- Home

- »

- Homecare & Decor

- »

-

Latex Mattress Market Size & Share, Industry Report, 2033GVR Report cover

![Latex Mattress Market Size, Share & Trends Report]()

Latex Mattress Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Blended/Hybrid Mix, Natural Latex, Synthetic Latex), By Application (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-373-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Latex Mattress Market Summary

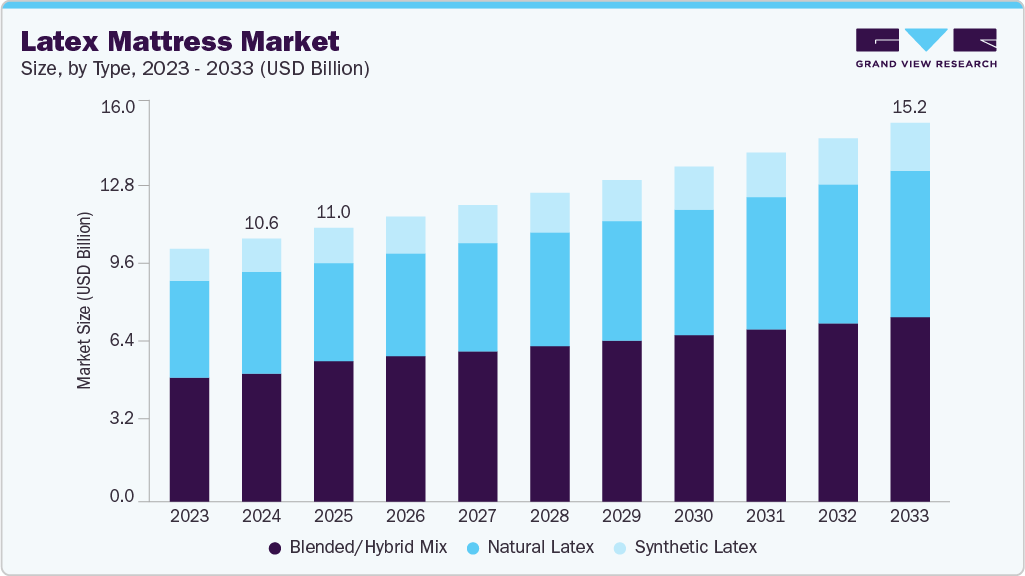

The global latex mattress market size was estimated at USD 10,578.1 million in 2024, and is projected to reach USD 15,225.6 million by 2033, growing at a CAGR of 4.1% from 2025 to 2033. The growing demand for latex mattresses can be attributed to several factors, including heightened consumer awareness of health and wellness, a noticeable rise in back and joint issues at younger ages driven by fast-paced urban living, and advancements in material and product innovation.

Key Market Trends & Insights

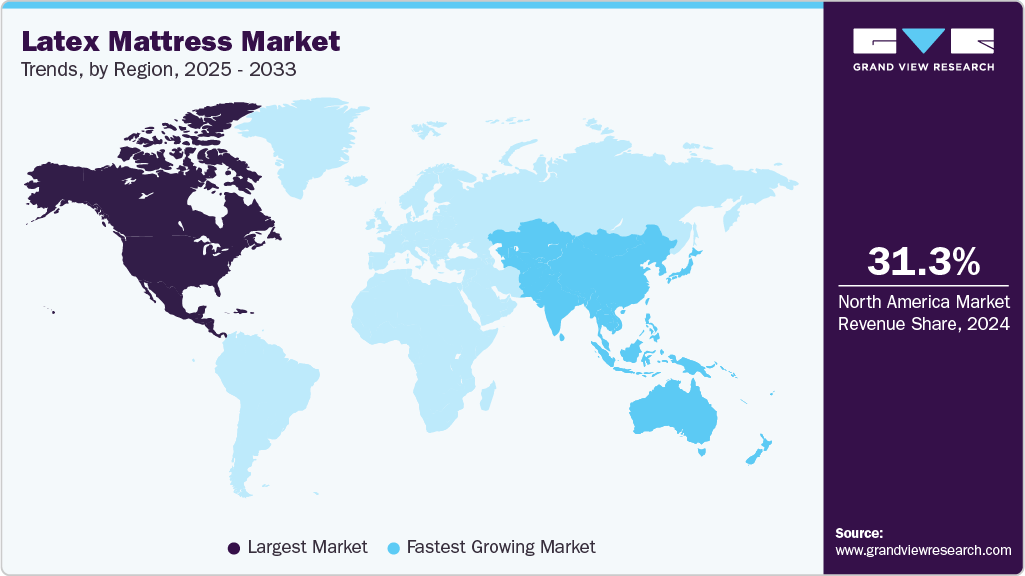

- North America latex mattress market held the major share of 31.33% of the global market in 2024.

