- Home

- »

- Drilling & Extraction Equipments

- »

-

Pump Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Pump Market Size, Share & Trends Report]()

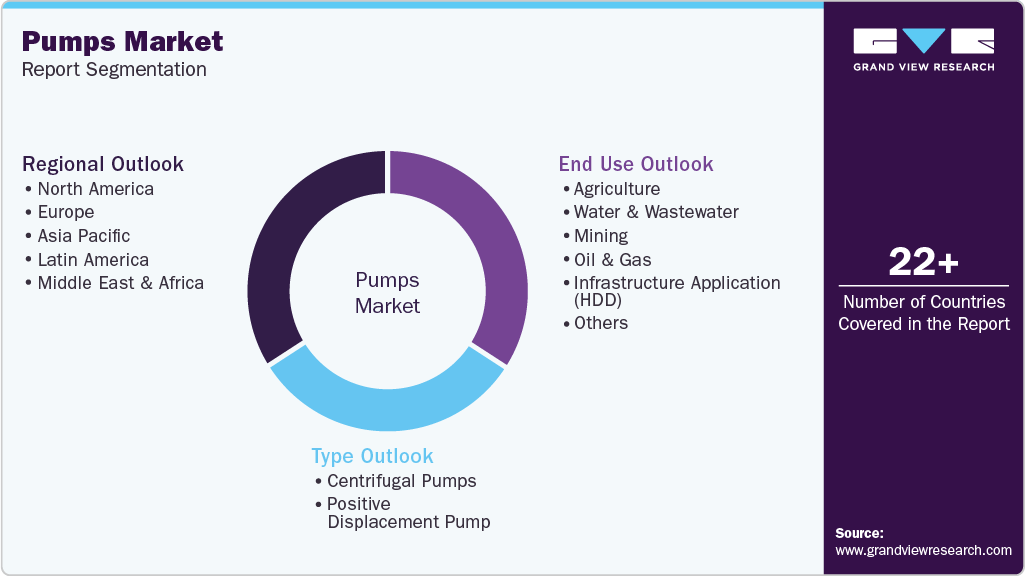

Pump Market (2026 - 2033) Size, Share & Trends Analysis Report, By Type (Centrifugal Pump, Positive Displacement Pump), By End Use (Agriculture, Water & Wastewater, Oil & Gas, Mining, Infrastructure Application), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-772-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pump Market Summary

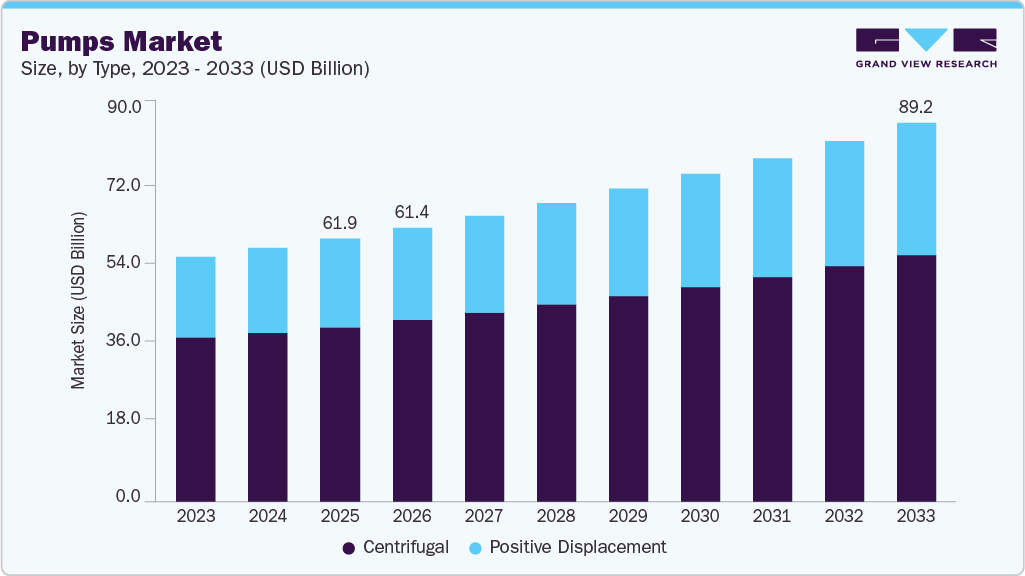

The global pumps market size was estimated at USD 61,876.6 million in 2025 and is projected to reach USD 89,175.3 million by 2033, growing at a CAGR of 4.8% from 2026 to 2033. The pump market is witnessing growth driven by their essential dual functions, enhancing fluid pressure and increasing flow rates.

