- Home

- »

- Pharmaceuticals

- »

-

Pharmaceutical Contract Manufacturing And Research Services Market, 2030GVR Report cover

![Pharmaceutical Contract Manufacturing And Research Services Market Size, Share & Trends Report]()

Pharmaceutical Contract Manufacturing And Research Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Manufacturing, Research), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-1-68038-924-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Contract Manufacturing And Research Services Market Summary

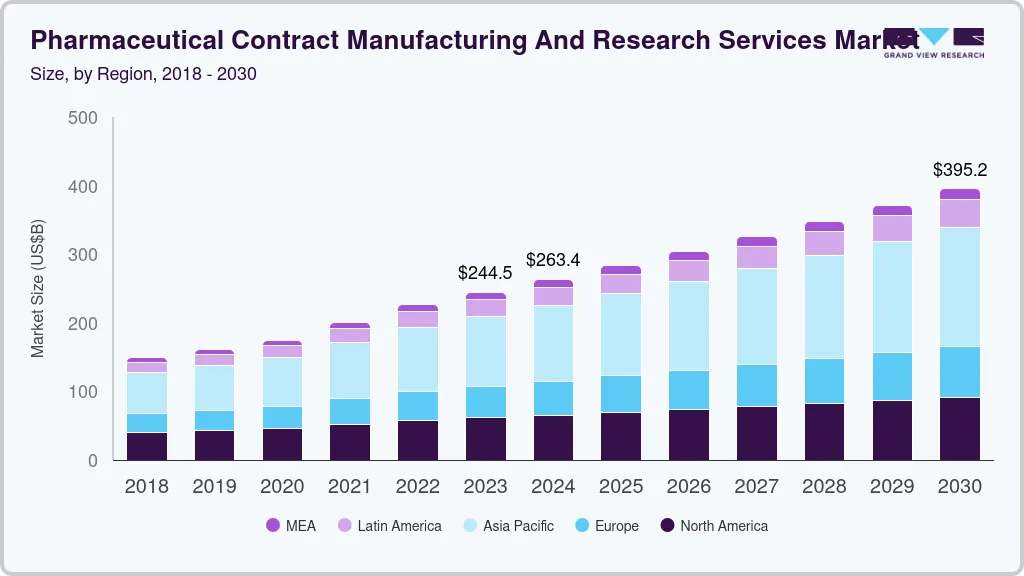

The global pharmaceutical contract manufacturing and research services market size was estimated at USD 263.37 billion in 2024 and is projected to reach USD 395.23 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. Cost-saving and time-saving benefits associated with the implementation of outsourcing are responsible for driving the market.

Key Market Trends & Insights

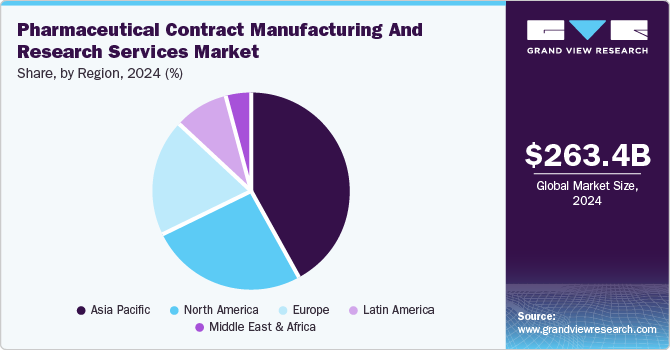

- Asia Pacific pharmaceutical contract manufacturing and research services market dominated the global market with a revenue share of 42.0% in 2024.

- The U.S. dominated North America with a revenue share of 95.5% in 2024,

- By service, pharmaceutical contract manufacturing services led the market with a revenue share of 66.1% in 2024

- By service, pharmaceutical contract research services are expected to grow at the fastest CAGR of 7.0% over the forecast period

Market Size & Forecast

- 2024 Market Size: USD 263.37 Billion

- 2030 Projected Market Size: USD 395.23 Billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2024

The market participants are routinely investing in infrastructure, personnel, and technology to gain a greater share of the outsourcing revenue. The presence of end-to-end service providers that are engaged in offering value-added services for an integrated or risk-sharing business model is expected to bolster growth in this industry.

