- Home

- »

- Medical Devices

- »

-

Ligation Devices Market Size & Share, Industry Report, 2033GVR Report cover

![Ligation Devices Market Size, Share & Trends Report]()

Ligation Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Appliers, Accessories), By Application (Gynecology, Cardiothoracic), By Procedure Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-072-9

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ligation Devices Market Summary

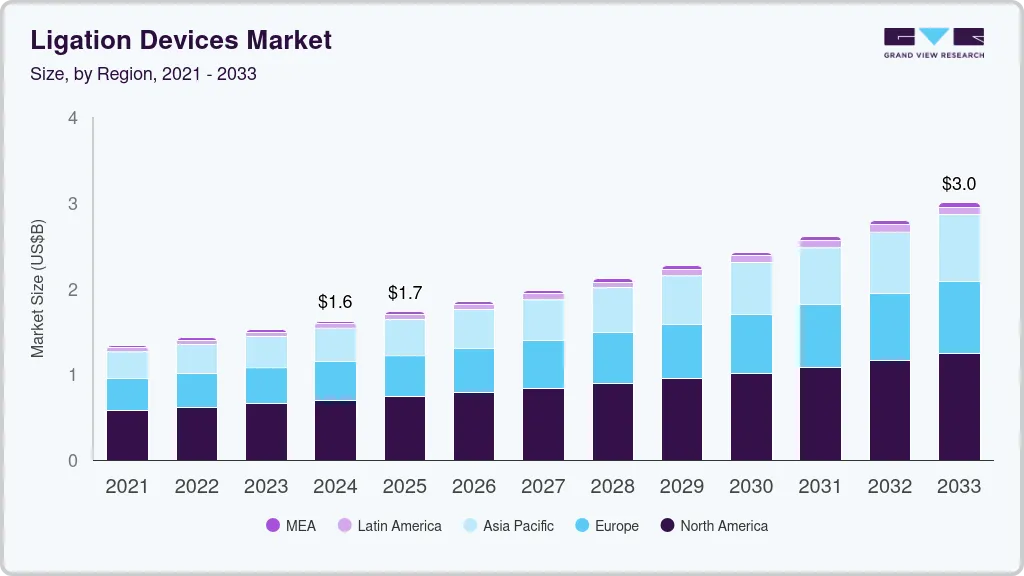

The global ligation devices market size was estimated at USD 1.6 billion in 2024 and is projected to reach USD 3.0 billion by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The industry is primarily driven by several key factors, including the increasing volume of surgical procedures and a growing preference for minimally invasive techniques.

Key Market Trends & Insights

- The North America ligation devices market held the largest share of the global ligation devices market at 42.9% in 2024.

- The ligation devices market in the U.S. held the largest share of the North American market.

- Based on product, the accessories segment of ligation devices captured the highest market share of over 69.4% in 2024.

- Based on application, the gastrointestinal and abdominal surgery segment dominated the market with a revenue share of 29.3% in 2024.

- Based on procedure type, the minimally invasive surgery (MIS) segment held the largest market share at 80.1% in 2024.

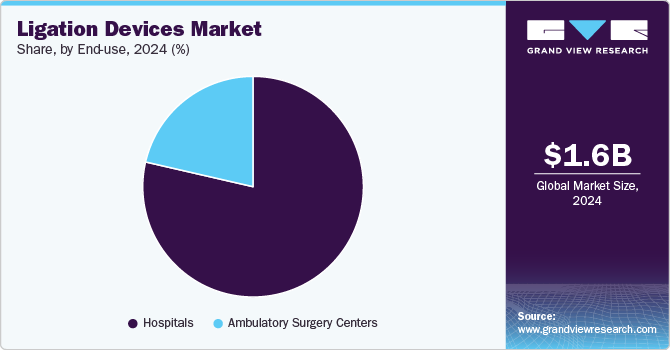

- Based on end use, the hospital segment accounted for the largest share of 70.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.6 Billion

- 2033 Projected Market Size: USD 3.0 Billion

- CAGR (2025-2033): 7.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising number of gastrointestinal, gynecological, urological, and cardiac surgeries significantly influences the demand for ligation devices. For instance, the World Health Organization (WHO) estimates that the number of people aged 60 years and older is expected to reach 2 billion by 2050, highlighting a significant demographic shift expected to increase the demand for surgical interventions. Coupled with the escalating demand for endoscopic procedures, the market is expected to experience substantial growth over the forecast period.