Key Market Trends & Insights

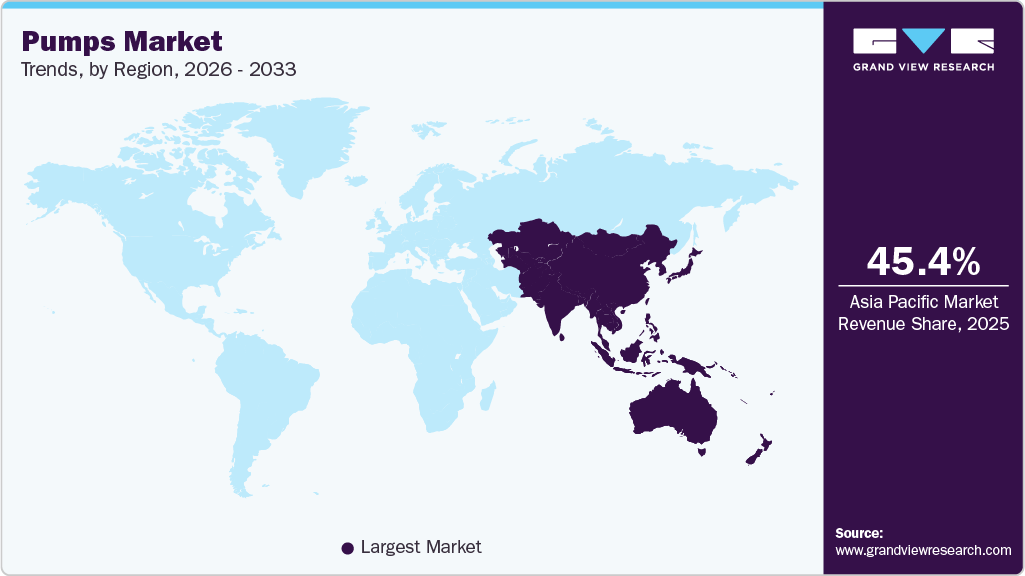

- Asia Pacific dominated the pump market with the largest revenue share of 45.4% in 2025.

- The pump market in the India is expected to grow at a substantial CAGR of 6.4% from 2026 to 2033.

- By type, the positive displacement segment is expected to grow at a considerable CAGR of 5.3% from 2026 to 2033 in terms of revenue.

- By end use, the water and wastewater segment is expected to grow at a considerable CAGR of 5.8% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 61,876.6 Million

- 2033 Projected Market Size: USD 89,175.3 Million

- CAGR (2026-2033): 4.8%

- Asia Pacific: Largest market in 2025

In industries such as oil & gas exploration and mining, pumps are vital for maintaining optimal pressure and ensuring accurate dosing of reagents during complex synthesis operations.

The demand for pumps is on the rise due to expanding fluid management needs in sectors like power generation and construction. Furthermore, growth in the agricultural investments, urban development, and the necessity for wastewater treatment are anticipated to boost the market further. Moreover, advancements in technology along with the expansion of key industries such as water & wastewater treatment, chemical, power generation, and agriculture are expected to propel the market's growth.

