- Home

- »

- Next Generation Technologies

- »

-

Light Fidelity Market Size & Trends Analysis Report, 2030GVR Report cover

![Light Fidelity Market Size, Share, & Trends Report]()

Light Fidelity Market (2023 - 2030) Size, Share, & Trends Analysis Report By Component (LED, Photodetector), By End-use (Automotive, Retail, Government), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-036-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global light fidelity market size was valued at USD 323.6 million in 2022 and is expected to expand at a Compound Annual Growth Rate (CAGR) of 51.0% from 2023 to 2030. Light Fidelity (Li-Fi) uses visible light communication technology that leverages LED lights to transmit data wirelessly. By communicating through visible light, Li-Fi can change how the world uses the internet, streams videos, receives mail, and much more. Benefits provided by Li-Fi technology include high-speed internet connectivity, highly secure data transmission, and no interference like traditional radio waves, making it a faster and cheaper option for data transmission; thereby propelling its adoption in the market.

The global digital population is increasing at a rapid rate across the globe. According to the International Telecommunication Union, over 5.3 billion of the world’s population are using the internet as of 2022, and it is expected to grow exponentially during the forecast period. As the number of internet users increases and the amount of data traffic increases significantly, the radio frequency (RF) spectrum is bound to get congested, limiting bandwidth availability. At this juncture, Li-Fi is expected to play a crucial role in providing strong indoor internet connectivity, without interfering with the RF spectrum, thus driving the market’s growth.

Li-Fi not only uses the visible light spectrum but can also work through the infrared spectrum. Because of this mechanism, it allows Li-Fi to reach at rapid rates without any interference. Moreover, since it uses visible light which cannot seep through walls, it is a more secure mode of data transfer and makes it difficult to intercept the data. This characteristic property of Li-Fi makes, highly secure. Moreover, the lower costs, energy efficiency, and simple implementation are expected to drive the market demand over the forecast period.

Li-Fi technology has the potential to offer more customized network access to enterprises and corporate offices. For instance, network access can be controlled more effectively at different places with different lighting. For example, the overhead lights at desks can provide access to specific parts of corporate networks and systems. While overhead lighting in other office premises can provide access to guest networks. This can offer corporate offices greater control over who can use their networks, providing more security. Additionally, since Li-Fi technology does not use radio frequency waves, it is suitable for spaces where the RF spectrum signal is low, and access to radio frequency is limited. Such benefits are expected to propel the market’s growth over the forecast period.

Li-Fi technology has multiple benefits among end-use verticals including automotive, retail, healthcare, aerospace & defense, government, transportation, and education, among others. However, it faces some operational challenges. One such challenge is limited range. Since Li-Fi communicates through light, the receivers need to be in the periphery of the light. Wi-Fi has a range of 32 meters, while Li-Fi has a range of 10 meters, limiting the use of Li-Fi in open environments. Another challenge is the limited compatibility. Most electronic devices are not compatible with Li-Fi as of 2022. However, as the technology evolves, more devices are expected to be Li-Fi compatible, which will eliminate the challenge. However, the limited range of Li-Fi is likely to create a hindrance to the market’s growth.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic adversely affected the telecom industry. The pandemic had a tragic impact on all businesses across the globe. Stringent regulations and a global shutdown resulted in halts in many business processes, and resulted in work-from-home models, drastically reducing the demand for network connectivity at enterprises and corporate offices. Subsequently, Li-Fi which is used mainly in enterprises saw a decrease in its adoption. However, Li-Fi technology found its application in the healthcare industry during the pandemic. Li-Fi can monitor patients remotely through visible light communication, which significantly reduced health threats for doctors. Such applications provided by Li-Fi are expected to drive the market’s growth, as the world recovers from the COVID-19 pandemic.

