- Home

- »

- Healthcare IT

- »

-

Laboratory Informatics Market Size & Share Report, 2030GVR Report cover

![Laboratory Informatics Market Size, Share & Trends Report]()

Laboratory Informatics Market Size, Share & Trends Analysis Report By Product (LIMS, CDS), By Delivery Mode (Web Based, Cloud Based), By Component (Software, Services), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-193-1

- Number of Report Pages: 170

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Laboratory Informatics Market Size & Trends

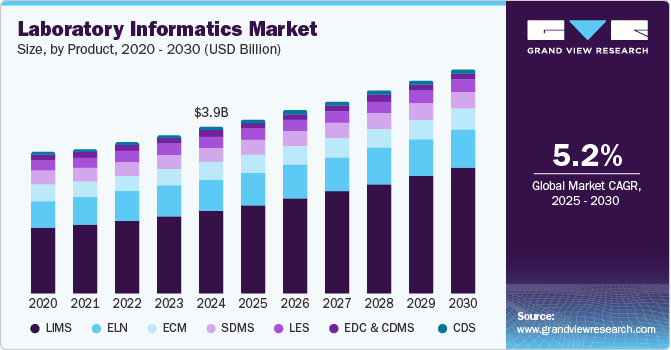

The global laboratory informatics market size was estimated at USD 3.68 billion in 2023 and is expected to grow at a CAGR of 5.13% from 2024 to 2030. An increase in demand for laboratory automation is expected to fuel the adoption in coming years. Data generated by laboratories has dramatically risen in the past few decades owing to rising technological advancements in molecular genomics and genetic testing practices.

In addition, the shift of preference toward personalized medicine, cancer genomics studies, and increasing patient engagement requirements is expected to upsurge the demand for lab automation systems. Software solutions are becoming more user-friendly, data is moving to the cloud and the number of startups in the field of laboratory informatics is on the rise. The cloud is becoming the norm for laboratory informatics software. Informatics providers must now have a cloud and SaaS strategy. In addition, the number of research laboratories implementing cloud, mobile, and voice technologies is increasing over time thereby boosting the demand for lab informatics solutions.

The adoption of laboratory informatics solutions is rising across various industries, including healthcare, pharmaceutical, biotechnology, and contract research organizations. These systems are helping laboratories improve efficiency, reduce errors, and better manage the growing volume of data generated by advanced laboratory equipment and techniques. Laboratory information systems are gaining popularity among biobanks, academic research institutes, and contract research organizations owing to their associated benefits such as process optimization, improved regulatory compliance and intellectual property rights protection, reduced throughput time, and paperless information management.

The increasing adoption of robotics and process automation in healthcare has rendered operations reproducible and repeatable. It is now possible to set up, run, and analyze the experimental results in a shorter time. Rising penetration of high-throughput systems has enabled efficient evaluation of experimental results, which increases the overall efficiency of laboratory operations. In addition, advancements in laboratory equipment enable faster replacement of manual data evaluation methods, including constructing calibration curves and measuring peak areas or heights, compared to traditional methods. For instance, in May 2023, FreeLIMS launched a new version of its secure, free, in-the-cloud LIMS with multiple modules and a wide range of functionality to better meet automation, data management, and regulatory requirements of laboratories.

Case Study:

Problem Statement: The Garvan Institute of Medical Research, a leading Australian medical research organization, faced challenges in managing the vast amounts of data generated by its genomics research. To address this, the institute implemented a comprehensive laboratory informatics solution from Autoscribe Informatics.

- Garvan's researchers were generating massive volumes of genomic data that needed to be efficiently stored, organized, and accessed.

- The institute's previous systems were unable to keep up with the growing data demands, leading to inefficiencies and delays in research.

- Garvan needed a flexible, scalable informatics platform that could integrate with its existing laboratory workflows and instrumentation.

Solution: Garvan deployed Autoscribe's Matrix Gemini LIMS to centralize its data management and streamline research operations. The LIMS provided the institute with the following capabilities:

-

Automated sample tracking and management

-

Seamless integration with lab instruments and equipment

-

Customizable workflows to support Garvan's unique research processes

-

Robust data storage and retrieval to facilitate collaboration & analysis

Outcomes:

-

The implementation of the Matrix Gemini LIMS has enabled Garvan to:

-

Improve the efficiency and productivity of its genomics research

-

Enhance data integrity and traceability through automated sample management

-

Facilitate collaboration among researchers by providing centralized access to data

-

Achieve greater visibility and control over its laboratory operation

Analyst Insights:

The case study of the Garvan Institute of Medical Research in Australia illustrates the transformative impact that laboratory informatics can have on academic research organizations. By implementing a comprehensive LIMS solution, the institute was able to streamline its genomics research, enhance data integrity, and facilitate collaboration among its researchers. The growing demand from such organizations is contributing to market growth.

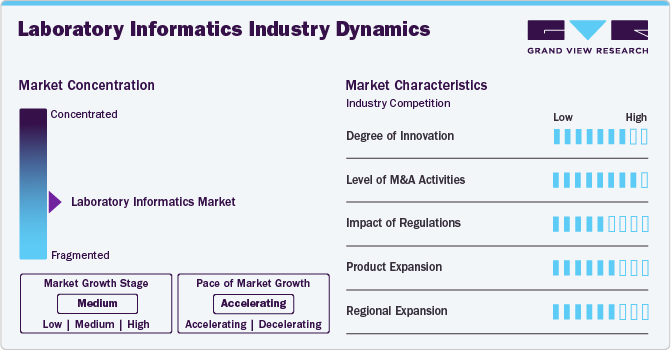

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaboration activities, degree of innovation, and regional expansion. For instance, the laboratory informatics market is fragmented, with many service providers entering the market. The degree of innovation is high, and the level of mergers & acquisitions activities is moderate. The impact of regulations on the industry is high, and the regional expansion of the industry is moderate.

