- Home

- »

- Sensors & Controls

- »

-

Level Sensor Market Size, Share And Growth Report, 2030GVR Report cover

![Level Sensor Market Size, Share & Trends Report]()

Level Sensor Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Contact Type, Non-contact Type), By Application (Automotive, Consumer Electronics, Healthcare), By Region, And Segment Forecasts

- Report ID: 978-1-68038-230-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Level Sensor Market Summary

The global level sensor market was valued at USD 4.81 billion in 2022 and is projected to reach USD 8.37 billion by 2030, growing at a CAGR of 7.3% from 2023 to 2030. These sensing technologies are used to measure the level of liquid and fluidized solids, including powders, slurries, and granular materials.

Key Market Trends & Insights

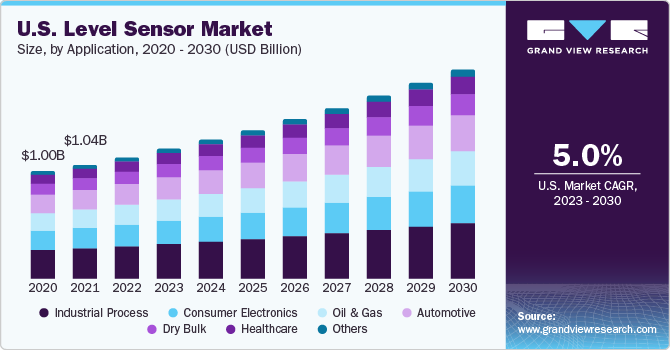

- The North America region dominated the market with a 33.8% revenue share in 2022.

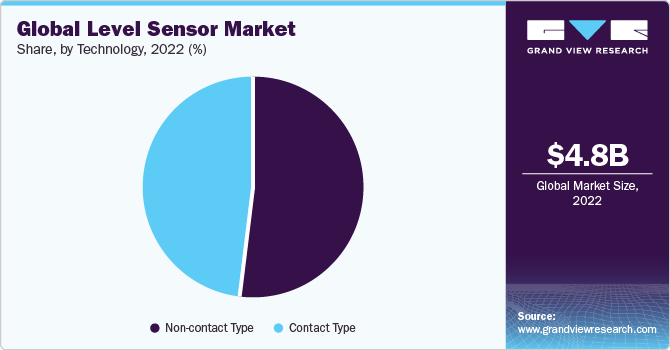

- By technology, the non- contact type segment accounted for the largest revenue share of 52.1% in 2022.

- By application, the industrial process segment accounted for the largest revenue share of 26.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.81 Billion

- 2030 Projected Market Size: USD 8.37 Billion

- CAGR (2023-2030): 7.3%

- North America: Largest Market in 2022

- Asia Pacific: Fastest growing market

The substance which is to be measured remains in the natural form or inside a container and the measurement can be of continuous or point values. The increasing use of smart sensors capable of two-way communication and self-diagnosis is projected to drive market growth. For instance, applications such as water conservation make use of digital technology can be connected to microcontrollers to monitor water usage and capacity.

Digital level sensors are also used for gas flow measurement technology, and can easily interface with computers. The increasing use of Micro-Electro-Mechanical Systems (MEMS) non-contact type technology in residential, commercial, and industrial measurement applications is also anticipated to enhance the market demand.

The growing demand for intelligent instruments equipped with microprocessors that provide information about the performance of the instrument is expected to fuel the market growth. The ability to offer higher accuracy and efficiency along with easy installation and maintenance is anticipated to drive the industry growth. The increasing acceptance of smart multiphase sensors in the oil & gas and food & water industries has led to enhanced growth.

The technology is easily available in the market owing to the presence of a large number of suppliers, reduction in the size of the sensors, and the increasing usage of multipurpose level sensors in the automotive and industrial sectors. However, the adoption of thin-film technology and increasing competition among market players is expected to hamper the market growth over the forecast period.

The evolution of sensor technologies and microcontrollers is enhancing the automobile industry to develop complex systems that provide better vehicle control and safety to the end-users. The increasing use of multipurpose level sensors in vehicle production and manufacturing industries is anticipated to fuel the market demand over the forecast period. Global automobile production is increasing owing to the growing urbanization and upgrading safety provisions by implementing various sensors. The buyer's inclination toward high-end cars in the emerging regions is expected to positively impact the level sensor market demand in the upcoming years.

