- Home

- »

- Advanced Interior Materials

- »

-

Laser Cladding Market Size & Share, Industry Report, 2033GVR Report cover

![Laser Cladding Market Size, Share & Trends Report]()

Laser Cladding Market (2025 - 2033) Size, Share & Trends Analysis Report By End User (Original Equipment Manufacturer, Small And Medium-sized Enterprises), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-234-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Laser Cladding Market Summary

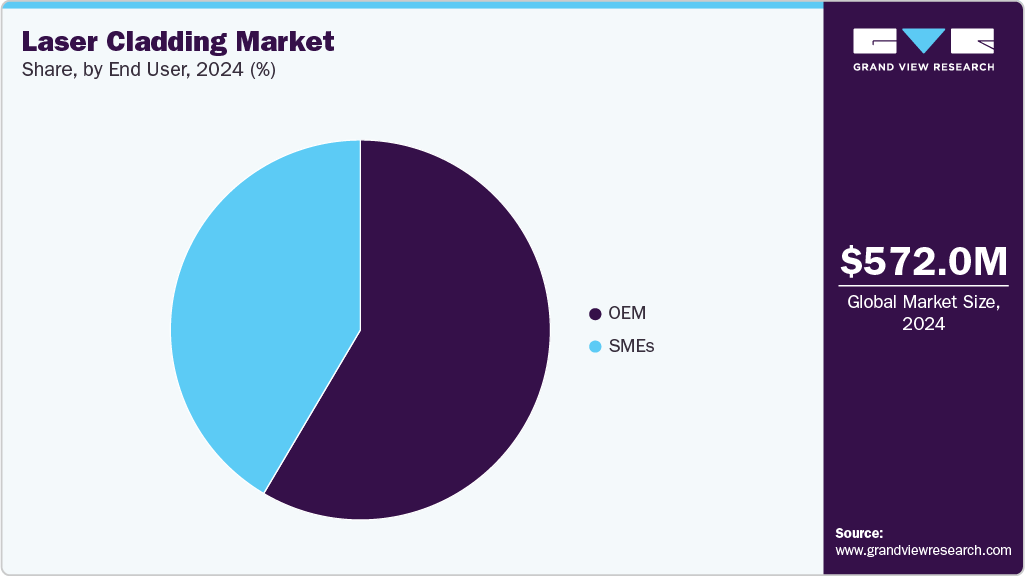

The global laser cladding market size was estimated at USD 572.0 million in 2024 and is projected to reach USD 1,403.9 million by 2033, growing at a CAGR of 10.7% from 2025 to 2033. The growing demand from aerospace, automotive, and other high-performance industries is expected to propel the market significantly.

