- Home

- »

- Biotechnology

- »

-

Lab-on-a-Chip Market Size, Share, Industry Report, 2030GVR Report cover

![Lab-on-a-Chip Market Size, Share & Trends Report]()

Lab-on-a-Chip Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service (Reagents & Consumables), By Technology (Microfluidics Technology, Optical Technology), By Application (Clinical Diagnostics), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-533-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lab-on-a-chip Market Summary

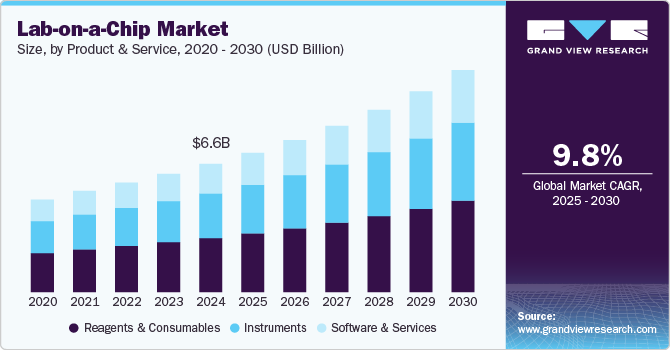

The global lab-on-a-chip market size was estimated at USD 6,614.1 million in 2024 and is projected to reach USD 11,451.1 million by 2030, growing at a CAGR of 9.8% from 2025 to 2030. The increasing demand for lab-on-a-chip technologies for applications in advanced medical and research technologies is driving the market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Canada is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, reagents & consumables accounted for a revenue of USD 3,025.5 million in 2024.

- Software & Services is the most lucrative product & service segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 6,614.1 Million

- 2030 Projected Market Size: USD 11,451.1 Million

- CAGR (2025-2030): 9.8%

- North America: Largest market in 2024

Lab-on-a-chip devices, which miniaturize laboratory functions into a single chip, offer numerous benefits that are driving their adoption across healthcare, pharmaceuticals, and research industries.

Lab-on-a-chip technology allows for rapid, cost-effective, and portable testing, making it ideal for real-time disease diagnosis, especially in remote or underserved areas. The ability to conduct diagnostic tests outside traditional lab settings significantly reduces the time and cost associated with testing and results delivery.

The growing trend towards personalized medicine also contributes to the market's expansion. Lab-on-a-chip devices are capable of handling complex assays, enabling precise and tailored treatments for patients based on their unique conditions. As the demand for targeted therapies rises, the need for lab-on-a-chip technology capable of providing quick and accurate diagnostic data continues to increase.

Moreover, advancements in microfluidics, materials science, and miniaturization technologies are enhancing the performance and capabilities of lab-on-a-chip devices. The increasing demand for efficient drug discovery and development processes, where lab-on-a-chip devices can rapidly test drug efficacy on small scales, is another contributing factor. The integration of artificial intelligence and machine learning with lab-on-a-chip systems is enhancing data analysis and decision-making, making these devices more effective and appealing for a broad range of applications.

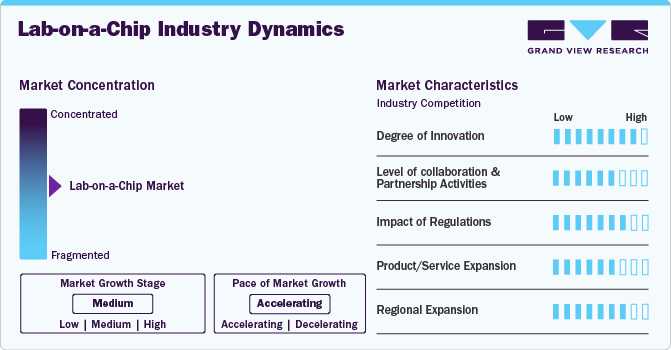

Market Concentration & Characteristics

The lab-on-a-chip industry is highly innovative, driven by advancements in microfluidics, miniaturization, and materials science. These technologies enable more efficient, precise, and multifunctional devices for complex biological assays. Integration with artificial intelligence and machine learning enhances data analysis and diagnostic capabilities. Innovations are expanding applications in personalized medicine, point-of-care testing, and drug development. This rapid technological progress ensures the lab-on-a-chip market remains at the forefront of scientific and healthcare advancements.

