Lidocaine Hydrochloride Market Trends

The global lidocaine hydrochloride market size is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030. The growing number of surgical procedures and an increase in the number of dental, cosmetic, and plastic surgeries conducted globally are contributing to the market growth.

The rise in acute and chronic pain-related diseases, as well as the numerous advantages linked to lidocaine hydrochloride, is also expected to boost demand for lidocaine hydrochloride during the forecast period. For instance, according to the American Society of Plastic Surgeons (ASPS) report published in September 2023, there were approximately 26.2 million less invasive cosmetic as well as reconstructive surgical procedures executed in the U.S. in 2022. More precisely, since 2019, the number of surgeries involving cosmetic surgery has increased by 19%. Due to their ability to provide patients with a minimum of side effects and comfort, creams containing lidocaine are essential in cosmetic dermatology.

In addition, lidocaine hydrochloride has widespread application in different medical procedures, including dentistry, dermatology, and several other surgeries. The rise in these treatments drives the need for lidocaine products. Furthermore, advancements in drug delivery systems have made it possible to develop innovative lidocaine formulations, like transdermal patches and sustained-release formulations, which have increased their market appeal.

The COVID-19 pandemic significantly impacted the lidocaine hydrochloride market. Due to the possible analgesic and anti-inflammatory effects of lidocaine in COVID-19, the pandemic had an impact on the market's growth. As per a research article, nebulized lidocaine, when inhaled as an adjuvant treatment for serious lung symptoms in patients struggling with the novel coronavirus, was helpful in lowering cytokines, safeguarding patients' lungs, as well as improving results in COVID-19 patients.

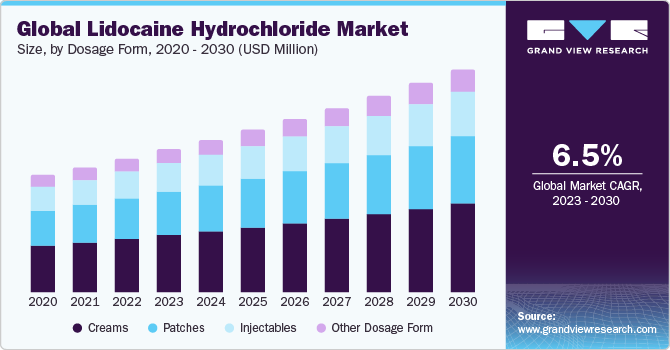

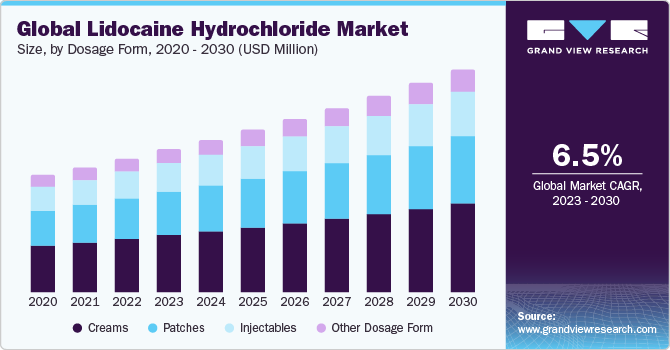

Dosage Form Insights

Based on dosage form, the market is segmented into creams, patches, injectables, and other dosage forms. The cream segment held the largest market share in 2023. Lidocaine cream is used to treat pain caused by conditions such as nerve, muscular, and arthritis discomfort. The market for lidocaine products may rise as a result of a growing elderly population and increased awareness of pain management options. Moreover, cream-based lidocaine formulations alleviate pain without the requirement for injections, which can be uncomfortable for some patients. Patients who are anxious or sensitive to needle injections prefer cream-based lidocaine formulations, thus supplementing segment growth.

Indication Insights

On the basis of indication, the lidocaine hydrochloride market is segmented into heart arrhythmia, dental procedures, epilepsy, and other applications. Dental procedures held the largest market share in 2023. One of the main factors driving the market is the widespread use of lidocaine hydrochloride in dental procedures to numb the affected area. Furthermore, the rising need for dental care services and the increasing number of dental procedures are contributing to segment growth.