The degree of innovation in the industry is high. The market is experiencing significant innovation as numerous providers introduce new products to meet the demand for scientific data integration solutions in various industries. For instance, in May 2024 , Thermo Fisher Scientific Inc. launched Applied Biosystems Axiom BloodGenomiX Array and Software. This innovative solution is designed for precise blood genotyping in clinical studies.

The level of merger & acquisition in the industry is moderate due to a rise in the acquisition of emerging players by major players to increase their capabilities, expand product portfolios, and improve competencies.For instance, in December 2023 , PerkinElmer Inc. acquired Covaris, a company that develops solutions to drive life science innovations. This acquisition is intended to boost Covaris’ growth and expand PerkinElmer’s life sciences portfolio in the rapidly growing diagnostics market.

The impact of regulations on the market is high. The primary objective of a laboratory is to ensure the generation of high-quality and reliable experimental data that complies with the industry's regulatory guidelines. The combination of technological advancements, stringent regulatory needs, and increasing commercial pressures have resulted in the rapid generation of vast amounts of data from various aspects, including research and development, quality assurance, and manufacturing. This is creating significant challenges for data management processes and conventional documentation requirements, particularly in regulated environments such as the life sciences sector.

The level of regional expansion in the industry is moderate due to increasing demand for laboratory informatics solutions in developing countries For instance, in February 2024, LabWare opened a new office located in central Seoul, Korea. This expansion represents a significant step forward in its global mission to deliver world-leading laboratory informatics solutions to customers worldwide.

Product Insights

The laboratory information management systems (LIMS) segment dominated the market with a revenue share of 49.43% in 2023. This is attributed to the increasing demand for efficient data management and automation in laboratories across various industries, such as healthcare, pharmaceuticals, biotechnology, and environmental testing. LIMS solutions offer comprehensive functionalities, including sample tracking, data analysis, compliance with regulatory standards, and integration with laboratory instruments, which enhances productivity, accuracy, & data integrity. In October 2023, Sapio Sciences introduced Sapio Jarvis, the first scientific data cloud specifically designed for scientists. Sapio Jarvis consolidates various lab data and integrates it with scientific context to speed up drug development processes by utilizing advanced analytics & artificial intelligence.

The Enterprise Content Management (ECM) segment is anticipated to grow significantly from 2024 to 2030. The adoption of ECM is increasing over time as it offers integrated and comprehensive solutions to meet the growing challenges in the healthcare industry. ECM offers a centralized approach to capture, create, organize, access, and analyze an organization’s entire ecosystem of media, knowledge assets, and electronic documents. The services offered by companies for ECM are consultation, design, implementation, and maintenance of these software solutions.

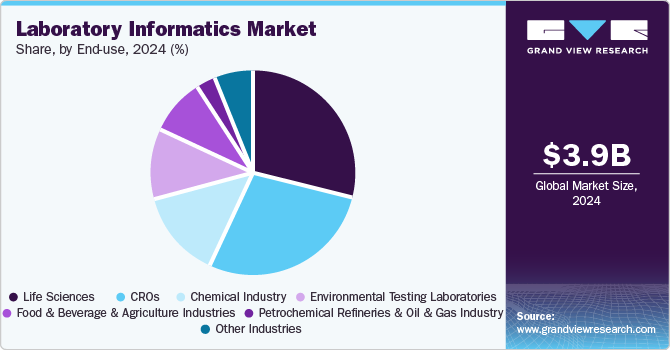

End Use Insights

The life science companies segment dominated the market with a revenue share of 28.83% in 2023. The demand for laboratory informatics is increasing in the life sciences industry to develop innovative product and improve product quality, and operational efficiency. To fulfill these requirements, the need for more virtual and electronic laboratories is increasing. Laboratory informatics systems allow effective management of huge amounts of data and break down research & discovery silos. Increasing technological advances in healthcare owing to rising R&D in the field of medicine are anticipated to fuel the demand for LIMS. Increasing adoption of LIMS in hospitals and research labs due to its growing application scope for patient engagement, workflow management, billing, patient health information tracking, and quality assurance is expected to augment the growth.

The CRO segment is anticipated to grow at the fastest growth rate over the forecast year. The demand for efficient data management and regulatory compliance drives CROs to adopt advanced laboratory informatics solutions, such as ELN, LIMS, and SDMS. These technologies enable CROs to streamline workflows, ensure data integrity, enhance collaboration, and expedite the drug development process. With growth in the life sciences sector, the reliance on CROs for high-quality, cost-effective research solutions is also increasing.

Delivery Mode Insights

The web-based segment dominated the market with a revenue share of 42.91% in 2023. Unparalleled accessibility is provided to laboratories utilizing the internet and web-based services, allowing lab operations to be managed and monitored from even the most remote locations using just a single monitoring device. This capability is especially advantageous for geographically dispersed research teams and organizations with multiple lab sites.

The cloud-based segment is anticipated to grow at the fastest CAGR from 2024 to 2030. This is due to its affordability, scalability, dependability, and sophisticated capabilities that meet the expanding storage and computational demands in healthcare. The rise of cloud laboratories offers a chance to leverage AI and Machine Learning to refine experimental methods and improve data accuracy with algorithms. Additionally, its cooperative and compatible characteristics simplify research activities, reduce repetitive tasks, and facilitate system sharing, enhancing research outcomes.

Component Insights

The services segment accounted for the largest revenue share of 56.81% in 2023. This is attributed to the need for a flexible, expandable, and easy-to-use service-oriented LIMS for efficient data and process management. Many large pharma and research labs outsource advanced analytics due to internal skill and resource shortages. The lab informatics market provides services such as compliance, social analytics, manufacturing analytics, predictive and preventive maintenance, and benchmarking.

