- Home

- »

- Pharmaceuticals

- »

-

Leukemia Therapeutics Market Size, Industry Report, 2033GVR Report cover

![Leukemia Therapeutics Market Size, Share & Trends Report]()

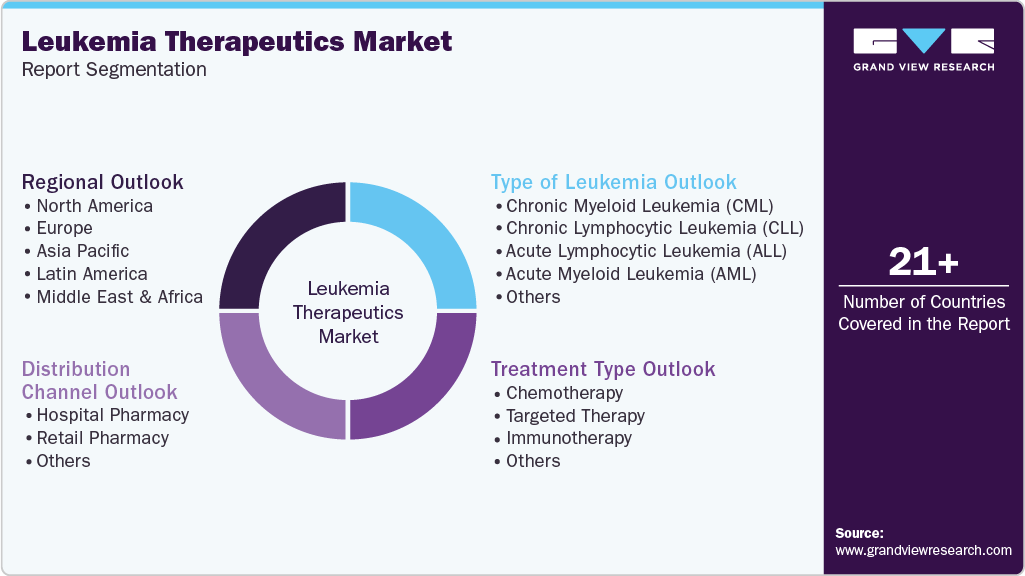

Leukemia Therapeutics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type Of Leukemia (Chronic Myeloid Leukemia (CML), Chronic Lymphocytic Leukemia (CLL)), By Treatment Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-809-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Leukemia Therapeutics Market Summary

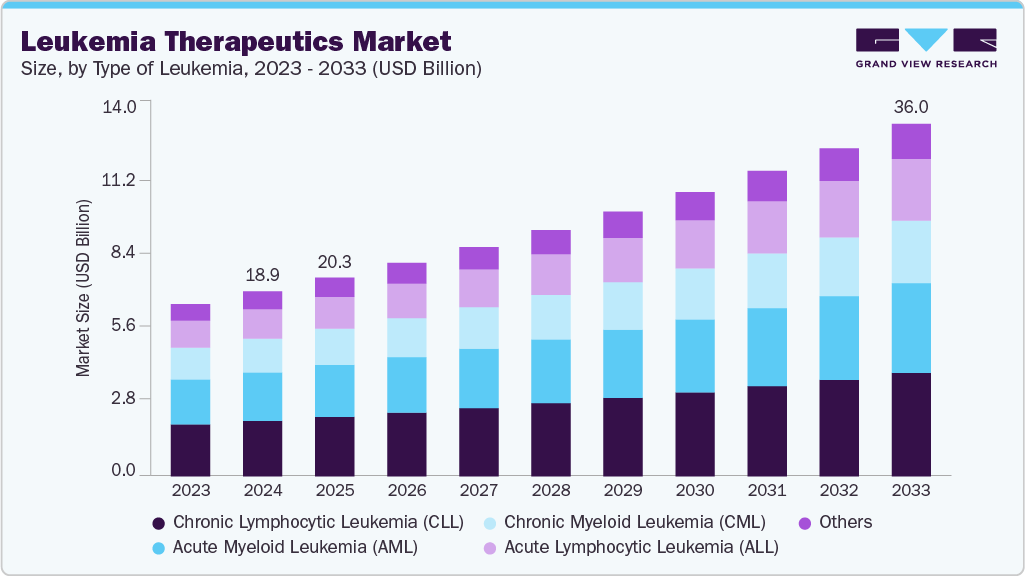

The global leukemia therapeutics market size was estimated at USD 18.90 billion in 2024 and is projected to reach USD 36.02 billion by 2033, growing at a CAGR of 7.43% from 2025 to 2033. The market is expanding due to a rising global prevalence of acute and chronic leukemia across all age groups.

