- Home

- »

- Next Generation Technologies

- »

-

Learning Management System Market Size Report, 2033GVR Report cover

![Learning Management System Market Size, Share & Trends Report]()

Learning Management System Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Enterprise Size, By Delivery Mode (Distance Learning, Blended Learning), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-946-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Learning Management System Market Summary

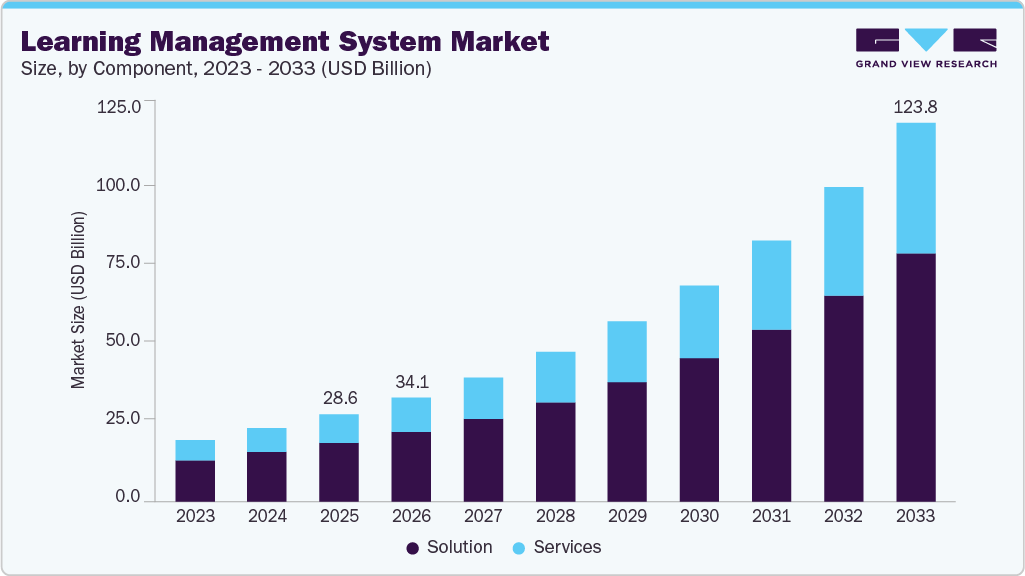

The global learning management system market size was estimated at USD 28.58 billion in 2025 and is projected to reach USD 123.78 billion by 2033, growing at a CAGR of 20.2% from 2026 to 2033. The rising adoption of AI-driven personalized learning, increased demand for mobile-first and microlearning platforms, growing integration of analytics for performance tracking, expanding use of LMS solutions in corporate upskilling and compliance training, and higher preference for cloud-based and scalable deployment models.

