- Home

- »

- Electronic & Electrical

- »

-

Laptop Accessories Market Size & Share Analysis Report, 2030GVR Report cover

![Laptop Accessories Market Size, Share & Trends Report]()

Laptop Accessories Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Electronic, Non-electronic), By End-use (Personal, Commercial), By Distribution Channel (Offline, E-commerce), And Segment Forecasts

- Report ID: GVR-4-68038-385-0

- Number of Report Pages: 143

- Format: PDF

- Historical Range: 2019 - 2022

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Laptop Accessories Market Summary

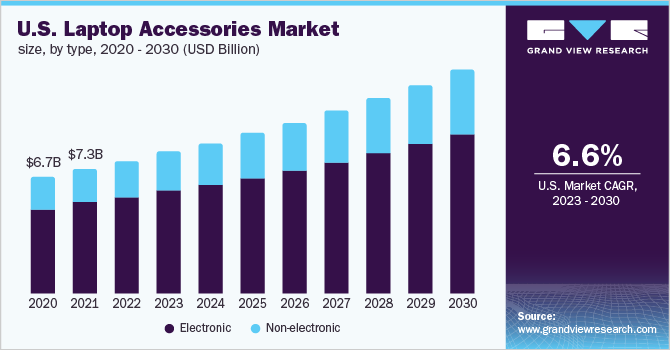

The global laptop accessories market size was estimated at USD 40,251.8 million in 2022 and is projected to reach USD 65,634.2 million by 2030, growing at a CAGR of 6.3% from 2023 to 2030. The demand for laptop accessories is primarily driven by the growing popularity of e-sports and the adoption of process automation in industries.

Key Market Trends & Insights

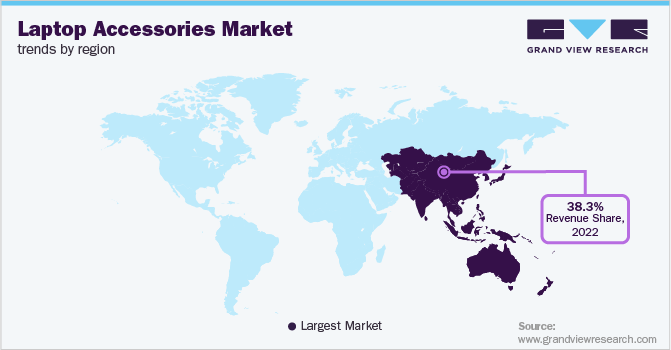

- The Asia Pacific region dominated the global industry in 2022 and accounted for the largest share of more than 38.30% of the overall revenue.

- By type, the electronic segment held the largest share of more than 67.05% of the overall revenue in 2022.

- By end-use, the personal segment dominated the industry and accounted for the maximum revenue share of over 58.05% in 2022.

- By distribution channel, the offline segment dominated the industry and accounted for a maximum revenue share of more than 62.90% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 40,251.8 Million

- 2030 Projected Market Size: USD 65,634.2 Million

- CAGR (2023-2030): 6.3%

- Asia Pacific: Largest market in 2022

Personal computer sales were predicted to decrease ten years ago, but it has only recently witnessed their first significant increase in a decade. In 2021, according to a market research firm, Canalys, personal computer (PC) shipments reached 297 million units in 2020, up 11% from 2019. IDC estimates 302 million shipments for the year, up 13.1% year over year. Booming sales of laptops are boosting the demand for accessories.

The pandemic prompted lockdowns around the world, starting from the first quarter of 2020. In the U.S., about 80% of large-scale companies and 45% of small-scale companies switched to at least some form of remote work, a survey conducted by Harvard Business School found in 2020. Moreover, 93% of U.S. households with school-age children reported some form of remote learning, according to the U.S. Census Bureau. The work-from-home and study-from-home trends due to the COVID-19 pandemic have benefited the overall PCmarket, including laptops and desktop systems, with sales exceeding 302 million in 2020, a 13% increase from the year before and the most since 2014.

This bodes well for the sales of various laptop accessories. According to the survey conducted by Local Circles in March 2021, with 10,530 respondents, the shoppers utilized online sales platforms to buy everything from vegetables to festive supplies, home furnishings, and computers. When the number of people in the pool was examined, 54% purchased medium-value things, such as electronic accessories, apparel, sporting goods, and so on. Moreover, the market is anticipated to grow significantly over the forecast period owing to external causes, such as technological advancements in Wi-Fi, Bluetooth, and Infrared, and internal factors, such as the reduction in overall accessory weight.

