- Home

- »

- Pharmaceuticals

- »

-

Legal Cannabis Market Size, Share & Trends Report, 2030GVR Report cover

![Legal Cannabis Market Size, Share & Trends Report]()

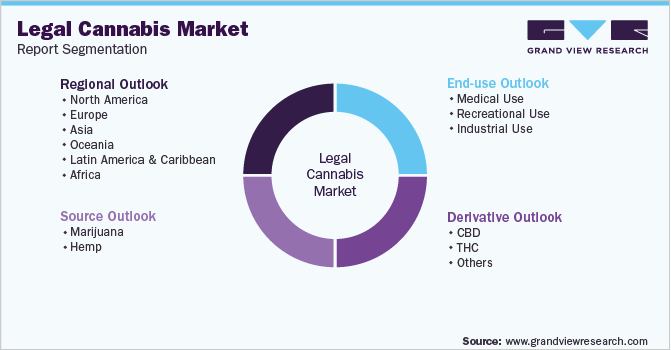

Legal Cannabis Market Size, Share & Trends Analysis Report By Source (Marijuana, Hemp), By Derivative (CBD, THC), By End Use (Medical Use, Recreational Use, Industrial Use), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-278-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

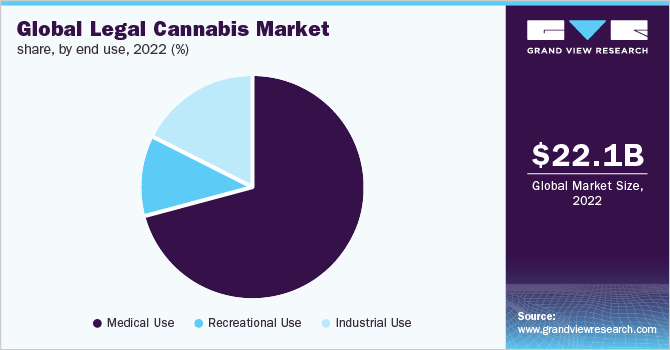

The global legal cannabis market size was valued at USD 22.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 25.5% from 2023 to 2030. The increasing rate of legalization of cannabis and acceptance of its use in the medical field are the key factors due to which the market is expected to boom. Cannabis has long been used for medicinal purposes but not as the first line of treatment. Research surrounding the use of cannabis for its medicinal properties has led to it being used for various indications. Cannabis has been found to be greatly effective in its ability as a therapeutic for chronic pain and in treating nausea caused due to chemotherapy. It is still classified as a Schedule I drug by the U.S. Drug Enforcement Administration (DEA), in spite of which it has been legalized in more than two-thirds of the states.

Even though surveys and studies done in the past have indicated diverse uses of cannabis for medical purposes, the fact that there are no federal laws legalizing the use of cannabis, pharmacists are still concerned about its use and do not suggest it to patients for fear of violating any federal laws. A survey conducted by California Pharmacists Association in 2019 stated that more than 75% of them would consider discussing the use of medical cannabis with patients if the same was approved by the FDA.

A steady rise in the legalization and legitimization of medicinal cannabis has resulted in the growth of the industry. Government-approved and designated purchasing options are rising as the demand for medical cannabis is also increasing. The FDA has approved medical cannabis in the form of CBD products for epilepsy seizures and for treating nausea caused due to chemotherapy. The FDA has agreed to consider changing the status of cannabis from Schedule I drug to Schedule II drug on the basis of studies being conducted on the efficacy of medical cannabis and its derivatives for several indications.

Covid-19 legal cannabis market impact: 29.6% decrease in revenue from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The legal cannabis market decreased by 29.6% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 25% to 30% in the next 5 years

The main factor for the decrease in the overall revenue was the government-imposed bans on trade across borders due to the ongoing pandemic. Consumers were stocking up due to the fear of the unavailability of cannabis and related products.

The number of players in the market is already less due to the stigma related to the use of cannabis in most parts of the world. The pandemic has led to an increase in the number of consumers. From the companies’ perspective, there are a number of funding activities due to the public interest and growing support from the governments throughout the globe in the form of legalization of regulated cannabis products.

The overall market has grown due to an increase in the number of consumers, however, the prices have gone down and there has been illicit trade going on due to the pandemic.

The FDA has several guidelines in place and new policies are currently underway in legalizing cannabis and regulating its use. The companies associated with the production and distribution of cannabis and related products have seen significant growth in the consumer base, which is driving the investors to put in more money. More studies are underway to determine medical uses and formulations for the safe consumption of cannabis. Hence, the overall market is expected to grow steadily over the coming years.