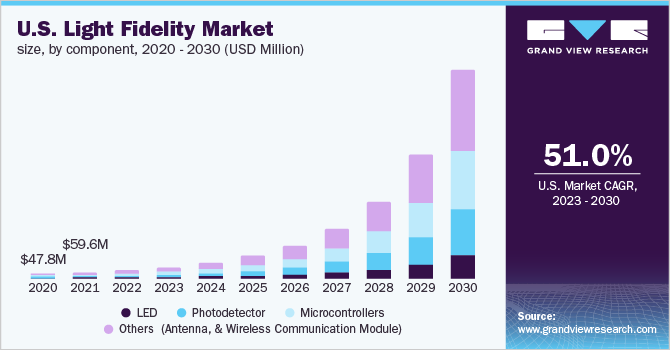

Component Insights

The LED segment dominated the market in 2022 and accounted for a revenue share of more than 38.0%. LED is considered as a core component of Li-Fi technology as it is used to transmit light and information. Lighting systems were only operated as localized points of illumination, but now, connected lighting systems are being used that blend LED capabilities with IoT and enable connectivity for engineers to provide illumination and data simultaneously. Since LEDs are semiconductor devices they can be modulated at high frequencies to transmit data. This characteristic property of LEDs is driving its adoption and enabling light-fidelity (Li-Fi), propelling the segment’s growth.

The microcontroller segment is anticipated to register significant growth over the forecast period. Microcontrollers modulate the LED to ON and OFF so that the photodetectors can detect it as 0 or 1. Microcontrollers then detect the code, which completes the data transfer process. Hence, microcontrollers form an essential component at the transmitter as well as at the receiver end, which is driving its adoption. MCUs have the potential to control the source of light and detect even the most minute modulations which is expected to drive its adoption in the forecast period.

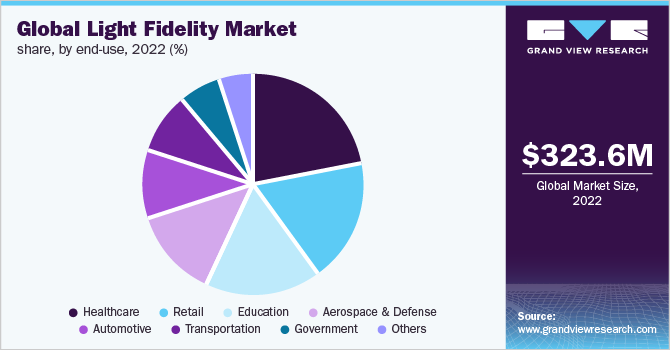

End-use Insights

The healthcare segment dominated the market in 2022 and accounted for a revenue share of more than 21.0%. The healthcare industry is evolving and adopting communication technologies to store and access data for remote monitoring, implementing robotic surgeries, and virtual reality for training, among other applications. All these applications require robust connectivity. However, the existing adopted technologies depend on the RF spectrum, which can be harmful in the hospital environment buildings. Additionally, Wi-Fi technology used in life-saving machines such as MRI scanners tends to cause electromagnetic pollution, having negative implications in healthcare facilities. Hence, the healthcare sector is adopting Li-Fi technology to reduce the electromagnetic pollution created by radio frequency-based communication systems, thereby propelling Li-Fi’s adoption in the healthcare sector.

The retail segment is anticipated to register significant growth in the forecast period. Li-Fi technology can help shoppers to navigate the shop and enhance their shopping experience. It can help them locate specific products in the store, check store promotions, check stock availability, and engage in in-store services via their smartphones. Additionally, as customers connect via Li-Fi, it can help retailers understand customer behavior and form strategies accordingly. However, as of now, most smartphones are incompatible with Li-Fi technology. As the compatibility of electronic devices with Li-Fi increases, the use of Li-Fi in retail is anticipated to grow thus propelling the segment's growth.

