- Home

- »

- Plastics, Polymers & Resins

- »

-

Latin America Adhesives And Sealants Market Report, 2030GVR Report cover

![Latin America Adhesives And Sealants Market Size, Share, & Trends Report]()

Latin America Adhesives And Sealants Market Size, Share, & Trends Analysis Report By Product, By Technology, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-120-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The Latin America adhesives and sealants market size was valued at USD 6.06 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. Demand for adhesives and sealants in Latin America has been primarily driven by Mexico and Brazil, which are among the fastest-growing economies in the world. Recently, Brazil hosted ATP, the professional tennis tournament in February 2023. Besides, Mexico hosted Major League Baseball (MLB) in 2023. Furthermore, other Latin territories regularly host CONMEBOL, the South American football tournament and Formula 1, the professional racing competition. Events of such large scale are anticipated to stimulate continuous demand for the product from various end-use industries such as construction, packaging, and furniture.

The Latin American market is experiencing substantial growth, primarily driven by advancements in the construction and automotive sectors. Favorable economic recovery trends in the region have resulted in an augmented purchasing power among customers, positively influencing the market's expansion in Latin America.

In addition, the regional market is witnessing a growing demand for lightweight vehicles, which is an emerging trend. Adhesives have a pivotal role to play in the assembly of automotive parts and are expected to gradually replace mechanical fasteners in the near future. Furthermore, adhesives offer the advantage of easy application while contributing to the weight reduction of cars.

Prominent automobile manufacturers are relocating their production facilities to Latin American nations to leverage cost-effective labor and adaptable regulatory environments. Brazil is rapidly emerging as one of the world's most dynamic automobile markets and ranks among the top global auto markets. Likewise, other Latin American countries like Mexico and Argentina are also establishing themselves as key automotive manufacturing hubs in the Western hemisphere. These encouraging trends within the regional automotive sector are anticipated to offer attractive prospects for market expansion.

Despite growing demand for the product, volatility in raw material prices, coupled with growing environmental concerns regarding petrochemical-based adhesives and sealants, is expected to hinder market growth over the forecasted period. In order to minimize such effects, the industry has shifted its focus towards developing bio-based alternatives, which provide an environment-friendly substitute for synthetic adhesives and sealants.

Application Insights

Paper & packaging dominated the market with a revenue share of around 29.62% in 2022. Adhesives are crucial in the construction of paperboard cartons and boxes. As e-commerce and consumer goods industries continue to grow, the demand for paper-based packaging materials also increases, leading to higher adhesive consumption.

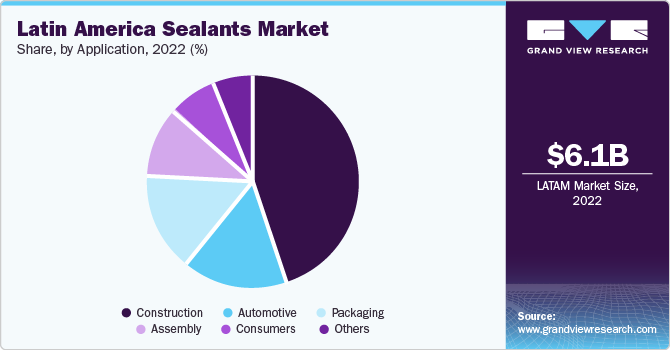

Construction dominated the Latin America sealants market with a revenue share of 44.49% in 2022. Sealants are commonly used to seal expansion and contraction joints in buildings, bridges, and other structures. These joints allow for the natural movement of structures without compromising their integrity. Sealants prevent the entry of water, dust, and pests into these joints. In addition, sealants are known for their durability and long-lasting performance. In a region where weather conditions can be harsh, the ability to maintain seal integrity over time is a key factor driving their use.

Product Insights

Acrylic dominated the market with a revenue share of 30.71% in 2022. Latin America has been experiencing growth in various industries, including automotive, construction, electronics, and packaging. Acrylic adhesives are used extensively in these industries for bonding, laminating, and assembly applications. As these industries expand, the demand for reliable and high-performance adhesives like acrylic adhesives tends to increase.

The Silicones sealants segment dominated the Latin America Sealants market with a revenue share of 36.14% in 2022. A booming real estate market and increased urbanization can lead to a higher demand for silicone sealants in residential and commercial construction. These sealants are used for various applications, including sealing windows, doors, and bathrooms.

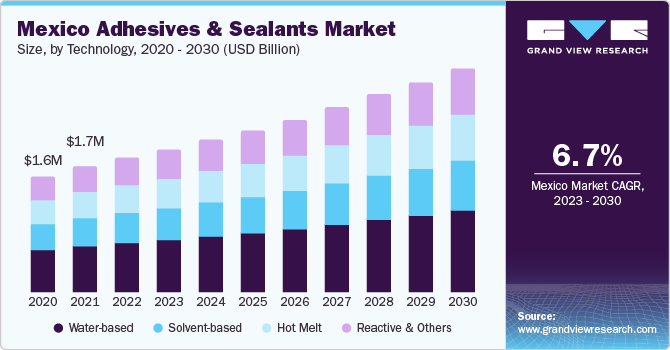

Technology Insights

Water based adhesives dominated the market with a revenue share of 35.0% in 2022. Latin America has been experiencing growth in various industries, including automotive, construction, and electronics. These adhesives are used extensively in key end-use industries and as these industries expand, the demand for reliable and high-performance adhesives tends to increase.