Furthermore, the market is predicted to grow due to product innovation and cost-effectiveness. The growing number of corporate offices worldwide is significantly fueling the sales of laptops, which further drives the demand for accessories. Consumers are increasingly opting for laptop accessories for a comfortable and easy working experience. Businesses have added more equipment to their office infrastructure as a result of the non-portable capabilities and functionalities of laptops. Moreover, the growing number of shipments of laptops, desktops, notebooks, and mobile workstations further increases the demand for accessories, such mouse, keyboards, and chargers, driving the laptop accessories market.

Type Insights

The electronic segment held the largest share of more than 67.05% of the overall revenue in 2022. The demand for laptops has increased as lockdown restrictions were eased owing to the increased need for work-from-home and the push for online learning. Increased searches for new and reconditioned devices have been observed on e-commerce platforms. This increase in demand for laptops is boosting the demand for electronic accessories, such as wireless keyboards and mouse.

According to HP Inc., the laptop accessories category is exhibiting early signs of increased usage in 2020, ranging from screens as consumers prepare for larger, high-definition viewing to headphones for connecting to online meetings and entertainment and gaming devices for improved gameplay. On the other hand, the non-electronic segment is expected to register a significant CAGR during the forecast period. The non-electronic laptop accessories segment covers mouse pads, stand and holders, protective cases, key guards, cleaning devices/products, etc. These products are considered to play an important role in improving the functionality and longevity of the product. This is anticipated to increase the use of laptop accessories, and positively impact the segment growth.

End-use Insights

The personal segment dominated the industry and accounted for the maximum revenue share of over 58.05% in 2022. This is mainly attributed to the sudden shift from work-from-office to work-from-home on the backdrop of the pandemic and subsequent lockdown. As per the survey conducted by Harvard Business School in 2020, in the U.S., about 80% of large companies and 45% of small companies switched to at least some remote work. Moreover, 93% of U.S. households with school-age children reported some remote learning, according to the Census Bureau. This rise of people working remotely increased the demand for laptops and their accessories, especially external mouse and keyboards. The commercial segment is expected to register the fastest CAGR during the forecast period.

The increasing demand for accessories, such as webcams, speakers, and pointing devices, from the business sector, is expected to favor the growth of the commercial segment. Businesses have added more equipment to their office infrastructure because of laptops’ non-portable capabilities and functionalities. As a result, there has been an increase in peripheral demand. In both the commercial sector and the high-tier market, there is a considerable and concurrent increase in shares invested. Due to the constant need for laptops for business use, the industry has been reasonably stable in recent years, with global shipments averaging 160 million units. However, the industry has seen unanticipated growth due to the pandemic and work-from-home settings.

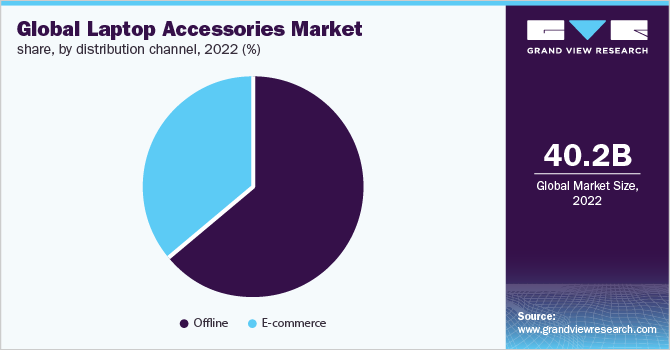

Distribution Channel Insights

The offline segment dominated the industry and accounted for a maximum revenue share of more than 62.90% in 2022. This is mainly because a large section of consumers still prefers the physical shopping of electronic appliances. As a result, an increase in the number of retail establishments is predicted to improve product sales through offline channels, particularly in growing nations, such as India, China, and Brazil. Increased product visibility and a strong presence of large international firms in expanding APAC countries through newly established strategic business units are likely to support the segment growth over the forecast period.

The e-commerce segment is expected to exhibit the fastest CAGR during the forecast period. The rise of the online category can be ascribed to the technical improvements and the increasing importance given to online platforms for purchasing laptop accessories, particularly by consumers looking for bargains. The main target demographic for online platforms is customers who are comfortable purchasing things without physically inspecting them. To boost product sales and profit margins, most manufacturers have turned to the direct sales approach.

Despite the recent establishment of local markets, retail stores, and malls, the findings of a poll conducted by community platform Local Circles in 2021 suggest that consumers who utilized e-commerce services in the previous year (2020) are still using them, according to Bennett, Coleman & Co. Ltd. Over the previous 12 months, over half of all respondents said e-commerce websites and apps have become their preferred form of shopping, while another 18% said they prefer having things delivered home from local businesses.

