- Home

- »

- Clothing, Footwear & Accessories

- »

-

Kids Footwear Market Size & Share, Industry Report, 2030GVR Report cover

![Kids Footwear Market Size, Share & Trends Report]()

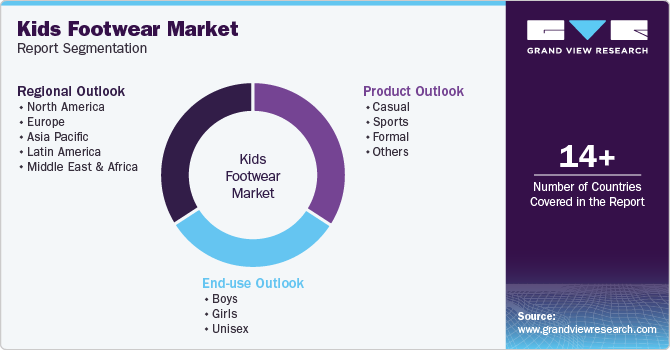

Kids Footwear Market Size, Share & Trends Analysis Report By Product (Casual, Sports, Formal), By End-use (Boys, Girls, Unisex), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-405-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Kids Footwear Market Size & Trends

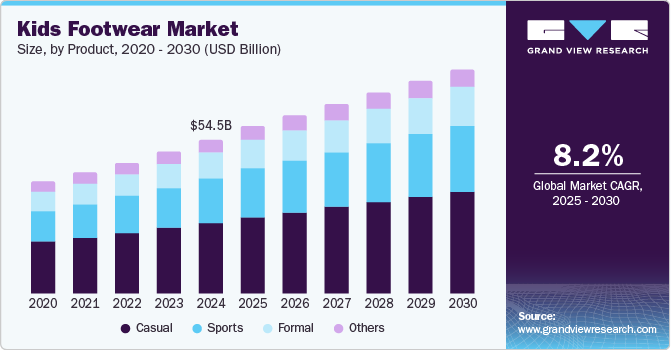

The global kids footwear market size was valued at USD 54.49 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. Factors such as faster physical growth of children, parents’ interest in matching footwear as per their children’s apparel, and kids’ interest in their favorite cartoon character-based footwear are driving the market. Moreover, the demand for smart footwear is increasing among children due to their technical specifications of light and sound, thereby boosting the market's growth.

An increase in the number of product innovations, along with the rise in attractive footwear easily affordable by parents according to the child’s desire, fuels the growth of the global market. Parents look for more attractive pairs of shoes in the market than branded and durable ones, as children need a pair of shoes about every three to four months for faster physical growth. Moreover, marketing and promotional activities by the stores, along with attractive functionality such as light and sound in the baby footwear, attract a large number of consumers in the industry.

Social media influences, growing children's exposure to various social settings, including schools, school buses, tuitions, family homes, hostels, and housing societies, and increasing peer contacts also contribute to the kids' footwear market growth. This includes changing and specific preferences of kids and parents regarding sizes, shapes, theme-based footwear, category-specific products such as sports, colors, brands, products endorsed by sports celebrities or entertainment industry participants, features, materials used, and more.

In addition, fashion trends and a new range of offerings introduced by the key companies drive the market dynamics. Prices, the use of sustainable materials, the addition of valuable product features, the launch of limited editions, the introduction of theme-based product ranges, and event-driven products also influence the growth of this market. Furthermore, effective distribution strategies adopted by the major market players, availability of kids' footwear products through online portals, e-commerce websites, quick-commerce applications, and other distribution settings, and strategic partnerships initiated by multiple brands to attract greater attention projected to drive the growth of this market in approaching years. For instance, in September 2024, Nike, Inc., one of the prominent companies in the sports and utilities industry, announced that starting in 2025, the company is partnering with The LEGO Group, a major manufacturer of play materials for kids, to launch co-branded products and experiences.

Product Insights

Based on products, the casuals segment dominated the market with a revenue share of 46.4% in 2024. The casual footwear includes sneakers, espadrilles, loafers, boat shoes, sandals, and more. Shifting consumer preferences and more demand for casual looks, printed shoes, and products developed with trendy fashions are driving the growth of this segment. Variety, ease of use, convenience and ease of availability, online presence, and durability are other factors that influence the development of this segment.

The sports footwear segment is expected to experience the fastest CAGR of 9.1% from 2025 to 2030. This is attributed to increasing participation in sports and outdoor activities, growing awareness regarding the importance of regular physical activities and fitness regimes for kids, increasing encouragement from governments and educational institutes for participation in different sorts of sports, increasing availability through online shopping portals, accessibility to a wide range of products delivered by key companies, and inclusion of kids footwear category by major brands operating in sports and accessories industry.

