- Home

- »

- Next Generation Technologies

- »

-

Lawful Interception Market Size, Share, Industry Report, 2030GVR Report cover

![Lawful Interception Market Size, Share & Trends Report]()

Lawful Interception Market (2025 - 2030) Size, Share & Trends Analysis Report By Solutions (Device Type, Software), Network Technology (Mobile Data, VoIP), Communication Technology (Voice Communication, Data Downloads), End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-574-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lawful Interception Market Summary

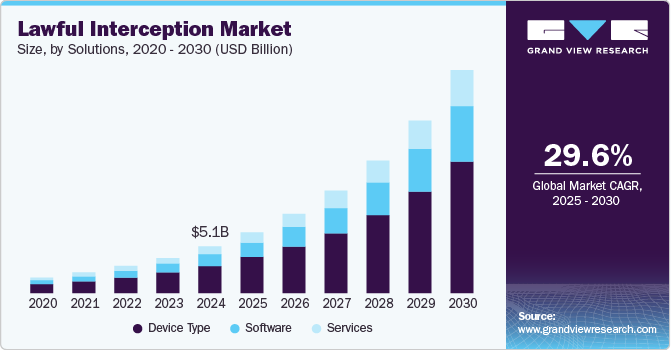

The global lawful interception market size was estimated at USD 5.14 billion in 2024 and is projected to reach USD 24.36 billion by 2030, growing at a CAGR of 29.6% from 2025 to 2030. The lawful interception market is experiencing significant growth driven by the increasing need for national security and public safety.

Key Market Trends & Insights

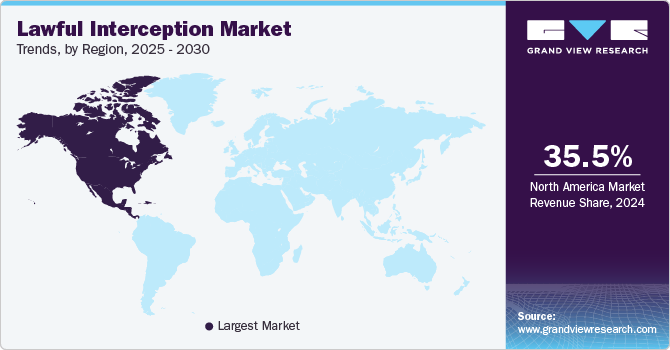

- The North America lawful interception market accounted for a 35.5% share of the overall market in 2024.

- The U.S. lawful interception market held a dominant position in 2024.

- By solution, the device type segment accounted for the largest revenue share of 59.90% in 2024.

- By network technology, the mobile data segment accounted for the largest revenue share in 2024.

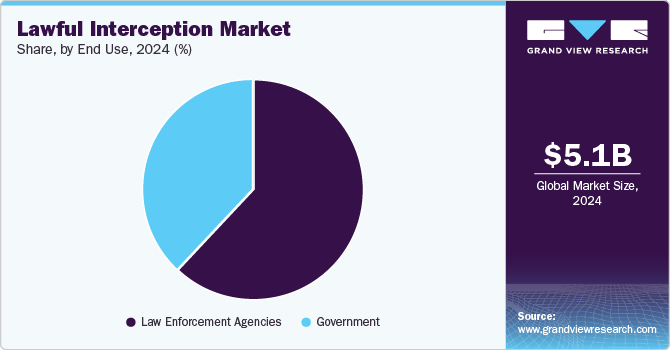

- By end use, the law enforcement agencies segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.14 Billion

- 2030 Projected Market Size: USD 24.36 Billion

- CAGR (2025-2030): 29.6%

- North America: Largest market in 2024

Governments and law enforcement agencies are adopting advanced technologies to combat cybercrime, terrorism, and illegal activities. As digital communications continue to evolve, there is a pressing demand for interception solutions that can monitor diverse communication channels, including VoIP calls, mobile data, social media, and cloud-based messaging platforms. Law enforcement agencies, in particular, rely on these technologies to gather real-time intelligence and carry out surveillance in a manner that adheres to legal and privacy regulations.

The rise of encrypted communications is also a significant factor contributing to the growth of the market. While encryption offers enhanced security for users, it also presents challenges for law enforcement agencies seeking to access critical information during investigations. Governments are implementing sophisticated lawful interception systems capable of bypassing encryption, enabling them to intercept communications and gather vital intelligence. This trend is especially relevant as encrypted messaging apps, such as WhatsApp and Signal, continue to grow in popularity, creating a need for specialized interception technologies.

The integration of AI and machine learning is also fueling growth in the lawful interception market. These technologies are enabling more efficient and scalable interception capabilities, allowing authorities to process vast amounts of data in real-time. By applying AI algorithms to communication data, law enforcement agencies can quickly identify patterns, detect threats, and prioritize critical information for investigation. The rise of AI-driven analytics is helping to automate the process of analyzing intercepted communications, making it more effective in identifying potential criminal activities or security threats.