The increasing volume of surgical procedures is a major driver of market growth. As healthcare systems evolve and expand their surgical capabilities, the number of surgeries performed worldwide is rising. For instance, the American College of Surgeons reported that in the United States alone, approximately 50 million surgical procedures are conducted annually, with a notable shift towards minimally invasive techniques. This trend is reflected in the growing demand for ligation devices essential for various surgical interventions, including those in gastrointestinal, gynecological, and urological fields.

Technological advancements in ligation devices are a significant market driver. Innovations such as improved materials and automated systems have greatly enhanced the precision and effectiveness of these devices. For instance, robotic-assisted ligation devices, such as those used in laparoscopic surgeries, have demonstrated reduced complication rates and shorter recovery times compared to traditional methods. In addition, advancements in biocompatible materials, such as those used in absorbable sutures and clips, have expanded the range of surgical applications for ligation devices. These ongoing technological improvements are expected to enhance surgical outcomes further and broaden the use of ligation devices across various medical specialties, thereby driving continued market growth.

The increasing adoption of endoscopic therapy for gastrointestinal perforations is a significant driver of growth in the ligation devices industry. Endoscopic techniques have gained prominence due to their minimally invasive nature, leading to reduced recovery times and lower complication rates. For instance, a study published in the Journal of Gastrointestinal Surgery found that endoscopic closure techniques achieved successful outcomes in approximately 90% of gastrointestinal perforations cases. This high success rate underscores the critical role of ligation devices in these procedures, as they facilitate effective closure and promote tissue healing.

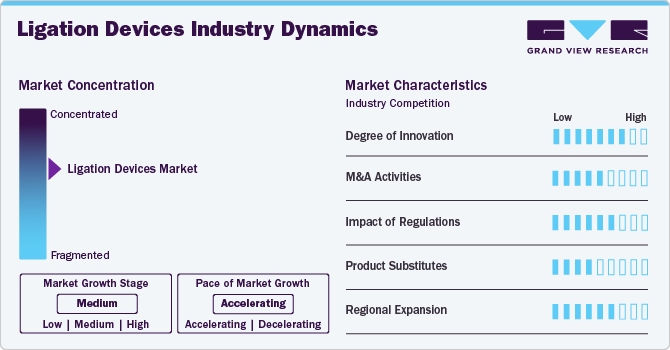

Market Concentration & Characteristics

The ligation devices industry is characterized by moderate to high market concentration, primarily dominated by a few key players offering advanced products, including clip, band, and suture ligation devices. This industry is driven by the increasing prevalence of chronic diseases, minimally invasive surgical technique advancements, and a growing preference for outpatient procedures. In addition, regional disparities in healthcare infrastructure and varying regulatory landscapes can impact industry dynamics. Innovative technologies, such as robotic-assisted ligation systems, are emerging trends, further shaping competitive strategies and enhancing patient outcomes in surgical procedures.

The ligation devices industry is marked by a strong emphasis on innovation, particularly in developing advanced technologies and materials. For instance, recent advancements include the introduction of self-anchoring ligation clips that simplify the surgical process and reduce procedure time. In addition, manufacturers are increasingly incorporating smart technology into ligation devices, such as sensors that provide real-time data on tissue perfusion during surgeries, improving patient safety and outcomes. Another notable innovation is the use of bioresorbable materials in ligation devices, which eliminate the need for subsequent removal surgeries, thereby enhancing patient comfort and reducing healthcare costs. These innovations reflect a broader trend towards minimally invasive techniques and improved surgical precision, showcasing the industry's commitment to addressing evolving clinical needs.

Mergers and acquisitions (M&A) activities within the ligation devices industry have increased as companies aim to strengthen their competitive positions and expand their market presence. Strategic acquisitions frequently focus on acquiring innovative technologies or established brands that complement existing product portfolios. In addition, collaborations between companies and research institutions are prevalent and aimed at developing next-generation ligation products. These M&A activities facilitate knowledge transfer and resource sharing and assist firms in navigating regulatory complexities and accelerating the time-to-market for innovations. As the market evolves, such strategic initiatives play a pivotal role in shaping its future landscape, enabling companies to enhance their capabilities and expand their service offerings.

