- Home

- »

- Disinfectants & Preservatives

- »

-

Korea Industrial And Institutional Cleaning Chemicals Market Report 2030GVR Report cover

![Korea Industrial And Institutional Cleaning Chemicals Market Size, Share & Trends Report]()

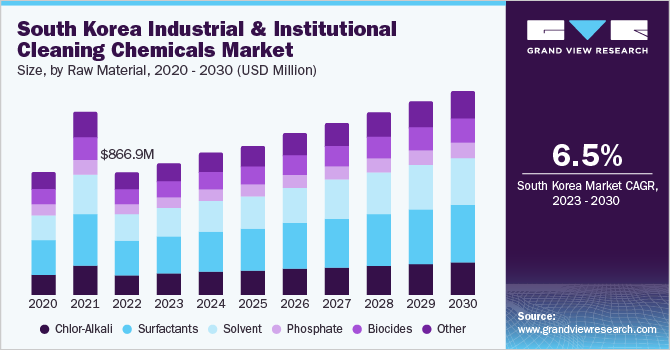

Korea Industrial And Institutional Cleaning Chemicals Market Size, Share & Trends Analysis Report By Raw Material (Chlor-Alkali, Surfactants, Solvent, Phosphate, Biocides), By Product, By End-use, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-108-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

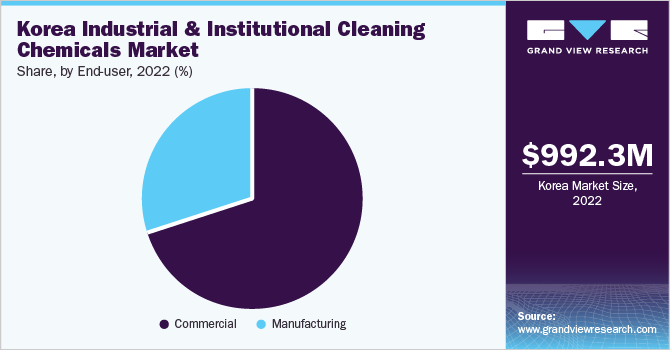

The Korea industrial and institutional cleaning chemicals market size was estimated at USD 992.3 million in 2022 and is anticipated to grow at a compounded annual growth rate (CAGR) of 6.3% from 2023 to 2030. The growth is attributed to the rising demand for cleaning products such as cleaners, sanitizers, and disinfectants in the commercial as well as manufacturing sectors in Korea. Rapid urbanization and growing consumer awareness regarding preventive healthcare have enabled consumers to spend more on general-purpose cleaning products. Furthermore, increasing literacy rates and rising awareness among consumers regarding workplace hygiene have augmented the penetration of institutional cleaning chemicals. Additionally, the high prevalence of diseases in the Asia Pacific region is another factor driving the market growth.

According to the Korean National Healthcare-associated Infections Surveillance System, the region has a prevalence of various types of infections such as urinary catheter-associated infections, central line-associated infections, and ventilator-associated infections with urinary catheter-associated accounting for the highest number of cases. This has led to the increased adoption of cleaning products in healthcare settings. Thus, the rising hygiene standards in the healthcare sector are expected to have a positive impact on the demand for the product market in the region over the forecast period.

South Korea emerged as the largest consumer of the product in Korea. This is attributed to the advancing demand for the product in the commercial and manufacturing sectors in the country. Moreover, the outbreak of diseases or pandemics, such as COVID-19, has significantly impacted the demand for cleaning chemicals. In response to health concerns, businesses and institutions have increased their cleaning and disinfection protocols, resulting in higher demand for cleaning products.

Raw Material Insights

Surfactants in the raw material segment dominated the market with a revenue share of 28.0% in 2022. This growth is attributed to the fact that they are highly effective at removing dirt and other substances from surfaces. Surfactants work by reducing the surface tension between two substances, allowing them to mix more easily. This makes it easier for cleaning solutions to penetrate and remove dirt, oil, and other substances from the surface being cleaned.