- The latex mattress industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the blended/hybrid mix segment held the highest market share of 48.73% in 2024.

- Based on application, the latex mattresses across residential properties segment held the largest share of 79.93% of the global market in 2024.

- By distribution channel, the latex mattresses distributed through specialty stores segment accounted for a revenue share of 49.34% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10,578.1 Million

- 2033 Projected Market Size: USD 15,225.6 Million

- CAGR (2025-2033): 4.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As a result, more consumers are prioritizing comfort and premium quality in their sleep solutions, fueling the product adoption of latex mattresses. The market is driven by growing consumer interest in environmentally friendly and health-oriented sleep products. This momentum is largely supported by heightened awareness around the advantages of natural latex mattresses, known for their allergy-resistant properties, long-lasting performance, and absence of toxic substances.In addition, the industry is gradually shifting toward digital sales platforms, as direct-to-consumer (DTC) brands attract buyers with affordable price choices, extended trial offers, and convenient return policies, simplifying the purchasing process. Latex mattresses are widely recognized for their health-enhancing properties, particularly their ability to support natural spinal alignment and improve sleep quality. Their inherent elasticity makes them exceptionally comfortable and effective in relieving pressure points, making them a preferred option for individuals with back pain.

Many healthcare professionals, including osteopaths, chiropractors, and physical therapists, recommend latex mattresses for spinal support. According to data from the National Library of Medicine, chronic low back pain affects up to 23% of the global adult population, with recurrence rates ranging from 24% to 80% annually.

The market is experiencing notable progress through technological innovations and improved manufacturing techniques. For example, in January 2024, King Koil USA expanded into the Canadian market with its Smartlife Mattress, incorporating features such as temperature-regulating memory foam, cooling technology that adapts to body heat, and patented smart cell systems offering zoned support.

In a similar move, NewGen Sleep Products unveiled its line of natural Talalay latex mattresses enhanced with CELLIANT technology, which transforms body heat into far-infrared energy to help improve circulation and speed up recovery. These mattresses also come with breathable organic cotton covers and are certified by Oeko-Tex for safety and sustainability.

Such innovations are driving strong growth in the market. The combination of cutting-edge sleep technology with the natural, eco-conscious, and allergy-friendly benefits of latex aligns with the growing consumer preference for sustainable, personalized, and wellness-focused bedding solutions.