Key Market Trends & Insights

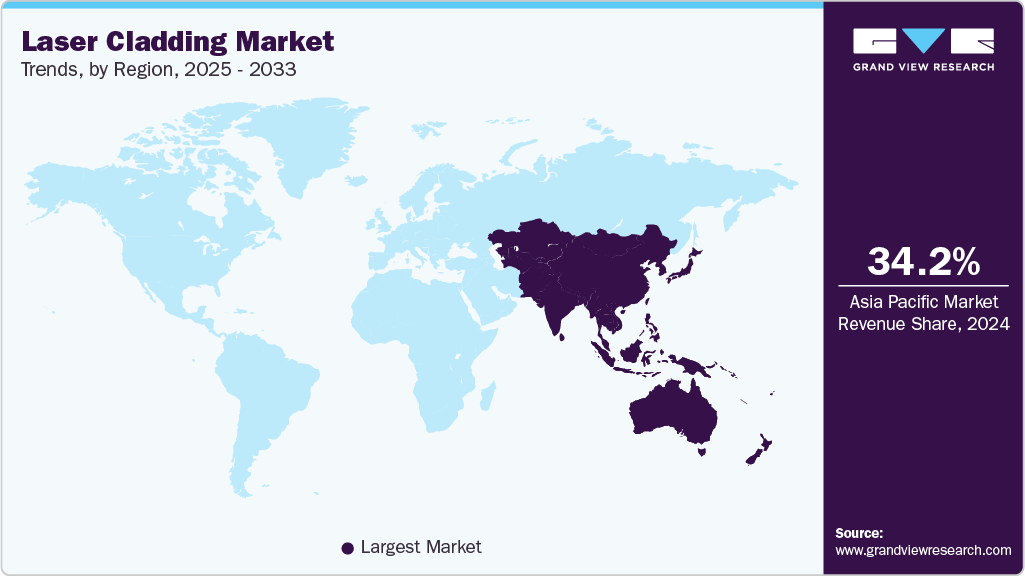

- The laser cladding market in the Asia Pacific is accounting for 34.2% market share in 2024.

- China laser cladding market is witnessing robust growth.

- By end user, OEM dominated the market in 2024, accounting for the highest revenue share at 58.8%.

Market Size & Forecast

- 2024 Market Size: USD 572.0 Million

- 2033 Projected Market Size: USD 1,403.9 Million

- CAGR (2025-2033): 10.7%

- Asia Pacific: Largest market in 2024

This growth spans laser cladding systems, specialized services, and consumable materials such as metallic powders, alloys, and composite coatings designed for high-wear and high-temperature applications. As indicated in the chart below, the steady increase in global motor vehicle production further reinforces this trend, as manufacturers seek durable components and surface refurbishment solutions. The market is experiencing robust growth as recent innovations in laser sources and automated process integration dramatically enhance performance and cost efficiency. Key technological breakthroughs in laser sources have been central to this surge. The transition from conventional CO₂ lasers to fiber and diode lasers offers higher beam quality, superior energy efficiency, and finer control over heat input, enabling thinner, denser clad layers with minimal substrate dilution.

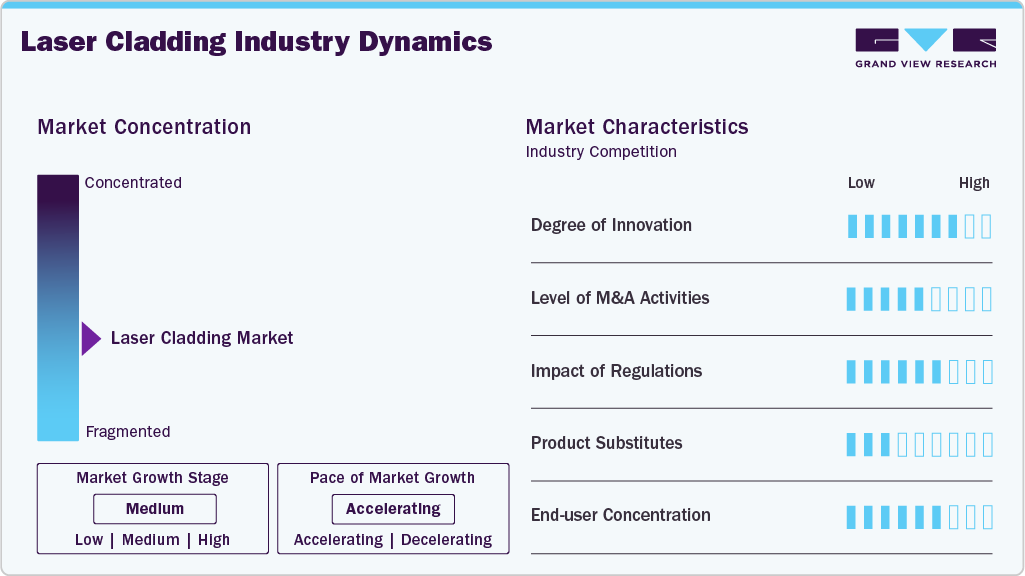

Market Concentration & Characteristics

The laser cladding industry is moderately fragmented due to several global and regional players offering diverse technologies and services. While a few large companies hold notable market shares, many mid-sized and specialized firms compete in specific sectors such as aerospace, automotive, and oil & gas. This competitive environment drives innovation and customization. However, barriers like high equipment costs and technical expertise requirements limit market entry.