Key Market Trends & Insights

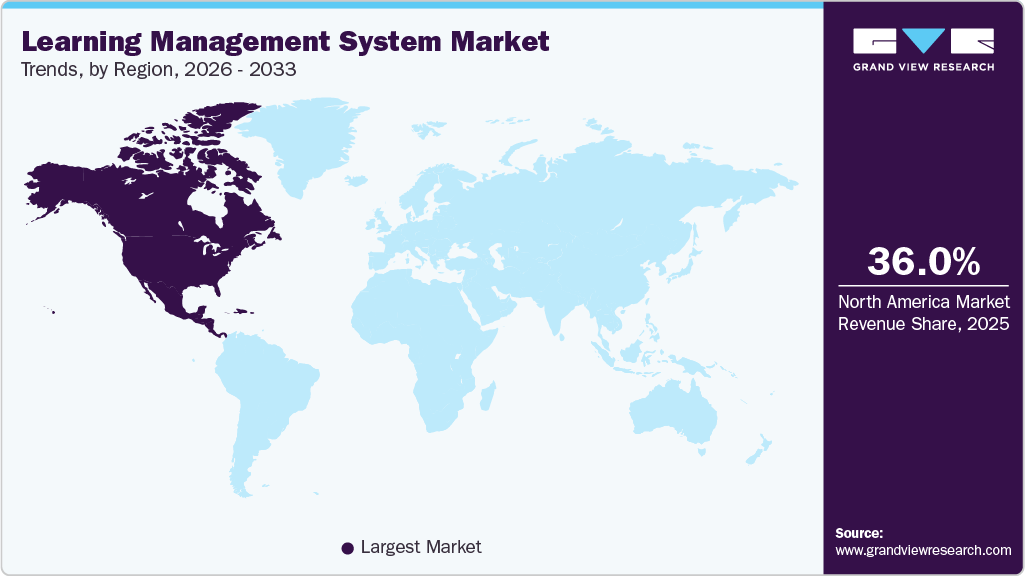

- North America dominated the global learning management system market with the largest revenue share of over 36% in 2025.

- The learning management system market in the U.S. led the North America market and held the largest revenue share in 2025.

- By component, solution segment led the market and held the largest revenue share of over 67% in 2025.

- By delivery mode, distance learning segment held the dominant position in the market and accounted for the leading revenue share of over 40% in 2025.

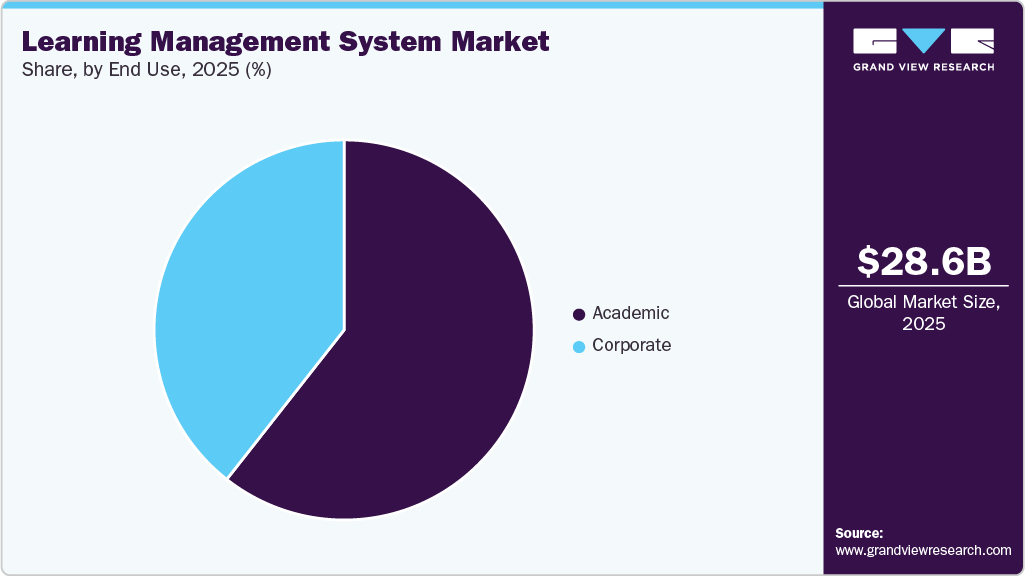

- By End Use, academic segment is expected to grow at the fastest CAGR of over 20% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 28.58 Billion

- 2033 Projected Market Size: USD 123.78 Billion

- CAGR (2026-2033): 20.2%

- North America: Largest Market in 2025

Microlearning is gaining traction as companies prioritize short, focused lessons that fit into busy schedules. Learners complete five to ten-minute modules that deliver essential information without overload, improving retention and encouraging frequent engagement. Organizations use microlearning to efficiently deliver updates, product knowledge, and compliance training. It also supports flexible hybrid and remote work models. As a result, microlearning offers a practical solution for continuous learning across diverse workforce environments.

Gamification is increasingly motivating learners through features such as badges, points, and leaderboards. These elements foster progress and achievement, encouraging greater participation. More interactive training reduces drop-off rates and increases engagement. Companies report higher course completion when gamified elements are integrated into the LMS. Vendors are expanding these tools to support team challenges and individual skill development. As a result, organizations can deliver learning programs that are both effective and engaging.

