- Home

- »

- Medical Devices

- »

-

Latin America Health Insurance Market Size Report, 2030GVR Report cover

![Latin America Health Insurance Market Size, Share & Trends Report]()

Latin America Health Insurance Market Size, Share & Trends Analysis Report By Type (Public, Private), By Demographics (Minors, Adults, Seniors), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-049-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

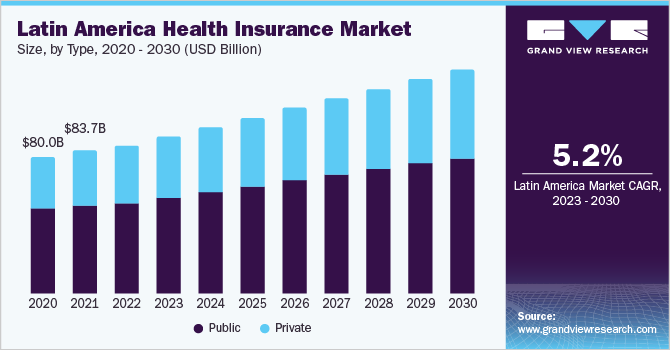

The Latin America health insurance market size was estimated at USD 86.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. The region's growing need for private health insurance coverage to cover expensive healthcare, rising income levels, and longer life expectancies are some factors driving the market growth. The COVID-19 outbreak has led to increased awareness about insurance among individuals. Insurance sectors in certain Latin American countries insurance sectors best performed during the pandemic. For instance, according to the trends reported by Fundación MAPFRE Canarias' 2020 report Puerto Rico showed the highest density (premiums per capita) indexes.

The COVID-19 pandemic has limited effect on Latin America's health insurance sector. Governments had dedicated a large portion of their budget to health care, leading to growth in the public segment of the market. Moreover, the closure of many healthcare facilities has reduced access to care for those dependent on government-funded insurance, particularly in rural areas. For example, due to limited resources, Peru has seen an increase in private health care and related insurance plans.

For instance, according to Fundación MAPFRE Canarias' "The Latin American Insurance Market" report, insurance premiums volume contributions from the health segment increased by 3.53% in 2020 and 0.66% in 2021.

Furthermore, the market for health insurance in Latin America is benefiting from rising internet usage and digitization. The industry is expected to increase due to rising health consciousness, supported by several strategic alliances. For instance, in December 2021, Betterfly and Chubb established their strategic alliance to provide insurance, well-being, and social impact solutions in Latin America.

With Chubb's assistance and this alliance, Betterfly's purpose-driven benefits program will promote healthy lifestyles and broaden access to insurance coverage throughout Mexico, Colombia, Ecuador, Chile, and Argentina.

Additionally, the Latin American health insurance market can benefit from product innovation, improved insurance distribution networks, better claims management, and regulatory developments due to rising incomes, the increased purchasing power of private health insurance, and household savings in the region.

Type Insights

In 2022, the public type segment dominated the market and is projected to retain dominance throughout the forecast period. This is owing to many countries in Latin America, having government insurance programs that provide access to health treatment. The specifics of these programs vary from country to country, but they often aim to provide coverage for a wide range of healthcare services, including preventive care, primary care, and hospitalization.

Differences among notable Latin American countries’ health insurance systems

Country

Argentina

Brazil

Colombia

Mexico

Universal Health Coverage (UHC)

Yes

Yes

Yes

Yes

Healthcare systems

Tripartite system (Public, Social Security, Private health plans)

Dual System (Public Sector (“Sistema Único de Saúde - SUS”), Private (Supplemental Health (SHS))

Mandatory Health Plan, Private health plans, and Armed Forces Plan

Tripartite system (Public sector,

Social security, Private)

Furthermore, the private insurance segment is expected to grow the fastest over the forecast period. Several factors, including rising earnings, an increase in the need for healthcare services, and a desire for additional healthcare coverage options, contributed to the rapid expansion.

For instance, the OECD reported in its June 2020 article that the average share of government spending and mandated health insurance in the Latin American and Caribbean (LAC) region's total health expenditures was 54.3%, much lower than the OECD average of 73.6%. This statistic highlights the rising potential for private health insurance expansion in Latin America.

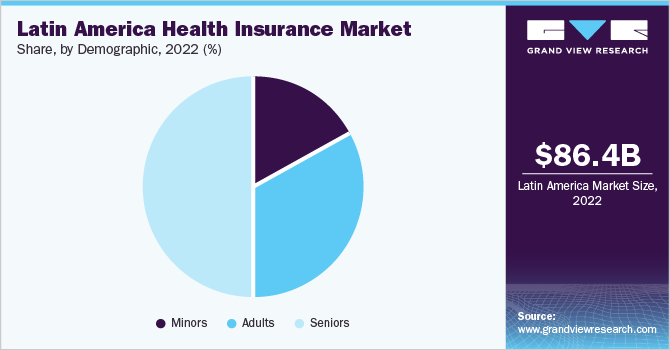

Demographic Insights

The market is segmented into three types based on demographic: minors, adults, and seniors. In 2022, the seniors segment dominated the market and is projected to retain dominance throughout the forecast period. This is due to a large senior population in Latin America, increased demand for healthcare services, and a subsequent rise in healthcare costs.

Furthermore, to fulfill the rising demand for healthcare services, governments in the region are taking various initiatives to ensure that people have access to the healthcare system. For instance, according to a January 2022 article in the National Library of Medicine titled “Has Latin America achieved universal health coverage yet? Lessons from four countries”, the Mexican government has signed agreements with private providers to improve the quality of care provided through health protection system (Seguro Popular (SP)), including cost-effective treatments for chronic conditions. These initiatives of expanding public health insurance programs and offering plans to the elderly population are expected to boost the health insurance market over the forecast period.