The laser cladding industry shows a high degree of innovation, driven by demand for wear-resistant and corrosion-resistant coatings across industries. Advancements include real-time process monitoring, automation, and hybrid cladding techniques. R&D is focused on improving material compatibility, deposition rates, and surface properties, enabling broader adoption in aerospace, energy, and tooling applications.

Mergers and acquisitions in the laser cladding industry are shaping competitive dynamics by enabling companies to expand technological capabilities, enter new markets, and strengthen supply chains. Strategic acquisitions often focus on enhancing material science, digital integration, and specialized equipment offerings. These activities help larger firms consolidate their presence in high-growth regions and streamline R&D and service portfolios. For instance, in September 2024, Laserline acquired a 70% stake in WBC Photonics, a Boston-based laser company, to expand its blue industrial diode lasers offerings. The deal enables Laserline to provide lasers with high beam quality above 4 mm·mrad and output powers up to 4 kW.

Regulations in the laser cladding industry primarily address worker safety, emission controls, and material standards. Compliance with industrial safety norms and environmental guidelines influences equipment design and operational practices. In addition, certification requirements for aerospace and automotive components are pushing manufacturers to adopt high-precision, reliable laser cladding processes, indirectly driving quality improvements and technological advancements in the market.

Drivers, Opportunities & Restraints

Aerospace initiatives also support market expansion. In February 2024, Safran opened a facility in Ploërmel, Brittany, producing composite fan cases for CFM LEAP engines using Resin Transfer Molding (RTM). These high-temperature-resistant parts require precision coatings and ceramic or metallic overlays via laser cladding to maintain performance under extreme conditions, for both new manufacturing and repair applications.

The integration of laser cladding with additive manufacturing (AM) and 3D printing technologies is creating significant growth opportunities in the market. Laser cladding enables precise deposition of metallic powders, alloys, and composite coatings onto complex geometries, complementing additive manufacturing processes that build parts layer by layer. This combination allows manufacturers to produce components with enhanced surface properties, tailored wear resistance, and improved fatigue life, expanding the application potential of new production and repair operations.

Competition from established coating and welding techniques presents a notable challenge to market growth. Traditional methods such as thermal spraying, hard chrome plating, and conventional welding are widely used across automotive, aerospace, and heavy industries due to their lower initial investment and operational costs. These processes are often well-understood, require less specialized equipment, and can be implemented with existing workforce skills, making them an attractive alternative for manufacturers seeking cost-effective surface protection and component repair solutions.

End User Insights

OEM dominated the market in 2024, accounting for the highest revenue share at 58.8%. OEMs are increasingly adopting laser cladding technology to enhance their products' performance, durability, and lifespan. Laser cladding involves depositing a thin material layer onto a substrate using a high-powered laser, which melts the coating material and fuses it precisely to the base metal. This process creates a strong metallurgical bond, resulting in coatings that provide superior wear resistance, corrosion protection, and heat resistance.

The SME segment is expected to witness significant growth during the forecast period. SMEs increasingly embrace laser cladding technology, driven primarily by its cost-efficiency, adaptability, and evolving accessibility in compact and automated systems. Traditional barriers like steep initial investment and the need for specialized skills continue to challenge uptake. Nonetheless, advances in laser technology and the rise of service-based models are helping to lower these hurdles.

Regional Insights

North America is expected to grow at a 9.9% CAGR during the forecast period, driven by increasing adoption across aerospace, automotive, oil & gas, energy, and heavy machinery industries. The region benefits from its advanced manufacturing ecosystem, which supports deploying cutting-edge surface engineering solutions designed to extend the lifecycle of critical components and reduce overall maintenance costs.

U.S. Laser Cladding Market Trends

The laser cladding market in the U.S. is expected to grow at a CAGR of 9.8% from 2025 to 2033, driven by its expansive aerospace and defense sector, strong automotive production base, and significant oil & gas operations. As an early adopter of advanced manufacturing technologies, the country benefits from a well-established innovation ecosystem supported by research collaborations between industry leaders, government programs, and academic institutions.