Key Market Trends & Insights

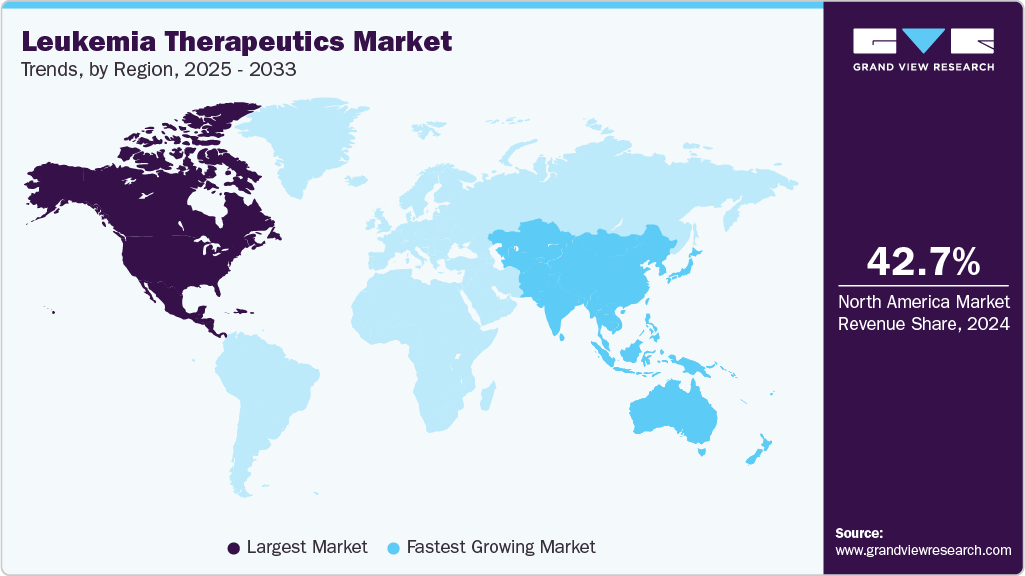

- The North America leukemia therapeutics market held the largest global share of 42.73% in 2024.

- The leukemia therapeutics industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By type of leukemia, the Chronic Lymphocytic Leukemia (CLL) segment held the highest market share of 30.01% in 2024.

- By treatment type, the targeted therapy segment held the highest market share in 2024.