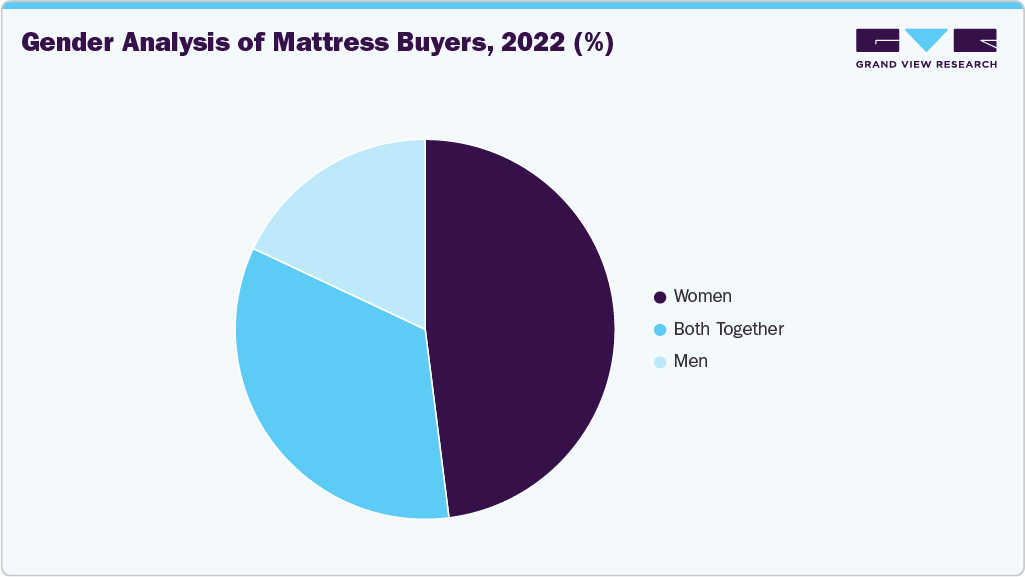

Consumer Surveys & Insights

In the North American market, consumer behavior varies notably by gender, with women often playing a central role in purchasing decisions. TraQline’s 2022 analysis of the mattress industry revealed that nearly 48% of mattress buyers are women, highlighting their strong influence in choosing home bedding products. This aligns with broader trends in home-related purchasing, where women frequently take the lead in decisions involving comfort, wellness, and design, areas where latex mattresses excel due to their high-quality materials and health-oriented features.

Moreover, about 34% of mattress purchases are made collaboratively by couples, prompting brands to adapt their strategies accordingly. To meet the needs of shared decision-making, many companies now emphasize personalized features such as dual-comfort zones and customizable firmness levels, ensuring their products appeal to all consumer demographics.

Income plays a significant role in the purchasing decisions for latex mattresses, given their generally higher cost compared to conventional foam or spring options. Households with higher disposable incomes, particularly those in the upper-middle class or with dual earners, are more inclined to consider these mattresses as a valuable investment in long-term comfort and well-being. While middle-income consumers tend to be more cautious about price, many are drawn to the product’s durability and health benefits. This indicates that strategic communication emphasizing long-term value and health advantages can help make latex mattresses more appealing to cost-conscious buyers.

Trump Tariff Impact

The Trump administration’s 2025 trade policy introduced sweeping tariffs, 10% on all imports starting April 5, and additional "reciprocal" tariffs of up to 25% applied to targeted countries, including China, Canada, and Mexico, from April 9 onward. For mattress manufacturers relying on imported latex, foam, coil springs, or fabric, this meant an immediate increase in input costs. All‑latex mattress makers sourcing materials from China or Mexico could face cost hikes in the range of ~5-15%, with hybrids and foam mattresses seeing even steeper bumps of ~15-25% due to their reliance on tariff‑affected components.

Some brands have been careful by diversifying supply chains or prioritizing non‑tariffed sources, like latex from Sri Lanka, and domestic production to mitigate rising costs. Despite these efforts, once existing inventories run down, many U.S. retailers are expected to raise prices, potentially by early summer, providing a strategic time for consumers to purchase before full tariff effects are reflected on price tags.

Type Insights

The blended/hybrid mix category held a revenue share of 48.73% in 2024. Blended or hybrid latex mattresses have witnessed a notable growth across North America, fueled by growing consumer interest in healthier, eco-friendly, and personalized sleep options. This trend aligns with increased awareness around sleep quality and its impact on overall well-being. Research indicates that as many as 80% of adults are likely to suffer from back pain at some stage in their lives. Using an unsuitable mattress can contribute to or worsen these issues, making supportive and adaptive bedding, such as hybrid latex mattresses, an increasingly attractive choice for health-conscious consumers.

Natural latex mattress segment is expected to grow at the fastest CAGR of 5.2% from 2025 to 2033. Natural latex mattresses are well known for their impressive durability, often lasting 15 to 20 years or more. Made from the sap of rubber trees, which is a renewable and eco-friendly resource, these mattresses have a core created by processing this sap into foam. This core not only provides lasting support but also ensures a high level of comfort over time. For instance, in April 2024, Essentia Organic Mattress launched the Grateful Eight Organic Latex Mattress, handcrafted with certified organic materials in their GOLS & GOTS-certified factory.

Application Insights

Latex mattresses across residential properties held the largest share of 79.93% of the global market in 2024. Latex mattresses are valued for their durability and extended lifespan, making them a smart and economical choice for homeowners looking for premium bedding solutions. The main buyers tend to be adults between 25 and 60 years old, primarily from middle to higher income groups. Increasing interest is driven by health-aware consumers who prioritize luxury and innovative sleep products that offer enhanced comfort and support tailored to individual needs.