Canada laser cladding market is anticipated to experience significant growth, primarily driven by the oil & gas and mining industries. The demand for surface repair and wear-resistant coatings in heavy machinery, pipelines, and drilling equipment is substantial, and the technology is gaining traction as industries seek more cost-effective and durable solutions to extend the lifespan of critical assets.

Europe Laser Cladding Market Trends

The laser cladding market in Europe is expected to grow at a 10.5% CAGR during the forecast period, driven by advancements across automotive, aerospace, defense, energy, and space sectors. The shift toward electric vehicles (EVs) and lightweight design has heightened the need for advanced surface engineering solutions in the automotive industry, particularly in Germany and Italy. Laser cladding plays a critical role by enhancing EV components' wear resistance and durability, such as battery casings, transmission systems, and tooling equipment.

Germany laser cladding market is growing rapidly. Home to globally renowned manufacturers such as Volkswagen, BMW, Audi, and Daimler, Germany has positioned itself as a leader in advanced automotive production. The industry’s ongoing shift toward electric vehicles (EVs) and lightweight materials is accelerating the need for precision surface engineering technologies like laser cladding.

The laser cladding market in the UK is expected to grow rapidly during the forecast period. In 2023, the United Kingdom strengthened its position as a global aerospace hub, ranking as the world's third-largest exporter of aircraft parts with exports valued at USD 10.5 million, according to OEC World data. Major destinations included Germany, the United States, France, Canada, and Spain. Although new U.S. tariffs may affect trade flows, the long-term outlook for the UK aerospace sector remains positive.

Asia Pacific Laser Cladding Market Trends

The laser cladding market in the Asia Pacific is accounting for 34.2% market share in 2024, supported by the rapid expansion of the automotive sector, particularly in the shift toward new energy vehicles (NEVs) and electric vehicles (EVs). As automakers across China, Japan, South Korea, and India invest heavily in lightweight, durable, and energy-efficient vehicle components, demand for advanced surface treatment and repair technologies has accelerated.

China laser cladding market is witnessing robust growth, fueled by the country’s leadership in producing and selling new energy vehicles (NEVs) and its broader automotive manufacturing strength. As EV production scales rapidly, the demand for high-performance, lightweight, and durable components is rising sharply. Laser cladding is increasingly used to enhance wear resistance, improve corrosion protection, and extend the lifecycle of automotive parts such as engine blocks, transmission systems, and drive shafts.

India’s laser cladding market is gaining strong momentum, supported by the rapid growth of the automotive sector. With passenger vehicle sales projected to reach USD 54.84 million by 2027 and the country ranking as the largest producer of tractors, the second-largest bus manufacturer, and the third-largest heavy truck producer globally, the demand for high-performance automotive components is accelerating.

Middle East & Africa Laser Cladding Market Trends

The laser cladding market in the Middle East & Africa (MEA) is experiencing notable growth, driven primarily by developments in the automotive sector. Strategic investments in electric vehicles (EVs) and the establishment of local automotive manufacturing facilities are creating increasing demand for high-performance components.

Saudi Arabia laser cladding market held a significant share in 2024. Saudi Arabia’s automotive sector is rapidly transforming with the rise of electric vehicles (EVs) and the establishment of local manufacturing facilities. Initiatives such as Lucid Motors, backed by the Public Investment Fund (PIF), Ceer Motors, a joint venture with Foxconn, and Hyundai’s collaboration with the Saudi Ministry of Industry to build EV and internal combustion engine vehicle plants, are driving the country’s ambitions in clean and autonomous mobility.

Latin America Laser Cladding Market Trends

The laser cladding market in Latin America is experiencing steady growth, primarily driven by the region’s automotive sector. With vehicle production rebounding in Brazil, Mexico, and Argentina, there is rising demand for high-performance materials that enhance component durability, wear resistance, and thermal performance.

Brazil laser cladding market is being driven strongly by the resurgence of its automotive industry. Vehicle production surged 24.7% in October 2024 compared to the previous year, creating a heightened demand for high-performance components that require enhanced wear resistance, durability, and thermal efficiency.

