- Home

- »

- Medical Devices

- »

-

Kyphoplasty Market Size, Share And Growth Report, 2030GVR Report cover

![Kyphoplasty Market Size, Share & Trends Report]()

Kyphoplasty Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Balloon Catheters, Bone Access Devices), By Application, By Indication, By End-use (Hospitals & Clinics, Ambulatory Surgical Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-942-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

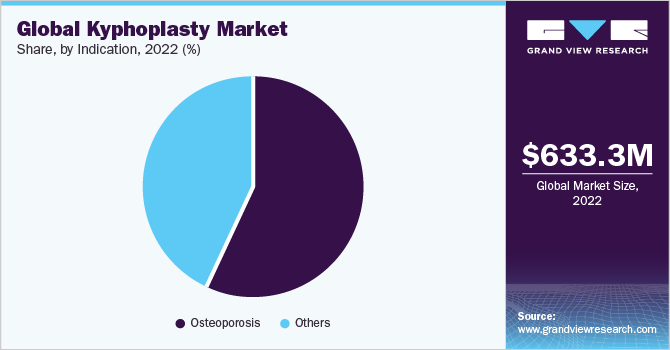

The global kyphoplasty market size was estimated at USD 633.3 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The rising base of the elderly population and the increasing prevalence of osteoporosis drive the market growth. According to the International Osteoporosis Foundation, it is expected that 1 in 5 men and 1 in 3 women over the age of 50 will experience osteoporosis fractures in their remaining years, globally. Vertebral compression fractures left untreated can have serious clinical consequences and significantly impact the quality of life of patients and caregivers. Since non-surgical management of these fractures has limited effectiveness, kyphoplasty procedures are gaining acceptance in medical practice for fracture stabilization and pain control.

According to the National Library of Medicine, between 1 and 1.5 million VCFs will occur annually in the US alone. When adjusted for factors such as age and sex, 25% of women above 50 years older experience at least one VCF. Furthermore, 40% to 50% of people over 80 are believed to have experienced a VCF, acutely or incidentally, while receiving treatment for another health condition. Vertebral augmentation procedures, such as balloon kyphoplasty, have reduced mortality by up to 55% compared to non-surgical management.

COVID-19 spread all over the globe and has met the epidemiologic criteria to be defined as a pandemic. In this alarming situation, standard medical practices were markedly affected, prioritizing the treatment of Coronavirus patients. In April 2020, the North American Spine Society (NASS) published a comprehensive guidance document encompassing clinical considerations and recommendations for surgeries and procedures falling under emergent, urgent, and elective categories.

Non-urgent elective surgeries were annulled. For instance, as per a study published in the Asian Spine Journal, surgical procedures decreased by approximately 50% in the first month of confinement in France compared to the same period in 2019 (March 2020 to April 2020). The pandemic is estimated to have a modest impact on the market in the short term. Once the impact decreases, acceptance of innovative devices and the ongoing expansion of dedicated infrastructure for spinal interventions will drive strong growth throughout the forecast period.

Innovations and the development of new technologies, based on research activities undertaken by manufacturers, are driving the market’s growth. For instance, in October 2021, Stryker set up an R&D lab in Australia (Queensland), which builds on the existing partnerships with researchers, hospitals, universities, and local governments, to drive the transformation of research into practical, commercially accessible precision medical device technology. This innovative R&D Lab will also associate with the company’s CMF instruments and endoscopy, medical, joint replacement, spine, & trauma, and extremities divisions to focus on research that drives technology platforms that can be used across facility lines over the upcoming years.

The kyphoplasty procedure can reduce pain while improving mobility and alignment. It, along with reduced dependence on opioid pain medication, can significantly enhance the overall quality of life. Kyphoplasty has the advantage of improving or restoring vertebral body height and mechanical alignment at the fracture site. The kyphosis and height loss related to compression fractures can lead to reduced pulmonary capacity and poor quality of life. Kyphoplasty procedures are safe, proven, and minimally invasive techniques. They provide relief from pain and fracture stabilization for individuals.

The balloon kyphoplasty procedure has been used for over two decades, treating over one million fractures. Clinical studies have demonstrated that balloon kyphoplasty, compared to non-surgical procedures, effectively restores vertebral body height and ameliorates vertebral body deformity. Besides, improved mobility, quality of life, and ability to do everyday activities reduced back pain, making this procedure more advantageous and supporting market growth.

So far, a comprehensive range of bone cement has been approved for clinical applications, and many have been used for balloon kyphoplasty procedures. New technical improvements in the development of balloon kyphoplasty cement rely on innovative concepts and interdisciplinary knowledge. With the advent of novel biodegradable and mechanically matched bone cement, the balloon kyphoplasty indications will likely be broadened, thus supporting segment growth. The preference for less invasive procedures has emerged as a key trend in the global kyphoplasty industry.