The software segment is anticipated to grow at the fastest growth rate over the forecast year due to the availability of technologically advanced software, such as SaaS, which offers effective information management solutions for laboratories. The software offered for laboratory informatics can perform critical functions such as data capture, storage, interpretation, and analysis. Periodic upgradation of this software is necessary to coordinate with the latest analytics methods.

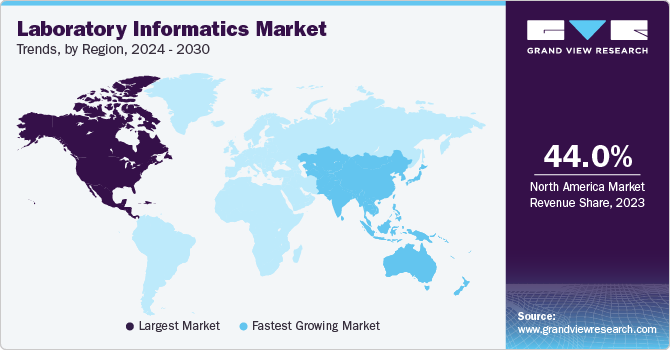

Regional Insights

North America laboratory informatics market held the largest revenue share of 43% in 2023. The field of laboratory informatics has undergone significant transformations in recent years, driven by a confluence of factors shaping the North American market. Rapid technological advancements, including measurement, digital, communication, and transportation technologies, have profoundly impacted how clinical laboratories are organized, staffed, and equipped. The increasing prevalence of point-of-care and critical care testing has necessitated real-time data availability and seamless information management to support clinical decision-making.

U.S. Laboratory Informatics Market Trends

The U.S. laboratory informatics market held the largest share in 2023 due to technology advancement, regulatory demands, and complex operations. Innovations such as cloud computing, AI, and ML are revolutionizing data analysis and efficiency, essential for sectors from healthcare to environmental testing for enhanced decision-making and faster drug development.

Europe Laboratory Informatics Market Trends

Europe laboratory informatics market is anticipated to grow significantly due to the increasing automation and digitalization of laboratory data, substantial R&D activities, the requirement for efficient and scalable management across various application industries, and technological advancements in laboratory solutions. The Digital Single Market Strategy, developed by the European Commission (EC), aims to provide consumers and businesses with access to online services and goods across Europe.

This strategy is intended to create the essential conditions for the growth of digital networks and related services, which in turn is expected to maximize the growth potential of the European economy. For instance, in April 2021, LabVantage Solutions, a prominent provider of laboratory informatics solutions, announced a collaboration with Holo4Med, a medical technology company, to expand its presence in the healthcare sector in Europe. Holo4Med will contribute to the continuity and efficiency of LabVantage Medical Suite services in the region through this strategic partnership.

The laboratory informatics market in the UK is expected to grow significantly over the forecast period owing to increasing per capita income, rising healthcare costs, and the growing prevalence of chronic disorders that increase the need for adoption of analytics services. Key trends in the UK include laboratories switching from standalone informatics systems to integrated platforms that are easier to use and maintain. There is a growing interest in converging laboratory informatics with AI and machine learning. Thus, UK laboratories are prioritizing investments in LIMS, AI, and automation to improve efficiency and data quality. 17% of European and U.S. lab decisionmakers plan to invest in a new LIMS or expand their current LIMS from June 2024 to June 2025.

Germany laboratory informatics market held the largest share in 2023, owing to the increasing laboratory automation, digitalization of laboratory data, and stringent regulations across industries. Moreover, the growing mergers, acquisitions, partnerships, and collaborations among key players to expand capabilities and market reach. For instance, in October 2022, LabVantage Solutions, a leading provider of laboratory informatics solutions, merged with Biomax Informatics, a German company, to create innovative capabilities for the life sciences and biomanufacturing industries.

Asia Pacific Laboratory Informatics Market Trends

The laboratory informatics market in Asia Pacific is expected to witness the fastest growth from 2024 to 2030. With the rising demand from pharmaceutical manufacturers seeking to improve efficiency and reduce costs. The presence of numerous CROs in fast-growing economies like India and China is expected to boost demand, complemented by the adoption of advanced technology-based laboratory information systems. Increased partnerships and collaborations among key regional players to drive market growth in the forecast period. For instance, in April 2024, Autoscribe Informatics, Inc. announced the expansion of its customer network in Asia Pacific by opening an office in Australia. This move supported the company’s growing LIMS business and enabled it to better serve the region in digitalizing laboratory information

China laboratory informatics market held the largest revenue share in 2023 driven by the government's push for e-health services and national electronic health records. Technological advancements, such as AI, automation, and blockchain, are further enhancing lab informatics by improving predictive capabilities, data analytics, and patient outcomes. For instance, in February 2022, Sanomede Medical Technology Co., Ltd. And Roche Diagnostics China partnered to introduce the RS600 Lab Automation Software to the Chinese market. This emphasizes the increasing focus on laboratory automation and informatics solutions in China.

The laboratory informatics market in India is driven by the rising prevalence of cardiovascular and infectious diseases is driving significant growth in eClinical services and laboratory informatics solutions, supported by government initiatives like lifting import duties on clinical trial supplies and allowing the export of clinical trial specimens. The government's efforts to improve healthcare infrastructure and promote digital health, along with geographical expansion by companies.

Latin America Laboratory Informatics Market Trends

Latin America laboratory informatics market is anticipated to grow significantly due to a growing demand for advanced healthcare amid an aging population and rising chronic diseases. Government and private sector investments, along with technological advancements, are driving the market, with significant growth expected in LIMS and ELN systems as awareness of laboratory automation's importance increases.