Non-ionic surfactants among other surfactants emerged as the major raw material in the manufacturing of the product. This is attributed to the fact that they are typically gentle on surfaces and can be used on a wide variety of materials, making them a popular choice for cleaning products used in industrial and institutional settings. On the other hand, anionic surfactants are often more effective at removing dirt and stains from surfaces, making them a common ingredient in laundry detergents and carpet cleaners.

Biocides is another segment anticipated to witness growth over the forecast period. High-performance biocides are preferred for hard surface cleaning as well as in a range of deep-cleaning applications across the industrial sector. Biocides including non-oxidizing and oxidizing deliver superior performance in water system controls and therefore, are largely used in water treatment applications to control microbial activities. Furthermore, with the advancement in technology and constant innovations by key chemical manufacturers, biocide-treated surfaces are now commonly found, which comprise active ingredients such as metallic ions and triclosan.

Product Insights

General purpose cleaners in the product segment dominated the Korea industrial & institutional cleaning chemicals market with a revenue share of 34.3% in 2022. This is attributed to the growing awareness about the importance of cleanliness and hygiene, increasing utilization of these chemicals across various industries, and the availability of a wide range of cleaning products. General purpose cleaners, also known as all-purpose cleaners, comprise a combination of solvents, surfactants, and chelants or either of these ingredients. They are broadly utilized to remove soil and greasy stains from hard floor surfaces. The presence of disinfectants in these cleaning products provides the ability to ensure surface disinfection by reducing microbial activity on surfaces and killing bacteria and viruses.

Laundry care products is another segment anticipated to witness significant growth over the forecast period. The demand for fabric care products and laundry care chemicals has been increasing significantly in Korea in the past decades. Multinationals in Korea, such as Croda International, Henkel AG, and BASF SE, are expanding their product portfolios for essential laundry care detergents, disinfectants, baking soda products, oxygen bleach, and distilled white vinegar, which are the essential ingredients in the laundry detergent industry. With consumer awareness regarding valuing their apparel purchases and maintenance, the demand for laundry detergents and detergent additives has increased extensively.

The majority of the brands are focusing on developing premium high-performance products for applications in front load or top load washers to capture domestic as well as commercial market space across the country. Increasing innovations in terms of product development coupled with the constant demand for various laundry care products from customers are anticipated to reflect steady demand for the product over the forecast period.

End-use Insights

The commercial segment dominated the market with a revenue share of 69.6% in 2022. This is attributed to the fact that the application of the product in the commercial sector largely comprises foodservice, healthcare, laundry care, retail, various institutional buildings, and more. The demand for various cleaning chemicals is persistent across these industries. Departmental stores, high retail stores, and various public institutions such as schools, colleges, recreational spaces, courts, and more demand all-purpose cleaners as well as a variety of disinfectants and sanitizing products. Furthermore, the healthcare sector highly demands sanitizers for various equipment and bulk quantities of disinfectant products to ensure all-around hygiene.

Healthcare in the commercial end-use segment dominated the market with a revenue share of 34.3% in 2022. This is attributed to the importance of maintaining a sterile environment to prevent the spread of diseases and infections in the healthcare industry. The use of cleaning chemicals is vital to prevent the spread of infections among patients, visitors, and healthcare workers. Hospitals, nursing homes, and other healthcare environments require frequent cleaning to minimize the risk of infection, and the use of industrial & institutional cleaning chemicals is essential to maintaining safety and reducing the risk of cross-contamination.

The manufacturing end-use segment is also anticipated to witness significant growth over the forecast period. This is attributed to the growing usage of the product in the food & beverage processing industry. These cleaning chemicals are specifically formulated to clean and sanitize the surfaces and equipment used during food and beverage manufacturing processes. Moreover, food and beverage processing plants require strict hygiene standards to prevent the contamination of products, which could lead to health problems for consumers. Cross-contamination and the spread of harmful bacteria and viruses are possible within the processing plant. Therefore, high-quality products are critical in ensuring that these facilities maintain optimal hygiene standards.