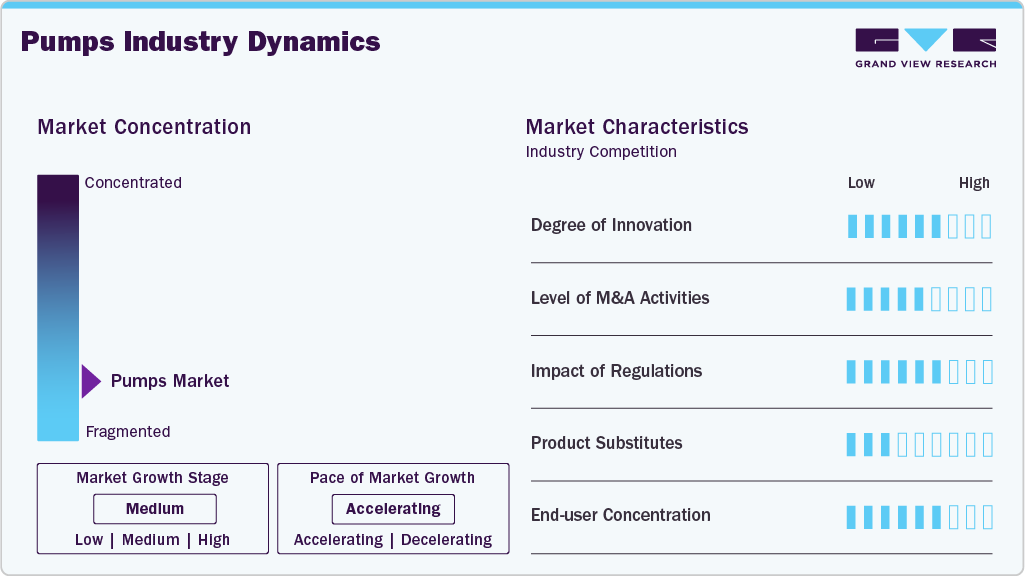

Market Concentration & Characteristics

The pump market is fragmented, with several global and regional players competing across various segments. While major companies hold significant market shares in specific applications like oil & gas or water treatment, numerous smaller firms cater to niche and localized demands. This competitive landscape fosters innovation and pricing pressure. Ongoing mergers and acquisitions may gradually increase consolidation in certain high-growth areas.

The pump industry is experiencing steady innovation, driven by the integration of smart technologies, IoT, and energy-efficient designs. Manufacturers are focusing on automation, remote monitoring, and predictive maintenance to enhance performance. Innovations also target reduced environmental impact and operational costs. This evolution is reshaping both product development and end user expectations.

The industry has seen a consistent level of mergers and acquisitions, especially among companies aiming to expand geographic presence or enter niche markets. Strategic acquisitions are enabling firms to strengthen their technological capabilities and diversify offerings. Bolt-on deals are common for accelerating growth and achieving economies of scale. This trend supports market consolidation and competitive positioning.

Regulatory frameworks heavily influence the pump market, especially in sectors like water treatment, oil & gas, and chemicals. Compliance with energy efficiency standards and environmental guidelines shapes product design and adoption. Regulations often drive the need for upgrades or replacements of legacy systems. As sustainability concerns grow, regulatory pressure is expected to intensify.

Drivers, Opportunities & Restraints

The growing need for efficient fluid handling in industries such as oil & gas, water treatment, and chemicals is driving pump demand. Rapid urbanization and rising infrastructure investments are further boosting market expansion. Energy-efficient and smart pumping solutions are gaining traction amid sustainability goals. These factors collectively support strong market growth globally.

Emerging economies are investing heavily in water infrastructure, offering significant growth potential for pump manufacturers. Technological advancements like IoT-enabled and remote-monitoring pumps are opening new revenue streams. Increasing focus on renewable energy and desalination also expands application areas. Strategic collaborations and R&D offer further scope for innovation and market penetration.

High upfront costs of advanced pumps can deter adoption, particularly among small and mid-sized enterprises. Volatile raw material prices affect manufacturing costs and supply chain stability. Complex maintenance requirements and downtime concerns may discourage continuous use. Additionally, strict environmental regulations may limit certain pump technologies in sensitive applications.

Type Insights

The demand for the positive displacement pump segment is expected to grow at the fastest CAGR of 5.3% from 2026 to 2033 in terms of revenue. Centrifugal pumps hold the largest market and accounted for 66.5% share in 2025, due to their simple design, low maintenance, and ability to handle high flow rates. They are widely used in water supply systems, HVAC systems, and industrial applications. Their efficiency in continuous operation makes them ideal for large-scale systems. Increasing demand from municipal and infrastructure projects continues to drive their dominance.

Positive displacement pumps are experiencing rapid growth due to their ability to handle high-viscosity fluids and precise flow control. They are increasingly used in chemical processing, pharmaceuticals, and food & beverage industries. Their suitability for high-pressure and metering applications enhances demand. Growing focus on accuracy and energy efficiency supports their accelerated adoption.