Brazil laboratory informatics market is anticipated to grow significantly due to the rising per capita income, increasing government medical & healthcare spending, and improving access to private healthcare facilities, and fast-growing healthcare R&D.

Middle East & Africa Laboratory Informatics Market Trends

The laboratory informatics market in the Middle East & Africa is expected to grow significantly due to the government implementing laboratory informatics systems to enhance patient care, with hospitals increasingly adopting these technologies. Market growth is driven by healthcare sector improvements, automation integration in labs, and increased public-private collaborations.

The South Africa laboratory informatics market is anticipated to grow significantly due to significant investments and government initiatives in modernizing laboratory operations aim at improving healthcare outcomes and data accuracy, addressing the rising burden of infectious and non-communicable diseases.

Key Laboratory Informatics Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Technologically advanced platforms developed by the companies, such as Software as a Service (SaaS), advanced products with the greater utility to gain an edge over competitors. A few emerging players include Artificial, Benchling, Synthace, and others.

Key Laboratory Informatics Companies:

The following are the leading companies in the laboratory informatics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Agilent Technologies, Inc.

- IDBS

- LabLynx, Inc.

- LabVantage Solutions, Inc.

- LabWare

- McKesson Corporation

- PerkinElmer, Inc.

- Thermo Fisher Scientific, Inc.

- Waters

Recent Developments

-

In February 2024, LabVantage Solutions, Inc., a provider of laboratory informatics solutions, now offers its advanced analytics, semantic search (AILANI), and purpose-built LIMS solutions within an integrated, digitally native ecosystem tailored to support R&D laboratory processes. This ecosystem enhances efficiency, productivity, decision-making, & collaboration and reduces operational costs.

-

In November 2023, Thermo Fisher Scientific Inc. partnered with Flagship Pioneering, a bioplatform innovation firm. This strategic partnership aims to develop and expand multiproduct platforms quickly, create new platform companies focusing on innovative biotech tools & capabilities, and broaden their existing supply relationship across life science tools, diagnostics, & services.

-

In September 2023, LabWare opened an office in Wageningen, The Netherlands. With this location, the company expanded its presence in six continents, with a network of over 40 offices.

-

In October 2022, LabVantage Solutions merged with Biomax Informatics, a software solutions and services provider, to enhance scientific discovery and product creativity and improve the provision of value-added services to customers. The company primarily serves the life sciences, healthcare, and information technologies sectors.

-

In December 2022, LabVantage Solutions, Inc. released version 8.8 of its LabVantage LIMS platform. This new version includes significant enhancements to its components, including the integrated Scientific Data Management System (SDMS), Electronic Laboratory Notebook (ELN), Laboratory Execution System (LES), and advanced analytics. These upgrades are designed to improve speed, accuracy, usability, and security, making it easier and more cost-effective for labs to deploy.

Laboratory Informatics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.86 billion

Revenue forecast in 2030

USD 5.21 billion

Growth rate

CAGR of 5.13% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott; Agilent Technologies, Inc.; IDBS; LabLynx, Inc.; LabVantage Solutions, Inc.; LabWare; McKesson Corporation; PerkinElmer, Inc.; Thermo Fisher Scientific, Inc.; Waters

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Informatics Market Report Segmenatation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory informatics market report based on product, delivery mode, component, and regions.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Information Management Systems (LIMS)

-

Electronic Lab Notebooks (ELN)

-

Scientific Data Management Systems (SDMS)

-

Laboratory Execution Systems (LES)

-

Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

-

Chromatography Data Systems (CDS)

-

Enterprise Content Management (ECM)

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

On-Premise

-

Cloud Based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Life Sciences

-

Pharmaceutical and Biotechnology Companies

-

Biobanks/Biorepositories

-

Contract Services Organizations

-

Molecular Diagnostics & Clinical Research Laboratories

-

Academic Research Institutes

-

-

CROs

-

Chemical Industry

-

Food & Beverage and Agriculture Industries

-

Environmental Testing Laboratories

-

Petrochemical Refineries and Oil & Gas Industry

-

Other Industries (Forensics and Metal & Mining Laboratories)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory informatics market size was estimated at USD 3.68 billion in 2023 and is expected to reach USD 3.86 billion in 2024.

b. The global laboratory informatics market is expected to grow at a compound annual growth rate of 5.13% from 2024 to 2030 to reach USD 5.21 billion by 2030.

b. The laboratory information management systems (LIMS) segment dominated the market with revenue share of 49.43% in 2023. This is attributed to increasing demand for efficient data management and automation in laboratories across various industries, such as healthcare, pharmaceuticals, biotechnology, and environmental testing.

b. The web-based segment dominated the market with revenue share of 42.91% in 2023. Unparalleled accessibility is provided to laboratories utilizing the internet and web-based services, allowing lab operations to be managed and monitored from even the most remote locations using just a single monitoring device.

b. Key players operating in the laboratory informatics market include Abbott; Agilent Technologies, Inc.; IDBS; LabLynx, Inc.; LabVantage Solutions, Inc.; LabWare; McKesson Corporation; PerkinElmer, Inc.; Thermo Fisher Scientific, Inc.; Waters

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product

1.2.2. Delivery Mode

1.2.3. Component

1.2.4. End Use

1.3. Estimates and Forecast Timeline

1.4. Research Methodology

1.5. Information Procurement

1.5.1. Purchased Database

1.5.2. GVR’s Internal Database

1.5.3. Secondary Sources

1.5.4. Primary Research

1.6. Information Analysis

1.6.1. Data Analysis Models

1.7. Market Formulation & Data Visualization

1.8. Model Details

1.8.1. Commodity Flow Analysis

1.9. List of Secondary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing adoption of laboratory informatics by biobanks/biorepositories, academic research institutes, and contract service organizations

