- Home

- »

- Pharmaceuticals

- »

-

Medical Marijuana Market Size & Share Report, 2030GVR Report cover

![Medical Marijuana Market Size, Share & Trends Report]()

Medical Marijuana Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Flower, Oil & Tinctures), By Application (Chronic Pain, Arthritis, Migraine, Cancer, Diabetes, AIDS, Epilepsy, Parkinson’s Disease), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-754-4

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global medical marijuana market size was valued at USD 13.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 21.80% from 2023 to 2030. The industry is experiencing growth due to the rising awareness regarding various therapeutic applications of the product, such as pain management, appetite enhancement, and reducing eye pressure. Medical marijuana is classified into two types, namely, Cannabis Sativa and Cannabis Indica, which originate from the countries of the western hemisphere and central & south Asian regions, respectively.

The growing percentage of countries permitting the usage of medical marijuana in various parts of the globe is one of the key factors driving the penetration rate of cannabis in therapeutic applications. With changes in government policies, the demand for medical marijuana is also increasing.

Many countries have legalized the usage of medical marijuana which is the leading way for its cultivation that will cut the imports and will lead to revenue generation in the form of taxes.

The increasing figure of states legalizing medical marijuana and the growing adoption of cannabis in healthcare sector and recreational applications are some of the major aspects that are expected to propel the demand for medical marijuana over the coming years. The growing research and development activities are also expected to drive the demand.

As per clinical studies, cannabis is highly effective for the treatment of chronic diseases. As per the data published by the WHO, the chronic disease burden reached to 57% in the year 2020. Thus, owing to the rising prevalence of chronic diseases throughout the globe the market is expected to see a steep growth in the forecast period.

One of the major challenges faced by the medical marijuana market is that, to date, the FDA has not permitted the marketing usage of cannabis for the treatment of any disease or condition. However, the organization has approved one cannabis-derived drug product: Epidiolex (cannabidiol), and three synthetic cannabis-related drug products: Marinol (dronabinol), Syndros (dronabinol), and Cesamet (nabilone). These permitted drug products are only available with a prescription from a licensed healthcare provider.

Like other industries, the ongoing Covid-19 pandemic had negatively impacted the medical marijuana market. The medical marijuana market growth declined by a rate of 32% from 2019 to 2020. Due to lockdown, most of the places were shut down and no movements were taking place in most of the industries which negatively impacted the market. The import-export business was negatively impacted on a huge scale due to lockdowns and changes in guidelines for the transportation of its products.

Most importantly, major healthcare companies were focusing on the production of COVID-19 vaccines thus, there is a decline in the research work related to medical marijuana. However, acquisitions and mergers among cannabis manufacturers are projected to fuel the growth of the market. Active research work, proven medical properties, growing legalization, and improvements in intellectual property rights of cannabis are some of the major factors that are expected to fuel the market growth.

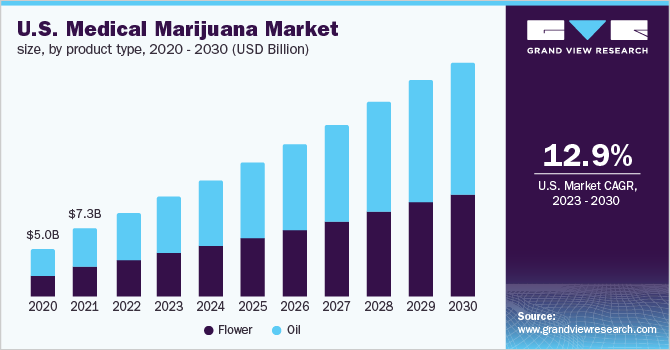

Product Insights

The oil and tincture segment dominated the medical marijuana market in 2022 and accounted for the largest revenue share of 53.1%. The growth is largely attributed to its growing medicinal usage. Clinical studies have shown that non-psychoactive compounds in marijuana, such as CBD have the property to reduce inflammation and thus have the capability to provide a new treatment for chronic pain.

