- Home

- »

- Medical Devices

- »

-

Latin America Pharmaceutical Contract Manufacturing & Research Services MarketGVR Report cover

![Latin America Pharmaceutical Contract Manufacturing & Research Services Market Size, Share & Trends Report]()

Latin America Pharmaceutical Contract Manufacturing & Research Services Market Size, Share & Trends Analysis Report By Services (Manufacturing, Research), By Country (Chile, Brazil), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-745-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

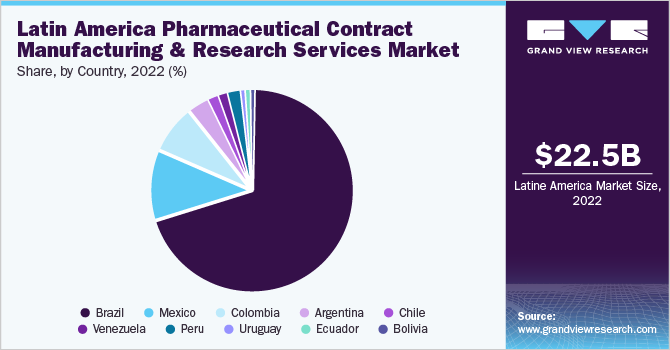

The Latin America pharmaceutical contract manufacturing & research services market size was valued at USD 22.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. Drug shortfall, tighter budgets, rising competition, patent expiration, and insufficient resources are some of the major factors boosting market growth. The time- and cost-saving benefits associated with the implementation of outsourcing are contributing to market growth. The key players are consistently capitalizing on technology, infrastructure, and personnel to gain a bigger share of the outsourcing revenue. Mexico has implemented a comprehensive regulatory framework to govern pharmaceutical contract manufacturing and research services.

The Federal Commission for Protection against Sanitary Risks (COFEPRIS) is the primary regulatory authority responsible for overseeing these activities. Intellectual property protection is a crucial aspect of the regulatory framework. Mexico has implemented intellectual property laws in line with international standards to safeguard innovations in the pharmaceutical industry. The Industrial Property Law and the Patent Law provide legal protections and incentives for research and development. Furthermore, import and export regulations, overseen by COFEPRIS and the Mexican Tax Administration Services (SAT), ensure compliance with customs procedures, licensing, and documentation requirements for the smooth flow of materials, products, and samples.

Biopharmaceutical manufacturing is recognized as a leading sector in terms of growth potential. Many healthcare entities believe that this sector would be one of the top 10 revenue generators in the coming years. Moreover, the market players are making continuous efforts for the development of this sector to meet the increasing demand for bio-based pharmaceuticals, which, in turn, is anticipated to result in a surge of CMOs for biopharmaceutical production. This healthy growth of biopharmaceuticals has resulted in the development of a large service pipeline. Understanding the cost-effectiveness associated with contract manufacturing, many firms have begun to outsource parts of their biopharmaceutical manufacturing to contract manufacturers.

Furthermore, in-house R&D at biopharmaceutical majors is no longer the sole source of successful innovation in the industry, with novel molecules discovered by small- to mid-capital companies before being acquired by established players. As a consequence, CROs have increasingly begun to highlight contract wins with such smaller biotech entities as an important driver of sustainability in volumes. Latin American companies are enhancing their global market presence by putting efforts into the modification and expansion of domestic specialty manufacturing facilities as well as focusing on worldwide partnerships. On the other hand, the expansion of international and well-established companies, such as Thermo Fisher Scientific Inc. (PPD) and IQVIA, Inc., in countries like Brazil, Mexico, Argentina, and Chile is expected to fuel market growth in the region. These countries are perceived to have great potential for pharmaceutical development.

Services Insights

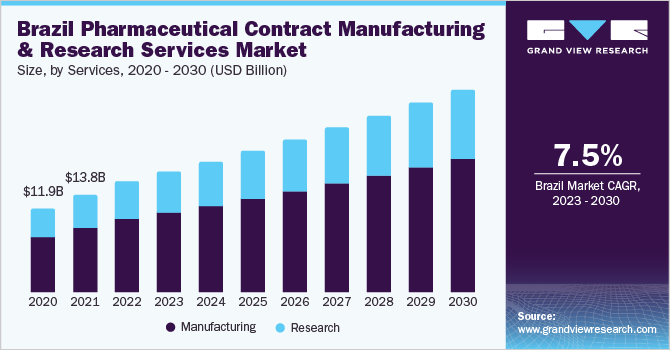

The manufacturing segment dominated the industry with a revenue share of 66.2% in 2022. Based on services, the market is segmented into manufacturing and research. Contract manufacturing services comprise the solutions and facilities for the manufacture of API/bulk drugs, advanced drug delivery formulations, packaging, and finished dose formulations. These services accounted for the largest share in 2022, in terms of revenue generation, as a large number of global companies are seeking the outsourcing of therapeutic development from the production of drug substances (APIs) to finished drug products due to limited capacity and lack of expertise.