3.2.1.2. Increasing burden on laboratories from regulatory authorities

3.2.1.3. Introduction of technologically advanced software services

3.2.1.4. Growing demand for lab automation activities

3.2.2. Market Restraint Analysis

3.2.2.1. Lack of integration standards for laboratory informatics

3.2.2.2. Threat to data security

3.2.3. Market Opportunity Analysis

3.2.4. Market Threat Analysis

3.3. Business Environment Analysis

3.3.1. Porter’s Five Forces Analysis

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTLE Analysis

Chapter 4. Laboratory Informatics Market: Product Estimates & Trend Analysis

4.1. Product Segment Dashboard

4.2. Product Market Share Movement Analysis, 2023 & 2030

4.3. Market Size & Forecasts and Trend Analysis, by Product, 2018 to 2030 (USD Million)

4.4. Laboratory Information Management Systems (LIMS)

4.4.1. Laboratory Information Management Systems (LIMS) market, 2018 - 2030 (USD Million)

4.5. Electronic Lab Notebooks (ELN)

4.5.1. Electronic Lab Notebooks (ELN) market, 2018 - 2030 (USD Million)

4.6. Scientific Data Management Systems (SDMS)

4.6.1. Scientific Data Management Systems (SDMS) market, 2018 - 2030 (USD Million)

4.7. Laboratory Execution Systems (LES)

4.7.1. Laboratory Execution Systems (LES) market, 2018 - 2030 (USD Million)

4.8. Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

4.8.1. Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS) market, 2018 - 2030 (USD Million)

4.9. Chromatography Data Systems (CDS)

4.9.1. Chromatography Data Systems (CDS) market, 2018 - 2030 (USD Million)

4.10. Enterprise Content Management (ECM)

4.10.1. Enterprise Content Management (ECM) market, 2018 - 2030 (USD Million)

Chapter 5. Laboratory Informatics Market: Delivery Mode Estimates & Trend Analysis