The increasing focus on cybersecurity is another factor that is propelling the lawful interception market. As cyberattacks become more sophisticated and frequent, governments are prioritizing the protection of critical infrastructure and national security. Lawful interception solutions are being integrated into cybersecurity frameworks to enable authorities to monitor and thwart cybercrimes, including hacking, data breaches, and identity theft. This alignment of interception technologies with cybersecurity initiatives is driving the adoption of advanced surveillance systems across both public and private sectors.

Growing need for cross-border cooperation in law enforcement is accelerating the demand for lawful interception solutions. Criminal activities such as human trafficking, drug smuggling, and terrorism are increasingly operating on a global scale, requiring international collaboration between different law enforcement agencies. This trend is pushing the development of more sophisticated interception systems that allow for the seamless sharing of data across borders, ensuring that authorities can track and investigate crimes that span multiple countries. As global threats continue to evolve, the lawful interception market will see greater investment in technologies that facilitate international collaboration and real-time intelligence sharing.

Solution Insights

The device type segment accounted for the largest revenue share of 59.90% in 2024. The shift towards more advanced devices such as Mediation Devices, Intercept Access Points (IAP), and Routers has significantly improved the effectiveness of lawful interception efforts. These devices are critical for ensuring that authorities can intercept a wide range of communication types, including voice, data, and video, across various networks. Their ability to monitor and capture data without interrupting normal communications operations has made them indispensable to law enforcement and intelligence agencies. A key factor driving the dominance of the device type segment is the growing complexity of communications networks. With the proliferation of 5G networks, cloud services, and Internet of Things (IoT) devices, interception systems must be able to manage high volumes of traffic and diverse communication channels.

The software segment is expected to grow at the fastest CAGR during the forecast period. This segment is driven by the increasing demand for advanced, scalable, and flexible interception solutions. As communication channels evolve with the rise of VoIP, social media, and cloud-based messaging, software solutions have become essential for monitoring and analyzing these diverse communication types. Unlike hardware-based systems, software offers the ability to process vast amounts of intercepted data in real time, enabling more efficient and precise surveillance operations. Additionally, the growing need for encryption breaking and the ability to intercept encrypted communications, such as those on WhatsApp or Signal, has placed advanced software solutions at the forefront of interception technology.

Network Technology Insights

The mobile data segment accounted for the largest revenue share in 2024. The mobile data segment continues to dominate the lawful interception market due to the exponential growth in mobile internet usage worldwide. As mobile devices become ubiquitous, the volume of data transmitted over mobile networks has surged, making it a critical area for surveillance. Law enforcement agencies and governments are increasingly focusing on intercepting mobile data for various purposes, such as cybercrime investigations, terrorism prevention, and anti-drug operations. The widespread adoption of 5G and 4G LTE technologies has further fueled this trend, offering faster data speeds and more robust mobile networks that allow for more sophisticated interception methods.

The VoIP (Voice over Internet Protocol) segment is expected to grow at a significant CAGR during the forecast period. This segment is rapidly emerging in the lawful interception market due to the increasing shift from traditional PSTN (Public Switched Telephone Network) systems to VoIP-based communication platforms. VoIP services, such as Skype, WhatsApp calls, and Zoom, have gained widespread adoption due to their cost-effectiveness and convenience. This shift has created new challenges for law enforcement and government agencies seeking to monitor and intercept voice communications. Unlike traditional phone systems, VoIP calls travel over the internet, often using end-to-end encryption, which poses challenges for interception. As a result, there is a growing demand for interception solutions capable of tapping into VoIP communication streams.

Communication Technology Insights

The voice communication segment held the largest revenue share in 2024. Despite the rapid growth of digital messaging and data-based services, voice remains a primary mode of communication worldwide. Law enforcement agencies and intelligence organizations consistently prioritize voice communication interception for surveillance, investigation, and intelligence gathering. This is particularly true for intercepting mobile voice telephony and VoIP calls, which are increasingly integrated into national security operations. The continued advancement of 5G networks has bolstered the demand for high-quality voice interception with minimal latency, allowing for seamless integration into surveillance infrastructure. Additionally, the rise of encrypted voice communications has led to greater emphasis on interception technologies capable of bypassing encryption, further driving growth in this segment.

The data downloads segment is expected to register the fastest CAGR during the forecast period. As cloud storage, streaming services, and file-sharing applications continue to dominate both business and personal activities, the need for intercepting data downloads has become critical for law enforcement and intelligence agencies. The volume of data being exchanged-whether through file transfers, large media downloads, or application updates-presents new opportunities and challenges for interception solutions.

