- Home

- »

- Advanced Interior Materials

- »

-

Laser Cutting Machines Market Size & Share Report, 2030GVR Report cover

![Laser Cutting Machines Market Size, Share & Trends Report]()

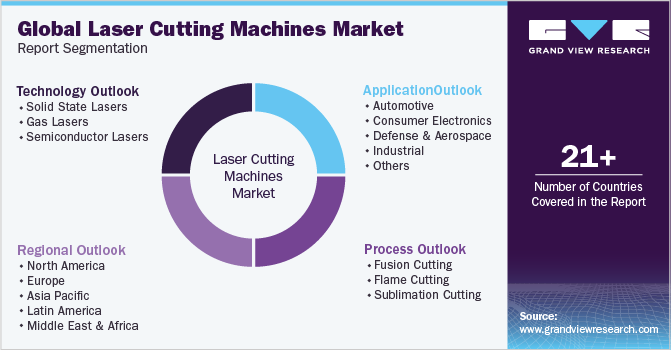

Laser Cutting Machines Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Solid State Lasers, Gas Lasers), By Process (Fusion Cutting, Flame Cutting), By Application (Automotive, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-393-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laser Cutting Machines Market Summary

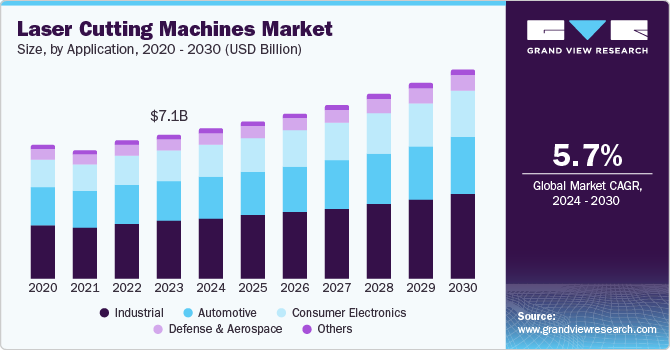

The global laser cutting machines market size was estimated at USD laser cutting machines in 2023 and is projected to reach USD 10.35 billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030. It is anticipated that the growing trend of automation in the manufacturing sector and the rising demand for the end-use industry will increase demand for laser cutting to support the laser cutting machine industry’s growth over the forecast period.

Key Market Trends & Insights

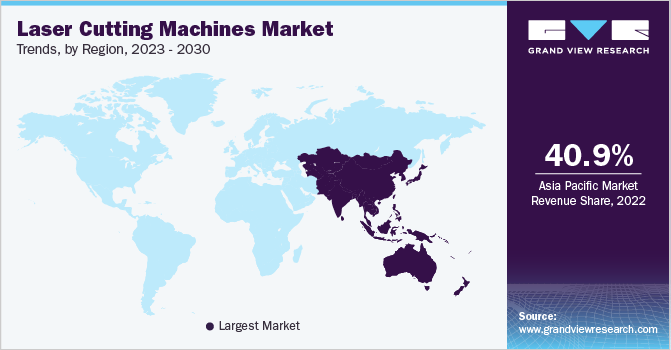

- The Asia Pacific region held the largest market share of 39.7% in 2023.

- Based on technology, the market is divided into solid state lasers, gas lasers and semiconductor lasers.

- Based on process, the market is divided into fusion cutting, flame cutting, and sublimation cutting.

- Based on application, the market is categorized into consumer electronics, industrial, defense and aerospace, automotive and other.

Market Size & Forecast

- 2023 Market Size: USD laser cutting machines

- 2030 Projected Market Size: USD 10.35 billion

- CAGR (2024-2030): 5.7%

- Asia Pacific: Largest market in 2023

Industries such as automotive, electronics, packing, pharmaceuticals, HVAC, and others are increasingly using automated laser cutting machines. Additionally, the end-use sectors widely utilize these machines to produce high-quality goods efficiently. Manufacturers are now able to automate a variety of processes, including laser cutting, owing to the growing trend of automation. These tools produce and cut pieces and patterns precisely; the machines deliver uniform outcomes, due to reduced downtime and the need for energy efficiency, manufacturers are investing in the automation of laser cutting, thus driving the market growth.

The growth of the laser cutting machines market is driven by the rising adoption of industry 4.0 technologies such as automation and data analytics. Also, Internet of Things (IoT) is assisting in maximizing the efficiency of laser cutting machinery due to the real-time information exchange that enables optimum output by enabling operators to monitor and manage their production processes. Manufacturers aim to improve operating cost-efficiency, decrease downtime, and enhance production. Another factor supporting the market growth of laser cutting machines is expanding due to the increased human-machine connection provided by industry 4.0 solutions, which is enhancing quality, productivity, and energy efficiency. Additionally, the early notification of the machine operation status provided by predictive analysis is promoting manufacturers to invest in industry 4.0 solutions by significantly lowering maintenance and replacement costs. This is expected to propel market growth.