5.1. Delivery Mode Segment Dashboard

5.2. Delivery Mode Market Share Movement Analysis, 2023 & 2030

5.3. Market Size & Forecasts and Trend Analysis, by Delivery Mode, 2018 to 2030 (USD Million)

5.4. Web-based

5.4.1. Web-based market, 2018 - 2030 (USD Million)

5.5. On-Premise

5.5.1. On-Premise market, 2018 - 2030 (USD Million)

5.6. Cloud Based

5.6.1. Cloud Based market, 2018 - 2030 (USD Million)

Chapter 6. Laboratory Informatics Market: Component Estimates & Trend Analysis

6.1. Component Segment Dashboard

6.2. Component Market Share Movement Analysis, 2023 & 2030

6.3. Market Size & Forecasts and Trend Analysis, by Component, 2018 to 2030 (USD Million)

6.4. Software

6.4.1. Software market, 2018 - 2030 (USD Million)

6.5. Services

6.5.1. Services market, 2018 - 2030 (USD Million)

Chapter 7. Laboratory Informatics Market: End Use Estimates & Trend Analysis

7.1. End Use Segment Dashboard

7.2. End Use Market Share Movement Analysis, 2023 & 2030

7.3. Market Size & Forecasts and Trend Analysis, by End Use, 2018 to 2030 (USD Million)

7.4. Life Sciences

7.4.1. Life sciences market, 2018 - 2030 (USD Million)

7.4.2. Pharmaceutical and Biotechnology Companies

7.4.2.1. Pharmaceutical and biotechnology companies market, 2018 - 2030 (USD Million)

7.4.3. Biobanks/Biorepositories

7.4.3.1. Biobanks/biorepositories market, 2018 - 2030 (USD Million)

7.4.4. Contract Services Organizations (CROs and CMOs)

7.4.4.1. Contract services organizations (CROs and CMOs) market, 2018 - 2030 (USD Million)

7.4.5. Molecular Diagnostics & Clinical Research Laboratories

7.4.5.1. Molecular diagnostics & clinical research laboratories market, 2018 - 2030 (USD Million)

7.4.6. Academic Research Institutes

7.4.6.1. Academic research institutes market, 2018 - 2030 (USD Million)

7.5. CROs

7.5.1. CROs market, 2018 - 2030 (USD Million)

7.6. Chemical Industry

7.6.1. Chemical industry market, 2018 - 2030 (USD Million)

7.7. Food and Beverage and Agriculture Industries

7.7.1. Food and beverage and agriculture industries market, 2018 - 2030 (USD Million)

7.8. Environmental Testing Laboratories

7.8.1. Environmental testing laboratories market, 2018 - 2030 (USD Million)

7.9. Petrochemical Refineries & Oil and Gas Industry

7.9.1. Petrochemical refineries & oil and gas industry market, 2018 - 2030 (USD Million)

7.10. Other Industries (Forensics and Metal & Mining Laboratories)

7.10.1. Other industries market, 2018 - 2030 (USD Million)

Chapter 8. Laboratory Informatics Market: Regional Estimates & Trend Analysis

8.1. Regional Market Dashboard

8.2. Regional Market: Key Takeaways

8.3. North America

8.3.1. North America laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.2. U.S.

8.3.2.1. Key country dynamic

8.3.2.2. Regulatory framework

8.3.2.3. Competitive insights

8.3.2.4. U.S. laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.3. Canada

8.3.3.1. Key country dynamic

8.3.3.2. Regulatory framework

8.3.3.3. Competitive insights

8.3.3.4. Canada laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.4. Mexico

8.3.4.1. Key country dynamic

8.3.4.2. Regulatory framework

8.3.4.3. Competitive insights

8.3.4.4. Mexico laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.4. Europe

8.4.1. Europe laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.2. Germany

8.4.2.1. Key country dynamic

8.4.2.2. Regulatory framework

8.4.2.3. Competitive insights

8.4.2.4. Germany laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.3. UK

8.4.3.1. Key country dynamic

8.4.3.2. Regulatory framework

8.4.3.3. Competitive insights

8.4.3.4. UK laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.4. France

8.4.4.1. Key country dynamic

8.4.4.2. Regulatory framework

8.4.4.3. Competitive insights

8.4.4.4. France laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.5. Italy

8.4.5.1. Key country dynamic

8.4.5.2. Regulatory framework

8.4.5.3. Competitive insights

8.4.5.4. Italy laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.6. Spain

8.4.6.1. Key country dynamic

8.4.6.2. Regulatory framework

8.4.6.3. Competitive insights

8.4.6.4. Spain laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.7. Denmark

8.4.7.1. Key country dynamic

8.4.7.2. Regulatory framework

8.4.7.3. Competitive insights

8.4.7.4. Denmark laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.8. Sweden

8.4.8.1. Key country dynamic

8.4.8.2. Regulatory framework

8.4.8.3. Competitive insights

8.4.8.4. Sweden laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.9. Norway

8.4.9.1. Key country dynamic

8.4.9.2. Regulatory framework

8.4.9.3. Competitive insights

8.4.9.4. Norway laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.5. Asia Pacific

8.5.1. Asia Pacific laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.5.2. Japan

8.5.2.1. Key country dynamic

8.5.2.2. Regulatory framework

8.5.2.3. Competitive insights

8.5.2.4. Japan laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.5.3. China

8.5.3.1. Key country dynamic

8.5.3.2. Regulatory framework

8.5.3.3. Competitive insights

8.5.3.4. China laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.5.4. India

8.5.4.1. Key country dynamic

8.5.4.2. Regulatory framework

8.5.4.3. Competitive insights

8.5.4.4. India laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.5.5. South Korea

8.5.5.1. Key country dynamic

8.5.5.2. Regulatory framework

8.5.5.3. Competitive insights

8.5.5.4. South Korea laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.5.6. Australia

8.5.6.1. Key country dynamic

8.5.6.2. Regulatory framework

8.5.6.3. Competitive insights

8.5.6.4. Australia laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.5.7. Thailand

8.5.7.1. Key country dynamic

8.5.7.2. Regulatory framework

8.5.7.3. Competitive insights

8.5.7.4. Thailand laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.6. Latin America

8.6.1. Latin America Laboratory Informatics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.2. Brazil

8.6.2.1. Key country dynamic

8.6.2.2. Regulatory framework

8.6.2.3. Competitive insights

8.6.2.4. Brazil laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.6.3. Argentina

8.6.3.1. Key country dynamic

8.6.3.2. Regulatory framework

8.6.3.3. Competitive insights

8.6.3.4. Argentina laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.7. MEA

8.7.1. MEA laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.7.2. South Africa

8.7.2.1. Key country dynamic

8.7.2.2. Regulatory framework

8.7.2.3. Competitive insights

8.7.2.4. South Africa laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.7.3. Saudi Arabia

8.7.3.1. Key country dynamic

8.7.3.2. Regulatory framework

8.7.3.3. Competitive insights

8.7.3.4. Saudi Arabia laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.7.4. UAE

8.7.4.1. Key country dynamic

8.7.4.2. Regulatory framework

8.7.4.3. Competitive insights

8.7.4.4. UAE laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

8.7.5. Kuwait

8.7.5.1. Key country dynamic

8.7.5.2. Regulatory framework

8.7.5.3. Competitive insights

8.7.5.4. Kuwait laboratory informatics market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Participant Overview

9.2. Company Market Position Analysis

9.3. Company Categorization

9.4. Strategy Mapping

9.5. Company Profiles/Listing

9.5.1. Abbott

9.5.1.1. Overview

9.5.1.2. Financial performance

9.5.1.3. Product benchmarking

9.5.1.4. Strategic initiatives

9.5.2. Agilent Technologies, Inc.

9.5.2.1. Overview

9.5.2.2. Financial performance

9.5.2.3. Product benchmarking

9.5.2.4. Strategic initiatives

9.5.3. IDBS

9.5.3.1. Overview

9.5.3.2. Financial performance

9.5.3.3. Product benchmarking

9.5.3.4. Strategic initiatives

9.5.4. LabLynx, Inc.

9.5.4.1. Overview

9.5.4.2. Financial performance

9.5.4.3. Product benchmarking

9.5.4.4. Strategic initiatives

9.5.5. LabVantage Solutions, Inc.

9.5.5.1. Overview

9.5.5.2. Financial performance

9.5.5.3. Product benchmarking

9.5.5.4. Strategic initiatives

9.5.6. LabWare

9.5.6.1. Overview

9.5.6.2. Financial performance

9.5.6.3. Product benchmarking

9.5.6.4. Strategic initiatives

9.5.7. McKesson Corporation

9.5.7.1. Overview

9.5.7.2. Financial performance

9.5.7.3. Product benchmarking

9.5.7.4. Strategic initiatives

9.5.8. PerkinElmer, Inc.

9.5.8.1. Overview

9.5.8.2. Financial performance

9.5.8.3. Product benchmarking

9.5.8.4. Strategic initiatives

9.5.9. Thermo Fisher Scientific, Inc.

9.5.9.1. Overview

9.5.9.2. Financial performance

9.5.9.3. Product benchmarking

9.5.9.4. Strategic initiatives

9.5.10. Waters

9.5.10.1. Overview

9.5.10.2. Financial performance

9.5.10.3. Product benchmarking

9.5.10.4. Strategic initiatives

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviations

Table 3 Global laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 4 Global laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 5 Global laboratory informatics market, by component, 2018 - 2030 (USD Million)