The level of collaboration and partnership activities in the lab-on-a-chip industry is medium to high, as companies, research institutions, and healthcare providers work together to drive innovation. Strategic partnerships between technology developers, academic institutions, and pharmaceutical companies facilitate the exchange of knowledge, resources, and expertise. Collaborations with healthcare providers are also crucial to test and implement new devices in clinical settings. These partnerships accelerate the development of advanced lab-on-a-chip technologies, fostering faster commercialization and broader adoption across diverse industries, including diagnostics, drug development, and personalized medicine.

Regulations in the lab-on-a-chip industry significantly influence product development, safety standards, and market accessibility. Stricter regulatory frameworks ensure the reliability and accuracy of diagnostic results, fostering trust in these technologies. However, they can also delay product approvals and increase development costs. Compliance with medical device regulations, quality control standards, and ethical considerations, such as patient privacy, plays a vital role in shaping innovation. Ultimately, regulations balance market growth with ensuring public health and safety.

Product and service expansion in the lab-on-a-chip industry drives innovation and addresses diverse healthcare needs. Companies are broadening their offerings by developing new chips for various applications, such as disease diagnostics, personalized medicine, and environmental monitoring. Expansion into emerging markets and collaborations with research institutions also fuel growth. Additionally, integrating advanced technologies like artificial intelligence and miniaturization enhances the functionality of these devices.

Regional expansion in the lab-on-a-chip industry enables companies to tap into new geographic areas, increasing their global footprint. By entering emerging markets, companies can cater to the growing demand for point-of-care diagnostics, especially in regions with limited healthcare infrastructure. Expanding into developed regions helps meet the rising need for precision medicine and personalized diagnostics.

AI Integration in Lab-on-a-Chip Market

AI integration in the lab-on-a-chip market is revolutionizing diagnostics, research, and healthcare by enhancing the functionality of miniaturized systems. These chips are designed to perform complex laboratory tasks in a compact, portable format, often using microfluidics to handle small amounts of fluids. With AI, these devices gain significant capabilities, such as real-time data analysis, automation, and predictive analytics. AI algorithms, including machine learning and deep learning, are employed to interpret complex sensor data, improving accuracy and efficiency in detecting biomarkers, diseases, and pathogens. Companies like Abbott laboratories and Illumina have utilized AI in their systems to enhance diagnostic accuracy. Additionally, AI can optimize the chip's performance by adjusting parameters autonomously, reducing human intervention and ensuring precise, reproducible results. AI-powered devices also enable personalized medicine by analyzing patient-specific data and providing tailored diagnostic solutions.

As AI continues to evolve, the integration of advanced technologies like cloud computing and the Internet of Things (IoT) further accelerates the capabilities of these systems, making them more accessible and cost-effective. This progress holds the promise of faster diagnostics, enhanced patient care, and the expansion of point-of-care applications in various fields, including genomics, drug testing, and environmental monitoring. Companies like Cepheid and Bio-Rad are at the forefront of this integration, driving innovation in the lab-on-a-chip market.

Product & Services Insights

The reagents and consumables segment held the largest revenue share of 42.16% in 2024 due to their essential role in the functionality and operation of these devices. These components are critical for performing tests, detecting biomarkers, and ensuring accurate results. As lab-on-a-chip technologies continue to advance in fields like diagnostics and personalized medicine, the demand for high-quality, reliable reagents and consumables rises. Their recurring need in experiments and diagnostic processes contributes to their dominant market share.

The software and services segment is expected to grow at the highest CAGR from 2025 to 2030 due to the increasing integration of advanced technologies like artificial intelligence, machine learning, and data analytics. These software solutions enhance data interpretation, automate processes, and improve diagnostic accuracy. Additionally, as lab-on-a-chip devices become more complex, the demand for specialized services, such as software customization, maintenance, and technical support, rises. This technological evolution drives rapid growth in software and service segments, supporting innovation and user adoption.

Technology Insights

The microfluidics technology segment held the largest revenue share of 59.87% in 2024 due to its ability to handle and manipulate small volumes of fluids with high precision. This technology enables rapid, cost-effective, and accurate diagnostics by performing complex tests on tiny samples, reducing the need for large equipment and extensive sample preparation. Its versatility in applications, such as point-of-care diagnostics, drug development, and environmental monitoring, further drives its dominance. The miniaturization and integration of multiple functions into a single chip enhance its appeal, contributing to its market leadership.