A primary driver is the strategic emphasis on cost efficiency and operational focus within pharmaceutical companies. By outsourcing manufacturing to specialized CMOs and CDMOs, firms can significantly reduce capital expenditure associated with facility construction and maintenance and the complexities of regulatory compliance. This allows them to concentrate their financial and human resources on core activities such as drug discovery, research and development, and commercialization strategies. Furthermore, CMOs and CDMOs often achieve substantial economies of scale through high-volume operations, translating to lower per-unit production costs for their pharmaceutical clients.

The escalating complexity of modern drug development also fuels the demand for contract services. The increasing prevalence of biologics, biosimilars, HPAPIs, and personalized medicines necessitates advanced manufacturing capabilities and specialized expertise that many pharmaceutical companies may lack internally. CMOs and CDMOs frequently possess cutting-edge technologies, such as continuous manufacturing processes, sophisticated containment systems for HPAPIs, and flexible production lines for personalized therapies, making them indispensable partners. Integrating automation and artificial intelligence further enhances their value proposition by improving quality control, optimizing processes, and ensuring stringent regulatory adherence, ultimately accelerating the often lengthy and intricate drug development lifecycle.

Beyond operational and scientific drivers, global health trends and market dynamics significantly expand the market. The worldwide surge in chronic diseases necessitates a greater volume and diversity of pharmaceutical products, many efficiently produced through contract manufacturing. The expiration of drug patents leads to a heightened demand for cost-effective generics and biosimilars, frequently outsourced for large-scale production. Moreover, the evolving regulatory landscape, stringent compliance requirements, and the imperative for faster time-to-market further incentivize pharmaceutical companies to leverage the expertise and established frameworks of CMOs and CDMOs. Geographic shifts, particularly the growth of the Asia-Pacific region as a cost-competitive manufacturing hub, and the emergence of integrated CRO-CDMO models offering end-to-end solutions, underscore this critical market's dynamic and expanding nature.

Market Concentration & Characteristics

The market growth stage is high, and the pace of market growth is accelerating. The pharmaceutical contract manufacturing and research services market exhibits a high degree of innovation, characterized by the adoption of advanced technologies such as continuous manufacturing and AI-driven quality control. Furthermore, developing sophisticated drug platforms, including HPAPIs and cell/gene therapies, necessitate specialized capabilities within CMOs/CDMOs. Digital integration through predictive analytics and IoT devices further enhances operational efficiency and regulatory adherence.

The sector is marked by accelerating mergers and acquisitions driven by strategic consolidation to expand geographic presence and service portfolios. Vertical integration, wherein CDMOs acquire CROs, aims to provide comprehensive, end-to-end solutions. Market expansion strategies also involve acquisitions in regions such as Asia-Pacific to leverage cost advantages and navigate evolving regulatory landscapes.

Stringent global regulatory compliance, encompassing cGMP, FDA, and EMA guidelines, necessitates substantial investments in quality assurance within CMOs. Regional variability in regulatory standards adds operational complexity. Conversely, accelerated approval pathways for critical therapies require CMOs to demonstrate agility in adapting to expedited production timelines.

The reliance on pharmaceutical contract manufacturing and research services is potentially moderated by the in-house capabilities of large pharmaceutical firms, particularly for high-margin biologics. Moreover, academic partnerships are increasingly undertaking early-stage development, potentially substituting some CRO functions. Emerging technologies such as 3D printing may offer decentralized production alternatives, though scalability remains a key consideration.

Service Insights

Pharmaceutical contract manufacturing services led the market with a revenue share of 66.1% in 2024, driven by the need for scale and cost efficiency, allowing companies to avoid substantial capital expenditure. This trend is amplified by the rising demand for generics, biosimilars, and vaccines requiring cost-effective, large-scale production. Contract manufacturers also provide crucial capacity, flexibility, and comprehensive regulatory and technical support, enabling big pharma to focus on core activities and facilitating growth in emerging markets such as Asia-Pacific due to cost advantages. In 2024, API/bulk drugs manufacturing dominated the contract manufacturing segment due to increasing HPAPI demand.