Regulatory frameworks governing product development, approval, and commercialization significantly influence the industry of ligation devices. Regulatory agencies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), impose stringent guidelines that ensure the safety and efficacy of medical devices. For instance, the FDA’s premarket approval process requires rigorous clinical trials for new ligation devices, which can extend development timelines and increase costs. In addition, regulations surrounding materials used in ligation devices, such as biocompatibility standards, necessitate thorough testing and documentation. Compliance with these regulations can drive innovation as manufacturers invest in research to develop safer, more effective products that meet regulatory demands.

Various product substitutes exist in the market that meet similar clinical requirements, influencing competitive dynamics and innovation strategies. Key substitutes include traditional sutures, which, while effective for tissue approximation and ligation, typically require more time and expertise to apply compared to contemporary ligation devices. Mechanical alternatives such as surgical staplers and clips are also available for securing tissues and vessels during procedures. The presence of these substitutes affects the adoption rates of ligation devices by offering surgeons multiple options to achieve comparable outcomes. Consequently, manufacturers must focus on differentiating factors, such as ease of use, procedural efficiency, and improved patient outcomes, to enhance the market appeal of their ligation devices and maintain a competitive edge. This continuous innovation is essential for addressing the challenges posed by alternative solutions.

Regional expansion in the market is a critical strategy for companies seeking to enhance their market presence and capitalize on emerging opportunities. As healthcare infrastructure improves in Asia Pacific and Latin America, an increasing demand for advanced surgical solutions prompts manufacturers to establish a foothold in these markets. For instance, companies collaborate with local distributors and healthcare providers to understand regional needs and tailor their offerings accordingly. In addition, regulatory harmonization initiatives in various regions can facilitate smoother entry for new products, enabling companies to leverage growth potential more effectively. This regional expansion enables firms to diversify their revenue streams while effectively adapting to local market dynamics and preferences. This approach fosters innovation and enhances overall competitiveness in the market.

Product Insights

The accessories segment of ligation devices captured the highest market share of over 69.4% in 2024 and is anticipated to experience the fastest growth during the forecast period. This segment primarily consists of clips and clip removers, with clips being the leading product category. The availability of clips in multiple sizes and their suitability for repeated use in single procedures contribute significantly to their appeal, making them an essential tool for healthcare providers. As demand for efficient and effective surgical solutions rises, the growth of this segment reflects the industry's ongoing shift towards innovations that enhance operational efficiency and improve patient outcomes. This positive trajectory positions the accessories segment as a key driver of market growth, attracting investment and strategic interest from industry players seeking to capitalize on emerging opportunities.

The appliers segment also has a considerable market share. It is further divided into disposable and reusable appliers. Reusable appliers account for the largest market size. They are expected to dominate the market during the forecast period, primarily attributed to their use in minimally invasive and open surgery.

Application Insights

The gastrointestinal and abdominal surgery segment dominated the market with a revenue share of 29.3% in 2024. This growth reflects the growing prevalence of conditions requiring surgical intervention in these areas. This segment benefits from increasing procedures driven by factors such as the rising incidence of gastrointestinal diseases and the aging population. Ligation devices are crucial in these surgeries, facilitating effective tissue management and ensuring optimal surgical outcomes. As minimally invasive techniques gain popularity, the demand for specialized ligation devices tailored for gastrointestinal and abdominal applications is expected to rise significantly. In addition, advancements in surgical technologies and techniques and ongoing clinician training further propel the segment's growth.

The cardiothoracic segment is projected to experience the fastest CAGR during the forecast period, driven by the rising incidence of heart-related diseases and an increasing number of surgical procedures. Ligation devices are vital in various cardiothoracic interventions, including open surgeries for repairing faulty heart valves and bypassing blocked arteries. For instance, the prevalence of conditions such as coronary artery disease has led to a growing demand for surgical solutions that effectively address these issues. In addition, the trend towards non-invasive heart surgeries is significantly boosting market growth. Procedures such as left atrial appendage closure for patients with atrial fibrillation illustrate this shift, as they offer effective treatment options with reduced recovery times. These factors collectively position the cardiothoracic segment for substantial market growth.