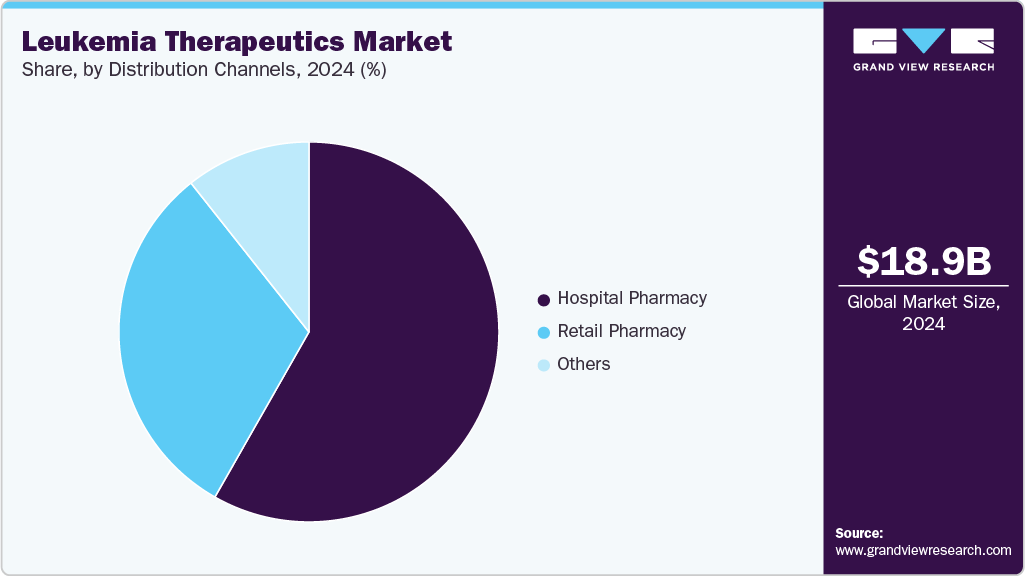

- By distribution channel, the hospital pharmacy segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.90 Billion

- 2033 Projected Market Size: USD 36.02 Billion

- CAGR (2025-2033): 7.43%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The growing adoption of precision oncology is enabling treatments tailored to genetic and molecular profiles, thereby improving patient outcomes. Advancements in diagnostic technologies are enabling earlier detection, which supports higher rates of treatment initiation. Pharmaceutical innovation in targeted therapies and immunotherapies is accelerating clinical adoption and shifting treatment standards. For instance, in April 2025, Frontiers in Medicine published a global burden study which reported that in 2021, there were approximately 461,422.7 leukemia incident cases, projected to reach 509,737.3 by 2031, and around 320,283.6 deaths in 2021 expected to rise to 344,694.3 by 2031, while DALYs declined from 10,982,836.2 to 10,785,356.1 during the same period.

Increasing survival rates are creating a larger population requiring long-term and sequential therapy. Strong R&D momentum supported by active clinical trials is introducing new therapeutic classes with improved efficacy. The commercial availability of combination regimens is further driving prescription volume and increasing therapy value.

The rapid penetration of targeted small-molecule drugs is transforming treatment strategies for AML, CLL, and ALL, delivering high response rates with manageable safety profiles. Continuous progress in kinase inhibitors, BCL-2 inhibitors, and monoclonal antibodies is driving a shift away from traditional chemotherapy. CAR-T therapies are gaining adoption due to their ability to achieve durable remission in patients with relapsed or refractory disease. For instance, in March 2025, Therapeutic Advances in Hematology reported a phase I trial in which 7 of 10 AML patients treated with anti-CLL-1 CAR-T achieved complete remission or CRi. All six who later underwent stem cell transplantation were alive at follow-up. At the same time, another trial showed three complete remissions among six patients receiving anti-CD38 CAR-T, with only grade 1-2 CRS and no ICANS events. Growing access to stem cell transplantation, wider use of oral regimens, and active label expansion strategies are strengthening long-term market growth.

Strategic collaborations, licensing deals, and expedited regulatory pathways are reducing the commercialization timelines for next-generation therapies. Rising investments in oncolytic platforms, bispecific antibodies, and targeted cytokine therapies are expanding the innovation pipeline. Increased awareness among clinicians and patients is accelerating the conversion from diagnosis to treatment, supporting market penetration. The strong uptake of premium-priced therapies in the US and Europe is elevating the overall revenue potential per patient. Competitive differentiation based on safety, durability, and cost-effectiveness encourages continuous product upgrades. Expansion of specialty pharmacy networks is improving distribution efficiency for high-value oncology drugs. The growing clinical focus on the eradication of minimal residual disease is driving demand for advanced and combination treatment options.

