair, leveraging Keratin’s reputation for enhancing hair strength and reducing damage. Similarly, in July 2023, L'Oréal introduced an innovative keratin treatment for their professional hair care line, aimed at salon clients looking for practical solutions. The growing consumer awareness of keratin's benefits, coupled with the increasing availability of these products across multiple retail channels, underscores the significant impact of consumer preferences on market expansion.

The high costs of treatments have been significant barriers to market entry, preventing products from reaching a broader customer base. For example, Oribe, a luxury hair care company, is encountering challenges with its latest keratin treatment due to its high price of USD 150 per bottle. This cost may deter many consumers, limiting the treatment's accessibility to a small number of people. Additionally, in March 2024, demand for keratin services began to decline at Paul Mitchell salons, with part of the issue attributed to the premium prices of their keratin treatments, which are significantly higher than regular hair care products. This financial barrier highlights affordability in the keratin industry, as this factor heavily influences consumer purchasing decisions and industry growth.

The market is experiencing promising prospects, driven by a rising demand for these products in developing countries. In June 2024, Schwarzkopf, one of the world's leading beauty companies, expanded its presence in India by launching an affordable range of keratin treatments. This move aims to meet the growing demand for quality hair care products in the rapidly expanding Indian market. Similarly, in September 2024, South Korea-based Amorepacific introduced a line of keratin-infused hair care products, targeting the swift market growth in Southeast Asia. This demonstrates a strategic effort to cater to these regions' increasing appetite for high-quality beauty items. The keratin industry has significant growth potential by expanding into emerging markets, thanks to higher disposable incomes, increased beauty awareness, and a growing demand for advanced hair care products in these areas.

Product Insights

The hydrolyzed segment accounted for the largest revenue market share, 79.4%, in 2024 and is expected to continue to dominate the industry over the forecast period. Hydrolyzed keratin is a blend of amino acids and peptides commonly found in nails, hair, skin, and other personal care products. It serves multiple purposes, including acting as a humectant, a nail conditioning agent, and an antistatic agent. Additionally, hydrolyzed keratin contributes to the health of biological tissues. Cosmetic and personal care companies incorporate it into their products to enhance well-being, health, and beauty.

Alpha-keratin is the leading type in this segment. As a fibrous structural protein, alpha-keratin is crucial in personal care and cosmetics. Several factors support their market dominance. Consumers seek high-quality hair cosmetics and smooth and straightening solutions, which drives the demand for alpha-keratin products. These products' safety and environmental friendliness have also contributed to their popularity.

Application by Source Insights

The personal care & cosmetics segment dominated the market with a market share of 45.4% in 2024 during the forecast period. The demand for personal care products has grown significantly globally in the past few years, particularly for hair care products. The product market finds applications in numerous personal care categories, such as conditioners, shampoos, and facial moisturizers. The rising demand for keratin reflects consumers' lifestyle changes, simplifying beauty routines amid busy schedules.

Due to its unique properties, keratin is increasingly being explored in the food and beverage industry. It can be utilized as a functional ingredient, enhancing the texture and stability of protein bars and beverages. Its high protein content makes it a valuable addition to fortifying snacks while offering potential health benefits, such as supporting hair, skin, and nail health. Additionally, Keratin’s natural resources can contribute to the trend of cleaner labels in food products.

Regional Insights

The Asia Pacific region is dominant in the keratin market, owing to the presence of global multinational companies in the region with high demand from end-use markets, personal care & cosmetics, healthcare & pharmaceuticals, and food & beverages markets. The Asia-Pacific region includes South Korea, Japan, China, India, and other countries. The growth of the female workforce, the development of the middle class, and urbanization have all contributed to the adoption of convenience-oriented lifestyles. This shift has led to an increased demand for keratin products in both developing and developed economies.

China Keratin Market Trends

The market in China is expected to grow during the forecast period. This growth is attributed to increasing consumer awareness about the product market, which must lead to increased demand for products in the region.

North America Keratin Market Trends

The North American market is experiencing growth, primarily due to consumers' increasing use of hair and skin care products. The presence of various small and large producers is enhancing awareness and driving demand for personal care products. Manufacturers in North America are adopting an integrated approach to health and cosmetic products, treating them as interconnected categories rather than handling each separately in the personal care sector.

Europe Keratin Market Trends

The European market is witnessing significant growth, fueled by a strong demand for high-quality hair care products and treatments. The region's focus on sustainability and eco-friendly formulations also increases the attractiveness of keratin products to consumers. Key markets in Europe include the United Kingdom, France, and Germany, which play crucial roles in shaping market trends and consumer preferences.

Latin America Keratin Market Trends

The Latin American keratin market is expected to experience significant growth, fueled by rising consumer demand for hair care and cosmetic products. Key contributors to this growth include Brazil and Argentina, where increasing disposable incomes and a heightened interest in personal grooming are noticeable. Additionally, the market is influenced by trends favoring sustainable and ethically sourced keratin, which aligns with global consumer preferences for eco-friendly products.