Moreover, increasing demand for minimally invasive surgical procedures in orthopedics, increasing health expenditure, and improving health reimbursements will likely drive market growth during the forecast period. For instance, in September 2020, The SpineJack implantable fracture reduction system developed by Stryker received the new technology add-on payment from the U.S. Centers for Medicare & Medicaid Services (CMS) as a component of the 2021 inpatient prospective payment system.

An upsurge in spine fractures is also anticipated to fuel the growth of the global kyphoplasty industry. CMS remains focused on enhancing price and information transparency and holding hospitals liable to make fully informed decisions regarding their health care. However, product recalls, such as the Device Recall of KyphX HVR Bone Cement, may hamper the market growth.

Product Insights

The bone access device segment accounted for the largest revenue share in 2022. In 2021, to meet the demand for real-time flow visualization during cement injection for kyphoplasty and vertebroplasty surgeries, IZI Medical Products introduced Vertefix HV cement. The company’s goal with this introduction was to give doctors a better way to monitor and manage cement flow during treatment.

Needles provide control & flexibility in accessing the vertebral body and delivering bone cement during vertebral compression fracture treatments. Globally, the prevalence of spine fractures and back pain is increasing exponentially. Around 2% of American laborers suffer compensable back injuries annually—500,000 cases. Low back pain accounts for 19% of all labor compensation claims in the U.S. Thus, the prevalence of such disease conditions is expected to propel market growth.

The balloon catheters segment is expected to grow at the fastest CAGR during the forecast period, owing to the growing number of technological advancements with the advent of next-generation kyphoplasty balloons, enabling efficient procedures in the market. Besides, new product launch further contributes to market growth. For instance, in January 2020, Merit Medical Systems, Inc. proclaimed the introduction of Arcadia Steerable and Straight Balloons for vertebral augmentation.

Application Insights

The spinal fractures segment held the largest revenue market share in 2022 and is expected to grow at the fastest CAGR over the forecast period due to the high adoption of kyphoplasty procedures for this application. Rising incidences of compressed spine bones due to cancer, and trauma have led to the growth of the market. The bones of people with cancer and older people can break easily with little or no force, increasing the incidences of cases and increasing demand for kyphoplasty procedures.

Compression fractures affect many individuals worldwide. Vertebral compression fractures (VCFs) are the most common fracture in osteoporosis patients, affecting approximately 750,000 people annually. This condition gradually rises as people age, with an estimated 40% of women aged 80 and older affected. Therefore, it supports overall market growth.

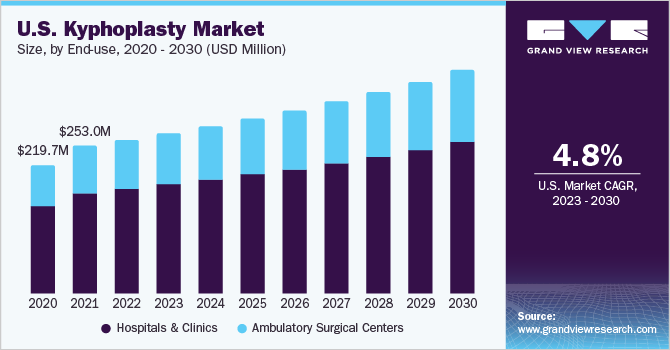

End-Use Insights

The hospital end-use segment held the largest revenue of 68.2% market share in 2022. Hospitals are the primary point of care for all kinds of health problems, so the segment is anticipated to hold the largest market size in the global market. Hospitals are an integral part of the healthcare industry and are the primary revenue source for the entire sector, which drives research and innovation. Consequently, numerous corporations are making significant efforts, both in terms of revenue & marketing strategies, to endorse their product/services in hospitals.

The ambulatory surgical centers (ASC) segment is expected to grow at the fastest CAGR of 5.0% over the forecast period. An ambulatory surgery center offers a convenient substitute to hospitals with the same quality of care at a lower cost to individuals. Increased outpatient admissions can also be attributed to the growing acceptance of technologically advanced techniques in centers, rendering treatment cost-effective and speedier. Innovative surgical methods in such settings allow tests and procedures to be performed without hospital admission. It is expected to support segment growth.

Indication Insights

The osteoporosis segment had the largest revenue share of over 57.2% in 2022. The increasing prevalence of osteoporosis can be attributed to the large market share of the segment over other segments. Osteoporosis is a chronic bone illness characterized by low bone mineral density, reduced bone quality, and an augmented susceptibility to fracture. Based on the findings of the National Osteoporosis Foundation, there is an increased risk for 44 million individuals in the U.S. who have insufficient bone density, and an estimated 10 million Americans are diagnosed with osteoporosis.