Pharmaceutical contract research services are expected to grow at the fastest CAGR of 7.0% over the forecast period.Among these, solid formulations accounted for the largest revenue share in 2024 due to the higher outsourcing for the powdered formulations. It is expected to witness gradual expansion in the coming years as it represents a significant share of the outsourcing of finished dose formulations. Solid dose manufacturing and oral delivery of new drug candidates, fixed-dose combinations, controlled release dosage forms, and reformulation of existing drugs are likely to accelerate the growth of contract manufacturing of solid dosage formulations.

Regional Insights

North America's pharmaceutical contract manufacturing and research services market held a significant share in the global market in 2024. Comprehensive CDMOs in the region offer end-to-end services, including formulation and regulatory support. The American Cancer Society‘s projections for 2024 estimated approximately 2,001,140 new cancer cases and 611,720 cancer-related deaths in the country. This increasing prevalence directly amplified the demand for specialized oncology research services within the pharmaceutical sector. Government contracts and partnerships are further supporting market growth in the region.

For instance, in January 2022, Recro Pharma secured a USD 1.5 million contract with a key U.S. government department. The agreement encompassed formulation development and cGMP manufacturing of a topical dermal treatment for skin cancer prevention clinical trials.

U.S. Pharmaceutical Contract Manufacturing And Research Services Market Trends

The pharmaceutical contract manufacturing and research services market in the U.S. dominated North America with a revenue share of 95.5% in 2024, supported by substantial investments in single-use bioreactors and modular facilities, driving advancements in biologics and mRNA therapies. Patent expirations of prominent drugs are increasing the demand for generic manufacturing outsourcing. Furthermore, the adoption of AI and decentralized clinical trial models by CROs, along with a robust biotech startup ecosystem relying on outsourced R&D, contributes significantly to market growth in the U.S.

Asia Pacific Pharmaceutical Contract Manufacturing And Research Services Market Trends

Asia Pacific pharmaceutical contract manufacturing and research services market dominated the global market with a revenue share of 42.0% in 2024. This growth is attributed to a rise in the number of companies outsourcing projects in the developing economies of this region. In recent years, countries such as Singapore, China, and India have been observed as major players in the pharmaceutical industry owing to their expanding manufacturing capabilities. The cash-rich nature of the Asian companies is responsible for the captive nature of the contract manufacturing sector. The spout of significant investments by Asian CMOs is expected to result in exponential progress.

The pharmaceutical contract manufacturing and research services market in China dominated the Asia Pacific market with a revenue share of 26.6% in 2024, aided by a rapidly expanding biologics sector, attracting increasing investments in advanced cell and gene therapy manufacturing. The “Made in China 2025” policy strategically promotes self-sufficiency within the high-tech pharmaceutical industry. Furthermore, the establishment of local facilities by multinational CDMOs aims to capitalize on both the global and substantial domestic Chinese market.

Europe Pharmaceutical Contract Manufacturing And Research Services Market Trends

Europe pharmaceutical contract manufacturing and research services market is projected to witness lucrative growth over the forecast period. The demand for CROs in Europe is driven by stringent EMA regulatory compliance for clinical trials. The region’s focus on biosimilars and personalized medicine is further supported by EU-funded research initiatives, fostering innovation and growth. Increasing sustainability mandates across Europe are pushing CMOs to adopt greener manufacturing practices, reflecting a regional priority towards environmental, social, and governance principles within the pharmaceutical sector.

Germany pharmaceutical contract manufacturing and research services marketdominated Europe in 2024. Germany’s market benefits from its leadership in small-molecule manufacturing, marked by expertise in complex generics and APIs. Its robust engineering sector facilitates precision in advanced drug delivery systems. Collaborations between academic institutions and CDMOs foster advancements in developing orphan drugs within the region.

Latin America Pharmaceutical Contract Manufacturing And Research Services Market Trends

The Latin American market is anticipated to witness substantial growth over the forecast period due to the presence of established multinational players in this region. Major entities operating in Brazil are Novartis, Roche, and Pfizer. Latin America holds the potential to transform into a global hub for the development and production of pharmaceutical products. Factors responsible for this transformation include the low cost of product development.

Key Pharmaceutical Contract Manufacturing And Research Services Company Insights

Some key companies operating in the market include Catalent, Inc (Novo Holdings A/S); PPD (Thermo Fisher Scientific Inc.); and AbbVie Inc.; among others. Organizations are employing strategic partnerships, M&A, and geographic expansion. Investments in technology and integrated services aim to capitalize on outsourcing demand driven by increasing R&D and the production of generics and biosimilars. For instance, in December 2024, Novo Nordisk (USA) completed its USD 16.5 billion CDMO Catalent (USA) acquisition, initially announced in February 2024, aiming to significantly increase its production capacity for key diabetes and weight-loss medications.