Skills mapping enhances the strategic value of LMS platforms by linking training content to specific competencies. Organizations use this approach to identify skill gaps and create targeted learning paths aligned with workforce needs. Employees better understand how training supports their career progression. LMS platforms with integrated skills mapping enable managers to track proficiency and plan development initiatives more effectively. Companies leverage this capability to support upskilling and reskilling during business transformation. This trend is shifting learning from a compliance activity to a structured talent development tool.

Component Insights

The solution segment led the market in 2025, accounting for over 67% of global revenue. Growth is driven by demand for advanced learning platforms that support personalized training, progress tracking, and efficient content delivery. Organizations are adopting feature-rich LMS solutions to enhance employee development and ensure compliance. As digital learning expands, companies are investing in platforms with integrated analytics, automation, and mobile access. Vendors are offering scalable solutions for large learner groups and complex training needs. The need for measurable learning outcomes is accelerating investment in LMS solutions, positioning the solution segment as a key driver of market growth.

The services segment is expected to see significant growth due to rising demand for implementation, integration, and ongoing support that optimize learning platforms. Companies rely on professional services to customize LMS features for their training structures, compliance needs, and workflows. The shift to remote and hybrid work is increasing demand for expert guidance in deployment and user onboarding. Service providers offer consulting, migration assistance, and training support to maximize system value from the start. Many enterprises also use managed services to maintain platform performance and reduce IT workload. These factors position the services segment as a critical enabler of successful LMS adoption across industries.

Deployment Insights

The on-premises segment held the largest market revenue share in 2025, driven by organizations’ need for control, enhanced data security, and advanced customization. Enterprises in highly regulated industries selected on-premises solutions to ensure compliance and protect sensitive information. Seamless integration with existing systems, as well as scalability and reliability, made these solutions well-suited for large-scale deployments. Consequently, on-premises LMS solutions became the preferred choice for organizations seeking secure, customized, and fully managed learning platforms.

The cloud segment is expected to grow significantly during the forecast period, driven by the accessibility, scalability, and cost-effectiveness of cloud-based solutions. Cloud infrastructure enables organizations to access LMS platforms from any location with internet access, supporting remote learning and global collaboration. Its scalability allows organizations to accommodate more users and expand learning initiatives without added infrastructure costs or manual effort. This flexibility enables organizations to adapt to changing needs and optimize resources while maintaining user satisfaction.

Enterprise Size Insights

The large enterprises segment is expected to hold the significant share of global revenue in 2025, driven by investments in structured training programs and advanced learning technologies. These organizations require scalable LMS platforms to deliver consistent training across regions and departments. Large enterprises often prioritize systems with analytics, compliance tracking, and automation to streamline training administration. They also use LMS platforms to enhance employee development, support leadership training, and maintain productivity. Dedicated IT teams allow for complex integrations and customized learning pathways. As a result, large enterprises remain key contributors to market growth.

The small and medium enterprises segment is expected to experience significant growth during the forecast period, driven by a preference for on-premises deployment that offers enhanced data security and protection from external threats. SMEs value maintaining full control over their data and machine-learning pipelines, which improves operational efficiency and cost management. Demand is further supported by LMS platforms with user-friendly interfaces that require minimal technical expertise, enabling SMEs to implement and manage learning solutions without extensive IT support. This accessibility allows smaller organizations to quickly adopt LMS tools and enhance employee learning and development.

Delivery Mode Insights

The distance learning segment is expected to capture a significant share of global revenue in 2025, driven by demand for flexible, location-independent education. Educational institutions and corporate training providers are expanding online offerings to meet the needs of students and professionals who prefer remote or hybrid learning. Advances in digital content delivery, virtual classrooms, and mobile learning are accelerating adoption in both academic and corporate settings. By lowering infrastructure costs, distance learning allows organizations to scale and reach more learners without expanding physical facilities. The increasing acceptance of digital credentials and online assessments further supports the segment’s sustained growth and market leadership.