Key Laser Cladding Company Insights

Some of the key players operating in the market include TRUMPF, OC Oerlikon Management AG, Höganäs AB, IPG Photonics Corporation, and Swanson Industries.

-

TRUMPF operates across several focused industrial verticals. Its machine tool division specializes in sheet-metal fabrication with bending, punching, laser cutting, welding, and additive manufacturing solutions. The laser technology unit delivers fiber, disk, CO₂, ultrashort-pulse, high-power lasers, and amplifiers used in semiconductor EUV lithography.

-

Oerlikon operates across several advanced technology verticals, including Surface Solutions, which offers PVD, CVD, and thermal spray coatings to enhance component performance in aerospace, automotive, and tooling industries.

Key Laser Cladding Companies:

The following are the leading companies in the laser cladding market. These companies collectively hold the largest market share and dictate industry trends.

- TRUMPF

- OC Oerlikon Management AG

- Höganäs AB

- Coherent Corp

- Jenoptik

- IPG Photonics Corporation

- Hayden Corp

- Titanova, Inc

- Swanson Industries

- American Cladding Technologies

- Alabama Laser

- Kondex Corporation U.S.A.

- HORNET LASER CLADDING

- TopClad

- Laserline GmbH

Recent Developments

-

In June 2025, Coherent launched the ACE FL Series, a Thulium Fiber Laser (TFL) designed for medical therapies such as lithotripsy and Benign Prostatic Hyperplasia (BPH) treatments. Compared to older Holmium: YAG systems, the two-micron laser offers high precision, improved patient outcomes, and greater procedural efficiency.

-

In June 2025, TRUMPF launched the TruMicro 9010, a 1 kW ultra-short pulse laser built for large-area material processing. It supports high-speed tasks such as drilling, contour cutting, cleaning, and marking within one compact system. With 10 mJ pulse energy, it enables efficient, scalable use in electronics and metal fabrication industries.

Laser Cladding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 621.4 million

Revenue forecast in 2033

USD 1,403.9 million

Growth rate

CAGR of 10.7% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End User, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

TRUMPF; OC Oerlikon Management AG; Höganäs AB; Coherent Corp.; Jenoptik; IPG Photonics Corporation; Hayden Corp.; Titanova, Inc.; Swanson Industries; American Cladding Technologies; Alabama Specialty Products, Inc.; Kondex Corporation U.S.A.; Hornet Laser Cladding; Topclad B.V.; Laserline GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laser Cladding Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global laser cladding market report based on end user and region:

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

OEM

-

Aerospace & Defense

-

Equipment

-

Material

-

Services

-

-

Oil & gas

-

Equipment

-

Material

-

Services

-

-

Automotive

-

Equipment

-

Material

-

Services

-

-

Power Generation

-

Equipment

-

Material

-

Services

-

-

Medical

-

Equipment

-

Material

-

Services

-

-

Mining

-

Equipment

-

Material

-

Services

-

-

Others

-

Equipment

-

Material

-

Services

-

-

-

SMEs

-

Equipment

-

Material

-

Services

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global laser cladding market size was estimated at USD 572.0 million in 2024 and is expected to be USD 621.4 million in 2025.

b. The global laser cladding market, in terms of revenue, is expected to grow at a compound annual growth rate of 10.7% from 2025 to 2033 to reach USD 1,403.9 million by 2033.

b. The laser cladding market in the Asia Pacific held the largest revenue share for 34.2% market share in 2024, supported by the rapid expansion of the automotive sector

b. Some of the key players operating in the global laser cladding market include TRUMPF, OC Oerlikon Management AG, Höganäs AB, Coherent Corp., Jenoptik, IPG Photonics Corporation, Hayden Corp., Titanova, Inc, Swanson Industries, American Cladding Technologies, Alabama Specialty Products, Inc., Kondex Corporation U.S.A., Hornet Laser Cladding, Topclad B.V., Laserline GmbH

b. Key factors driving the global laser cladding market include increasing demand for wear-resistant and corrosion-resistant coatings, growing use in aerospace and automotive industries, advancements in laser technology, and the need for cost-effective, high-performance surface enhancement and repair solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.