Country Insights

Brazil held the largest revenue share in 2022, attributed to the growing demand for insurance and high levels of government investments in the healthcare sector. This is further supported by growth in the private health insurance segment. For instance, according to the report "The Latin American Insurance Market" by Fundación MAPFRE Canarias, premiums contributions show year-over-year growth of 15.4% and 8.2% in 2015 and 2021, respectively.

Additionally, the demand for dental insurance in Brazil is boosting market expansion due to rising health consciousness. For instance, according to a June 2020 article by The Commonwealth Fund, in 2018, 9.6% of Brazilians had dental insurance, and 23% had private medical/hospital insurance, showing an increasing potential for dental insurance adoption that is anticipated to support market expansion.

Furthermore, with increased private insurance acceptance anticipated to boost market growth, Puerto Rico, in 2022, holds the second leading position in the market. According to the 2021 report titled "The Latin American Insurance Market" by Fundación MAPFRE Canarias, Puerto Rico has a penetration rate of 16.5% and a density (premiums per capita) of 5,421 dollars, the highest in Latin America, attributed to the anticipated rise in health insurance for the most underprivileged people, which is controlled by the private insurance sector but covered by government funds.

Additionally, according to the Fundación MAPFRE Canarias 2021 report, overall insurance was the business segment with the best performance during the COVID-19 pandemic. After Puerto Rico, Chile (3.6%), Brazil (3.1%), and Colombia (3.0%) had the highest penetration indexes above the regional average (2.98%).

Key Companies & Market Share Insights

The private health insurance market in Latin America is becoming highly competitive as companies use strategic initiatives such as alliances to grow their customer base and expand their market share. For instance, in February 2023, Bupa and MAPFRE allied to develop health insurance in Latin America, beginning in Peru and expanding to Paraguay and Uruguay. They intend to investigate opportunities in other countries as well. This regional alliance combines the strengths and experience of both companies to increase penetration of the health markets and provide access to top-level international medical care.

Furthermore, strategic mergers in the market are expected to consolidate the health insurance sector, enabling providers to widen their product reach and increase their revenue market share. For instance, UnitedHealth Group, one of the largest health insurers in the U.S., entered the South American market in 2012 by acquiring Brazil’s healthcare company, Amil. Furthermore, in January 2018, the company further penetrated the market by completing the acquisition of Empresas Banmédica, a major healthcare provider and insurer serving Chile, Peru, and Colombia. Some prominent players in the Latin America health insurance market include:

-

BUPA

-

MAPFRE

-

EMPRESAS BANMÉDICA

-

SAGICOR LIFE INSURANCE COMPANY (SAGICOR)

-

ALLIANZ CARE

-

ASSICURAZIONI GENERALI S.P.A.

-

AETNA INC.

-

SURAMERICANA S.A.

-

AXA

-

CHUBB

-

GRUPO NACIONAL PROVINCIAL (GNP)

Latin America Health Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 91.9 billion

Revenue forecast in 2030

USD 131.1 billion

Growth Rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, demographics, country

Regional scope

Latin America

Country Scope

Mexico; Guatemala; Costa Rica; Panama; Dominican Republic; Puerto Rico; Colombia; Brazil; Peru; Chile; Venezuela; Others (Honduras, El Salvador, Paraguay, Nicaragua, Ecuador, Bolivia, Argentina, Uruguay)

Key companies profiled

BUPA; MAPFRE; EMPRESAS BANMÉDICA; SAGICOR LIFE INSURANCE COMPANY (SAGICOR); ALLIANZ CARE; ASSICURAZIONI GENERALI S.P.A.; AETNA INC.; SURAMERICANA S.A.; AXA; CHUBB; GRUPO NACIONAL PROVINCIAL (GNP)

Customization scope

Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Health Insurance Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America health insurance market report based on type, demographic, and country:

-

Type Outlook (Revenue, Billion, 2018 - 2030)

-

Public

-

Private

-

-

Demographics Outlook (Revenue, Billion, 2018 - 2030)

-

Minors

-

Adults

-

Seniors

-

-

Country Outlook (Revenue, Billion, 2018 - 2030)

-

Mexico

-

Guatemala

-

Costa Rica

-

Panama

-

Dominican Republic

-

Puerto Rico

-

Colombia

-

Brazil

-

Peru

-

Chile

-

Venezuela

-

Others

-

Honduras

-

El Salvador

-

Paraguay

-

Nicaragua

-

Ecuador

-

Bolivia

-

Argentina

-

Uruguay

-

-

Frequently Asked Questions About This Report

b. The Latin America health insurance market size was estimated at USD 86.4 billion in 2022 and is expected to reach USD 91.9 billion in 2023.

b. The Latin America health insurance market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 131.1 billion by 2030.

b. Brazil dominated the Latin America health insurance market with a share of 28.29% in 2022. This is attributable to the growing demand for insurance and high levels of government investments in the healthcare sector.

b. Some key players operating in the Latin America health insurance market include BUPA; MAPFRE; EMPRESAS BANMÉDICA; SAGICOR LIFE INSURANCE COMPANY (SAGICOR); ALLIANZ CARE; ASSICURAZIONI GENERALI S.P.A.; AETNA INC.; SURAMERICANA S.A.; AXA; CHUBB; GRUPO NACIONAL PROVINCIAL (GNP)

b. Key factors that are driving the market growth include the region's growing need for private health insurance coverage to cover expensive healthcare, increasing public and private organization initiatives, rising income levels, and longer life expectancies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."