Table 6 Global laboratory informatics market, by end use, 2018 - 2030 (USD Million)

Table 7 Global laboratory informatics market, by region, 2018 - 2030 (USD Million)

Table 8 North America laboratory informatics market, by country, 2018 - 2030 (USD Million)

Table 9 North America laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 10 North America laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 11 North America laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 12 North America laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 13 U.S. laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 14 U.S. laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 15 U.S. laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 16 U.S. laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 17 Canada laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 18 Canada laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 19 Canada laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 20 Canada laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 21 Mexico laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 22 Mexico laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 23 Mexico laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 24 Mexico laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 25 Europe laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 26 Europe laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 27 Europe laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 28 Europe laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 29 Europe laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 30 UK laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 31 UK laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 32 UK laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 33 UK laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 34 Germany laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 35 Germany laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 36 Germany laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 37 Germany laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 38 France laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 39 France laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 40 France laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 41 France laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 42 Italy laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 43 Italy laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 44 Italy laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 45 Italy laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 46 Spain laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 47 Spain laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 48 Spain laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 49 Spain laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 50 Norway laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 51 Norway laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 52 Norway laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 53 Norway laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 54 Sweden laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 55 Sweden laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 56 Sweden laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 57 Sweden laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 58 Denmark laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 59 Denmark laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 60 Denmark laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 61 Denmark laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 62 Asia Pacific laboratory informatics market, by country, 2018 - 2030 (USD Million)

Table 63 Asia Pacific laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 64 Asia Pacific laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 65 Asia Pacific laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 66 Asia Pacific laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 67 Japan laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 68 Japan laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 69 Japan laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 70 Japan laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 71 China laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 72 China laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 73 China laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 74 China laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 75 India laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 76 India laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 77 India laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 78 India laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 79 Australia laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 80 Australia laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 81 Australia laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 82 Australia laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 83 South Korea laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 84 South Korea laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 85 South Korea laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 86 South Korea laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 87 Thailand laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 88 Thailand laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 89 Thailand laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 90 Thailand laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 91 Latin America laboratory informatics market, by country, 2018 - 2030 (USD Million)

Table 92 Latin America laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 93 Latin America laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 94 Latin America laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 95 Latin America laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 96 Brazil laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 97 Brazil laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 98 Brazil laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 99 Brazil laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 100 Argentina laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 101 Argentina laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 102 Argentina laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 103 Argentina laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 104 Middle East & Africa laboratory informatics market, by country, 2018 - 2030 (USD Million)

Table 105 Middle East & Africa laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 106 Middle East & Africa laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 107 Middle East & Africa laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 108 Middle East & Africa laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 109 South Africa laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 110 South Africa laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 111 South Africa laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 112 South Africa laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 113 Saudi Arabia laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 114 Saudi Arabia laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 115 Saudi Arabia laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 116 Saudi Arabia laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 117 UAE laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 118 UAE laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 119 UAE laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 120 UAE laboratory informatics market, by end use , 2018 - 2030 (USD Million)

Table 121 Kuwait laboratory informatics market, by product, 2018 - 2030 (USD Million)

Table 122 Kuwait laboratory informatics market, by delivery mode, 2018 - 2030 (USD Million)

Table 123 Kuwait laboratory informatics market, by component , 2018 - 2030 (USD Million)

Table 124 Kuwait laboratory informatics market, by end use , 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value chain-based sizing & forecasting

Fig. 6 Market formulation & validation

Fig. 7 Market segmentation

Fig. 8 Market snapshot

Fig. 9 Segment snapshot

Fig. 10 Competitive landscape snapshot

Fig. 11 Market trends & outlook

Fig. 12 Market driver relevance analysis (current & future impact)

Fig. 13 Market restraint relevance analysis (current & future impact)

Fig. 14 PESTLE analysis

Fig. 15 Porter’s five forces analysis

Fig. 16 Laboratory informatics market : Product outlook and key takeaways

Fig. 17 Laboratory informatics market : Product movement analysis

Fig. 18 Laboratory Information Management Systems (LIMS) market, 2018 - 2030 (USD Million)

Fig. 19 Electronic Lab Notebooks (ELN) market, 2018 - 2030 (USD Million)

Fig. 20 Scientific Data Management Systems (SDMS) market, 2018 - 2030 (USD Million)

Fig. 21 Laboratory Execution Systems (LES) market, 2018 - 2030 (USD Million)

Fig. 22 Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS) market, 2018 - 2030 (USD Million)

Fig. 23 Chromatography Data Systems (CDS) market, 2018 - 2030 (USD Million)

Fig. 24 Enterprise Content Management (ECM) market, 2018 - 2030 (USD Million)

Fig. 25 Laboratory informatics market : Delivery mode outlook and key takeaways

Fig. 26 Laboratory informatics market : Delivery mode movement analysis

Fig. 27 Web-based market, 2018 - 2030 (USD Million)

Fig. 28 On-Premise market, 2018 - 2030 (USD Million)

Fig. 29 Cloud based market, 2018 - 2030 (USD Million)

Fig. 30 Laboratory informatics market : Component outlook and key takeaways

Fig. 31 Laboratory informatics market : Component movement analysis

Fig. 32 Software market, 2018 - 2030 (USD Million)

Fig. 33 Services market, 2018 - 2030 (USD Million)

Fig. 34 Laboratory informatics market : End use outlook and key takeaways

Fig. 35 Laboratory informatics market : End use movement analysis

Fig. 36 Software market, 2018 - 2030 (USD Million)

Fig. 37 Life sciences market, 2018 - 2030 (USD Million)