In particular, cybersecurity threats, intellectual property theft, and illegal distribution of data have made it essential for authorities to monitor and control these digital flows. With increasing incidents of data breaches and malicious activity tied to downloaded content, the focus on monitoring and intercepting data download activities is expected to expand. Technologies that can effectively intercept large-scale data transfers, while maintaining privacy and compliance are becoming an integral part of the interception landscape.

End Use Insights

The law enforcement agencies segment held the largest revenue share in 2024. Law Enforcement Agencies are playing a crucial role in driving the growth of the lawful interception market, as the need for real-time surveillance and intelligence gathering has never been greater. The rise in cybercrime, terrorism, and organized criminal networks has made it essential for law enforcement to adopt advanced technologies that allow for the interception of a wide range of communications, including mobile data, VoIP calls, and social media activity. These agencies are increasingly relying on automated interception systems to process vast amounts of data quickly, identify threats, and respond in real-time to national security risks.

The government segment is expected to register the fastest CAGR during the forecast period. This segment is a major driver of the lawful interception market, primarily motivated by national security concerns, public safety, and the need to protect critical infrastructure. As governments face an increasing number of cybersecurity threats, terrorism, and political unrest, there is a growing demand for advanced surveillance systems that can monitor and analyze communications in real-time. Lawful interception plays a central role in enabling governments to collect intelligence, monitor potential threats, and ensure compliance with national laws and regulations. Additionally, the integration of interception technologies with cybersecurity frameworks allows governments to protect sensitive data, defend against cyberattacks, and prevent security breaches.

Regional Insights

The North America lawful interception market accounted for a 35.5% share of the overall market in 2024. This dominance is largely driven by the U.S., where the demand for lawful interception technologies continues to rise due to national security concerns, the need to combat cybercrime, and the growing surveillance requirements of law enforcement agencies. With the increasing adoption of 5G networks, the U.S. market is seeing a surge in the demand for interception solutions capable of managing mobile data and VoIP communications. The market benefits from the presence of leading telecom service providers and government agencies, which are increasingly focused on enhancing security and monitoring encrypted communications.

U.S. Lawful Interception Market Trends

The U.S. lawful interception market held a dominant position in 2024. The rapid growth of e-commerce and digital communication platforms has led to more sophisticated interception tools for monitoring digital threats. The U.S. government's focus on cybersecurity and national defense continues to bolster the market, contributing to its strong position in the region.

Europe Lawful Interception Market Trends

The Europe lawful interception Industry was identified as a lucrative region in 2024. Regulations like GDPR (General Data Protection Regulation) have shaped the need for interception solutions that can balance security requirements with privacy concerns. European countries are progressively adopting lawful interception technologies to address threats such as terrorism, cybercrime, and organized criminal activity. The region has a strong presence of telecommunications providers and law enforcement agencies, which are increasingly focusing on intercepting mobile data and encrypted communications. The rise of mobile data traffic and the expansion of 5G networks have intensified the need for advanced, scalable interception solutions.

The UK lawful interception market is thriving, driven by increasing national security concerns, the need to combat cybercrime, and the growing demand for enhanced surveillance technologies. The country has a robust law enforcement ecosystem, with government agencies and telecom providers investing heavily in lawful interception solutions to monitor and secure communications.

Asia Pacific Lawful Interception Market Trends

The Asia Pacific lawful interception market held a significant revenue share in 2024. The region's booming telecommunications industry, coupled with the expansion of mobile networks (especially 5G), is fueling market growth. Countries like China, India, Japan, and South Korea are at the forefront of adopting lawful interception solutions as they face increasing cybersecurity threats and terrorism concerns. The Chinese market is witnessing robust growth due to the nation's expansive manufacturing sector and technological advancements in digital communication interception.

China lawful interception market held a substantial revenue share in 2024. The Chinese lawful interception market is experiencing significant growth, driven by the country’s rapid digitalization and the increasing demand for advanced surveillance technologies to ensure national security. As one of the largest global players in telecommunications, China is expanding its 5G networks, which are creating new opportunities and challenges for lawful interception solutions.

Japan lawful interception market held a significant revenue share in 2024. Japan’s highly developed telecommunications infrastructure and rapid adoption of 5G networks are major factors pushing the demand for lawful interception solutions. With a keen focus on national security and public safety, Japan's law enforcement and government agencies are increasingly adopting advanced technologies to intercept and analyze communications, particularly mobile data and VoIP services.