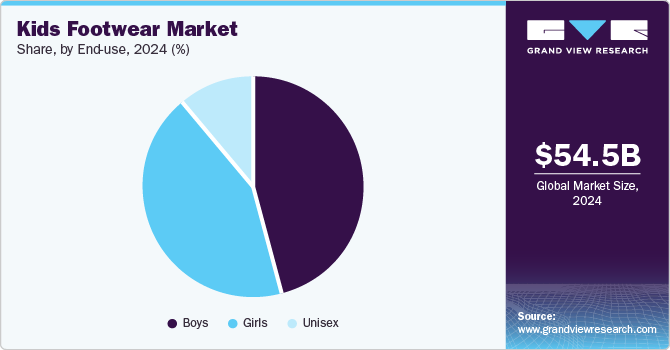

End-use Insights

The boy's end use segment held the largest revenue share in 2024. This is attributed to growing spending, increased participation in sports and other outdoor activities, the extraordinary variety of products available in this category, enhanced accessibility through online portals, and more.

The girl's segment is expected to experience the fastest CAGR during the forecast period. Key companies' launches of dedicated collections, increasing demand for a variety of footwear products specially designed for different purposes, growing girls' participation in outdoor activities and sporting events, and the availability of various footwear products through online portals are expected to propel the market growth in the coming years.

Regional Insights

North America dominated the global kids' footwear industry, with a revenue share of 33.0% in 2024. The presence of multiple manufacturers, large networks of hypermarkets and supermarkets that feature a range of kids' footwear products, increased alternatives available in the market, growing demand for sustainably developed kids' footwear products, and growing disposable income levels are fueling demand in this market.

U.S. Kids Footwear Market Trends

The U.S. kid's footwear market held a 73.0% revenue share of the regional industry in 2024. This market is primarily driven by the robust fashion and accessories industry, growth experienced by the e-commerce industry, key companies' increasing focus on enhancing customer experience through portfolio expansion and effective distribution strategies, improved marketing efforts initiated by the major market participants, and the inclusion of customer-friendly and sustainable materials.

Europe Kids Footwear Market Trends

Europe was identified as one of the most lucrative regions in 2024. The presence of multiple manufacturers in the region across various locations, increasing innovation and adoption of sustainability practices, growing focus of companies on delivering contextual fashion trends, increasing availability through online platforms are contributing to the growth of this regional industry.

Asia Pacific Kids Footwear Market Trends

The Asia Pacific kids' footwear industry is projected to experience the fastest CAGR of 9.5% from 2025 to 2030. The increasing population, the entry of global companies into the regional market, the enhancement of penetration of e-commerce and quick-commerce industry, growth in personal disposable income, and new products launched by global brands are some of the key growth driving factors for this market.

China held the largest revenue share of the Asia Pacific kid's footwear industry in 2024. This is attributed to the presence of multiple manufacturers in the domestic market, the availability of various products launched by global brands in the country, the growth experienced by e-commerce businesses, and enhanced accessibility through hypermarkets and supermarkets.

Key Kids Footwear Company Insights

Some of the key companies operating in the global kids footwear market are Nike, Inc., Crocs, The Children's Place, See Kai Run, SKECHERS USA, Inc., and others.

-

Nike Inc., one of the prominent brands in the sports apparel and footwear industry, offers a wide range of products, including clothing, footwear, performance essentials, accessories, equipment, and more. It entails a diverse portfolio of products designed and delivered for kids aged 0 to 14, including shoes, slides, and sandals.

Key Kids Footwear Companies:

The following are the leading companies in the kids footwear market. These companies collectively hold the largest market share and dictate industry trends.

- Nike, Inc.

- The Children's Place

- Crocs Retail, LLC

- Stride Rite

- New Balance

- See Kai Run

- Puma SE

- ASICS Corporation

- SKECHERS USA, Inc.

- adidas AG

Recent Developments

-

In August 2024, Munro Footwear Group, a major participant in the retail, e-commerce, and wholesale footwear industry in Australia and New Zealand, announced that it acquired The Trybe, a retailer specializing in kids' footwear, strengthening its positioning in the kids' footwear market.

-

In April 2024, Nike Inc., one of the prominent global sports apparel and footwear companies launched 'The Day One,' a newly designed product specifically for kids. The addition was initiated through the company's Nike SB brand, which offers products and accessories for skateboarding.

Kids Footwear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.17 billion

Revenue forecast in 2030

USD 79.11 billion

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, Brazil, South Africa

Key companies profiled

Nike, Inc.; The Children's Place; Crocs Retail, LLC; Stride Rite; New Balance; See Kai Run; Puma SE; ASICS Corporation; SKECHERS USA, Inc.; adidas AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kids Footwear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global kids footwear market report based on product, end-use and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Casual

-

Sports

-

Formal

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Boys

-

Girls

-

Unisex

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."