Middle East & Africa (MEA) Keratin Market Trends

The keratin market in the MEA region is set for growth. This expansion is fueled by an increasing demand for personal care products and the rising popularity of keratin in hair treatments and cosmetics. Key markets in the region include Saudi Arabia and South Africa, where consumer awareness of hair health and beauty trends is growing. Additionally, a significant shift toward sustainable and ethically sourced keratin products aligns with global consumer preferences for eco-friendly options.

Key Keratin Company Insights

Some of the key players operating in the market include BASF SE and Keraplast.

-

BASF SE operates through six business segments: Industrial Solutions, Materials, Surface Technologies, Chemicals, Nutrition and care, and Agricultural Solutions. The company's products are used in agriculture, construction, pharmaceuticals, energy and power, home care and nutrition, automotive and transportation, rubber and plastics, leather and textiles, and personal care and hygiene industries. The company has over 355 manufacturing facilities in over 90 countries and regions, including Europe, Asia Pacific, North America, Central America, South America, the Middle East, and Africa. BASF has a presence in 93 countries and operates 234 production sites worldwide.

-

Keraplast is a leading biotechnology company dedicated to developing keratin protein technology. The company has created a process that preserves the natural properties of keratin, allowing clients to harness the benefits of authentic keratin protein across various fields, including hair care, wound care, skincare, and nutrition.

Key Keratin Companies:

The following are the leading companies in the keratin market. These companies collectively hold the largest market share and dictate industry trends.

- Proteina

- Hefei TNJ Chemical Industry Co., Ltd.

- Rejuvenol

- Scherdiva

- Keratin Express

- Keraplast

- NutriScience Innovations LLC

- Guangzhou FONCIU Cosmetics Limited

- Shaanxi Qinland Bio-Tech Co., Ltd.

- Wellgreen Technology Co., Ltd.

- Greentech Biochemicals Co., Limited.

- MakingCosmetics Inc.

- Kerline Srl

- Active Concepts LLC

- BASF SE

Recent Developments

-

In March 2024, Keraplast Technologies, a prominent keratin market player, announced plans to expand its operations into new regions, explicitly targeting Europe and the Asia-Pacific. This strategic initiative aims to enhance the company’s market presence and capitalize on the increasing global demand for keratin-based products. By entering these dynamic markets, Keraplast seeks to take advantage of growth opportunities and meet evolving consumer preferences.

-

In April 2024, Unilever, a significant player in the keratin industry, recently launched a new line of hair care products featuring keratin as a key ingredient. This launch is part of Unilever's strategy to diversify its product offerings and meet consumer demand for effective, natural hair care solutions. By introducing keratin-infused products, the company aims to improve hair health and attract a broader range of customers.

Keratin Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,761.7 million

Revenue forecast in 2030

USD 2,404.4 million

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Tons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, Application by Source, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Proteina; Hefei TNJ Chemical Industry Co., Ltd.; Rejuvenol; Scherdiva; Keratin Express; Keraplast; NutriScience Innovations LLC; Guangzhou FONCIU Cosmetics Limited; Shaanxi Qinland Bio-Tech Co., Ltd.; Wellgreen Technology Co., Ltd.; Greentech Biochemicals Co., Limited.; MakingCosmetics Inc.; Kerline Srl; Active Concepts LLC; BASF SE.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Keratin Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global keratin market report by product, application by source, and region.

-

Product Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Hydrolyzed

-

Other Products

-

-

Application by source Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Personal Care & Cosmetics

-

Animal

-

Plant

-

-

Healthcare & Pharmaceuticals

-

Animal

-

Plant

-

-

Food & Beverage

-

Animal

-

Plant

-

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The Global keratin market size was valued at USD 1660.1 million in 2024 and is expected to reach USD 1761.7 million in 2025

b. The global keratin market is projected to grow at a compound annual growth rate (CAGR) of 6.4% in terms of revenue from 2025 to 2030 and reach USD 2404.4 million by 2030.

b. Personal Care & Cosmetic Market accounted for the major share of 45.4% in the market by revenue in 2024 owing to the increasing demand for Keratin from personal care & cosmetic market. . This is attributed to factors such as rising consumption of personal care & cosmetic products that offer added nutrition to skin and hair is anticipated to lead to an increased demand for keratin in the coming years.

b. Some prominent players in the keratin market include Hefei TNJ Chemical Industry Co. Ltd., BASF SE, Active Concepts LLC., Parchem Fine & Specialty Chemicals and others.

b. The global keratin market anticipated to witness a significant growth over the forecast years. Increasing consumption of keratin in personal care & cosmetic industry is a major factor driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.