Medical cannabis has been legalized in around 20 states in the U.S. and several other countries have now established laws regarding the decriminalization of its use. Africa, Europe, Australia, and South America are among the few forerunners of its legalization. This comes with strict laws on the sale and distribution of cannabis and related products. The legalization of medical cannabis is still under different approval stages; countries like Portugal, Spain, the Czech Republic, Russia, Ukraine, and Switzerland have legalized it and other regions of Europe are still debating its decriminalization. South American countries are becoming more welcoming to cannabis but possession and sale of the same are still illegal. The Middle East and Asia are the regions where legalization and acceptance rates are quite low.

There has been a steep increase in the consumption of cannabis and its derivatives in recent years. CBD for medical uses has gained a lot of popularity and several governments across the globe are forming policies for its use and distribution. In Canada, The Cannabis Act (Bill C-45) legalized the use of cannabis, the government started the Canadian Cannabis Survey (CCS) in 2017, and it has been conducted annually since then. In 2020, 14% of the participants aged 16 and older indicated they used cannabis for medical use. The legalization has curbed the black market sales as was evident by the data in the CCS 2020, majority percentage of the medical use cannabis was purchased via legal and authorized stores across Canada and there was a decline in the percentage of purchases from non-authorized or illegal sources.

The pandemic affected the overall market of legal cannabis and related products. A lot of countries have now legalized some form of cannabis or cannabis products. A number of countries are fast-tracking commercially regulated cannabis product authorizations e.g., Ecuador has set in motion plans to legalize commercially regulated cannabis to give a boost to its economic growth, post-pandemic. There has been an increase in the number of countries allowing the production of cannabis for internal and domestic use. Canada was the first country to have cannabis legalization and regulatory protocols in place. The current market for import and export of cannabis is limited, the market will see a change only upon pharmaceutical industries take interest in formulating API grade CBD and an organization like the WHO forming trade policies regarding the use, production, and sale (import, export) of cannabis.

The sales of CBD turned a new leaf during the pandemic. In the U.S., in more than 8 states, dispensaries selling CBD products were deemed essential, many states legalized cannabis during the pandemic, and the sales continued to climb. The pandemic provided the momentum that the market needed to grow exponentially. Recreational adult-use cannabis and medicinal use cannabis are both being preferred by the youth across the world, e.g., in New Mexico, the demand for medical cannabis has grown steadily, and dispensaries are seeing more than double retail transactions since 2019.

In the last two years, there has been a paradigm shift in the usage of cannabis both medicinal and recreational. The pandemic saw a number of people stocking up on marijuana and filling prescriptions for the same across dispensaries in the U.S. and Mexico. They were deemed essential services and the sale was legalized in many more states. The illicit market has seen a steady rise the recent years but with the legalizations underway, they could significantly reduce in the coming years.

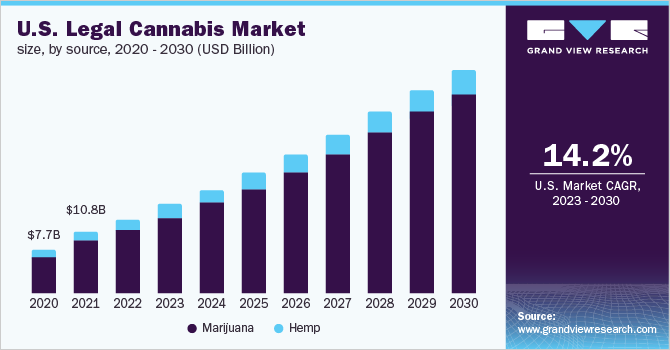

Source Insights

In 2022, marijuana accounted for the largest revenue share of over 75.6%. Hemp is anticipated to register the fastest growth rate of 26.0%. The growth in the segment can be attributed to the increasing rate of legalization across the globe. Both recreational and medical marijuana have seen a huge jump in acceptance and legalization since the pandemic. The use of medical marijuana is acceptable in a number of countries including the U.S., Canada, Italy, Czech Republic, Croatia, and Australia. A lot of countries are legalizing the production as well as domestic use of marijuana. For instance, Ecuador has now legalized cannabis production. The growing consumer base of cannabis and legal purchasing of marijuana and other cannabis products have made possession and selling in regulated quantities much more decriminalized.

The black market is slowly dwindling with the governments making policies on the legal consumption and selling of cannabis. The legalization still sparks fear of an overall increase in consumption but in Canada, despite legalization, the usage grew by only 1% in 2020. Increasing legalization has created a plethora of jobs in the cannabis industry and the taxes of the state governments have grown a lot since legalization, e.g., Colorado makes more than USD 20 million from tax on legal cannabis and California rakes in about USD 50 million, monthly. Since the legalization, there has been a shift in the type of usage and consumers are preferring recreational use rather than medical use cannabis due to its ease of availability.