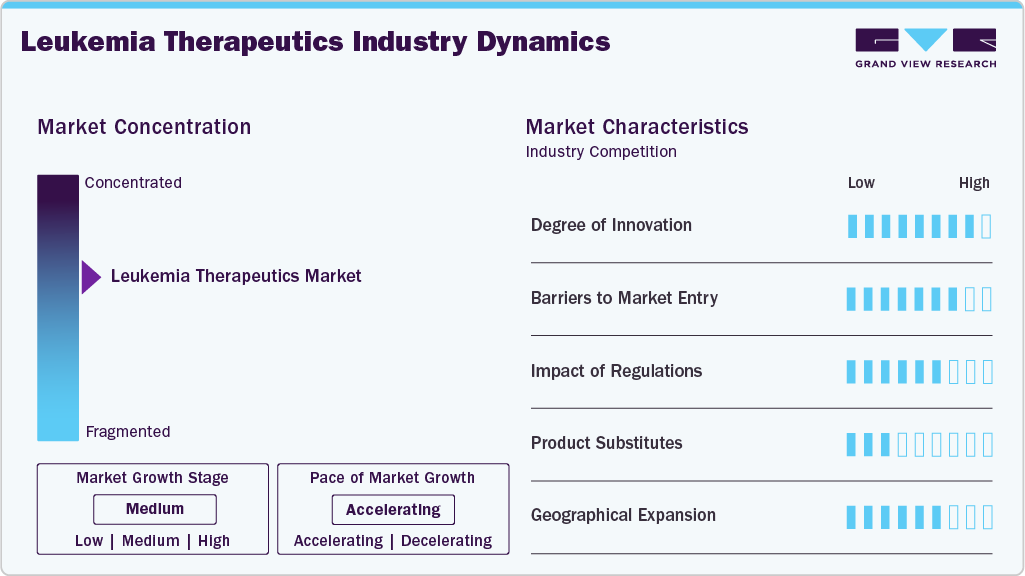

Market Concentration & Characteristics

The leukemia therapeutics market is highly innovation-driven, with continuous progress in targeted therapy, immunotherapy, and genetic-based drug development. Research is shifting from broad cytotoxic agents toward precision oncology and next-generation platforms such as CAR-T, bispecific antibodies, and RNA-based therapeutics. Innovation is also centered on improving the durability of remission, minimizing toxicity, and overcoming resistance in cases of relapse or refractory disease. Strong clinical pipelines from major pharma and biotech firms reflect high investment in novel mechanisms of action. The pace of scientific advancement keeps competitive pressure high and shortens product life cycles.

New entrants face high capital requirements due to costly R&D, complex clinical development, and lengthy approval timelines. Strong IP protection and patent exclusivity held by major players limit competition in key drug classes. Clinical trial design in leukemia is complex due to heterogeneous patient populations and evolving treatment standards. Manufacturing capability for cell and gene therapies represents an additional technical and financial barrier. Market access depends on strong medical, regulatory, and distribution expertise, making entry difficult for non-specialized companies.

Regulatory frameworks enforce strict evidence requirements for safety, efficacy, and long-term clinical outcomes in hematologic cancers. Accelerated approval pathways are available for high-unmet-need therapies; however, post-marketing data commitments increase compliance responsibilities. Price justification and expectations for real-world evidence from HTA bodies influence commercial success after approval. Label expansions require additional trial data, increasing development cycles for multi-indication strategies. Regulatory scrutiny is rising in areas such as gene-modified therapies, long-term patient monitoring, and treatment-related toxicity.

Traditional chemotherapy remains a therapeutic option but is increasingly replaced by targeted and immuno-oncology agents due to better response and tolerability. Hematopoietic stem cell transplantation acts as a curative alternative in selected patients, limiting drug demand in eligible cases. Emerging modalities such as allogeneic CAR-T, gene editing, and tumor-specific vaccines may shift future treatment paradigms. Supportive therapies and palliative care can substitute aggressive treatment in late-stage or elderly populations. However, no direct substitute offers equivalent therapeutic value for advanced targeted agents in most leukemia subtypes.

North America and Europe dominate revenue share due to high diagnosis rates, established oncology infrastructure, and strong reimbursement for premium therapies. Asia Pacific is emerging as a high-growth region, driven by the expansion of cancer registries, improvements in clinical capacity, and increased treatment affordability. Market penetration in Latin America and Middle East is rising through partnerships, local trials, and tiered pricing models. Companies are expanding through regional licensing, co-development deals, and localized biomanufacturing for cell-based therapies. Global expansion strategies focus on broadening patient eligibility beyond traditional high-income markets.