Furthermore, approximately 54 million people, constituting half of the adult population aged 50 and above, are at a heightened risk of bone fractures and should prioritize their bone health accordingly. Due to osteoporosis, one in two women and one in four men may break a bone during their lifetime. The prevalence is higher in women than for heart attack, stroke, and breast cancer combined.

The others segment is expected to grow at the fastest CAGR of 5.5% over the forecast period. Kyphoplasty is commonly used in the palliative treatment of metastatic vertebral tumors. From the viewpoint of aging patients in the U.S., kyphoplasty is cost-effective compared to nonsurgical treatment. As per a study published in the National Library of Medicine, the kyphoplasty procedure significantly and rapidly reduced pain intensity in cancer patients with VCFs.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 51.1% in 2022, owing to high awareness levels and improved healthcare infrastructure. The dominance can be attributed to the rising prevalence of osteoporosis, back pain, and spine fractures. This disease has been mostly seen in females compared to men in the region. The surge in the adoption of kyphoplasty and the growing burden of vertebral compression fractures fuel the market growth. Key companies such as Medtronic and Stryker are major revenue contributors, which also undertake acquisitions and partnerships to propel market growth.

Asia Pacific is expected to grow at the fastest CAGR of 6.1% during the forecast period due to the growing patient pool and rising healthcare infrastructure. The increasing older population and growing acceptance of the procedure are aiding the market growth. Similarly, factors such as the availability of advanced methods in fracture stabilization, limitations of the conventional approach, increasing incidence of vertebral compression fracture, rising cases of osteoporosis, improvement in health care infrastructure, and growth in patient compliance because of technological advancements are some of the others key aspects driving Asia Pacific market.

Key Companies & Market Share Insights

The key players are involved in strategies such as new product developments, distribution agreements, and expansion strategies to improve their market penetration. For instance, in August 2020, IZI Medical introduced an Osteo-site Vertebral Balloon for vertebral augmentation. The novel Osteo-site Vertebral Balloon is intended to form a cavity within the vertebral body. This launch helped the company expand its product portfolio. Likewise, in June 2020, Joline GmbH & Co. KG received U.S. FDA approval for Joline Kyphoplasty products to treat vertebral compression fractures. Some prominent players in the global kyphoplasty market include:

-

Stryker

-

Medtronic Inc.

-

Smith & Nephew

-

MicroPort Scientific Corporation

-

DePuy Synthes (Johnson & Johnson Services Inc.)

-

IZI Medical Products

-

CareFusion

-

Merit Medical Systems

-

Joimax GmbH

-

G21 S.r.l.

-

Joline GmbH & Co. KG

-

Seawon Meditech

-

Hensler Surgical Products

-

Taeyeon Medical Co., Ltd.

-

iMEDICOM

-

Jiangsu ChangMei Medtech Co., Ltd

Kyphoplasty MarketReport Scope

Report Attribute

Details

Market size value in 2023

USD 662.7 million

Revenue forecast in 2030

USD 950.8 million

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, indication, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Stryker; Medtronic Inc.; Smith & Nephew; MicroPort Scientific Corporation; DePuy Synthes (Johnson & Johnson Services Inc.); CareFusion; G21 S.r.l.; Merit Medical Systems; joimax GmbH; Joline GmbH & Co. KG; Seawon MediTech; Hensler Surgical Products; Taeyeon Medical Co., Ltd.; iMEDICOM; Merit Medical Systems; Jiangsu ChangMei Medtech Co., Ltd; IZI Medical Products

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kyphoplasty Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kyphoplasty market report based on product, application, indication, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Balloon Catheters

-

Bone Access Devices

-

Cement Application Products

-

Bone Cement

-

Cement Mixing Systems

-

Instruments

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vertebral Alignment Restoration

-

Spinal Fractures

-

Kyphosis

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Osteoporosis

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global kyphoplasty market size was estimated at USD 633.28 million in 2022 and is expected to reach USD 662.7 million in 2023.

b. The global kyphoplasty market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 950.8 million by 2030.

b. North America held more than 50% of the kyphoplasty market in 2022. This is attributable to the rising prevalence of osteoporosis and the high demand for minimally invasive surgeries.

b. Some key players operating in the kyphoplasty market include Stryker Corporation, Medtronic, BMK Global Medical Company, CareFusion, Taeyeon Medical Co., Ltd, DePuy Synthes (Johnson & Johnson Services, Inc.), iMEDICOM, Alphatec Spine, Inc., Osseon LLC, G21 Srl, and Smith + Nephew

b. Key factors driving the kyphoplasty market growth include increasing prevalence of osteoporosis, geriatric population, limitations associated with the traditional techniques, and technological advancements by market participants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.