Optical technology is expected to grow significantly in the lab-on-a-chip market due to its ability to provide high sensitivity, rapid analysis, and non-invasive detection methods. Optical sensors, including those based on fluorescence, absorbance, and refractive index measurements, enable precise diagnostics with minimal sample preparation. As the demand for faster, more accurate diagnostic tools increases, optical technology offers a compelling solution for applications like disease detection, biomarker analysis, and environmental monitoring. Its integration into lab-on-a-chip devices enhances performance, driving market growth.

Application Insights

The clinical diagnostic applications segment held the largest revenue share in 2024 due to its critical role in providing quick, accurate, and cost-effective medical testing. Lab-on-a-chip technologies allow for point-of-care diagnostics, enabling real-time disease detection, biomarker analysis, and personalized treatment decisions. Their ability to process small samples with high precision and reduced time compared to traditional methods enhances patient outcomes. As the demand for rapid diagnostics in healthcare increases, these technologies are pivotal in improving early disease detection, contributing to their dominance in the market.

Drug discovery and development applications are growing significantly due to several factors, including the increasing need for personalized medicine and the rising complexity of diseases. Advances in technologies like lab-on-a-chip allow for faster, more efficient screening of drug candidates, reducing costs and time in the development process. These platforms enable precise simulation of biological environments, improving the accuracy of tests. Additionally, the growing demand for targeted therapies and innovations in genomics and biotechnology are driving the expansion of drug discovery and development efforts.

End Use Insights

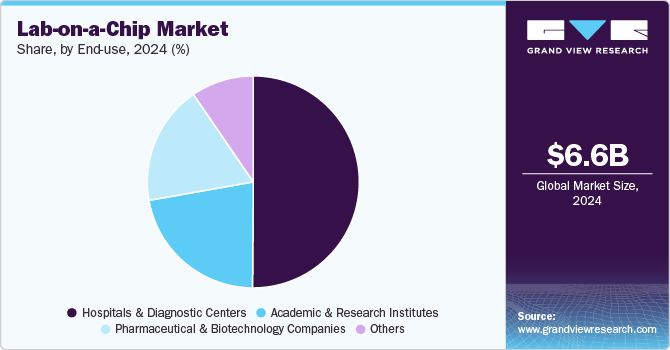

Hospitals and diagnostic centers held the largest market share of 50.12% in 2024 due to their critical role in healthcare. These facilities demand advanced diagnostic tools that provide quick, accurate, and cost-effective results. Lab-on-chip technology enables real-time monitoring, early detection, and personalized treatment plans. It reduces the need for expensive and time-consuming laboratory tests. Additionally, hospitals and diagnostic centers prioritize convenience and portability, making lab-on-chip devices a valuable solution for streamlining diagnostic processes and improving patient outcomes.

Academic and research institutes are growing significantly in the lab-on-chip market due to their focus on innovation and advanced research. These institutions play a vital role in developing new technologies and methodologies. Lab-on-chip devices offer high precision and miniaturization, making them ideal for conducting experiments in various scientific fields such as biology, chemistry, and medicine. Additionally, the growing need for cost-effective, portable, and efficient research tools drives the adoption of lab-on-chip technology in academic settings.

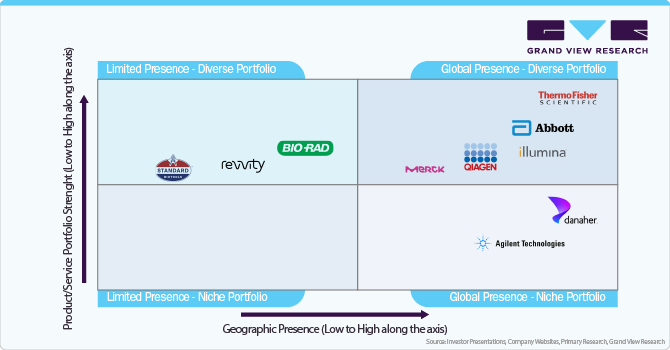

Competitive Scenario Insights

The lab-on-a-chip market consists of companies with varying levels of geographic reach and product/service portfolio diversity. The figure below illustrates the competitive scenario for the key players based on these parameters.