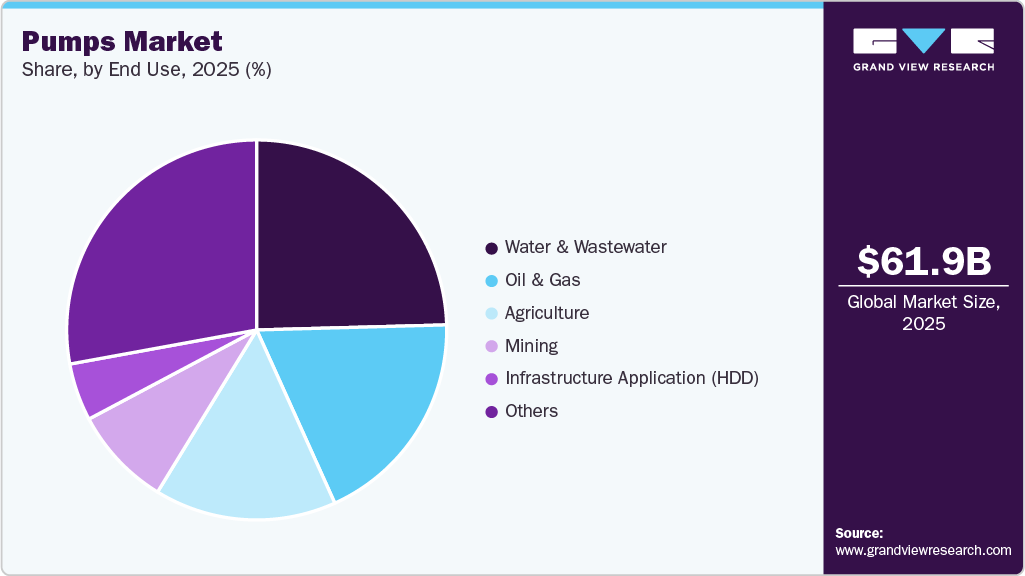

End Use Insights

The oil and gas sector segment is expected to grow at a significant CAGR of 5.4% from 2026 to 2033 in terms of revenue. The water and wastewater remain the dominant end user of pumps and accounted for a 24.6% share in 2025, due to rising global concerns over water scarcity and pollution. Government initiatives and infrastructure upgrades are driving pump installations in treatment plants. Urban expansion and industrial discharge necessitate efficient water management solutions. The demand for energy-efficient and automated pumps is driving growth in this segment.

The oil and gas sector segment is growing significantly due to its continuous demand for fluid transfer in drilling, refining, and transportation processes. Pumps are critical for maintaining pressure and ensuring safety in upstream and downstream operations. High investment in exploration and production sustains strong usage. The sector's global scale ensures consistent demand for advanced pumping systems.

Regional Insights

The North America pump market is driven by ongoing investments in infrastructure development, water and wastewater management, and the oil & gas sector. The region exhibits a strong demand for energy-efficient and technologically advanced pumping systems, particularly in the U.S. and Canada. Growth is further supported by industrial automation trends, stringent environmental regulations, and the modernization of aging water infrastructure.

U.S. Pumps Market Trends

The pumps market in the U.S. is expected to expand at a CAGR of 2.9% over the forecast period. In the U.S., the growth of the pumps market is attributed to the modernization of infrastructure, stringent environmental regulations, and advancements in energy-efficient pump technologies. The increasing exploration activities in the oil and gas sector also contribute to the growth. Furthermore, the adoption of smart pumps equipped with IoT technology for predictive maintenance and efficiency optimization is a trend expected to positively impact the market growth.

Canada pump market is expanding with strong demand from the oil & gas, mining, and municipal sectors. Investments in water infrastructure and irrigation systems are also contributing to pump adoption. The growing focus on energy efficiency and automation is pushing the use of modern pumping solutions. Environmental sustainability efforts are encouraging the shift toward eco-friendly and advanced pump technologies.

Europe Pumps Market Trends

In Europe, the demand for pumps is similarly increasing, fueled by the need for modernized water and wastewater systems. The market is experiencing a shift towards more energy-efficient solutions, such as heat pumps, which are becoming increasingly popular due to their substantially greater energy efficiency compared to traditional gas boilers. This trend is part of a broader movement towards sustainability and environmental responsibility, which is driving investments in pump technologies that reduce energy consumption and improve service delivery in urban areas.