Type of Leukemia Insights

The Chronic Lymphocytic Leukemia (CLL) segment dominated the leukemia therapeutics industry, with the largest revenue share of 30.01% in 2024. This was largely due to its high prevalence among adult and elderly populations, as well as the strong clinical adoption of oral targeted therapies, particularly BTK and BCL-2 inhibitors, which continue to generate sustained treatment value. Longer treatment duration and the need for sequential therapy lines contribute to higher lifetime treatment costs per patient. For instance, in March 2025, MDPI published a review in the International Journal of Molecular Sciences reporting an age-adjusted CLL incidence of 4.9 per 100,000 per year and a median diagnosis age of 70 years. The review cited a phase 2 trial of ibrutinib plus venetoclax, where 48% of 60 patients achieved bone-marrow uMRD after 12 cycles and 67% of 24 patients after 24 cycles, with grade 3/4 neutropenia in 29%, thrombocytopenia in 3%, and atrial fibrillation in 9%, and a 30-month progression-free survival rate of up to 97%. The growing adoption of combination regimens, increased monitoring of measurable residual disease, and the presence of high-value branded therapies further reinforce the commercial dominance of this segment.

The Acute Lymphocytic Leukemia (ALL) segment is projected to grow at the fastest CAGR of 8.56% over the forecast period, primarily due to rising adoption of immunotherapies and cell-based treatments that deliver higher remission rates in relapsed or refractory cases. Strong demand from pediatric and young adult populations continues to drive preference for effective, low-toxicity regimens, while advances in molecular subtyping are improving alignment of therapies across risk categories. The segment is further supported by increasing clinical use of targeted kinase inhibitors for Philadelphia chromosome-positive patients and rising survival rates, which are expanding the pool of patients eligible for maintenance therapy. For instance, April 2022, MDPI published a review in Cancers that reported adult Ph+ ALL patients achieved complete response rates above 90%, 5-year overall survival of 43-50%, and 5-year event-free survival of 32-52% with first-generation TKIs plus chemotherapy, while second- and third-generation TKI trials showed CR rates of 96%, 91%, and 100%, complete molecular remission rates of 65% and 86%, and 5-year OS and DFS exceeding 50%; a ponatinib-based regimen achieved 100% CR, 83% CMR, 5-year OS of 73%, and 5-year EFS of 68%, although the relapse-driving T315I mutation appeared in up to 75% of relapsing cases, emphasizing ongoing need for next-generation targeted therapies.

Treatment Type Insights

The targeted therapy segment dominated the leukemia therapeutics market, with the largest revenue share of 40.27% in 2024, due to growing demand for precision medicines offering high efficacy and manageable safety profiles. Oral kinase and BCL-2 inhibitors remain the preferred treatment options in both frontline and relapse settings, supporting longer treatment durations and higher patient retention. Broader clinical eligibility and companion diagnostics continue to improve response predictability and prescribing confidence. Blockbuster therapies maintain strong utilization through ongoing label expansions, particularly in elderly and high-risk groups. For instance, in May 2023, Frontiers in Oncology reported that a novel BCL-2 inhibitor in 78 relapsed or refractory CLL patients achieved a 67% overall response rate, 12% complete response rate, and 22-month median progression-free survival, while grade 3/4 neutropenia and thrombocytopenia occurred in 54% and 29% of patients, supporting sustained adoption of targeted therapies in hematologic cancers.

The immunotherapy segment is projected to grow at the fastest CAGR of 8.60% over the forecast period. The expanding use of monoclonal antibodies, bispecific T-cell engagers, and CAR-T therapies primarily fuels this growth. Strong response durability in refractory leukemia is increasing physician preference for immune-mediated approaches, while long-term remission benefits are accelerating adoption in patients with relapsed and high-risk disease. Advancements in cell-processing and manufacturing are improving treatment accessibility, supported by growing real-world evidence and favorable reimbursement inclusion. Combination-based strategies and rising investment in next-generation platforms continue to strengthen the commercial outlook for immunotherapy in leukemia care. For instance, in August 2023, Frontiers in Oncology published a review highlighting that early immunotherapy trials using bispecific T-cell engagers in relapsed/refractory AML reported overall response rates of 20-40%. A dual-antigen immunotherapy approach showed a 40.0% ORR in 40 newly diagnosed AML patients, including 53.8% in those with TP53/RUNX1/ASXL1 mutations, while cytokine-release syndrome occurred in up to 96% of patients (grade ≥3 in 4%).

