Lice Treatment Market Size & Trends

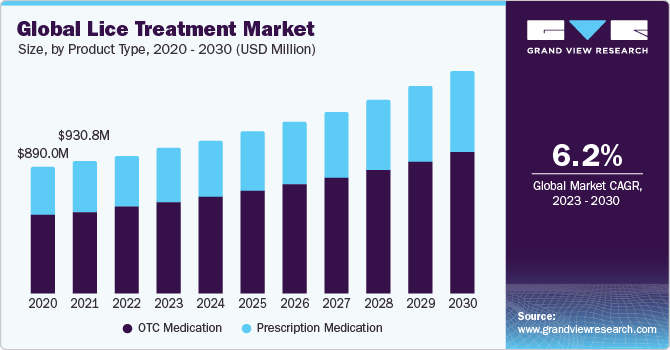

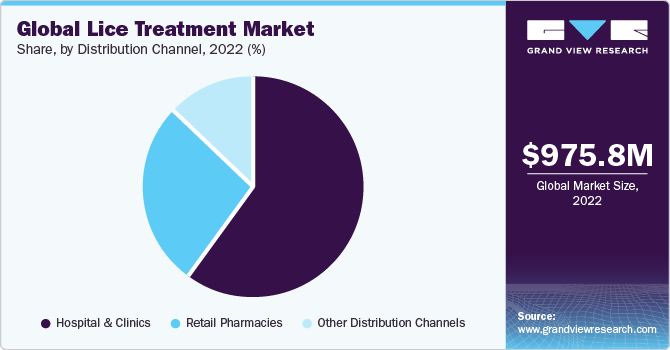

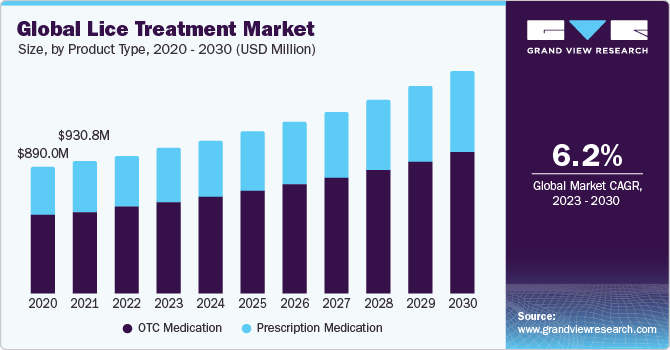

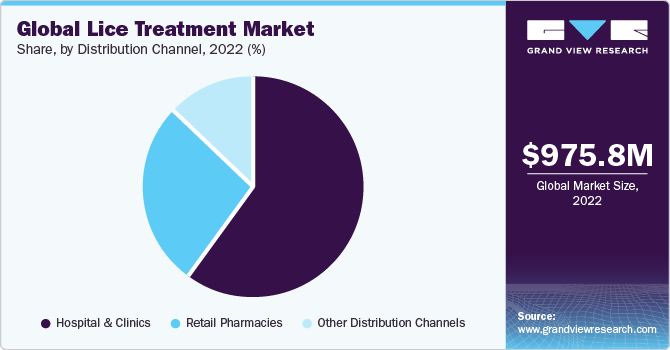

The global lice treatment market was valued at USD 975.8 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.22% from 2023 to 2030. The rising prevalence of lice infestations, changing lifestyles, and product innovations are anticipated to impel the growth of the market over the forecast period. In addition, the rise of e-commerce and online sales channels has made it easier for buyers to access lice treatment products.

In October 2022, Lice Clinics of America announced that they have accomplished administering over 750,000 effective head lice treatments through the utilization of heated air, with a success rate beyond 99 percent. This was accomplished during the second year of the COVID-19 pandemic.