Country Insights

South Korea emerged as the major consumer of the product in Korea with a revenue share of 87.4% in 2022. This is attributed to the fact that the country relies on imports to meet its fossil fuel consumption because of insufficient domestic resources. However, the manufacturing sector has driven the country’s economic development. The country’s growing automotive, steel, and electronic sectors majorly employ the population. Therefore, industrial cleaning and maintenance are done on a high scale.

North Korea is also anticipated to witness growth over the forecast period. Due to the country’s isolation from global markets, its ability to engage in significant international trade and investment in the chemical sector may be restricted. Moreover, the country operates under a centrally planned economy, where the government controls most economic activities, including the chemical industry. The government's emphasis on self-sufficiency has influenced the development and organization of the chemical sector further affecting the growth of the product market in the country.

Key Companies & Market Share Insights

The Korea I&I cleaning chemicals market is fragmented with the presence of local and global players in the market with global players accounting for the majority of the market share. Key players include BASF SE, Procter & Gamble, 3M, and Eastman Chemical Corporation. The players are investing in innovation, product launches, and mergers and acquisitions to improve their market share and gain a competitive edge. For instance, in July 2023, Croda International Plc announced the acquisition of Solus Biotech, a global leader in premium, biotechnology-derived active ingredients for pharmaceuticals and beauty care for USD 232 million. Some prominent players in the Korea industrial and institutional cleaning chemicals market include:

-

3M

-

BASF SE

-

Procter & Gamble

-

The Clorox Company

-

Reckitt Benckiser Group Plc

-

Croda International Plc

-

Eastman Chemical Corporation

-

Huntsman International LLC

-

Solvay

-

Dow

-

Sasol

-

DDC Dolphin Ltd.

-

Kook Je Industry

-

Fireball

-

Luminus KOREA

-

ISU Chemical

Korea Industrial And Institutional Cleaning Chemicals Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.61 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, end-use, country

Regional scope

Korea

Country scope

South Korea; North Korea

Key companies profiled

3M; BASF SE; Procter & Gamble; The Clorox Company; Reckitt Benckiser Group Plc; Croda International Plc; Eastman Chemical Corporation; Huntsman International LLC; Solvay; Dow; Sasol; DDC Dolphin Ltd.; Kook Je Industry; Fireball; Luminus KOREA; ISU Chemical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Korea Industrial And Institutional Cleaning Chemicals Market Segmentation

This report forecasts revenue & volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Korea industrial and institutional cleaning chemicals market report based on raw material, product, end-use, and country:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Chlor-Alkali

-

Caustic Soda

-

Chlorine

-

Soda Ash

-

-

Surfactants

-

Non-Ionic

-

Cationic

-

Amphoteric

-

Anionic

-

-

Solvent

-

Alcohols

-

Hydrocarbons

-

Chlorinated

-

Ethers

-

Others

-

-

Phosphate

-

Biocides

-

Other

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

General Purpose Cleaners

-

Disinfectants & Sanitizers

-

Laundry Care Products

-

Vehicle Wash Products

-

Commercial Vehicles

-

Private Vehicles

-

-

Other Products

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Food Service

-

Retail

-

Healthcare

-

Laundry Care

-

Institutional Buildings

-

Other Commercial End-Uses

-

-

Manufacturing

-

Food & Beverage Processing

-

Metal Manufacturing & Fabrication

-

Electronic Components

-

Other Manufacturing End-Uses

-

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

South Korea

-

North Korea

-

Frequently Asked Questions About This Report

b. Korea industrial & institutional cleaning chemicals market was estimated at USD 992.3 million in 2022

b. Korea industrial & institutional cleaning chemicals market is anticipated to grow at a notable CAGR of 6.3%.

b. The commercial end-use of the industrial & institutional cleaning chemicals accounted for the 69.6% share in the market. This growth rate can be attributed to its high demand from healthcare, food service, and institutional buildings among others.

b. Some of the prominent players in the industry include: • 3M • BASF SE • Procter & Gamble • The Clorox Company • Reckitt Benckiser Group Plc

b. The growth is attributed to rising demand for cleaning products such as cleaners, sanitizers, and disinfectants in commercial as well as manufacturing sectors worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."