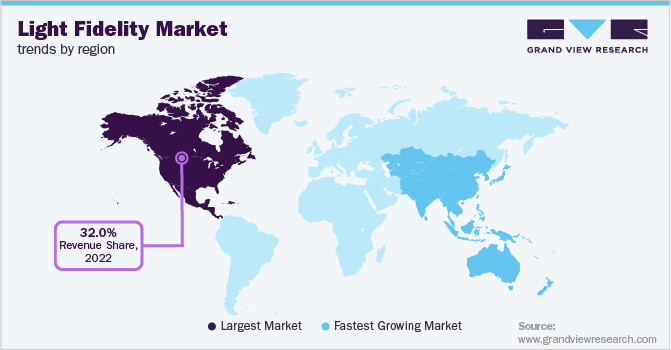

Regional Insights

North America dominated the Li-Fi market in 2022 and accounted for a revenue share of more than 32.0%. The regional market's growth can be attributed to the growing demand for internet connectivity from various industry verticals. Additionally, enterprises are seeking connectivity technologies that offer higher speed and security which bodes well for the market's growth. In April 2021, PureLiFi announced its agreement with the U.S. Army to supply its Li-Fi technology with its Kitefin platform. The platform uses Li-Fi and is a next-generation optical wireless communication system that provides secure data transmission without radio frequencies. Such initiatives are expected to fuel the region's growth.

Asia Pacific is anticipated to register significant growth over the forecast period. Asia Pacific is home to some of the prominent market players. Moreover, organizations in Asian countries, such as China, India, and Japan, are investing aggressively in Li-Fi-related innovations. For instance, in October 2022, Nav Wireless Technologies Pvt. Ltd., a research-based company in India, introduced next-generation Li-Fi technology solutions that are much faster and cheaper than existing network solutions. Such initiatives are fostering innovation and growth in the Asia Pacific regional market.

Key Companies & Market Share Insights

The Li-Fi market can be described as a fragmented market with a presence of several small players. The vendors operating in the Li-Fi market are mainly adopting product development strategies, partnerships, and geographical expansion to enhance their product offerings. The growing demand for Li-Fi can be attributed to multiple benefits, such as higher security, higher speed, lower costs, high peak data rates, enabling IoT, and enhanced energy efficiency.

Vendors are focusing on launching new products which is fostering innovation in the market. For instance, in January 2023, Oldecomm announced the launch of its new product, LIFIMAX2G, which offers a faster, more reliable, and more secure connection. The LIFIMAX 2G will enable industrial rail and other mobility infrastructures to access high-speed transmissions securely, without interference. Such initiatives by key market players are expected to further drive the market’s growth over the forecast period. Some of the prominent players in the global light fidelity market include:

-

PureLiFi

-

Oledcomm

-

Signify Holding.

-

VLNComm

-

Velmenni

-

Wipro Lighting

-

LiFiComm

-

Lucibel

-

Zero1

-

Panasonic Corporation

Light Fidelity Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 434.4 million

Revenue forecast in 2030

USD 7,757.3 million

Growth rate

CAGR of 51.0% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Australia; Brazil

Key companies profiled

PureLiFi; Oledcomm; Signify Holding; VLNComm; Velmenni; Wipro Lighting; LiFiComm; Lucibel; Zero1; Panasonic Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Light Fidelity Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the light fidelity market report based on component, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

LED

-

Photodetector

-

Microcontrollers

-

Others (Antenna, and Wireless Communication Module)

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Retail

-

Healthcare

-

Aerospace & Defense

-

Government

-

Transportation

-

Education

-

Others (Consumer Electronics, Mining, Oil & Gas, BFSI)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global light fidelity market size was estimated at USD 323.6 million in 2022 and is expected to reach USD 434.4 million in 2023

b. The global light fidelity market is expected to grow at a compound annual growth rate of 51.0% from 2023 to 2030 to reach USD 7,757.3 million by 2030.

b. North America dominated the Li-Fi market with a share of 32.90% in 2022. The regional market growth can be attributed to the presence of numerous market players in the region. These vendors are also adopting numerous growth strategies to strengthen their foothold in the market.

b. Some key players operating in the light fidelity market are PureLiFi, Oledcomm, Signify Holding, VLNComm, Velmenni, Wipro Lighting, LiFiComm, Lucibel, Zero1, and Panasonic Corporation

b. Benefits provided by Li-Fi technology include high speed internet connectivity, highly secure data transmission, and no interference like traditional radio waves, making it a faster and cheaper option for data transmission; thereby propelling its adoption in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.