Distribution Channel Insights

The hospital pharmacy segment dominated the leukemia therapeutics industry, accounting for the largest revenue share of 58.24% in 2024, driven by the high use of inpatient and infusion-based leukemia treatments. Complex biologics, CAR-T therapies, and injectable regimens require hospital-based administration and monitoring. Centralized oncology units support controlled dispensing of high-cost specialty drugs. Hospital-linked treatment protocols ensure better safety oversight for adverse event management. Strong reliance on multidisciplinary care teams reinforces hospital-based prescribing. Higher patient volume in tertiary cancer centers drives concentrated drug distribution through hospital channels. Strong integration with hematology departments supports streamlined pharmaceutical handling.

The retail pharmacy segment is projected to grow at a CAGR of 7.15% over the forecast period, driven by expanding access to oral targeted therapies, increasing patient preference for convenient prescription refills, and the broader integration of specialty pharmacy services that support adherence, reimbursement navigation, and counseling for chronic leukemia management. Additionally, rising availability of generics and improved distribution networks strengthen retail penetration, enabling faster fulfillment and wider accessibility of advanced leukemia therapeutics across diverse patient populations.

Regional Insights

North America held the largest share of the leukemia therapeutics market in 2024, accounting for 42.73% of the global revenue, due to the strong adoption of targeted therapies and immuno-oncology drugs. The region benefits from early access to next-generation treatments driven by active clinical research networks. High diagnosis rates and established oncology care pathways facilitate the initiation of treatment across leukemia subtypes. Major pharmaceutical companies operate extensive commercialization and medical outreach programs across the region. The presence of premium reimbursed therapies raises per-patient treatment value and overall market revenue. Continuous clinical trial participation further supports long-term therapeutic innovation and patient enrollment.

U.S. Leukemia Therapeutics Market Trends

The U.S. leukemia therapeutics industry dominates regional growth due to high disease prevalence, tracking with advanced diagnostic capabilities. Strong utilization of CAR-T therapies, kinase inhibitors, and monoclonal antibodies drives treatment revenue. Large oncology centers, specialist networks, and strong payer coverage for innovative drugs support market penetration. Rapid launch uptake favors companies with robust medical education and real-world evidence programs. High treatment affordability among insured populations expands access to advanced regimens. Strong collaboration between biotech firms and research institutes accelerates pipeline progression.

Europe Leukemia Therapeutics Market Trends

Europe represents a mature and steadily expanding leukemia therapeutics industry with broad clinical access to novel agents. Treatment guidelines emphasize precision medicine and high-value therapies for AML, ALL, and CLL. Academic hospitals manage large patient cohorts, supporting the growth of real-world data and post-approval studies. Pricing controls influence the speed of therapy adoption, yet high-efficacy agents maintain strong uptake in key economies. High survival rates and the need for long-term therapy reinforce demand. Cross-border clinical research drives the development of molecules and facilitates multi-country approvals.

The UK leukemia therapeutics market benefits from centralized cancer care pathways, which enable the rapid adoption of new leukemia treatments. Clinician preference is shifting toward oral targeted agents, which offer favorable adherence and reduced hospital burden. Accelerated review programs support the timely availability of breakthrough therapies. High genomic testing penetration supports the use of biomarker-driven treatment selection. Real-world evidence programs from national patient registries strengthen long-term therapy evaluation. Clinical demand is rising as survival outcomes expand the pool of relapsed and maintenance-phase patients.

The leukemia therapeutics market in Germany represents one of the highest-value leukemia drug markets in Europe, driven by the strong uptake of innovative oncology brands. The country has an advanced hospital infrastructure with dedicated hematology units for complex therapies. Early adoption of CAR-T and combination regimens strengthens treatment intensity and duration. Strong collaboration between manufacturers and academic centers enhances clinical evidence and post-launch optimization. High physician familiarity with targeted therapy reinforces use across multiple disease stages. A competitive biologics market encourages continuous product differentiation.

