- Home

- »

- Next Generation Technologies

- »

-

Know Your Customer Software Market Analysis Report, 2030GVR Report cover

![Know Your Customer Software Market Size, Share & Trends Report]()

Know Your Customer Software Market (2022 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-002-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Know Your Customer Software Market Summary

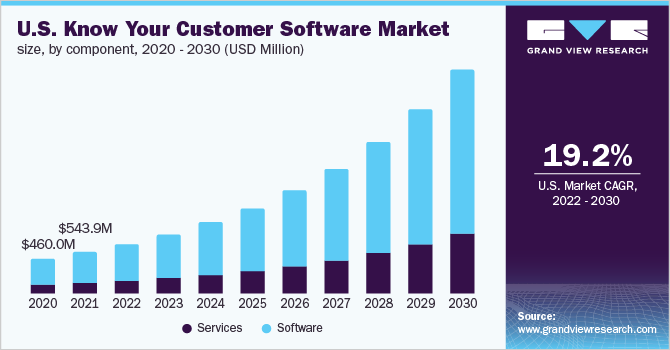

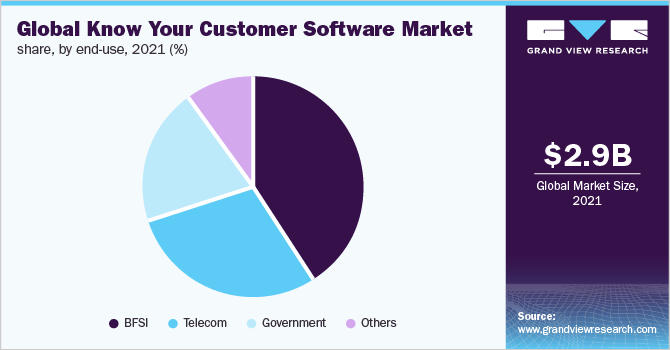

The global know your customer software market size was estimated at USD 2.93 billion in 2021 and is projected to reach USD 15.81 billion by 2030, growing at a CAGR of 20.8% from 2022 to 2030. The growth of the market can be attributed to the growing importance of compliance management and the rising number of identity-related frauds in financial institutions.

Key Market Trends & Insights

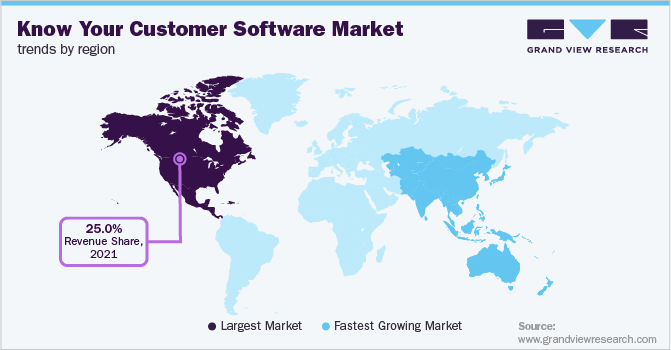

- North America dominated the market and accounted for more than 25.0% share of the global revenue in 2021.

- Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period.

- By component, the software segment accounted for the largest share of more than 70.0% in 2021.

- By deployment, the cloud segment accounted for the largest share of more than 55.0% in 2021.

- By enterprise size, the large enterprises segment accounted for a dominant share of more than 65.0% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 2.93 Billion

- 2030 Projected Market Size: USD 15.81 Billion

- CAGR (2022-2030): 20.8%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

At the same time, stringent government regulations to prevent financial fraud and money laundering by using know your customer (KYC) applications are driving the market. Additionally, the use of evolving technologies such as machine learning, Artificial Intelligence (AI), and biometrics for face recognition is supporting the growth of the KYC software market. Financial institutions worldwide are focusing on adopting KYC solutions to verify the customer efficiently.

Moreover, prominent players across the globe are focusing on making efforts to expand in the increasingly competitive market. For instance, in October 2021, SentiLink Corp., an identity verification solution provider, announced that it expanded its services, including new KYC products, as a compliment to its Synthetic Fraud and ID Theft Scores. The new KYC product allowed financial institutions to access the customer identity efficiently at the time of account opening.

Development in cloud technology and services has broadened its applications in the financial industry. The banking sector across the globe is focusing on leveraging cloud-based services to increase flexibility in customer identification and meet changing customer demands. Cloud technology helps the banking sector to remotely use KYC software such as video KYC for better customer verification. At the same time, the KYC software also allows banks to authenticate their clients and staff by running checks through their reliable information and documents, thereby reducing the compliance and fraud risks.