Derivatives Insights

In 2022, CBD accounted for the largest revenue share of over 65.9%. This growth is due to the acceptance of the efficacy of CBD by the scientific community and by consumers. However, studies are still underway to determine the potential uses of CBD other than the ones currently indicated. CBD has proven to be beneficial for the treatment of epileptic seizures and for nausea in chemotherapy, it has lower side effects than the traditional medicines being prescribed. CBD has been studied for the treatment of anxiety and sleep disorders and has been found to have positive effects on patients during the study but the, long-term effects remain to be studied.

Cannabinoids have in general shown their potential in the treatment of various diseases like PTSD and several types of cancers. They are considered potent analgesics and may have possible anti-stress properties. The others segment is expected to register the fastest growth rate of 28.0% over the forecast period. This can be due to the rise in the acceptance of cannabis as a potent pain-reliever and in several other indications. There has been a surge in the companies making cannabis derivatives products and an overall increase in the demand for the same. This can be a key factor for the segment growth.

End-use Insights

In 2022, the medical-use segment accounted for the largest revenue share of over 71.6%. Several studies are being conducted for determining the potency and efficacy of cannabis and its derivatives for the treatment of various conditions, this has resulted in the increased adoption of medical cannabis throughout the world. Legalization of its use has also served as a key factor for market growth. The medical use application has been widely accepted and is thus the largest sub-segment. With the governments making policies on its use and regulations the medical practitioners are now finding it easier to prescribe to patients who demand it. The awareness regarding the benefits has significantly reduced the stigma surrounding the use of cannabis.

Recreational marijuana is expected to witness the fastest growth rate of 38.0% over the forecast period and is gaining more and more popularity with the youth around the world. Cannabis has been legalized for both recreational and medical use in the U.S. and Canada in the North American region. Other countries where recreational marijuana has been legalized are Uruguay and Colombia. Through this, the government is trying to put a stop to the illicit trade of marijuana, and it has also resulted in significant tax revenues for governments. The legalization has resulted in an increase in jobs in the sector and has boosted market growth.

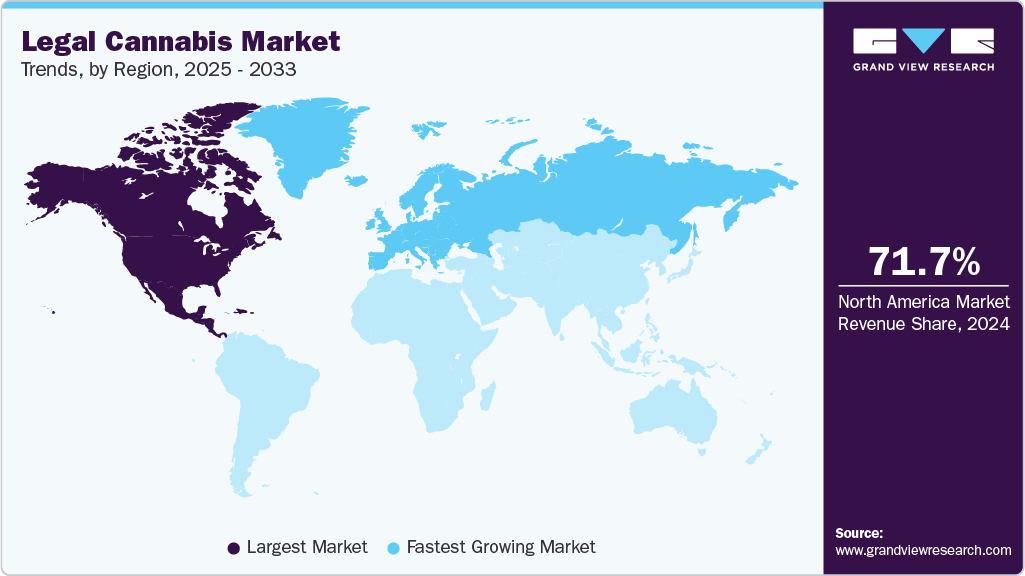

Regional Insights

North America accounted for the largest revenue share of over 68.8% in 2022. Revenue generated is highly territorial owing to laws and policies on the trade of cannabis. The majority of the established companies are from the North American region, resulting in it being the largest market shareholder. Key players include Canopy Growth, Curaleaf Holdings, Green Thumb Industries, Innovative Industrial Properties, Trulieve Cannabis, GW Pharmaceuticals, Cronos Group, GrowGeneration, Creso Labs, and Columbia Care. Growing demand among the consumers has resulted in the overall regional market growth, another reason for the same could be the increased rate of legalization.