The France leukemia therapeutics market is stable and innovation-driven, with strong access to advanced hematology treatments. Major oncology centers support high adoption of targeted agents, monoclonal antibodies, and combination therapies. Precision medicine programs are expanding molecular testing in leukemia diagnosis, improving therapy selection. Clinical networks play a key role in generating post-marketing data for new immunotherapies. Treatment demand is rising due to longer survival rates and increased relapse management needs. Competitive pricing evaluations may slow entry speed, yet high-value therapeutics maintain strong utilization.

Asia Pacific Leukemia Therapeutics Market Trends

The Asia Pacific leukemia therapeutics industry is expected to register a significant CAGR of 8.70% over the forecast period, due to a rising patient pool and expanding oncology treatment capacity. The improvement of diagnostic capabilities across major countries supports the growing adoption of precision therapies. Regional clinical trial participation is on the rise, providing patients with earlier access to pipeline drugs. Healthcare investment is strengthening multi-specialty cancer centers and biologic drug distribution networks. A shift from conventional chemotherapy to targeted regimens is gaining momentum in urban healthcare systems. Local biopharma partnerships are accelerating the entry of new therapeutics into the market.

The Japan leukemia therapeutics market is expected to grow. Japan has a well-established leukemia care ecosystem that supports strong adoption of advanced biologics and oral targeted agents. Rapid acceptance of next-generation therapies is driven by strong clinician familiarity with hematologic oncology. Advanced molecular testing protocols across major hospitals reinforce diagnostic precision. The aging population contributes to a rising treatment pool for chronic leukemia types. Market entry is supported by efficient regulatory evaluation for high-impact therapies. Patient adherence is strengthened through preference for convenient oral and outpatient regimens.

The leukemia therapeutics market in China is experiencing rapid growth in terms of treatment demand, driven by rising disease incidence and increased screening rates. Domestic and multinational firms are introducing advanced targeted agents through local approvals and partnerships. Expansion of cell therapy manufacturing is supporting broader access to CAR-T products within the country. Large treatment centers in tier-1 cities enable higher prescribing rates for novel drug classes. Price competition among biosimilars and generics is improving treatment affordability. Clinical R&D momentum is positioning China as a key market for future immuno-oncology launches.

Latin America Leukemia Therapeutics Market Trends

Latin America shows growing interest in modern leukemia treatments as diagnosis rates increase across major urban regions. Adoption of novel therapies is gradually improving through hospital tenders, expanded insurance models, and local distribution partnerships. Treatment access varies significantly across countries, leading to uneven market penetration for premium therapies. Pharma companies are expanding medical education programs to support earlier detection and guideline-based treatment. Demand for oral targeted drugs is rising due to preference for outpatient care and reduced hospital dependency. Market growth remains moderate, but is supported by the increasing provision of private sector oncology services.

The Brazil leukemia therapeutics market is the largest in Latin America, with rising use of targeted and immuno-oncology drugs in major cancer centers. High patient volumes support the wider clinical use of tyrosine kinase inhibitors, BCL-2 inhibitors, and monoclonal antibodies. Access to advanced therapies is improving through strategic pricing, patient support programs, and the expansion of oncology healthcare networks. Local manufacturing and regional licensing agreements are increasing the availability of high-cost biologics. Growing physician familiarity with precision medicine is strengthening treatment selection based on genetic profiling. Despite cost constraints in public hospitals, demand from the private sector drives long-term market expansion.

Middle East & Africa Leukemia Therapeutics Market Trends

MEA shows a rising treatment demand driven by growing detection rates and the expansion of specialty oncology hospitals. Access to branded leukemia therapies is improving through regional distribution agreements and tiered pricing models. Clinical practice is evolving from chemotherapy-dominant regimens to the introduction of targeted drugs in priority hospitals. Market potential is concentrated in urban centers with higher insurance coverage. Pharma companies are increasing participation in hospital-based education and physician training programs. Growth remains gradual, yet long-term opportunity is rising with infrastructure expansion.