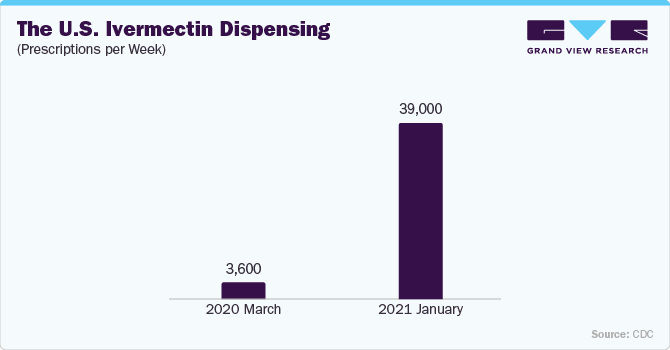

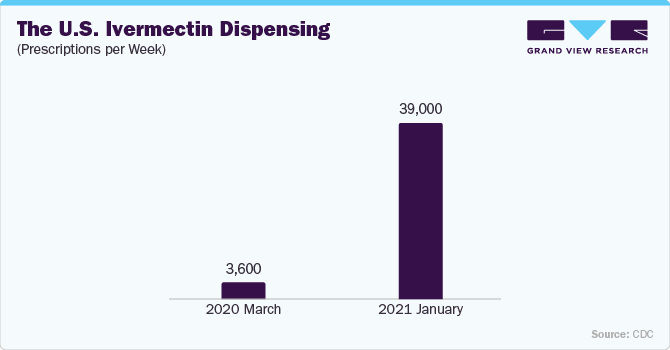

According to a CDC article published in August 2021, the dispensing of ivermectin from patient retail chemists in the U.S. experienced a significant rise during the COVID-19 pandemic period. It increased from the usual 3,600 recommendations per week in the pre-pandemic time (March 2019-March 2020) to the greatest of 39,000 recommendations in the week on January 8, 2021.

Product Type Insights

In 2022, the OTC medication segment dominated the market and is estimated to witness the fastest CAGR during the forecast period. The OTC medication is further segmented into Permethrin, Pyrethrin, and other product types. Changes in lifestyles, such as more people spending time in close contact settings, like sleepovers and sports activities, have increased the risk of lice transmission. This has driven the demand for various products for lice treatment. Furthermore, the growing environmental concerns and an interest in non-toxic, eco-friendly products have influenced the segment’s growth.

Prescription medications are anticipated to witness a significant growth rate over the forecast period. It is further segmented into Ivermectin, Spinosad, Malathion, and other prescription medications. These prescription medications are often used topically or orally, depending on the severity of the infestation, and their safety and effectiveness may vary from one individual to another.

Distribution Channel Insights

On the basis of distribution channels, retail pharmacies dominated the lice treatment market in terms of revenue. One of the key factors is that they provide convenient access to a wide range of over-the-counter healthcare products, comprising various treatments for common conditions like head lice. When it comes to lice treatment, retail pharmacies are often the first stop for concerned parents or individuals seeking effective solutions. These pharmacies offer a variety of lice treatment products, which include numerous shampoos, combs, and creams, making it easy for customers to address this common issue.

Hospital pharmacies are projected to exhibit the fastest CAGR during the forecast period. Hospital pharmacies often collaborate with delivery personnel to ensure that patients receive their medications promptly and conveniently, especially in cases where mobility or transportation is a challenge for patients. These services enhance the accessibility and efficiency of healthcare, ensuring that even lice treatments are readily available for individuals.

Regional Insights

In 2022, North America held the largest market share, owing to the presence of a large infestation pool and a growing number of children population. The 2020 census conducted by the United States Census Bureau revealed that the population of children under the age of 18 was 73.1 million in 2020. Additionally, as per the CDC report in September 2020, infestations of head lice are prevalent among preschool children in childcare, elementary school students, and household members of infested children in the U.S. It was estimated that approximately 6 million to 12 million such infestations occur each year in the country, primarily affecting children between the ages of 3 and 11.

Asia Pacific is projected to grow with the fastest CAGR during the forecast period, owing to the increasing incidence of lice infestations and growing healthcare infrastructure.

Key Lice Treatment Company Insights

The high demand for lice treatment due to growing lice infestation has led to numerous market opportunities for major players to capitalize on. Some of the key players in the global lice treatment market include GlaxoSmithKline, Alliance Pharmaceuticals Ltd, Oystershell Consumer Health (Bayer), Perrigo Company plc (Omega Pharma), Prestige Consumer Healthcare Inc., Fleming Medical Ltd, Johnson and Johnson Services, Inc., Arbor Pharmaceuticals Inc. (Azurity Pharmaceuticals), and Parapro Pharmaceuticals among others. In April 2022, Arbor Development, LLC., announced the completion of the third-party clinical study that exhibits a remarkable 95% efficacy rate through the utilization of their cutting-edge, exclusive technology H.A.L.T.

In August 2021, ParaPRO announced the U.S. FDA approval for Natroba (spinosad) Topical Suspension, 0.9%, making it the inaugural product for treating scabies now accessible within the U.S.