Thermo Fisher Scientific, Inc. and Illumina, Inc. occupy the top-right quadrant, excelling in both product portfolio strength and geographic presence. Their comprehensive product offerings and global reach make them dominant players in the market. On the other hand, Revvity and Bio-Rad are placed in the upper-left quadrant, indicating a strong product portfolio but a more limited geographic reach. These companies excel in niche segments but may need further expansion to reach broader markets.

Regional Insights

North America lab-on-a-chip market dominated the global market in 2024 and accounted for the largest revenue share of 49.22%. The region is home to numerous leading pharmaceutical and biotechnology companies, driving the demand for cutting-edge diagnostic and testing solutions. Additionally, the presence of top academic and research institutions further accelerates the adoption of lab-on-chip technologies. Government initiatives, funding, and a robust healthcare system also contribute to the region’s dominance in the market.

U.S. Lab-on-a-Chip Market Trends

The lab-on-a-chip market in the U.S. dominated the global market in 2024. The country has a strong healthcare system, advanced technological infrastructure, and significant investments in research and development. The U.S. has numerous leading pharmaceutical, biotechnology, and medical device companies driving innovation in diagnostics. Additionally, the presence of top-tier academic and research institutions fosters the development of new technologies. U.S. government support through funding and healthcare policies, along with a high demand for advanced, cost-effective healthcare solutions, further bolsters the adoption of lab-on-chip technologies.

Europe Lab-on-a-Chip Market Trends

Europe lab-on-a-chip market registered significant growth in 2024. The market is growing due to strong research and development initiatives, particularly in biotechnology and pharmaceuticals. The region benefits from advanced healthcare systems, collaborative academic partnerships, and increasing demand for portable, cost-effective diagnostics. European regulations and funding also promote innovation and adoption of lab-on-chip technologies in healthcare.

The lab-on-a-chip market in the UK held a significant share in 2024, driven by its robust healthcare system, cutting-edge research, and strong presence of biotech and pharmaceutical companies. The country’s academic institutions play a crucial role in developing innovative technologies. Additionally, government funding and support for medical advancements help promote the adoption of lab-on-chip solutions for diagnostics and personalized medicine.

France lab-on-a-chip market is experiencing significant growth due to its strong healthcare sector, thriving biotechnology industry, and focus on innovative research. French academic institutions and private companies are advancing lab-on-chip technologies for diagnostics and personalized medicine. Government support and funding initiatives further contribute to the adoption of these technologies in the healthcare system.

The lab-on-a-chip market in Germany is driven by its advanced healthcare system, strong engineering expertise, and leading pharmaceutical industry. The country’s emphasis on innovation, supported by top-tier research institutions and government funding, accelerates the development of lab-on-chip technologies. These advancements support diagnostic efficiency and personalized medicine, fueling market growth.

Asia Pacific Lab-on-a-Chip Market Trends

Asia Pacific lab-on-a-chip market is anticipated to witness significant growth in the lab-on-a-chip market. The region is driven by increasing healthcare needs, rising healthcare investments, and technological advancements. Countries like China, Japan, and India are leading the way with expanding healthcare infrastructure and growing research initiatives. The region's large population and demand for affordable, efficient diagnostics further boost the adoption of lab-on-chip technologies.

The lab-on-a-chip market in China is fueled by rapid advancements in healthcare and biotechnology. The country’s large population and increasing demand for efficient, cost-effective diagnostics drive market growth. Government investments in research and development, along with growing partnerships between academic institutions and private companies, further accelerate the adoption of lab-on-chip technologies in healthcare.

Japan's lab-on-a-chip market is witnessing significant growth. The country’s focus on innovation, particularly in biotechnology and medical devices, supports the development of efficient diagnostic solutions. Additionally, Japan’s aging population creates a growing demand for portable, accurate, and cost-effective diagnostic tools, further boosting market growth.