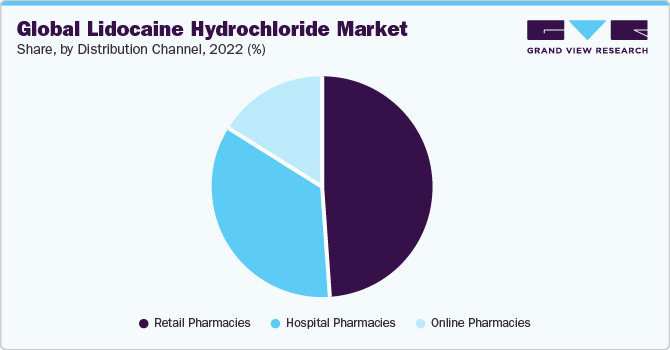

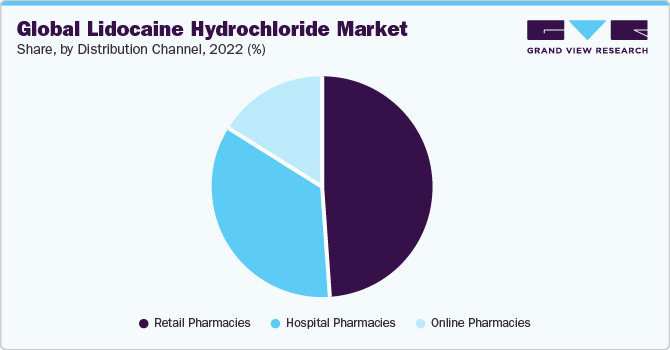

Distribution Channel Insights

On the basis of distribution channels, the market is segmented into hospital pharmacies, online pharmacies, and retail pharmacies. Retail pharmacies dominated the distribution channels segment in 2023. The increasing availability of over-the-counter (OTC) prescriptions, the high rate of generic penetration, and the rising number of prescriptions for lidocaine hydrochloride due to the rising incidence rate of pain, accidents, etc., are all factors contributing to the growth of the retail pharmacy sector. Another factor driving segment growth is the increase in the launch of over-the-counter lidocaine hydrochloride products.

Regional Insights

North America dominated the market in 2023 owing to an increase in the geriatric population and a growing number of surgical procedures in which lidocaine hydrochloride is given. The growing technological developments in various surgical procedures, the rising number of different surgical and aesthetic treatments, and the expanding usage of lidocaine hydrochloride for postoperative pain management are all factors contributing to the regional market's growth. For instance, according to the Aesthetic Society report published in April 2022, approximately 458,628 women in the U.S. underwent liposuction treatments, 362,346 breast augmentation procedures, and 146,761 breast implant removal procedures in 2021. Furthermore, according to OECD data released in December 2022, roughly 54,991 hip replacement surgical procedures were carried out in Canada in 2021. Furthermore, it's expected that the growing elderly population will fuel the region's surgical procedure volume, promising an increase during the forecast period.

Key Companies & Market Share Insights

Some of the key players operating in the market are Merck KGaA, Alanza Inc, Cirondrugs, AstraZeneca, Medexim India, Pfizer Inc., Nortec Qumica, Mahendra Chemicals, Sintetica S.A., and Amphastar Pharmaceuticals, Inc. The key players in the market undertake various strategic initiatives, such as new FDA approval, product launches, partnerships, and mergers acquisitions, to gain more market share.

-

In March 2023, Sintetica S.A.,a subsidiary of the global pharmaceutical company Sintetica S.A., launched Lidocaine Hydrochloride Injection, USP 1%, 2%, and 4% through its subsidiary Sintetica US.

-

In April 2023, FFF Enterprises Inc. signed an exclusive agreement with Sintetica US to deliver Lidocaine Hydrochloride Injection, an amide-type short-acting local or regional anesthetic.

-

In August 2022, Scilex Holding Company was granted fast-track status by the FDA for SP-103, a topical lidocaine system. SP-103 is a triple-strength, non-aqueous, non-opioid medication used to treat acute lower back pain.