Germany pumps market benefits from its strong engineering and manufacturing base, with a focus on energy-efficient, high-quality pump solutions. The emphasis on renewable energy sources and the chemical industry's requirements for specialized pumps are key growth drivers. Germany's commitment to sustainability and its leading position in the automotive industry, requiring sophisticated pumping systems, further enhance market prospects.

France pumps market is growing due to the government's investment in water and wastewater management infrastructure, the nuclear energy sector's need for cooling pumps, and initiatives in energy efficiency. The country's focus on environmental sustainability also plays a vital role. Additionally, France's position as a hub for the pharmaceutical and food and beverage industries, which require high-quality and hygienic pumps, supports market growth.

Asia Pacific Pumps Market Trends

Asia Pacific dominated the market and accounted for 45.4% revenue share in 2025. The surge in industrial and urban development, along with a rising need for managing fluids and ensuring access to safe drinking water in various countries, including China and India, are poised to enhance market prospects. Additionally, the economies within the Asia-Pacific area are projected to prosper over the forecast period, driven by heightened governmental investments in sectors such as agriculture, construction, and water and wastewater treatment.

In China, the pumps market is propelled by rapid industrialization, urbanization, and significant investments in water infrastructure and wastewater treatment plants. The country's focus on enhancing its manufacturing capabilities and environmental regulations also plays a crucial role. Additionally, the expansion of the chemical and power generation sectors demands advanced pumping solutions, further driving market growth.

The pumps market in India isdriven by the agriculture sector's demand for irrigation solutions, government initiatives for water conservation, and infrastructure development projects. The burgeoning real estate sector and industrial expansion further fuel demand. Moreover, increased investments in renewable energy projects, such as solar-powered pumps for agriculture and rural areas, contribute significantly to the market expansion.

Latin America Pumps Market Trends

The Latin America region faces challenges related to insufficient access to clean water and poor service quality, which are prompting investments in pump infrastructure. The water pumps market in Latin America is expected to see significant growth. This growth is essential for addressing public health concerns and enhancing the quality of life for residents across the region.

In Brazil, the growth of the pumps market is significantly influenced by the agriculture sector, which requires large-scale irrigation solutions to support its vast agricultural lands. Additionally, the country's focus on developing its oil and gas industry, particularly in offshore reserves, necessitates advanced pumping technologies for extraction processes. The government's investment in water and wastewater treatment infrastructure to address environmental concerns and improve public health further boosts the demand for pumps.

Middle East & Africa Pumps Market Trends

The Middle East & Africa region is anticipated to witness substantial growth during the projected period, fueled by booming sectors such as oil & gas along with water & wastewater treatment. This region stands as a pivotal center for oil & gas production, where pumps play a crucial role in the transfer and refining of crude oil. Furthermore, nations in the Middle East are significantly investing in water treatment projects aimed at transforming saline water into potable water, utilizing pumps for processes such as seawater intake, reverse osmosis, and brine disposal.

The pumps market in Saudi Arabia is primarily driven by the oil and gas sector, where pumps are essential for a myriad of operations ranging from extraction to processing. The country's ambitious vision to diversify its economy and reduce its dependence on oil revenues has led to substantial investments in water desalination, wastewater treatment, and construction projects, all of which require extensive use of pumps. Moreover, the push towards renewable energy sources and modernization of infrastructure projects in the kingdom further catalyzes the growth of the pumps market.

Key Pumps Company Insights

Some of the key players operating in the Pumps market include Ingersoll Rand, SLBc, and the SPX FLOW, Inc.

-

The company offers its products through various brands, including Nash, CompAir, Gardner Denver, ARO, Thomas, Emco Wheaton, Runtech systems, and Evolution. It provides industrial pumps products through the ARO brand. The company has been offering products through four subsegments, including compressor systems, lifting & material handling, pumps, and power tools. Apart from this product portfolio, the company also offers maintenance services, rental services, performance services, remanufacturing services, and installation services. Seepex, GHHRand, LMI chemical pumps, Williams pumps, and YZ systems are some important brands of the company.