Procedure Type Insights

The minimally invasive surgery (MIS) segment held the largest market share at 80.1% in 2024, reflecting the growing preference for surgical techniques that minimize patient trauma and recovery times. The increasing adoption of MIS procedures is driven by technological advancements, such as enhanced imaging and precision instruments, which improve surgical outcomes and reduce complications. As healthcare providers prioritize efficiency and patient comfort, ligation devices designed for MIS applications are becoming essential tools in many procedures. The segment’s dominance is further supported by rising patient demand for outpatient surgical options and ongoing training and education initiatives to equip surgeons with the skills needed to perform these advanced techniques. This strong market position underscores the significance of the MIS.

The open surgery segment is projected to experience significant CAGR during the forecast period. This robust growth is largely driven by the increasing prevalence of heart disease, with WHO estimating that cardiovascular diseases are responsible for approximately 31% of global deaths. Consequently, the rising number of open-heart surgeries, including procedures such as Coronary Artery Bypass Graft (CABG), aortic valve replacement, and mitral valve replacement, underscores the demand for effective ligation solutions. As the volume of surgeries continues to rise, with projections indicating that CABG procedures are expected to exceed 1 million annually by 2025, the demand for reliable ligation devices is expected to increase significantly. This trend underscores the potential for substantial growth within the open surgery segment, emphasizing these devices' critical role in achieving successful surgical outcomes.

End Use Insights

The hospital segment accounted for the largest share of 70.2% in 2024. Hospitals are the primary venues for various surgical procedures, where ligation devices are vital for effective tissue management and patient outcomes. This significant market share is driven by the increasing number of surgeries performed in hospital settings. For instance, over 15 million surgical procedures are conducted annually in the United States alone. In addition, as hospitals invest in advanced surgical technologies and enhanced training for medical staff, the demand for ligation devices continues to grow. With healthcare systems increasingly focused on improving surgical efficiency and outcomes, the hospital segment is well-positioned for sustained growth, presenting substantial opportunities for manufacturers in the market.

The Ambulatory Surgical Centres (ASCs) segment is projected to have a significant CAGR over the forecast period. This growth is largely driven by the rising preference for outpatient procedures, which is expected to reach approximately 23 million surgeries annually in the U.S. by 2025. ASCs are becoming increasingly popular due to their ability to offer lower costs, reduced recovery times, and enhanced patient convenience. The shift towards value-based care further supports this trend, as healthcare providers seek to adopt outpatient models that improve patient satisfaction and reduce the strain on hospital resources. Consequently, the ASC segment is well-positioned to capitalize on these trends, becoming a key market growth driver.

Regional Insights

The North America ligation devices market held the largest share of the global ligation devices market at 42.9% in 2024. This significant market presence is driven by several factors, including a highly developed healthcare infrastructure and the rapid adoption of innovative surgical technologies. For instance, the United States alone is projected to perform over 15 million surgical procedures that utilize ligation devices annually, highlighting the critical role these tools play in various surgical specialties. In addition, the increasing prevalence of chronic diseases, such as cardiovascular conditions and obesity, further fuels the demand for effective surgical interventions. For instance, according to the Centers for Disease Control and Prevention (CDC), heart disease remains the leading cause of death in the U.S., affecting approximately 697,000 individuals each year. This trend emphasizes the need for advanced surgical solutions, including ligation devices, to improve patient outcomes.

U.S. Ligation Devices Market Trends

The ligation devices marketin the U.S. held the largest share of the North American market, reflecting its significant impact on the overall landscape. In 2024, the U.S. accounted for approximately 89.2% of revenue share, driven by a well-established healthcare infrastructure and a high volume of annual surgical procedures. With over 15 million surgeries utilizing ligation devices, the U.S. market benefits from advanced surgical techniques and a strong emphasis on minimally invasive procedures. The increasing prevalence of chronic diseases, including cardiovascular conditions and gastrointestinal disorders, further propels the demand for effective surgical solutions. For instance, the American Heart Association (AHA) estimates that nearly 18.2 million adults in the U.S. have coronary artery disease, underscoring the need for procedures that require ligation devices.