Fig. 38 Pharmaceutical and biotechnology companies market, 2018 - 2030 (USD Million)

Fig. 39 Biobanks/Biorepositories market, 2018 - 2030 (USD Million)

Fig. 40 CROs and CMOs market, 2018 - 2030 (USD Million)

Fig. 41 Molecular diagnostics & clinical research laboratories market, 2018 - 2030 (USD Million)

Fig. 42 Academic research institutes market, 2018 - 2030 (USD Million)

Fig. 43 CROs market, 2018 - 2030 (USD Million) market, 2018 - 2030 (USD Million)

Fig. 44 Chemical industry market, 2018 - 2030 (USD Million)

Fig. 45 Food and beverage and agriculture industries market, 2018 - 2030 (USD Million)

Fig. 46 Environmental testing laboratories market, 2018 - 2030 (USD Million)

Fig. 47 Petrochemical refineries & oil and gas industry market, 2018 - 2030 (USD Million)

Fig. 48 Other industries (Forensics and Metal & Mining Laboratories) market, 2018 - 2030 (USD Million)

Fig. 49 Regional marketplace: Key takeaways

Fig. 50 Regional outlook, 2023 & 2030

Fig. 51 Laboratory informatics market : Region movement analysis

Fig. 52 North America laboratory informatics market , 2018 - 2030 (USD Million)

Fig. 53 U.S. laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 54 Key country dynamics

Fig. 55 Canada laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 56 Key country dynamics

Fig. 57 Mexico laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 58 Key country dynamics

Fig. 59 Europe laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 60 Germany laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 61 Key country dynamics

Fig. 62 UK laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 63 Key country dynamics

Fig. 64 France laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 65 Key country dynamics

Fig. 66 Italy laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 67 Key country dynamics

Fig. 68 Spain laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 69 Key country dynamics

Fig. 70 Sweden laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 71 Key country dynamics

Fig. 72 Norway laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 73 Key country dynamics

Fig. 74 Denmark laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 75 Key country dynamics

Fig. 76 Asia Pacific laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 77 Japan laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 78 Key country dynamics

Fig. 79 China laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 80 Key country dynamics

Fig. 81 India laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 82 Key country dynamics

Fig. 83 Australia laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 84 Key country dynamics

Fig. 85 South Korea laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 86 Key country dynamics

Fig. 87 Thailand laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 88 Key country dynamics

Fig. 89 Latin America laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 90 Brazil laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 91 Key country dynamics

Fig. 92 Argentina laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 93 Key country dynamics

Fig. 94 Middle East and Africa laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 95 South Africa laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 96 Key country dynamics

Fig. 97 Saudi Arabia laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 98 Key country dynamics

Fig. 99 UAE laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 100 Key country dynamics

Fig. 101 Kuwait laboratory informatics market, 2018 - 2030 (USD Million)

Fig. 102 Key country dynamics

Fig. 103 Company categorization

Fig. 104 Strategy mapping

Fig. 105 Company market position analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Laboratory Informatics Product Outlook (Revenue, USD Million, 2018 - 2030)

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Laboratory Informatics Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

- Web-based

- On-Premise

- Cloud Based

- Laboratory Informatics Component Outlook (Revenue, USD Million, 2018 - 2030)

- Software

- Services

- Laboratory Informatics End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- Laboratory informatics Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- North America laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- North America laboratory informatics market, by component

- Software

- Services

- North America laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- U.S.

- U.S. laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- U.S. laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- U.S. laboratory informatics market, by component

- Software

- Services

- U.S. laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- U.S. laboratory informatics market, by product

- Canada

- Canada laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Canada laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- Canada laboratory informatics market, by component

- Software

- Services

- Canada laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- Canada laboratory informatics market, by product

- Mexico

- Mexico laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Mexico laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- Mexico laboratory informatics market, by component

- Software

- Services

- Mexico laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- Mexico laboratory informatics market, by product

- North America laboratory informatics market, by product

- Europe

- Europe laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Europe laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- Europe laboratory informatics market, by component

- Software

- Services

- Europe laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- UK

- UK laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- UK laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- UK laboratory informatics market, by component

- Software

- Services

- UK laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- UK laboratory informatics market, by product

- Germany

- Germany laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Germany laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- Germany laboratory informatics market, by component

- Software

- Services

- Germany laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- Germany laboratory informatics market, by product

- France

- France laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- France laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- France laboratory informatics market, by component

- Software

- Services

- France laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- France laboratory informatics market, by product

- Italy

- Italy laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Italy laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- Italy laboratory informatics market, by component

- Software

- Services

- Italy laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- Italy laboratory informatics market, by product

- Spain

- Spain laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Spain laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- Spain laboratory informatics market, by component

- Software

- Services

- Spain laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- Spain laboratory informatics market, by product

- Sweden

- Sweden laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Sweden laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- Sweden laboratory informatics market, by component

- Software

- Services

- Sweden laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- Sweden laboratory informatics market, by product

- Denmark

- Denmark laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Denmark laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- Denmark laboratory informatics market, by component

- Software

- Services

- Denmark laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- Denmark laboratory informatics market, by product

- Norway

- Norway laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Norway laboratory informatics market, by delivery mode

- Web-based

- On-Premise

- Cloud Based

- Norway laboratory informatics market, by component

- Software

- Services

- Norway laboratory informatics market, by end use

- Life Sciences

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations (CROs and CMOs)

- Molecular Diagnostics (MDx) & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

- Life Sciences

- Norway laboratory informatics market, by product

- Europe laboratory informatics market, by product

- Asia Pacific

- Asia Pacific laboratory informatics market, by product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

- Asia Pacific laboratory informatics market, by delivery mode

- Web-based

- On-Premise