The beneficial property can also be used for treating cancer, sleep disorder, anxiety, and others. Moreover, the growing legalization of cannabis throughout the globe is further expected to drive the industry’s growth. Furthermore, children who consume cannabis derivatives for their treatment are prescribed oils and tinctures as they cannot use flowers to smoke due to respiratory problems which can be caused by smoking flowers.

The flower segment is expected to have a slower CAGR in the upcoming years. However, the launch of new products is expected to push the market growth of the segment. For instance, in March 2021, Germany's largest pharmaceutical company, Stada entered the medical marijuana market by launching its two flower products further, the company has plans to offer five flower products along with three extracts with different compositions of CBD and THC.

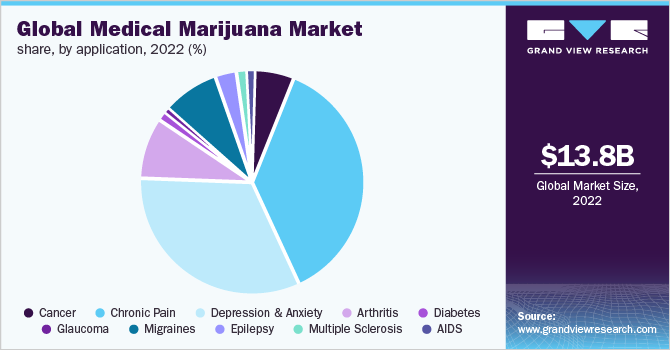

Application Insights

The chronic pain segment held 25.9% of the revenue share in 2022. Studies of various research, state that medical cannabis is safe for treating patients with chronic pain and neuropathic pain. The growing number of clinical trials with marijuana to treat neuropathic and chronic pain is one of the key indicators, which highlights the rising usage of cannabis in pain management over the coming few years.

New York’s “New Medical Marijuana Law” states that a patient certified by a healthcare professional to use medical marijuana, possessing a patient identification card registered with the New York State Department of Health is eligible to use medical marijuana for pain management.

However, amyotrophic lateral sclerosis (ALS) will be the fastest-growing application segment with a CAGR of 30.9% during the forecast period. The growing prevalence of amyotrophic lateral sclerosis is one of the factors driving the growth of the segment.

For instance, as per the data released by Johns Hopkins Medicine, in the US about 5,000 cases are diagnosed every year and ALS is responsible for five of every 100,000 deaths in people aged 20 or older. The rapidly growing number of states, districts, and territories enacting laws to legalize the use of cannabis for treatment is also driving the market growth.

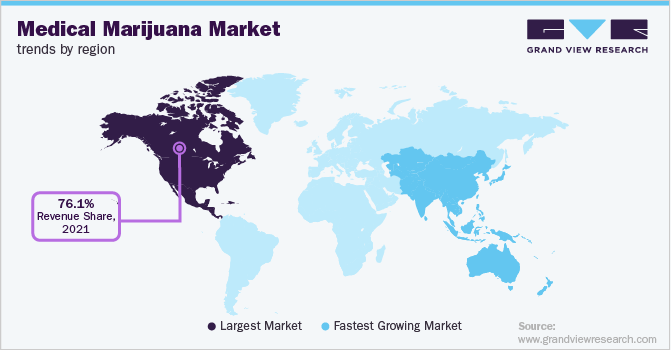

Regional Insights

North America accounted for the largest revenue share of 76.1% in 2021. The increasing cannabis legalization in the U.S. is one of the vital factors contributing to its increased demand. Moreover, in the U.S., 37 states and the District of Columbia have legally permitted the use of cannabis for therapeutic purposes. Whereas, other ten states have also legalized the usage of cannabis for recreational purposes.