The sale of latex mattresses across commercial properties is expected to grow at a CAGR of 3.2% from 2025 to 2033. Latex mattresses play a key role in enhancing the overall guest experience at boutique eco-hotels, luxury resorts, and destination spas. Their ergonomic design, allergy-resistant qualities, and environmentally friendly nature complement the wellness-centered services that upscale retreats typically promote. For example, the Ace Hotel group incorporates natural latex mattresses in many of their guest rooms to align with their commitment to comfort and sustainability.

Distribution Channel Insights

Latex mattresses distributed through specialty stores accounted for a revenue share of 49.34% in 2024. Many consumers choose to buy latex mattresses from specialty stores due to the expert advice and tailored service they receive. Unlike broad retail outlets, these specialty stores concentrate solely on sleep-related products, enabling their staff to offer detailed knowledge about different mattress types, materials, and the principles of sleep ergonomics.

Latex mattresses distributed through online/e-commerce channels are expected to grow at a CAGR of 6.2% from 2025 to 2033. Consumers increasingly choose to purchase latex mattresses via online and e-commerce platforms due to the superior convenience and flexibility these channels provide. Buyers can easily browse a diverse range of products, compare prices, access customer feedback, and gather detailed information about features, all from the comfort of their own homes, eliminating the necessity of visiting brick-and-mortar stores.

Regional Insights

The North America latex mattress industry held the largest global market share of 31.33% in 2024. Latex mattress manufacturers are quickly strengthening their footprint across North America by investing in domestic manufacturing plants, establishing retail collaborations, and adopting direct-to-consumer sales strategies. Leading companies such as Serta Simmons Bedding LLC, Tempur Sealy International Inc., Casper Inc., Sleep Number Corp., and Saatva Inc. are broadening their market influence through strategic mergers within the U.S. For instance, in May 2023, Tempur Sealy finalized an agreement to acquire Mattress Firm, the country’s largest mattress retailer. These developments are anticipated to significantly contribute to the growth of the North America latex mattress industry over the forecast years.

Furthermore, international manufacturers are entering the North American latex mattress industry to tap into growing eco-conscious consumer trends. For example, European latex mattress maker Latexco opened a production facility in Georgia, U.S.A., to better serve North American customers and reduce logistical costs.

U.S. Latex Mattress Market Trends

The latex mattress industry in the U.S. is expected to grow at a significant CAGR from 2025 to 2033. The US is home to numerous latex mattress manufacturing companies, which is an additional factor boosting the U.S. latex mattress industry. The region witnesses increasing competition among companies in terms of pricing strategy, increased availability of products through the multichannel distribution network, and the introduction of new products.

Key companies such as Kingsdown Inc. (Kingsdown), Serta Simmons Bedding LLC (Serta Simmons Bedding), Avocado Green Mattress, and Tempur Sealy International Inc. (Tempur Sealy International) are utilizing the omnichannel retail format to enhance the availability of their mattresses both online and offline. Currently, most consumers in the U.S. prefer to buy products online to ease their shopping process and to avail benefits such as attractive discounts, home delivery services, and parallel price discounts.

Europe Latex Mattress Market Trends

The European latex mattress industry is experiencing growth driven by several key factors. Increasing awareness of health and wellness among consumers has led to a preference for mattresses that offer superior comfort and support. Latex mattresses, known for their durability and hypoallergenic properties, are gaining popularity as they provide a healthier sleep environment.

Sustainability is another significant driver. European consumers are increasingly prioritizing eco-friendly products, and natural latex mattresses align with this trend. These mattresses are biodegradable and often produced with minimal chemical treatments, appealing to environmentally conscious buyers. The rise of online retail platforms has also contributed to the latex mattress industry expansion. E-commerce allows consumers to access a wider range of latex mattress options and make informed purchasing decisions from the comfort of their homes.

Asia Pacific Latex Mattress Market Trends

The Asia Pacific latex mattress industry is anticipated to grow at the fastest CAGR of 5.7%, fueled by urbanization and an expanding middle class. As disposable incomes rise, consumers are increasingly investing in quality sleep products, including latex mattresses known for their comfort and durability. Health consciousness is another driving force. With rising concerns over sleep disorders and back pain, consumers are seeking mattresses that provide optimal support and promote better sleep quality. Latex mattresses, offering pressure relief and spinal alignment, are becoming a preferred choice.

The growth of the hospitality industry in countries like India and China is further propelling latex mattresses demand. Hotels and resorts are experiencing significant adoption to enhance guest comfort, thereby boosting sales in the commercial sector. Technological advancements are also influencing the market dynamics. Innovations in mattress design and manufacturing processes are leading to improved product offerings, attracting tech-savvy consumers.