The Saudi Arabia leukemia therapeutics market is emerging as a strong market due to rising investments in cancer care and improving diagnostic capacity. High utilization of branded therapies is driven by strong access to specialty hospitals. International pharma collaboration supports the adoption of targeted and cell-based therapies. Growing medical tourism in oncology enhances treatment flow through designated cancer centers. Patient awareness campaigns are increasing early diagnosis rates and therapy initiation. Expansion of private sector oncology services adds momentum to long-term market penetration.

The leukemia therapeutics market in Kuwait represents a smaller but high-value segment characterized by a strong preference for premium oncology drugs. Specialist hospitals support treatment regimens aligned with global prescribing standards. Access to imported targeted therapies remains strong in insured patient groups. Increasing physician exposure to global clinical updates enhances prescribing confidence in novel agents. Rising demand for less toxic alternatives to chemotherapy is influencing treatment patterns. The expansion of private-sector oncology capacity supports market growth.

Key Leukemia Therapeutics Company Insights

Pfizer Inc. participates in the leukemia therapeutics market with a diverse oncology portfolio and ongoing programs in hematologic cancers. Novartis focuses on targeted and cell-based therapies supported by extensive clinical research. Amgen Inc. develops biologics and immunotherapy assets used across multiple leukemia settings. AbbVie expands treatment reach through targeted agents and continued lifecycle development. Bristol-Myers Squibb advances immuno-oncology approaches with active data generation across leukemia types. F. Hoffmann-La Roche maintains a broad presence in hematology supported by biologics and global trial networks. Takeda Pharmaceutical Co., Ltd. advances through partnerships and a combination of small-molecule and biologic candidates. Sanofi/Genzyme Corporation invests in the development of targeted therapies and treatment options for patients with relapsed and refractory conditions.

Key Leukemia Therapeutics Companies:

The following are the leading companies in the leukemia therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Novartis

- Lupin Ltd.

- Amgen Inc.

- AbbVie

- Johnson & Johnson Services, Inc.

- Bristol-Myers Squibb

- F. Hoffmann-La Roche

- Takeda Pharmaceutical Co Ltd

- Sanofi/ Genzyme Corporation

Recent Developments

-

In October 2024, Novartis reported that the FDA approved Scemblix for newly diagnosed Ph+ CML-CP, citing superior efficacy, deeper molecular response, and a more favorable safety and tolerability profile compared with standard therapy in a global Phase III study.

-

In June 2024, Amgen announced that the U.S. FDA approved BLINCYTO® for CD19-positive, Philadelphia chromosome-negative B-cell precursor ALL in the consolidation phase, after Phase III data showed higher 3-year and 5-year overall survival rates in the BLINCYTO plus chemotherapy arm compared with chemotherapy alone.

-

In May 2024, Lupin received U.S. FDA approval for its 25 mg generic Midostaurin Capsules, a product linked to USD 75 million in U.S. annual sales. The drug was cleared for ASM, SM-AHN, and MCL. Lupin noted 15 manufacturing sites and 7 R&D centers, with 7.8% of FY24 revenue invested in R&D.

Leukemia Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.30 billion

Revenue forecast in 2033

USD 36.02 billion

Growth rate

CAGR of 7.43% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type of leukemia, treatment type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Pfizer Inc.; Novartis; Lupin Ltd.; Amgen Inc.; AbbVie; Johnson & Johnson Services, Inc.; Bristol-Myers Squibb; F. Hoffmann-La Roche; Takeda Pharmaceutical Co Ltd; Sanofi/ Genzyme Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Leukemia Therapeutics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global leukemia therapeutics market report based on type of leukemia, treatment type, distribution channel, and region:

-

Type of Leukemia Outlook (Revenue, USD Million, 2021 - 2033)

-

Chronic Myeloid Leukemia (CML)

-

Chronic Lymphocytic Leukemia (CLL)

-

Acute Lymphocytic Leukemia (ALL)

-

Acute Myeloid Leukemia (AML)

-

Others

-

-

Treatment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemotherapy

-

Targeted Therapy

-

Immunotherapy

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.