Key Lawful Interception Company Insights

Some key companies in the lawful interception market include Utimaco Management Services GmbH, Vocal Technologies, BAE Systems plc, AQSACOM Innovating Intelligence, and others. To gain a competitive edge and expand their market share in the lawful interception market, key players are actively engaging in strategic initiatives such as mergers, acquisitions, and partnerships with prominent organizations in the telecommunications, cybersecurity, and intelligence sectors. These collaborations enable companies to enhance their technology portfolios, integrate advanced surveillance capabilities, and offer more robust solutions for intercepting and monitoring communication across a variety of platforms.

-

Utimaco Management Services GmbH is one of the leading global providers of cybersecurity and lawful interception solutions. Their products support various types of communications, including mobile, internet, and VoIP, offering highly customizable and scalable systems for governments and telecom operators.

-

BAE Systems plc is one of the prominent player in the lawful interception market, leveraging its deep expertise in cybersecurity, intelligence, and national defense technologies to support governments and law enforcement agencies in intercepting and analyzing critical communications.

Key Lawful Interception Companies:

The following are the leading companies in the lawful interception market. These companies collectively hold the largest market share and dictate industry trends.

- AQSACOM Innovating Intelligence

- Vocal Technologies

- SS8 Networks, Inc.

- Jatom Systems Inc (JSI)

- NICE Ltd.

- Incognito Software Systems Inc

- Siemens AG

- BAE Systems plc

- Utimaco Management Services GmbH

- FireEye, Inc.

- Cisco Systems, Inc.

Recent Developments

-

In August 2022, SS8 Networks, Inc. deployed its lawful interception (LI) solution on AWS to help communication service providers (CSPs) meet global regulatory obligations. The SS8 platform, featuring its Xcipio mediation system, was purpose-built for high-speed, cloud-native environments and adhered to standards such as 3GPP and ETSI. By partnering with AWS, SS8 delivered a scalable and secure turnkey solution that allowed CSPs to manage LI requirements across hybrid and cloud-native infrastructures. The deployment addressed the growing complexity of networks, particularly with 5G and IoT by leveraging AWS’s well-architected framework, focusing on reliability, security, cost optimization, and sustainability.

-

In August 2022, Epson launched the SureColor F1070 as its first entry-level direct-to-garment (DTG) printer, designed for small business owners and home-based printers. Positioned as a compact and affordable solution, it complemented the existing SureColor F-Series, including the hybrid F2270 and high-production F3070 models. The SureColor F1070 supported both DTG and direct-to-film (DTFilm) printing, making it ideal for one-off and small-batch production. It was previewed at the 2023 Printing United Expo, where it received positive feedback, and debuted at the Impressions Expo on January 19, 2024. Epson planned to begin shipping the printer in May 2024, addressing a market gap for entry-level garment printing solutions.

Lawful Interception Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.66 billion

Revenue forecast in 2030

USD 24.36 billion

Growth rate

CAGR of 29.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, network technology, communication technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AQSACOM Innovating Intelligence; Vocal Technologies; SS8 Networks, Inc.; Jatom Systems Inc (JSI); NICE Ltd.; Incognito Software Systems Inc.; Siemens AG; BAE Systems plc; Utimaco Management Services GmbH; FireEye, Inc.; Cisco Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lawful Interception Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lawful interception market report based on solutions, network technology, communication technology, end use, and region.

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Device Type

-

Mediation Devices

-

Routers

-

Intercept Access Point (IAP)

-

Gateways

-

Switch

-

Handover Interface

-

Management Server

-

-

Software

-

Services

-

-

Network Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Data

-

WLAN

-

DSL

-

PSTN

-

ISDN

-

Mobile Voice Telephony

-

VoIP

-

Others

-

-

Communication Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Voice Communication

-

Video

-

Text Messaging

-

Facsimile

-

Digital Pictures

-

Data Downloads

-

File Transfer

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Law Enforcement Agencies

-

Government

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lawful interception market size was estimated at USD 5.14 billion in 2024 and is expected to reach USD 6.66 billion in 2025.

b. The global lawful interception market is expected to grow at a compound annual growth rate of 29.6% from 2025 to 2030, reaching USD 24.36 billion by 2030.

b. North America dominated the lawful interception market in 2024 and accounted for a 35.5% share of the global revenue. The market growth is largely driven by the U.S., where the demand for lawful interception technologies continues to rise due to national security concerns, the need to combat cybercrime, and the growing surveillance requirements of law enforcement agencies.

b. Some key players operating in the lawful interception market include AQSACOM Innovating Intelligence, Vocal Technologies, SS8 Networks, Inc., Jatom Systems Inc (JSI), NICE Ltd., Incognito Software Systems Inc., Siemens AG, BAE Systems plc, Utimaco Management Services GmbH, FireEye, Inc., Cisco Systems, Inc.

b. The lawful interception market is experiencing significant growth driven by the increasing need for national security and public safety. Governments and law enforcement agencies are adopting advanced technologies to combat cybercrime, terrorism, and illegal activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.