-

AbbVie’s contract manufacturing wing provides comprehensive pharmaceutical development and manufacturing services, spanning small and large molecules, including biologics and potent compounds. The company offers global partnerships for clinical and commercial supply, emphasizing quality, flexibility, and supply chain security across various dosage forms.

-

Lonza is a global CDMO specializing in biologics, cell and gene therapies, and small molecule APIs. Lonza offers integrated solutions from early development to commercial production, with notable expertise in mRNA, viral vectors, and continuous manufacturing, serving a diverse global clientele in the pharmaceutical and biotech sectors.

Key Pharmaceutical Contract Manufacturing And Research Services Companies:

The following are the leading companies in the pharmaceutical contract manufacturing and research services market. These companies collectively hold the largest market share and dictate industry trends.

- Catalent, Inc (Novo Holdings A/S)

- PPD (Thermo Fisher Scientific Inc.)

- AbbVie Inc.

- Advent International, L.P.

- Grifols

- Dalton Pharma Services

- Boehringer Ingelheim International GmbH

- Lonza

Recent Developments

-

In January 2025, Lonza (Switzerland) announced its intention to divest its Capsules & Health Ingredients business. This strategic decision aims to allow Lonza to concentrate on its core CDMO operations.

-

In October 2024, Thermo Fisher Scientific (Italy) introduced its Accelerator Drug Development at CPHI Milan. This integrated CDMO and CRO solution aims to expedite drug development across the pharmaceutical value chain.

-

In July 2024, Suven Pharmaceuticals (India), backed by Advent International, proposed acquiring a controlling stake in Sapala Organics (India), a Hyderabad-based CDMO specializing in oligo drugs, with a phased acquisition plan.

-

In June 2024, Dalton Pharma Services (Canada) partnered with 3P Innovation to commission a high-speed aseptic powder filling line, enhancing their drug production capabilities to meet increasing global demand.

-

In October 2023, Advent International and Warburg Pincus completed their USD 4.25 billion acquisition of Baxter’s BioPharma Solutions (USA), rebranding it as Simtra BioPharma Solutions, a standalone CDMO.

Pharmaceutical Contract Manufacturing And Research Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 283.12 billion

Revenue forecast in 2030

USD 395.23 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Catalent, Inc (Novo Holdings A/S); PPD (Thermo Fisher Scientific Inc.); AbbVie Inc.; Advent International, L.P.; Grifols; Dalton Pharma Services; Boehringer Ingelheim International GmbH; Lonza

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase option

Global Pharmaceutical Contract Manufacturing And Research Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical contract manufacturing and research services market report based on service and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

API/Bulk Drugs

-

Advanced Drug Delivery Formulations

-

Packaging

-

Finished Dose Formulations

-

Solid

-

Liquid

-

Semi-solid Formulations

-

-

-

Research

-

Oncology

-

Vaccines

-

Inflammation & Immunology

-

Cardiology

-

Neuroscience

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical contract manufacturing and research services market size was estimated at USD 226.6 billion in 2022 and is expected to reach USD 244.5 billion in 2023.

b. The global pharmaceutical contract manufacturing and research services market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 395.2 billion by 2030.

b. The Asia Pacific dominated the pharmaceutical contract manufacturing and research services market with a share of 41.3% in 2021. This is attributable to the Cash-rich nature of Asian companies.

b. Some key players operating in the pharmaceutical contract manufacturing and research services market include Catalent, Pharmaceutical Product Development LLC, AbbVie, Baxter BioPharma Solutions, Patheon, Grifols International, S.A., Dalton Pharma Services, and Boehringer Ingelheim Biopharmaceuticals GmBh, and Lonza AG.

What are the factors driving the pharmaceutical contract manufacturing and research services market?b. Key factors that are driving the pharmaceutical contract manufacturing and research services market growth include increasing demand as a consequence of the ongoing patent cliff of the biologic drugs and drug shortage leading to drive demand for pharmaceutical development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.