MEA Lab-on-a-Chip Market Trends

The lab-on-a-chip market in the MEA region has experienced considerable growth in recent years due to increasing healthcare investments and technological advancements. Countries like the UAE and South Africa are driving innovation in diagnostics, supported by government initiatives and improved healthcare infrastructure. The growing demand for efficient, portable diagnostic solutions further accelerates the adoption of lab-on-chip technologies in the region.

Saudi Arabia lab-on-a-chip market is driven by substantial investments in healthcare and biotechnology. The country’s Vision 2030 initiative promotes innovation in medical technologies, supporting the growth of advanced diagnostics. Saudi Arabia’s focus on improving healthcare infrastructure and demand for efficient, cost-effective solutions accelerates the adoption of lab-on-chip technologies.

The lab-on-a-chip market in Kuwait is emerging due to increasing healthcare investments and a focus on advanced medical technologies. The country is expanding its healthcare infrastructure and promoting innovation in diagnostics. With a rising demand for efficient and cost-effective diagnostic tools, lab-on-chip technologies are gaining traction as part of Kuwait's efforts to enhance healthcare delivery.

Key Lab-on-a-Chip Company Insights

The lab-on-a-chip market is witnessing various initiatives focused on innovation and expansion. Companies and research institutions are developing advanced microfluidic devices for diagnostics, personalized medicine, and drug testing. Collaborations between industry leaders and academia aim to enhance lab-on-a-chip technologies, improving their efficiency and affordability. Prominent initiatives include the integration of artificial intelligence and machine learning to automate analysis and improve decision-making in diagnostics. Additionally, efforts are being made to develop point-of-care testing solutions for faster and more accurate disease detection. The adoption of biocompatible materials and miniaturization techniques is helping to create more compact, reliable, and cost-effective lab-on-a-chip systems.

Key Lab-on-a-Chip Companies:

The following are the leading companies in the lab-on-a-chip market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Danaher

- Merck KGaA

- Abbott Laboratories

- QIAGEN

- Agilent Technologies

- Standard BioTools

- Revvity, Inc.

- Bio-Rad Laboratories

Recent Developments

-

In July 2023, Opteev Technologies, Inc. submitted a patent application for an innovative multiplex biochip intended for diagnosing respiratory infections. This polymer-based biochip was designed to detect various pathogens associated with respiratory illnesses and accurately identify the specific virus or bacteria within one minute.

-

In June 2023, ACRO Biosystems, through its Aneuro brand, partnered with Diagnostic Biochips to launch in vivo electrophysiology solutions aimed at accelerating neuroscience drug discovery and commercialization.

-

In January 2022, Onera Health unveiled the Onera Biomedical-Lab-on-Chip intended for use with wearable devices to process multiple biosignals.

Lab-on-a-Chip Market Report Scope

Report Attribute

Details

Market size in 2025

USD 7.19 billion

Revenue forecast in 2030

USD 11.45 billion

Growth rate

CAGR of 9.76% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait.

Key companies profiled

Thermo Fisher Scientific, Inc.; Illumina, Inc.; Danaher; Merck KGaA; Abbott Laboratories; QIAGEN; Agilent Technologies; Standard BioTools; Revvity, Inc.; Bio-Rad Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lab-on-a-Chip Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lab-on-a-chip market report based on product & service, technology, application, end use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Consumables

-

Instruments

-

Software & Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Microfluidics Technology

-

Optical Technology

-

Electrochemical Technology

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Diagnostics

-

Drug Discovery & Development

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Hospitals & Diagnostic Centers

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lab-on-a-chip market size was estimated at USD 6.61 billion in 2024 and is expected to reach USD 7.19 billion in 2025.

b. The global lab-on-a-chip market is expected to grow at a compound annual growth rate of 9.76% from 2025 to 2030 to reach USD 11.45 billion by 2030.

b. North America dominated the lab-on-a-chip market with a share of 49.22% in 2024. This is attributable to rising chronic disease incidence coupled with the increase in demand for advanced point-of-care solutions.

b. Some key players operating in the lab-on-a-chip market include Thermo Fisher Scientific, Inc., Illumina, Inc., Danaher, Merck KGaA, Abbott Laboratories, QIAGEN, Agilent Technologies, Standard BioTools, Revvity, Inc., Bio-Rad Laboratories

b. Key factors driving market growth include the growing demand for lab-on-a-chip technologies in advanced medical and research applications and the growing trend towards personalized medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.