The growth of the laser cutting machines market is driven by the rising adoption of industry 4.0 technologies such as automation, data analytics, and the Internet of Things (IoT) are assisting in maximizing the efficiency of laser cutting machinery due to the real-time information exchange that enables optimum output by enabling operators to monitor and manage their production processes. Manufacturers aim to improve operating cost-efficiency, decrease downtime, and enhance production.

Another factor supporting the market growth of laser cutting machines is expanding due to the increased human-machine connection provided by industry 4.0 solutions, which is enhancing quality, productivity, and energy efficiency. Additionally, the early notification of the machine operation status provided by predictive analysis is promoting manufacturers to invest in industry 4.0 solutions by significantly lowering maintenance and replacement costs. This is expected to propel market growth.

The emergence of fiber laser cutting is further expected to support the market growth of laser-cutting machinery. Fiber laser cutting devices are frequently employed in macro-processing applications with millimeter-level precision, such as cutting and welding industrial metals. Given the high demand for laser equipment, the market potential for macro processing is greater than that for micro processing. Fiber lasers are frequently employed in macro processing, which is the processing of objects whose size and shape have a laser beam influence range of millimeters, due to their high output power.

Fiber laser cutting boosts advantages such as precise, high-quality cuts, improved process for micro cutting, and shaping structural steel, positioning them as the preferred choice among the manufacturers. Additionally, the traction of fiber laser cutting equipment is fueled by several key features, including their ergonomics, quick operation, and high power safety. Most of these machines employ pre-focused optical systems with suitable deflection lenses, improving focus accuracy, laser light transmission, and machine performance. Thus, the emergence of new cutting technologies is driving the market growth.

The high cost of laser-cutting machinery coupled with high power consumption is a major restraint hindering the market growth. The high cost of the machinery components, such as water tubes, laser generators, and laser lenses, and their overall maintenance cost is another factor that affects the growth. Furthermore, when heated at high temperatures, cutting polymers such as Polytetrafluoroethylene and other metals releases harmful gases such as phosgene gas. This is another disadvantage restraining the industry’s growth.

Technology Insights

Based on technology, the market is divided into solid state lasers, gas lasers and semiconductor lasers. Among these, the solid-state laser cutting machine segment accumulated the largest market share of 43.3 % in 2023. The growth is attributed to the increasing usage of solid-state lasers cutting machine in industries such as automotive, pharma, and optical industry for precision cutting.

Solid state laser cutting machine enables flexibility, high efficiency, low energy consumption, shorter wavelength, and low cost; these advantages support segmental growth. Furthermore, because this technology is being widely used in medical fields like endoscopy, dentistry, and skin rejuvenation, demand for the solid-state laser cutting machine is anticipated to rise over the course of the forecast period. In the fields of consumer electronics, defense, and healthcare, lasers like CO2, YAG, and fiber are employed more frequently.

The gas laser segment is expected to grow rapidly from 2024 to 2030. A surge in the demand for enhanced laser cutting machine equipment and tools is driving the market for the use of these lasers. They are widely used for laser printing, barcode scanning, dye laser pumping, and hologram generation.

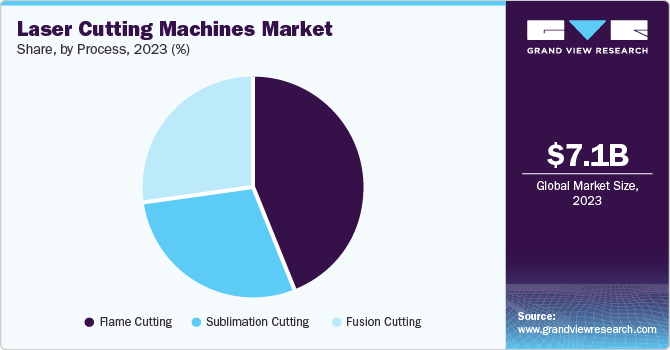

Process Insights

Based on process, the market is divided into fusion cutting, flame cutting, and sublimation cutting. Among the three, the flame cutting segment held the largest market share of 43.7% in 2023. The growth of the flame-based laser cutting machine is attributed to improved finish, precision cutting, and fast cutting speeds. The demand for small steel and carbon alloy timing is expected to increase the demand for flame cutting process over the forecast period.