Europe Ligation Devices Market Trends

The ligation devices market in Europe is experiencing growth driven by several key factors, contributing to its expanding presence in the global landscape. The rising prevalence of chronic diseases, such as obesity and cardiovascular disorders, is a significant driver, with the European Society of Cardiology reporting that cardiovascular diseases account for nearly 4 million deaths annually in Europe. In addition, the region's commitment to improving healthcare infrastructure and access to advanced medical technologies is crucial in market growth. Many European countries are investing in state-of-the-art surgical facilities and training programs, enhancing the capabilities of healthcare providers and increasing the demand for effective surgical solutions like ligation devices.

The UK ligation devices market is expected to grow fastest over the forecast period, driven by technological advancements and the rising prevalence of chronic disorders. As healthcare technology continues to evolve, the adoption of innovative ligation devices that enhance surgical efficiency and patient safety is on the rise. For instance, the National Health Service (NHS) reports that over 4 million surgical procedures are performed annually in the UK, a significant portion of which utilizes ligation devices for various applications. The increasing incidence of chronic disorders, such as cardiovascular diseases and obesity, further propels the demand for effective surgical solutions. For instance, according to the British Heart Foundation, around 7.6 million people in the UK are living with heart disease, highlighting the urgent need for surgical interventions that incorporate ligation devices.

The ligation devices market in France is projected to grow significantly during the forecast period, driven by factors such as the rising prevalence of chronic diseases, particularly cardiovascular conditions and gastrointestinal disorders, which are key factors contributing to this growth. For instance, according to the French Ministry of Health, cardiovascular diseases are responsible for nearly 140,000 deaths annually, highlighting the urgent need for effective surgical interventions that often involve ligation devices. In addition, France is investing heavily in healthcare modernization, with approximately USD 2. 7 billion allocated to improving surgical facilities and enhancing access to advanced medical technologies. This investment supports adopting innovative ligation solutions that improve surgical outcomes and patient safety.

Germany ligation devices market is poised for exponential growth over the forecast period, driven by several key factors. One of the primary catalysts is the increasing incidence of chronic diseases, particularly cancer. For instance, according to The Global Cancer Observatory, Germany reported approximately 628,519 new cancer cases in 2020. This rising prevalence is expected to necessitate more surgical interventions, where ligation devices are critical. In addition, advancements in medical technology and the integration of minimally invasive surgical techniques are further propelling market expansion. As healthcare providers increasingly adopt these technologies to improve patient outcomes, the demand for innovative ligation devices is set to surge.

Asia Pacific Ligation Devices Market Trends

The Asia Pacific ligation devices market is anticipated to exhibit the fastest growth rate of 8.4% during the forecast period. This rapid expansion can be attributed to several key factors, including a rising burden of chronic diseases, increasing healthcare expenditure, and advancements in medical technology. A significant contributor to this growth is the alarming rise in chronic conditions such as cardiovascular diseases and cancer. For instance, WHO reported that non-communicable diseases accounted for 60% of total deaths in the Asia Pacific region annually. This escalating health crisis necessitates more surgical interventions, thereby driving the demand for ligation devices. In addition, as countries in the region invest more in healthcare infrastructure, including state-of-the-art surgical facilities and training for medical professionals, the adoption of advanced ligation technologies is expected to accelerate.

The China ligation devices market holds a dominant share in the Asia Pacific region, driven by several factors contributing to its strong position, with a rapidly expanding healthcare infrastructure. The country’s emphasis on improving healthcare access and quality is evidenced by substantial investments in its healthcare system, projected to reach over USD 1 trillion by 2025, according to the National Health Commission. A critical driver for market growth is the increasing prevalence of chronic diseases, particularly cancer. The Chinese National Cancer Center reported approximately 4.57 million new cancer cases in 2020, underscoring the urgent need for effective surgical interventions. This rising incidence translates into a higher demand for ligation devices essential for various surgical procedures. In addition, as China’s economy grows, healthcare spending is expected to increase, further propelling the market for advanced medical devices.

The Japan ligation devices market is primarily driven by several key factors, including an aging population, advancements in medical technology, and a strong focus on minimally invasive surgical procedures. One of the most significant drivers is Japan's rapidly aging demographic. For instance, according to the World Bank, by 2025, approximately 30% of Japan’s population is projected to be 65 and older. This demographic shift leads to an increased prevalence of chronic diseases, such as cardiovascular issues and cancers, which necessitate surgical interventions where ligation devices are essential. For instance, the Japanese Ministry of Health, Labor, and Welfare reported that cancer was responsible for nearly 28% of all deaths in 2020, highlighting the urgent need for effective treatment options. In addition, Japan is renowned for its commitment to medical innovation and technology. The country invests heavily in healthcare R&D, with the government allocating about 5% of its GDP to healthcare annually, fostering the development of advanced ligation devices.