The favorable industry regulations aid in stimulating the growth of the level sensors market. For instance, regulations laid by the Environmental Protection Agency (EPA) for power plants have increased the level sensor demand for monitoring gas leakage. Health and safety organizations are also working toward implementing a hazard-free environment, ensuring workplace safety for employees. Compliance with regulations and standards in the food and beverage industry is the most demanding challenge for measuring instruments and sensors. The product design must comply with the industry guidelines issued by the Food and Drug Administration (FDA) and European Hygienic Engineering &Design Group (EHEDG) as well as meet the special Sterilization-in-Place and Clean-in

Place (SIP/CIP) process requirements for surface quality, materials used, process connections, and reliability. Programmable measuring instruments and specialized accessories further improve the customer experience. In the U.S., EPA regulates the wastewater discharge and treatment of wastewater under the Clean Water Act (CWA).

The global sensor industry has undergone intense competition and significant price reductions over the past years. The prices of sensors are declining significantly, which has negatively impacted the market, and this trend is expected to continue over the forecast period. The relatively short lifecycle of semiconductor components prompts manufacturers to strive for the development of components at a lower per-unit cost. Competition within the industry has intensified the need for efficiency and productivity improvements.

Application Insights

Based on applications, the market is segmented into automobile, consumer electronics, healthcare, industrial process, oil & gas, dry bulk and others. The industrial process segment accounted for the largest revenue share of 26.6% in 2022. The industrial process segment is growing under the market because of the increasing demand for automation and process control in various industries, such as oil and gas, chemicals, and food and beverage. Level sensors are used to monitor and control the level of liquids and solids in industrial processes, and they are becoming increasingly important as industries strive to improve efficiency and safety.

The industrial and municipal wastewater management application is also expected to witness significant growth owing to the stringent regulations in developed regions such as the UK, Germany, and the U.S. Furthermore, increasing government initiatives are anticipated to increase the adoption rate of water treatment technology in emerging economies. Manufacturers are increasingly focusing on reliability requirements and lowering the repair cost in case of any damage.

The automotive segment is expected to grow at the fastest CAGR of 8.2% during the forecast period. Automobiles are usually equipped with a fuel sensor to measure the amount of fuel in the tank. The automotive segment is growing due to the increasing demand for advanced safety features and the rising popularity of electric vehicles. Level sensors are used in a variety of automotive applications, such as fuel level sensors, oil level sensors, and coolant level sensors.

Technology Insights

Based on technology, the market is segmented into contact type and non-contact type. The non- contact type segment accounted for the largest revenue share of 52.1% in 2022 and is expected to grow at the fastest CAGR of 8.9%. The market is experiencing a transition from contact type to non-contact type owing to their flexibility, accuracy in measurement, and a lesser need for maintenance. Non-contact/continuous level sensors are electronic devices that generate the electromagnetic field for level measurement. These sensors operate faster and have greater application flexibility. Non-Contact Type technologies include photoelectric, capacitive, and ultrasonic sensors.

Contact Type segment is expected to grow at a significant CAGR of 5.2%. Contact/point level are electrochemical devices that are used to detect a change through physical contact with the target material/object. Magnetostrictive, vibratory probe, hydrostatic, and magnetic float are a few types of contact sensors. Continuous level monitoring systems offer continuous level measurement of liquids and solids in silos, bins, and sumps. The solid flow sensor is based on microwave technology that senses solid materials, whereas point level switches are used to measure the level of solids, slurries, and liquids and are usually mounted on bins, hoppers, tanks, chutes, pipes, and vessels.

Regional Insights

The North America dominated the market and accounted for the largest revenue share of 33.8% in 2022. The U.S. EPA’s Air, Climate, and Energy research program has developed a research initiative to survey both O3 and NO2 low-cost sensors. As a part of the research program, the U.S. EPA works in collaboration with developers to evaluate the characteristics of such sensors.

The growth in the U.S. regional level sensor industry is primarily driven by an increase in the adoption of various sensors in the new cars. The introduction of TEREAD act mandates the pressure sensor for every vehicle to intimate the underinflated tires is expected to drive the industry demand in the U.S. region.

Asia Pacific is expected to grow at the fastest CAGR of 8.5% during the forecast period. The presence of a large number of semiconductor manufacturers in Korea, China, and Japan is anticipated to spur the Asia Pacific regional market. Additionally, the growing concern toward the environment and water management also positively impact the market growth over the forecast period.

The autonomous car technology and coupled with connected car technology contributed to the growth of the Japan level sensor industry. The major factor that drives the market is improved communication capabilities and reduction in size of the sensors. The government-driven initiatives, such as “Make in India” and “Digital India”, are anticipated to boost the penetration of smartphones and other consumer electronics in the region, resulting in the increasing demand for the level sensors.