Solvent-based technology utilizes organic solvents as the medium for adhesive or sealant formulation. These formulations provide strong initial bonding and fast curing capabilities. Solvent-based adhesives and sealants are extensively used in industries where rapid drying and strong adhesion are required, such as automotive, electronics, and construction. However, the demand for solvent-based technology is expected to grow at a lower rate owing to environmental and work safety regulations and increasing crude oil prices.

Hot melt technology involves the application of adhesives and sealants in a molten state, which solidify upon cooling to form a bond. Hot melt adhesives and sealants are thermoplastic materials that offer fast bonding, high bond strength, and excellent temperature resistance. They are commonly used in industries such as packaging, labeling, woodworking, and automotive assembly.

Regional Insights

Brazil dominated the Latin America adhesives market with a revenue share of 38.65% in 2022. As Brazil's industrial sector grows, so does the demand for adhesives. Adhesives are essential in various industries, including automotive, packaging, construction, and electronics, among others. Increased industrial production and construction projects can lead to higher demand for adhesives.

Colombia witnessed the fastest growth rate in the Latin America sealants market. The demand for sealants is closely tied to the construction and infrastructure sectors. Rapid urbanization and investment in infrastructure projects, such as roads, bridges, and buildings, can drive the need for sealants in applications like sealing joints, bonding, and insulation.

Key Companies & Market Share Insights

Leading companies in the Latin America adhesives and sealants market are employing various strategies to strengthen their market presence and drive growth. These strategies include launching new products, engaging in mergers and acquisitions, forming joint ventures, and expanding into new geographic regions. By implementing these initiatives, these key players aim to enhance their competitive position and capitalize on market opportunities.

For instance, in October 2019, 3M, the U.S.-based multinational corporation successfully finalized the acquisition of Acelity, Inc., a prominent provider of wound care solutions, along with its KCI subsidiaries worldwide, at an approximate value of USD 6.7 Billion. This strategic acquisition is expected to pave the way for further growth and innovation in the adhesives and sealants industry.

Key Latin America Adhesives And Sealants Companies:

- 3M

- Ashland

- Avery Dennison Corporation

- BASF SE

- Beardow Adams

- Bostik

- Dow

- Eastman Chemical Company

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Momentive

- ND Industries, Inc.

- Sika AG

- Uniseal, Inc.

- Comp15

Recent Development

- In February 2023, 3M launched new product of medical adhesives which offers premium wear time of up to 28 days. This innovative medical adhesive is designed to adhere to the skin for an extended period of up to 28 days and is intended for compatibility with a diverse range of health monitors, sensors, and long-term medical wearables. Prior to 2022, the typical wear duration for extended medical adhesives was limited to 14 days. 3M has now extended that norm, effectively doubling it, in order to advance a more patient-focused approach to healthcare.

Latin America Adhesives And Sealants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.39 billion

Revenue forecast in 2030

USD 9.41 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD Billion, Volume in Kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

Latin America

Country scope

Brazil; Mexico; Argentina; and Rest of Latin America

Key companies profiled

3M; Ashland; Avery Dennison Corporation; BASF SE; Beardow Adams; Bostik; Dow; Eastman Chemical Company; H.B. Fuller Company; Henkel AG & Co. KGaA; Momentive; ND Industries, Inc.; Sika AG; Uniseal, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Adhesives And Sealants Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Latin America adhesives and sealants market on the basis of product, technology, application, and region:

-

Product Outlook (Revenue in USD Billion, Volume in Kilotons, 2018 - 2030)

-

Adhesives

-

Acrylic

-

PVA

-

Polyurethanes

-

Styrenic Block

-

Epoxy

-

EVA

-

Others

-

-

Sealants

-

Silicones

-

Polyurethanes

-

Acrylic

-

PVA

-

Others

-

-

-

Technology Outlook (Revenue in USD Billion, Volume in Kilotons, 2018 - 2030)

-

Water-based

-

Solvent-based

-

Hot Melt

-

Reactive & Others

-

-

Application Outlook (Revenue in USD Billion, Volume in Kilotons, 2018 - 2030)

-

Adhesives

-

Paper & Packaging

-

Consumer & DIY

-

Building & Construction

-

Furniture & Woodworking

-

Footwear & Leather

-

Automotive & Transportation

-

Medical

-

Other

-

-

Sealants

-

Construction

-

Automotive

-

Packaging

-

Assembly

-

Consumers

-

Other

-

-

-

Regional Outlook (Revenue in USD Billion, Volume in Kilotons, 2018 - 2030)

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Frequently Asked Questions About This Report

b. The Latin America adhesives and sealants market size was estimated at USD 6.06 billion in 2022 and is expected to reach USD 6.39 billion in 2023.

b. The Latin America adhesives and sealants market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 9.41 billion by 2030.

b. The water-based segment dominated the Latin America adhesives and sealants market with a share of 35% in 2022. This is attributable to the strong performance delivered by the product and the environment-friendly nature of water-based adhesives and sealants

b. Some key players operating in the Latin America adhesives and sealants market include Bostik SA, Henkel Adhesives, KLEIBERIT Klebstoffe, Akzo Nobel, Eastman Chemical Co.,H.B Fuller, BASF AG, and The Dow Chemical Company.

b. Key factors that are driving the market growth include ongoing developments in the construction and automotive industries and positive economic recovery trends in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."