The instructor-led training is expected to grow significantly, driven by demand for structured, interactive learning in corporate and academic environments. Organizations use this approach for in-depth discussions, real-time feedback, and hands-on skill development, especially for complex topics that require expert guidance or collaboration. Virtual instructor-led training extends access by combining live instruction with digital tools. More companies are adopting blended learning models that integrate instructor-led sessions with self-paced content to improve outcomes. These trends highlight the continued importance of instructor-led training in delivering effective learning experiences.

End Use Insights

The corporate segment held the significant market revenue share in 2025, driven by the need for ongoing workforce development amid digital and operational transformation. Companies are investing in LMS platforms to streamline training, improve onboarding, and ensure compliance. As organizations prepare employees for new technologies and roles, demand for upskilling and reskilling is rising. Corporate learning teams now prioritize platforms with analytics, automation, and mobile access to enhance training outcomes. The move to hybrid and remote work is also accelerating the adoption of digital learning solutions for distributed teams.

The academic segment is expected to grow significantly over the forecast period, driven by the widespread adoption of digital learning platforms in schools, colleges, and universities. Institutions are increasingly using LMS solutions to manage online classes, digital assessments, and curriculum delivery more efficiently. The shift toward hybrid and distance learning is prompting further investment in platforms that support virtual classrooms and mobile learning. Government and education board initiatives are also accelerating LMS adoption in both public and private institutions. The academic sector values LMS features that improve student engagement, monitor progress, and streamline faculty workflows.

Regional Insights

The North American learning management system market is projected to hold over 36% of revenue share in 2025. This growth is driven by increasing demand for online education at all levels and the need for efficient content delivery, course management, and remote student engagement. Advancements in AI, machine learning, and data analytics are further enhancing LMS capabilities, enabling personalized learning and improved outcomes. Additionally, corporate investments in employee training, combined with the flexibility of cloud-based LMS solutions, are supporting widespread adoption across various sectors.

U.S. Learning Management System Market Trends

The U.S. learning management system market, the growth of the U.S. market can be primarily attributed to the increasing adoption of online education in the education as well as corporate sectors. The market has witnessed a growing demand for LMS platforms that offer efficient content delivery, course management, remote student engagement, and progress-tracking capabilities. Moreover, businesses are increasingly investing in employee training and development initiatives to remain competitive, further contributing to market expansion.

Europe Learning Management System Market Trends

In Europe learning management system market, the regional market growth can be attributed to the European Union's increased focus on enhancing digital competencies and technology integration within the education sector via the Digital Education Action Plan. This has increased LMS adoption across educational institutions in the region. In addition, the growing focus of governments and education authorities on workforce development and learning is driving the demand for flexible and accessible training solutions, positioning LMS platforms as essential tools for upskilling and reskilling the workforce. Furthermore, the region's diversity necessitates LMS platforms with multilingual and multicultural support, offering a competitive edge to providers catering to diverse learning needs.

Asia Pacific Learning Management System Market Trends

The Asia Pacific learning management system market is expected to achieve the highest CAGR during the forecast period, driven by increased adoption of computing devices and smart technologies. Countries such as India have seen a rise in affordable broadband, expanding access to digital educational resources. This enables broader participation in digital learning. Education stakeholders are leveraging technology to bridge gaps in infrastructure and teaching resources. In addition, governments are implementing national digital education programs, including India’s Digital India initiative and China’s Smart Education strategy, to enhance digital infrastructure and promote online learning.