Regional Insights

On the basis of geographies, the industry has been further categorized into Asia Pacific, North America, Europe, Central & South America, and Middle East & Africa. The Asia Pacific region dominated the global industry in 2022 and accounted for the largest share of more than 38.30% of the overall revenue. The region is projected to expand further at the fastest In Asia Pacific, the primary markets for laptop accessories are China, Japan, and South Korea (Republic of Korea).

Since the laptop accessories industry is fragmented, vendors are employing growth methods, such as offering additional perks to customers to acquire a competitive advantage. Rapid industrialization is also contributing to the growth of consumer electronics in the region. For instance, according to Amazon India, there has been a 1.7-fold increase in searches for headphones and earphones, a doubling of searches for laptops and tablets, a nearly 1.2-fold increase in searches for stationery, over 2 times for mouse and keyboards, 1.3 times for printers, over 3 times for routers, and 2.5 times for study tables.

Key Companies & Market Share Insights

The market is fragmented owing to the presence of a large number of domestic as well as international players. However, key players capture the majority of the industry share. An increase in the use of accessories by various businesses and specialized consumer segments is one of the primary reasons for boosting the industry's growth. Vendors are releasing new products based on improved technologies, such as Luminae’sTransluSense keyboards and Tobii’s REX Gaze engagement device, which will have an impact on the industry growth over the forecast period

-

In December 2022, Microsoft teamed up with London-based global design company, Liberty, to launch the Surface Pro Liberty Keyboard. The special-edition Surface Pro 9 marks 10 years of Surface and features a customized pattern-an intense blue flower pattern-that was inspired by the Windows 11 Bloom. The stylish Liberty keyboard also has a large glass touchpad and illustrated keys

-

In September 2022, Western Digital Corp. partnered with Epic Games and Nintendo to deliver the first officially licensed Fortnite SanDisk microSDXC card for Nintendo Switch

-

In August 2022, ASUSTeK Computer Inc. launched the MD100 ASUS Marshmallow Mouse, adding the Portable Silent Wireless Mouse to the list of the ever-evolving segment of ASUS accessories. The MD100 ASUS Marshmallow mouse will be available online on Flipkart and ASUS E-shop, as well as at offline stores

-

In July 2022, Kingston Technology Company, Inc., a world leader in memory products and technology solutions, announced its partnership with the legendary e-sports organization, Ninjas in Pyjamas. The two-year deal makes Kingston FURY the official memory partner of Ninjas in Pyjamas

-

In January 2022, Microsoft launched its HoloLens 2 mixed reality headset in India to enable businesses across different industries to make use of the capabilities of mixed reality solutions. The device, introduced about three years ago at MWC Barcelona, is said to augment the jobs of employees in sectors like manufacturing, automotive, healthcare, and education

The key companies operating in the global laptop accessories market are as follows:

-

Logitech

-

Western Digital Corp.

-

HP INC.

-

ASUSTeK Computer, Inc.

-

Dell Inc.

-

GIGA-BYTE Technology Co., Ltd.

-

Seagate Technology LLC

-

Microsoft

-

Kingston Technology

-

Hama

Laptop Accessories Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 42.61 billion

Revenue forecast in 2030

USD 65.63 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2021

Historical data

2019 - 2022

Forecast period

2017 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Mexico; U.K.; Germany; Japan; Australia; Brazil; Turkey

Key companies profiled

Logitech; Western Digital Corp.; HP Inc.; ASUSTeK Computer Inc.; Dell Inc.; GIGA-BYTE Technology Co., Ltd.; Seagate Technology LLC; Microsoft; Kingston Technology; Hama

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laptop Accessories Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global laptop accessories market report on the basis of type, end-use, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Electronic

-

Charger & Adapter

-

Battery

-

Memory Drives

-

Mouse & Keyboard

-

Audio Devices

-

Others (Adapters, readers, cooling fan, etc.)

-

-

Non-electronic

-

Mouse Pad

-

Stand & Holder

-

Protective Case

-

Others (Key guards, laminates & covers, anti-thefts, cleaning, etc.)

-

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Personal

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global laptop accessories market was estimated at USD 40.25 billion in 2022 and is expected to reach USD 42.61 billion in 2023.

b. The global laptop accessories market is expected to grow at a compound annual growth rate of 6.3% from 2022 to 2030 to reach USD 65.63 billion by 2030.

b. Asia Pacific dominated the laptop accessories market with a share of 38.3% in 2022. This is attributed to the high penetration of personal computers across the region, especially in the emerging economies.

b. Some key players operating in the laptop accessories market include Logitech, Western Digital Corporation, Hewlett-Packard Company, ASUSTeK Computer Inc., Dell, GIGA-BYTE Technology Co., Ltd., Seagate Technology LLC; Microsoft, Kingston Technology, and Hama

b. Key factors that are driving the laptop accessories market growth include the growing popularity of e-sports and the adoption of process automation in industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.