The government of the U.S in May 2021, for the first time in more than 50 years has approved new growers of research marijuana. Thus, broadening the capacity to study the drug’s medical value. Furthermore, product launches are also fueling the market growth. For instance, in August 2021, Tilray launched new medicinal cannabis edibles in CBD and TCH-rich varieties of chocolates and soft chew gummies in Canada, escalating the brand's widespread offering of cannabis medicines, which comprises whole flower, pre-rolls, oils, and vapes, designed with patient health and wellbeing in mind.

Asia Pacific is anticipated to register the fastest CAGR over the forthcoming years to growing favorable government initiatives & support. Additionally, a rise in disposable income, increasing social acceptance, and growth in awareness regarding the benefits of the product, along with the increase in the legalization of cannabis certainly affect the cannabis market.

The surge in the popularity of cannabis oil among countries with legalized medical marijuana and the growing percentage of the population from chronic illnesses, such as Parkinson's, Alzheimer's, cancer, neurological disorders, and others accelerate the growth of the industry.

Key Companies & Market Share Insight

The key players are devising various strategic initiatives to expand their business footprint and gain a competitive edge. They are also focusing on strategic initiatives such as mergers & acquisitions, collaborations, partnerships, funding & investments, and innovative product developments & launches to expand their expertise & product portfolio.

For instance, in June 2021, one of the largest cannabis companies named Canopy Growth proclaimed its 100% acquisition of The Supreme Cannabis Company. The acquisition will further strengthen its global leadership position. Some prominent players in the global medical marijuana market include:

-

Tilray

-

Aurora Cannabis

-

Canopy Growth Corporation

-

Aphria, Inc.

-

Maricann Group, Inc.

-

Tikun Olam, Ltd.

-

MedReleaf. Corp.

-

GW Pharmaceuticals plc.

-

Cannabis Sativa, Inc.

-

Medical Marijuana, Inc.

Medical Marijuana Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.6 billion

Revenue forecast in 2030

USD 65.9 billion

Growth rate

CAGR of 21.80%

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; Italy; Poland; Czech Republic; Switzerland; Croatia; Netherlands; Spain; China; Japan; India; Thailand; Australia; New Zealand; Uruguay; Colombia; Brazil; Mexico; Africa

Key companies profiled

Tilray; Aurora Cannabis; Canopy Growth Corporation; Aphria, Inc.; Maricann Group, Inc.; Tikun Olam, Ltd.; MedReleaf. Corp.; GW Pharmaceuticals plc.; Cannabis Sativa, Inc.; Medical Marijuana, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Marijuana Market SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global medical marijuana market report on the basis of product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Flower

-

Oil & Tinctures

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s Disease

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson's Disease

-

Tourettes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Poland

-

Czech Republic

-

Switzerland

-

Croatia

-

Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

Australia

-

New Zealand

-

-

Latin America

-

Uruguay

-

Colombia

-

Brazil

-

Mexico

-

-

MEA

-

Africa

-

-

Frequently Asked Questions About This Report

b. The global medical marijuana market size was estimated at USD 13.8 billion in 2022 and is expected to reach USD 16.6 billion in 2023.

b. The global medical marijuana market is expected to grow at a compound annual growth rate of 21.6% from 2023 to 2030 to reach USD 65.9 billion by 2030.

b. Chronic pain dominated the legal marijuana market with a share of 25.9% in 2022. This is attributable to the increased need for pain management across the globe coupled with a large patient pool suffering from several chronic illnesses.

b. Some key players operating in the legal marijuana market include Canopy Growth Corporation; Aphria, Inc.; Aurora Cannabis; Maricann Group, Inc.; Tilray; The Cronos Group; Organigram Holding, Inc.; ABcann Medicinals, Inc.; GW Pharmaceuticals, plc.; and Lexaria Corp.

b. Key factors that are driving the legal marijuana market growth include a rise in the legalization of marijuana in various countries, and the use of cannabis for medical purposes is gaining momentum worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.