The contract research services segment is anticipated to register the fastest growth rate of 7.5% during the forecast period. One of the major factors driving the growth of this segment includes the clinical testing cost requirement that has skyrocketed in the past few years, and the overall cost is anticipated to increase by a few billion dollars every year. Consequentially, this compels pharmaceutical companies to outsource the clinical research aspects of drug development.

Country Insight

Brazil accounted for the largest revenue share of 69.4% in 2022. Factors driving the market in the country include the rapidly developing biotechnology hub in the northeastern region of the country. Moreover, the low manufacturing costs of pharmaceuticals and the presence of a significant number of Goods & Manufacturing Practices (GMP)-certified plants are attracting investors from other countries to establish their presence in Brazil. This, in turn, is expected to have a positive impact on the market for pharmaceutical contract manufacturing & research services in Latin America.

Mexico is anticipated to register the second-fastest growth rate of 7.5% during the forecast period. This growth can be attributed to the goal of transforming Mexico into an innovation-driven country, of which, the pharmaceutical industry is one of the major sectors. Current government's goal to enhance the Mexican market as a cost-competitive manufacturing hub is anticipated to revolutionize the market growth in this country in the coming years.

Key Companies & Market Share Insights

Key market players are undertaking various strategic initiatives, such as the signing of the new partnership agreement, collaborations, mergers, acquisitions, and geographic expansions, to strengthen their industry presence, thus providing a competitive advantage. For instance, in December 2021, Samsung Biologics and AstraZeneca formed an agreement to manufacture Evusheld, which is an amalgamation of binary antibodies in development for the potential treatment of COVID-19. These factors are promoting the demand for CMOs and CROs in Latin American countries. The initiatives to decrease the commodity prices are expected to improve the region’s economic growth thereby boosting the revenue generation in the outsourcing market for pharmaceutical development. Some of the prominent players in the Latin America pharmaceutical contract manufacturing & research services market are:

-

Boehringer Ingelheim International GmbH

-

Fresenius Kabi AG

-

Unither Pharmaceuticals

-

Lonza

-

Pfizer Inc.

-

Charles River Laboratories

-

Laboratory Corporation of America Holdings

-

IQVIA, Inc.

-

Recipharm AB.

-

AbbVie, Inc.

-

Catalent, Inc.

- West Pharmaceutical Services, Inc.

Latin America Pharmaceutical Contract Manufacturing & Research Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.3 billion

Revenue Forecast in 2030

USD 40.3 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Services, country

Regional scope

Latin America

Country scope

Brazil; Mexico; Colombia; Argentina; Chile; Venezuela; Peru; Uruguay; Ecuador; Bolivia

Key companies profiled

Boehringer Ingelheim International GmbH; Fresenius Kabi AG; Unither Pharmaceuticals; Lonza; Pfizer Inc.; Charles River Laboratories; Laboratory Corporation of America Holdings; IQVIA, Inc.; Recipharm AB; AbbVie, Inc.; Catalent, Inc.; West Pharmaceutical Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Pharmaceutical Contract Manufacturing & Research Services Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Latin America pharmaceutical contract manufacturing & research services market based on services, and country:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Research

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

Venezuela

-

Peru

-

Uruguay

-

Ecuador

-

Bolivia

-

Frequently Asked Questions About This Report

b. The Latin America pharmaceutical contract manufacturing and research services market size was estimated at USD 22.50 billion in 2022 and is expected to reach USD 24.3 billion in 2023.

What is the Latin America pharmaceutical contract manufacturing and research services market growth?b. The Latin America pharmaceutical contract manufacturing and research services market is expected to grow at a compound annual growth rate of 7.46% from 2023 to 2030 to reach USD 40.3 billion by 2030.

b. Brazil dominated the Latin America pharmaceutical contract manufacturing and research services market with a share of 69.44% in 2021. This is attributable to the developing biotechnology hub, the presence of numerous GMP-certified plants, and low manufacturing costs attracting investors from other regions to establish their presence in this country.

b. Some key players operating in the Latin America pharmaceutical contract manufacturing and research services market include Boehringer Ingelheim GmbH, Fresenius Kabi AG, Unither Pharmaceuticals, Lonza, Charles River Laboratories International, Inc, Laboratory Corporation of America Holdings, IQVIA

b. Key factors that are driving the Latin America pharmaceutical contract manufacturing and research services market growth include drug shortfall, rising competition, tighter budgets, insufficient resources, and patent expiration.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."