Key Companies & Market Share Insights

Several key manufacturers are increasingly undergoing inorganic growth strategies, such as frequent mergers & acquisitions, in an attempt to expand their product portfolio.

Key Level Sensor Companies:

- ABB

- AMETEK. Inc.

- Garner Industries, Inc.

- Bindicator

- Emerson Electric Co.

- Electro-Sensors, Inc.

- Endress+Hauser Group Services AG

- Gems Sensors, Inc.

- Honeywell International, Inc

- Magnetrol International, Inc.

- OMEGA Engineering inc.

- MTS System Corporation

- Pepperl+Fuchs GmbH

- Siemens

- Senix Corporation

Recent Development

-

In June 2023, Endress+Hauser introduced an improved version of Micropilot 80 GHz radar sensors, which are intended to provide solutions for a wide range of industries and applications. These sensors are designed for difficult-to-access measurement sites, dusty settings, and hostile environments with severe process temperatures and process conditions.

-

In December 2022, OMEGA Engineering Inc., a temperature measurement innovation company announced the introduction of the recent version of their HANI Clamp-On Temperature Sensor, a the HANI Clamp Sensor for plastic pipe applications.

-

In November 2022, Atlas Material Testing Technology LLC, a manufacturer of weathering test equipment and related testing and consulting services, acquired by AMETEK, Inc. Atlas sets to offer AMETEK, Inc. an additional growth platform in the very competitive materials testing equipment market, as well as to increasing footprint in the fast-growing photovoltaic testing sector through this acquisition.

-

In August 2022, Sense-secure, a Canada-based IT security solution provider, in partnership with General Electric Research, U.S., developed first of its kind "Sense-PRO 1" a carbon monoxide nano sensor sticker. This wireless CO sensor, smart sticker is unique as it is capable of operating with no power source needed. It is also extremely thin and compact, measuring thickness of 0.1mm and 22mm in diameter, which makes it ideal to use with smartphones. The sensor can be attached to the back of smartphone to transform them into sophisticated analyzers and carbon monoxide detectors.

-

In June 2022, Magnetrol-AMETEK announced launch of the Genesis Multiphase Detector, a new level sensor that uses groundbreaking patents to improve the accuracy and reliability of multiphase level measurement. The new Genesis Multiphase Detector incorporates a number of key engineering achievements. This cutting-edge multiphase detector delivers profiler performance at a competitive price while avoiding regulatory hassles and HSE concerns.

-

In April 2021, Magnetrol, Orion Instruments, SWI, and Introtek announced acquisition by AMETEK, Inc., a manufacturer of electronic instruments and electromechanical devices.

-

In March 2019, Senix's TSPC-15S Series level and distance sensor works in collaboration with SenixVIEW software to give a user-friendly interface that enables users to instantly alter, optimize, store, and clone programs without the need for calibration. In addition, the sensor makes a tough transducer that is potted in a stainless-steel housing for long life. Because of the sensor's non-contact technology, it is not exposed to materials, making it appropriate for usage in a number of applications.

Level Sensor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.13 billion

Revenue forecast in 2030

USD 8.37 billion

Growth rate

CAGR of 7.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Application, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ABB; AMETEK. Inc.; Garner Industries, Inc.; Bindicator; Emerson Electric Co.; Electro-Sensors, Inc.; Endress+Hauser Group Services AG; Gems Sensors, Inc.; Honeywell International, Inc; Magnetrol International, Inc.; OMEGA Engineering inc.; MTS System Corporation; Pepperl+Fuchs GmbH; Siemens; Senix Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Level Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global level sensor market report on the basis of technology, application, and region:

-

Technology Outlook (Revenue in USD Billion, 2017 - 2030)

-

Contact Type

-

Non-contact Type

-

-

Application Outlook (Revenue in USD Billion, 2017 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare

-

Industrial Process

-

Oil & Gas

-

Dry Bulk

-

Others

-

-

Regional Outlook (Revenue in USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the growing demand for intelligent instruments equipped with microprocessors that provide information about the performance of the instruments.

b. The global level sensor market size was estimated at USD 4.81 billion in 2022 and is expected to reach USD 5.13 billion in 2023.

b. The global level sensor market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 8.37 billion by 2030.

b. North America dominated the level sensor market with a share of 33.8% in 2022. This is attributable to the presence of a large number of semiconductor manufacturers and growing concern towards water management.

b. Some key players operating in the level sensor market include Siemens AG, ABB, Ltd., Emerson Electric Company, and MTS Sensor.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.