The fusion cutting segment is expected to grow at the fastest CAGR of 6.3% from 2024 to 2030. The fusion laser cutting machine method is suitable for developing and manufacturing electric motors, owing to its ease of cutting structural steel and electrical sheets. Moreover, the process is anticipated to grow over the forecast period due to its high flexibility and quick cutting speed.

Application Insights

Based on application, the market is categorized into consumer electronics, industrial, defense and aerospace, automotive and other. Among these, the industrial segment held the largest market share of 39.7% in 2023. The growth is attributed to the increasing manufacturing output across developing nations. The industrial sector is expanding as a result of the expanding use of these machines to clean parts and moulds during the manufacturing process.

The consumer electronics segment is expected to grow at the fastest CAGR of 6.4% from 2024 to 2030. These lasers cutting machines are deployed in consumer electronics and other devices for cutting and welding. To cut printed circuit boards, iPhone displays, and casings, laser-based equipment is frequently employed. Additionally, it is anticipated that over the forecast period, demand for the machines will rise due to the short shelf life of these devices.

Regional Insights & Trends

North America held more than 25.0% share in 2023. The U.S. contributed the regional growth and held the largest market share of 73.7% in 2023. It is a hub to prominent automotive and aerospace companies, such as GM, Ford, Chevrolet, Chrysler, and Boeing, which are significant users of laser-cutting machinery. The focus on smart home automation, new product developments, and rapid expansion of the consumer electronics market in the U.S. are among the key factors responsible for driving product demand, thereby supporting the regional growth.

Europe Laser Cutting Machines Market Trends

Europe held a market share of 19.8% in 2023 and is expected to grow at a CAGR of 5.1% from 2024 to 2030. Presence of countries such as Germany and France which are increasingly emphasizing on developing advanced manufacturing technologies has driven the market in recent years.

Asia Pacific Laser Cutting Machines Market Trends

The Asia Pacific region held the largest market share of 39.7% in 2023 and is expected to grow at a CAGR of 6.5% during the forecast period. The growing presence of consumer electronics and automotive manufacturers in the region is expected to further propel the market growth. The growing adoption of automation in laser-cutting machinery is another factor that is augmenting laser cutting machine market growth.

Key Laser Cutting Machines Company Insights

The key market players include Trumpf, Bystronic, Mazak, Amada, Coherent and others. Manufacturers are concentrating on implementing tactics like acquisitions, collaborations, and expansions to increase their position in the worldwide market.

Participants in the market are focusing on bolstering their position through a range of strategic initiatives, including the development of new products, joint ventures, partnerships, and mergers and acquisitions. R&D efforts are heavily prioritized by major market participants to develop cutting-edge products and expand their product portfolios. These players are also focusing on developing laser equipment that uses less power and is more effective. Some prominent players in the global laser cutting machines market include:

-

Bystronic offers high-quality solutions enabling transformation into a productive and sustainable future. The focus is on the automation of the complete material and data flow of the cutting and bending process chain.

Key Laser Cutting Machines Companies:

The following are the leading companies in the laser cutting machines market. These companies collectively hold the largest market share and dictate industry trends.

- Trumpf

- Bystronic

- Mazak

- Amada

- Coherent

- IPG Photonics

- Prima Power

- Mitsubishi Electric

- Han's Laser Technology

- Hypertherm

Recent Developments

-

In May 2022, Yamazaki Mazak announced the launch of FG-400 NEO. It is a 3D fiber laser cutting machine. It is equipped with functions enabling users to adjust the shape and diameter of laser beam, thereby making it possible to cut thin sheets to thick plates with one machine.

Laser Cutting Machines Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.43 billion

Revenue forecast in 2030

USD 10.35 billion

Growth Rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2020 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, process, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan , China, India, Australia, South Korea, Brazil, South Africa , South Arabia, and UAE

Key companies profiled

Trumpf, Bystronic, Mazak, Amada, Coherent,

IPG Photonics, Prima Power, Mitsubishi Electric, Han's Laser Technology, Hypertherm

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laser Cutting Machines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the laser cutting machines market report based on technology, process, application and region:

-

Technology Outlook (Revenue, USD Million, 2020 - 2030)

-

Solid state lasers

-

Gas lasers

-

Semiconductor lasers

-

-

Process Outlook (Revenue, USD Million, 2020 - 2030)

-

Fusion cutting

-

Flame cutting

-

Sublimation cutting

-

-

Application Size Outlook (Revenue, USD Million, 2020 - 2030)

-

Automotive

-

Consumer electronics

-

Defense and aerospace

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

South Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.