Key Learning Management System Company Insights

Some key companies in the learning management system industry are Cornerstone, D2L Corporation, SAP, Instructure, Inc., and Moodle

-

Cornerstone develops cloud-based talent management software aimed at helping companies optimize their capabilities and foster enhanced collaboration. Cornerstone’s AI-powered talent experience platform caters to future-ready workforces, seamlessly integrating technology, data, and content to cultivate environments of growth, adaptability, and triumph on a large scale. Cornerstone’s products and services also help organizations revolutionize their learning and development processes, providing the most pertinent content from any location, accelerating talent and career progression, and optimally utilizing skills for growth and success.

-

D2L Corporation is a software provider, learning innovator, and a prominent player in the LMS market. The company’s cloud-based learning platform, D2L Brightspace, caters to a diverse clientele, ranging from K-12 schools and districts to universities and corporations, empowering educators and trainers to create impactful learning experiences, engaging online courses, and training programs. The platform boasts user-friendly authoring tools, fostering efficient course creation. The company’s solutions extend beyond traditional education and cater to the professional development and corporate training needs of businesses as well.

Key Learning Management System Companies:

The following are the leading companies in the learning management system market. These companies collectively hold the largest market share and dictate industry trends.

- Cornerstone.

- Anthology Inc.

- D2L Corporation

- PowerSchool

- Instructure, Inc.

- Adobe.

- Oracle

- SAP

- Moodle

- McGraw Hill

Recent Developments

-

In September 2025, Continu Inc., a leading Enterprise LMS provider, launched Eddy, its AI-powered Learning Agent aimed at transforming workplace learning. Eddy enables employees to learn in the flow of work with no context switching, providing instant answers, 24/7 access to company knowledge, and productivity-focused learning experiences that directly support business outcomes.

-

In July 2025, PowerSchool expanded its partnership with Uruguay’s Ceibal to drive digital education transformation. Ceibal will adopt PowerBuddy for Learning, an AI assistant integrated with Schoology LMS, to support nearly 700,000 students through improved data analysis, PowerBuddy for Learning, an AI assistant integrated with Schoology LMS, to support nearly 700,000 students through improved data analysis, engagement tracking, and AI-driven teaching and learning support, and Connected Intelligence K-12 for data modernization.

-

In May 2025, Cornerstone partnered with Microsoft and Salesforce to launch product innovations that help organizations upskill, reskill, and plan AI-augmented workforces. The collaboration integrates Cornerstone agent actions into Salesforce’s Agentforce and embeds its AI agents within Microsoft Copilot and Microsoft 365, bringing workforce agility solutions directly into the flow of work.

Learning Management System Market Report Scope

Report Attribute

Details

Market size in 2026

USD 34.09 billion

Revenue forecast in 2033

USD 123.78 billion

Growth rate

CAGR of 20.2% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, delivery mode, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Cornerstone.; Anthology Inc.; D2L Corporation; PowerSchool; Instructure, Inc.; Adobe.; Oracle; SAP; Moodle; McGraw Hill

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Learning Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global learning management system market report based on component, deployment, enterprise size, delivery mode, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Delivery Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Distance Learning

-

Instructor-led Training

-

Blended Learning

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic

-

K-12

-

Higher Education

-

-

Corporate

-

Healthcare

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecommunication

-

Retail

-

Manufacturing

-

Government & Defense

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global learning management system market size was estimated at USD 28.58 billion in 2025 and is expected to reach USD 34.09 billion in 2026.

b. The global learning management system market is projected to grow at a compound annual growth rate (CAGR) of 20.2% from 2026 to 2033, reaching USD 123.78 billion by 2033.

b. North America dominated the learning management system market, accounting for over 36% share in 2025. The region’s growth is attributed to the rising demand for online education across all levels, as well as the subsequent need for efficient content delivery, course management, and remote student engagement.

b. Some key players operating in the learning management system market include Cornerstone., Anthology Inc., D2L Corporation, PowerSchool, Instructure, Inc., Adobe., Oracle, SAP, Moodle, McGraw Hill

b. Key factors that are driving the learning management system market growth include increasing digitalization of education and corporate training, integration of emerging technologies into LMS platforms, and growing Internet adoption and smartphone penetration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.