Key Latex Mattress Company Insights

The latex mattress industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Tempur Sealy International, Latexco NV, Serta Simmons Bedding LLC, Foshan Aussie Hcl Furniture Co., Ltd., Kingsdown, Inc., and others. Leading brands like Tempur Sealy International, Spring Air International, and Avocado Green Brands, Inc. focus on premium product offerings and innovations, targeting affluent consumers who prioritize quality and durability.

-

Serta Simmons Bedding, LLC (SSB), is one of North America's foremost mattress manufacturers and distributors, boasting a legacy that spans over 150 years. The company oversees a diverse portfolio of renowned brands, including Serta, Beautyrest, Simmons, and Tuft & Needle, each catering to various consumer preferences and needs. Serta's offerings encompass collections like Perfect Sleeper and iComfort, emphasizing comfort and support.

-

Spring Air International is a leading manufacturer in the bedding industry with a strong domestic and global presence. The company partners with a network of independently owned U.S. factories and international licensees to deliver high-quality mattresses worldwide. Spring Air offers a variety of sleep products designed to meet diverse consumer needs, including its Back Supporter line for enhanced spinal support, the luxury-focused Chattam & Wells collection, the dual-sided Four Seasons mattresses tailored for year-round comfort, and the eco-conscious Nature’s Rest series made with natural latex.

Key Latex Mattress Companies:

The following are the leading companies in the latex mattress market. These companies collectively hold the largest market share and dictate industry trends.

- Tempur Sealy International

- Latexco NV

- Serta Simmons Bedding LLC

- Foshan Aussie Hcl Furniture Co., Ltd.

- Kingsdown, Inc.

- Avocado Green Brands, Inc.

- Royal Pedic Mattress

- Spring Air International

- Savvy Rest, Inc.

- Spindle Mattress Company

Recent Developments

-

In May 2024, Serta Simmons Bedding launched an upgraded Beautyrest Black Collection, featuring four series with advanced technologies like triple-stranded Pocketed Coil springs, temperature-regulating Sleep Climate technology, and high-density foams for improved comfort and support.

-

In January 2024, Avocado Green Mattress partnered with Raymour & Flanigan, the largest furniture and mattress retailer in the Northeast, to make certified organic mattresses more accessible. This collaboration brings Avocado's GOTS-certified organic mattresses, including the Green Mattress, Eco Mattress, and Luxury Organic Mattress, to select Raymour & Flanigan stores.

-

In February 2023, Kingsdown introduced its Blue Zone mattress collection at the Winter Market in Las Vegas, drawing inspiration from global Blue Zones regions known for longevity and holistic living.

Latex Mattress Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11,007.5 million

Revenue forecast in 2033

USD 15,225.6 million

Growth rate (Revenue)

CAGR of 4.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia

Key companies profiled

Tempur Sealy International; Latexco NV; Serta Simmons Bedding LLC; Foshan Aussie Hcl Furniture Co., Ltd.; Kingsdown, Inc.; Avocado Green Brands, Inc.; Royal Pedic Mattress; Spring Air International; Savvy Rest, Inc.; Spindle Mattress Company

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Latex Mattress Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global latex mattress market based on type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Blended/Hybrid Mix

-

Natural Latex

-

Synthetic Latex

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global latex mattress market was estimated at USD 10,578.1 million in 2024 and is expected to reach USD 11,007.5 million in 2025.

b. The global latex mattress market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033 to reach USD 15,225.6 million by 2033.

b. North America dominated the latex mattress market in 2024 with a share of about 30.76%. The industry here is booming due to growing consumer interest in environmentally friendly and health-oriented sleep products.

b. Key players in the latex mattress market are Tempur Sealy International; Latexco NV; Serta Simmons Bedding LLC; Foshan Aussie Hcl Furniture Co., Ltd.; Kingsdown, Inc.; Avocado Green Brands, Inc.; Royal Pedic Mattress; Spring Air International; Savvy Rest, Inc.; and Spindle Mattress Company.

b. Key factors that are driving the latex mattress market growth include growing demand for latex mattresses can be linked to several factors, including heightened consumer awareness of health and wellness, a noticeable rise in back and joint issues at younger ages driven by fast-paced urban living, and advancements in material and product innovation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.