Biometric authentication is also gaining more popularity in performing electronic KYC checks in financial institutions. Governments and financial institutions worldwide are increasingly adopting biometric authentication for electronic KYC checks. For instance, from 2017, the Monetary Authority of Singapore (MAS) allowed financial institutions to adopt facial recognition to verify customer details efficiently. Such government initiatives are expected to create more lucrative opportunities for the market over the forecast period.

The rising technological advancements in KYC software are also a significant factor driving the market. KYC software uses technologies such as digital footprint analysis, AI and machine learning, biometrics, real-time video, and live verification for better identification. Digital footprint analysis proves the user's existence by assessing the user's behavior, web history, and online presence to verify their authenticity. However, technical glitches and a lack of awareness in developing economies are expected to hinder the growth of the market over the coming years.

COVID-19 Impact Analysis

The COVID-19 pandemic played a significant role in driving the KYC software market over the forecast period. Restrictions on the movement of the people and the spreading of contamination due to the pandemic trigged banks and financial institutions worldwide to adopt electronic verification for KYC checks. At the same time, growth in online processes such as online payments and online onboarding made it essential for various end-users such as banks, telecom companies, and financial institutions to shift towards electronic KYC solutions. Furthermore, several vendors started adopting cloud-based KYC solutions to ensure a safe and secure check of customer documents remotely.

Component Insights

The software segment accounted for the largest share of more than 70.0% in 2021. The rapid deployment of KYC software across banks and financial institutions to verify and improve customer identification to prevent fraud is a major factor driving the segment. Major market players are focusing on developing automated KYC soft wares to simplify the KYC review processes. For instance, in October 2022, Fenergo, a KYC solution provider, announced the launch of the Fenergo Smart Review, a KYC solution to streamline and simplify the KYC review processes and reduce prices through automation. Such factors are expected to create lucrative growth opportunities for the segment over the forecast period.

The services segment is anticipated to register the highest CAGR over the forecast period. The ability of KYC software services to help banks and other financial institutions improve operational efficiency is a major factor fueling segment growth. Professional and managed services support banks and financial institutions in managing the software requirements to maintain and improve the KYC processes. Additionally, services for KYC help to maintain and enhance multiple verification tools such as document verification, ID check, and biometric scanning, which make customer identification more efficient.

Deployment Insights

The cloud segment accounted for the largest share of more than 55.0% in 2021. Growing adoption of cloud-based KYC solutions among banks and financial institutions is a major factor driving the segment. Market players are also focusing on developing cloud-based KYC solutions to reduce fraud. For instance, in September 2021, ComplyCube, an identity verification company, launched Flow, a cloud-based KYC solution that helps businesses to reduce KYC/AML compliance and fraud risks significantly. Such factors bode well for the growth of the segment over the coming years.

The on-premise segment is anticipated to register a significant CAGR over the forecast period. The ability of the on-premise KYC software to verify and store the customer data on the organizations’ premises is a significant factor driving the segment. On-premise solutions help financial institutions to verify the customer’s data at the company's site more easily. Additionally, KYC solutions maintain better privacy of the customer data with improved operational efficiency. Such factors prompt enterprises to adopt on-premises KYC software to maintain customer data and prevent fraudulent activities.

Enterprise Size Insights

The large enterprises segment accounted for a dominant share of more than 65.0% in 2021. The demand for KYC software solutions is rising among large enterprises as these enterprises are more focused on identifying fraudulent activities. Large enterprises are striking partnerships with technology firms to transform their KYC processes digitally. For instance, in January 2022, PassFort, an analytics firm, announced its partnership with Trulioo, an identification company, to provide regulated businesses with digital KYC processes. Through this partnership, Trulioo would offer accurate data that is needed to satisfy the KYC processes.

The small and medium enterprises segment is anticipated to register a significant CAGR over the forecast period. Small and medium enterprises are rapidly digitizing their services to provide a better customer experience. Numerous companies across the globe are forming KYC development teams to help small and medium-scale banks simplify their KYC process. For instance, in July 2022, Encompass Corporation, a KYC solution provider, introduced a KYC implementation team to help banks implement the KYC processes and digital onboarding. Moreover, small and medium enterprises are focusing on developing video-based KYC solutions so that customer identification can be done remotely at a faster rate.