-

The company manages its business operations in 25 countries and has a significant presence in 140 countries. The company has more than 26 Innovation and Design Centers globally. These state-of-the-art collaborative spaces are where companies design new products, develop technologies, and work with customers to build, test, and perfect their critical manufacturing processes. The company’s product portfolio supports global industries, such as food & beverage, chemical processing, compressed air, and mining, by offering a wide range of pumps, filters, mixers, valves, air dryers, separators, hydraulic tools, homogenizers, and heat exchangers, along with aftermarket materials and services.

Key Pumps Companies:

The following are the leading companies in the pumps market. These companies collectively hold the largest market share and dictate industry trends.

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation.

- ITT INC.

- EBARA CORPORATION.

- IWAKI CO., LTD.

- Sulzer Ltd

- SPX FLOW, Inc.

- Titan Manufacturing Inc.

Recent Developments

-

In June 2025, Sentinam has launched as a dedicated pump solutions provider, offering a wide range of systems for industries such as water treatment, chemicals, and manufacturing. Backed by MechTronic’s industry expertise, the company focuses on tailored solutions, dependable service, and high-quality products. With a strong supply network and technical support, Sentinam aims to deliver efficient and reliable pumping solutions.

-

In July 2024, Flowserve Corporation obtained the intellectual assets and ongoing research, and development associated with cryogenic Liquefied Natural Gas (LNG) submerged pump technology, packaging, and systems from NexGen Cryogenic Solutions, Inc., a company based in Arizona that specializes in the design, engineering, and testing of LNG pumps and turbines.

-

In October 2024, Ingersoll Rand has expanded its portfolio by acquiring APSCO, Blutek, and UT Pumps, strengthening its presence in compressed air and fluid management. These acquisitions enhance its technological capabilities and market reach across key sectors like wastewater and biogas. The move aligns with the company’s strategy to drive long-term, high-return growth through targeted investments.

Pumps Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 64,375.1 million

Revenue forecast in 2033

USD 89,175.3 million

Growth rate

CAGR of 4.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, end use, and region.

Region Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

SLB; Ingersoll Rand; The Weir Group PLC; Vaughan Company; KSB SE & Co. KGaA; Pentair; Grundfos Holding A/S; Xylem; Flowserve Corporation.; ITT INC.; EBARA CORPORATION.; IWAKI CO., LTD.; Sulzer Ltd; SPX FLOW, Inc.; Titan Manufacturing Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pump Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc has segmented the global pumps market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Centrifugal Pumps

-

Centrifugal Pumps By Configuration

-

Single Stage

-

Multistage

-

-

Centrifugal Pumps By Design

-

Radial Flow Pump

-

Mixed Flow Pump

-

Axial Flow Pump

-

-

-

Positive Displacement Pump

-

Rotary Pump By Type

-

Gear Pump

-

Screw Pump

-

Vane Pump

-

Lobe Pump

-

Others

-

-

Reciprocating Pump By Type

-

Diaphragm Pump

-

Piston Pump

-

Plunger Pump

-

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Agriculture

-

Water & Wastewater

-

Mining

-

Oil & Gas

-

Infrastructure Application (HDD)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pump market size was estimated at USD 61,876.6 million in 2025 and is expected to reach USD 64,375.1 million in 2026.

b. The global pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2026 to 2033 and reach USD 89,175.3 million by 2033.

b. Asia Pacific dominated the market and accounted for 45.4% revenue share in 2025. The surge in industrial and urban development, along with a rising need for managing fluids and ensuring access to safe drinking water in various countries, including China and India, are poised to enhance market prospects. Additionally, the economies within the Asia-Pacific area are projected to prosper over the forecast period.

b. Some of the key players operating in the pump market include SLB, Ingersoll Rand, The Weir Group PLC, Vaughan Company, KSB SE & Co. KGaA, Pentair, Grundfos Holding A/S, Xylem, Flowserve Corporation, ITT INC., EBARA CORPORATION., IWAKI CO., LTD., Sulzer Ltd, and SPX FLOW, Inc.; Titan Manufacturing Inc.

b. The increasing fluid handling requirements in various industries such as water & wastewater treatment and chemical, power generations has been propelling the market. Further, regulatory compliance and technological advancements in pump technology for energy efficient pumps are driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.