Latin America Ligation Devices Market Trends

The Latin America ligation devices market is experiencing steady growth, driven by several key factors, including increasing healthcare investments, a rising prevalence of chronic diseases, and improvements in medical infrastructure. One of the primary drivers of this growth is the escalating burden of chronic conditions, particularly cardiovascular diseases and cancers. For instance, according to the Pan American Health Organization, non-communicable diseases are responsible for over 70% of all deaths in the region. This alarming statistic underscores the need for effective surgical interventions, thereby boosting the demand for ligation devices that are integral to various procedures.

Middle East & Africa Ligation Devices Market Trends

The Middle East and Africa ligation devices market is anticipated to witness robust growth over the forecast period, driven by several key factors, including rising healthcare expenditure, an increasing prevalence of chronic diseases, and significant advancements in medical technology. One major contributor to market growth is the region's rising burden of chronic diseases. For instance, according to WHO, non-communicable diseases (NCDs) account for 70% of deaths in the Middle East and North Africa (MENA) region, with cardiovascular diseases and cancers being particularly prevalent. For instance, the International Agency for Research on Cancer estimates that cancer cases in the MENA region could increase by 30% by 2030. This rising incidence of diseases necessitatessurgical interventions, thereby driving demand for ligation devices.

Key Ligation Devices Company Insights

The corneal topographer market is highly competitive, with key players such as Medtronic, Johnson & Johnson Services, Inc., and others. The major companies are undertaking various organic and inorganic strategies, such as new product development, collaborations, acquisitions, mergers, and regional expansion, to serve their customers' unmet needs.

Key Ligation Devices Companies:

The following are the leading companies in the ligation devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Johnson & Johnson Services, Inc.

- The Cooper Companies, Inc.

- CONMED Corporation.

- B. Braun SE

- Teleflex Incorporated.

- Olympus Corporation

Recent Developments

-

In March 2023, Clario launched a cloud-based image viewer specifically for clinical trials. This innovation aims to streamline medical image analysis and improve its accessibility within the clinical research context.

-

In May 2023, Cleerly has partnered with ProScan Imaging to provide personalized solutions for cardiac health, which involve analyzing and devising treatment strategies for cardiovascular issues. The partnership is expected to leverage Cleerly's AI-powered platform to examine coronary CT angiography (CCTA) images.

Ligation Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.7 billion

Revenue forecast in 2033

USD 3.0 billion

Growth rate

CAGR of 7.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, procedure type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Johnson & Johnson Services, Inc.; The Cooper Companies, Inc.; CONMED Corporation.; B. Braun SE; Teleflex Incorporated.; Olympus Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Litigation Devices Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ligation devices market based on product, application, procedure type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Appliers

-

Disposable

-

Reusable

-

-

Accessories

-

Clips

-

Clip remover

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Gastrointestinal and abdominal surgery

-

Gynecological surgery

-

Cardiothoracic surgery

-

Urological surgery

-

Bariatric

-

Vascular

-

Other

-

-

Procedure Type Outlook (Revenue, USD Million, 2021 - 2033)

-

MIS

-

Open surgery

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory surgical centers

- Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ligation devices market size was valued at USD 1.6 billion in 2024 and is expected to reach USD 1.7 billion in 2025.

b. The global ligation devices market is expected to grow at a compound annual growth rate of 7.0% from 2025-2030 to reach USD 2.42 billion in 2030.

b. North America dominated the ligation devices market with a share of 42.9% in 2024. This is attributable to increasing government spending and the presence of key players in the region.

b. Key companies operating in the market are Medtronic Plc; Johnson and Johnson (Ethicon); the Cooper Companies, Inc.; CONMED Corporation; B Braun Melsungen AG; Teleflex Incorporated; and Olympus Corporation.

b. Key factors that are driving the market growth include increasing number of minimally invasive procedures, increasing prevalence of digestive diseases, technological advancements and rising healthcare spending.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.