Despite strict laws against the use and possession of cannabis, Asia is the fastest-growing regional market and is anticipated to register the fastest growth rate of 48.4%. This can be due to the increase in the acceptance of cannabis across different countries in the region. The number of clinical studies on possible uses of cannabis in a myriad of medical conditions can also be a key driver for the regional market. Recreational use of marijuana is still frowned upon in most parts of Asia, but medicinal and industrial use of marijuana is gaining popularity in the region.

In Japan, clinical trials for CBD compounds have been approved but possession of recreational cannabis is still punishable by up to 5 years in prison with the growing geriatric population, Japan is set to become a substantial consumer of medicinal cannabis. China has been growing hemp, a part of the cannabis plant used to make fibers, and is frequently used in beauty products. Since 2019, the cultivation of cannabis has increased for the production of CBD for medicinal purposes. Growth in the production and revenue from exports can also drive the market in the region. Thailand has been one of the forerunners in legalizing the use of cannabis for medical purposes in Asia, other countries in the region are expected to follow suit.

Key Companies & Market Share Insights

The companies are turning to expansion in their product portfolios as well as expansion through mergers and acquisitions of small players in the industry. For e.g., GreenThumbs is selectively focusing on cannabis derivatives-based products due to the fact that they have more profit margins. In 2020, Curaleaf completed two major acquisitions increasing its foothold in the cannabis market in the U.S. Some prominent players in the global legal cannabis market include:

-

Canopy Growth Corporation

-

GW Pharmaceuticals, plc

-

Aurora Cannabis, Inc.

-

Aphria, Inc.

-

Cronos Group

-

Tilray

-

Sundial Growers Inc.

-

Insys Therapeutics, Inc.

-

The Scotts Company LLC

-

VIVO Cannabis Inc.

-

Cara Therapeutics Inc.

Legal Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.4 billion

Revenue forecast in 2030

USD 134.4 billion

Growth rate

CAGR of 25.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivative, end use, region

Regional scope

North America; Europe; Asia; Oceania; Latin America & Caribbean; Africa

Country scope

U.S.; Canada; U.K.; Germany; Italy; Poland; Czech Republic; Switzerland; Croatia; Netherlands; Spain; China; Japan; India; Thailand; Australia; New Zealand; Brazil; Mexico; Uruguay; Colombia

Key companies profiled

Canopy Growth Corporation; GW Pharmaceuticals, plc; Aurora Cannabis, Inc.; Aphria, Inc.; Cronos Group; Tilray; Sundial Growers Inc.; Insys Therapeutics, Inc.; The Scotts Company LLC; VIVO Cannabis Inc.; Cara Therapeutics Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global legal cannabis market report on the basis of source, derivative, end use, and region:

-

Source Outlook (Revenue, USD Million, 2016 - 2030)

-

Marijuana

-

Flowers

-

Oil and Tinctures

-

-

Hemp

-

Hemp CBD

-

Supplements

-

Industrial Hemp

-

-

-

Derivative Outlook (Revenue, USD Million, 2016 - 2030)

-

CBD

-

THC

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Medical Use

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson's

-

Tourette’s

-

Others

-

-

Recreational Use

-

Industrial Use

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Poland

-

Czech Republic

-

Switzerland

-

Croatia

-

Netherlands

-

Spain

-

-

Asia

-

Japan

-

China

-

India

-

Thailand

-

-

Oceania

-

Australia

-

New Zealand

-

-

Latin America and Caribbean

-

Brazil

-

Mexico

-

Uruguay

-

Colombia

-

-

Africa

-

Frequently Asked Questions About This Report

b. The global legal cannabis market size was estimated at USD 17.8 billion in 2021 and is expected to reach USD 22.1 billion in 2022.

b. The global legal cannabis market is expected to grow at a compound annual growth rate of 25.3% from 2022 to 2030 to reach USD 134.4 billion by 2030.

b. In 2021, the marijuana segment accounted for the largest revenue share of 74.3% and is anticipated to register the fastest CAGR of more than 25% from 2022 to 2030 in the legal cannabis market.

b. In 2021, the CBD segment accounted for the largest revenue share of 66.5% and will expand further at a steady CAGR from 2022 to 2030 in the legal cannabis market.

b. In 2021, the medical-use segment accounted for the largest revenue share of more than 70% and will expand at the second-fastest CAGR from 2022 to 2030 in the legal cannabis market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."