End-use Insights

The BFSI segment led the market and accounted for more than 40.0% share of the global revenue in 2021. The segment growth can be attributed to a rise in the number of online payment activities through various banks and financial institutions across the globe. Customers need to do KYC checks to use online payment platforms for making online payment transactions. Banks and financial institutions are adopting numerous innovative technologies, such as AI and cloud computing, to expand their presence in the market. Moreover, banks understand the benefits of video-based KYC solutions, which include increased revenue, reduced KYC process time, and improved operational efficiency.

The telecom segment is anticipated to register a lucrative CAGR over the forecast period. KYC checks are rapidly gaining popularity throughout the telecom industry to prevent frauds. Telecom businesses across the globe have started adopting cutting-edge technologies to eradicate the illegal problems faced by the companies. Telecom businesses have started using digital KYC solutions to eliminate paper-based procedures, thereby reducing the time and cost spent on verification. Moreover, telecom companies are adopting electronic KYC solutions for customer on-boarding and to reach potential customers remotely.

Regional Insights

North America dominated the market and accounted for more than 25.0% share of the global revenue in 2021. The presence of major market players such as Truth Technologies, Inc.; Pegasystems Inc.; and Experian Information Solutions, Inc. is a major factor facilitating the regional growth. The rising adoption of automated KYC solutions among banks and financial institutions to offer customers with convenient verification process is expected to create more growth opportunities for KYC providers in the region, which, in turn, is boosting the growth. Additionally, the growing preference for digitization is expected to drive the demand for innovative solutions from banks, retail, and other financial institutions. Such factors are anticipated to boost regional growth over the forecast period.

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The regional growth can be attributed to the rising awareness regarding KYC solutions in emerging economies such as India and Japan. At the same time, stringent regulations made by the government to follow customer identity practices are expected to fuel regional growth. For instance, as per the University of Cambridge Judge Business School, 66% of the Jurisdictions in APAC have some time of electronic KYC framework. Such regulations are anticipated to drive the regional market over the forecast period.

Key Companies & Market Share Insights

Major players have developed novel concepts and ideas, improved solution offering techniques, upgraded the current set of products, and enhanced their profitability to sustain the intense competition. KYC solution providers have adopted new product development as their key development strategy to cater to the increasing demand of end-users. Additionally, they have obtained approvals to launch their products across various countries. For instance, in August 2021, Kroll, a digital technology provider, launched Kroll Business to enhance the on-boarding efficiency and KYC checks.

Expansions are the new strategies adopted by the market players to expand their KYC offerings and enhance their processes. This has helped businesses to develop efficient products across different geographies. Moreover, companies are developing video-based KYC solutions to collect details through live video. For instance, in June 2022, IDfy, a KYC solution provider, launched Video KYC to help the service entities collect the user’s information through live video and reduce the cost by 90%. Some prominent players in the global know your customer software market include:

-

WWW.KYCPORTAL.COM

-

Fenergo

-

Truth Technologies, Inc.

-

Trulioo

-

Equiniti

-

ACTICO GmbH

-

Pegasystems Inc.

-

Experian Information Solutions, Inc.

-

Acuant, Inc.

-

LexisNexis Risk Solutions Group

Know Your Customer Software Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.49 billion

Revenue forecast in 2030

USD 15.81 billion

Growth rate

CAGR of 20.8% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Mexico; UAE; Saudi Arabia

Key companies profiled

WWW.KYCPORTAL.COM; Fenergo;

Truth Technologies, Inc; Trulioo; Equiniti; ACTICO GmbH; Pegasystems Inc.; Experian Information Solutions, Inc.; Acuant, Inc.; LexisNexis Risk Solutions Group

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Know Your Customer Software Market Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global know your customer software market report based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

Managed Services

-

Professional Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Banks

-

Insurance Companies

-

Financial Service Provider

-

-

Telecom

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global know your customer software market size was estimated at USD 2.93 billion in 2021 and is expected to reach USD 3.49 billion in 2022.

b. The global know your customer software market is expected to grow at a compound annual growth rate of 20.8% from 2022 to 2030 to reach USD 15.81 billion by 2030.

b. North America dominated the know your customer software market with a share of 28.47% in 2021. This is attributable to the presence of prominent market players in the region.

b. Some key players operating in the KYC software market include WWW.KYCPORTAL.COM, Fenergo, Truth Technologies, Inc, Trulioo, Equiniti, ACTICO GmbH, Pegasystems Inc., Experian Information Solutions, Inc., Acuant, Inc., LexisNexis Risk Solutions Group

b. Key factors driving the know your customer software market can be attributed to the growing importance of compliance management and the rising number of identity-related frauds in financial institutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.